Why Pay $250K for a $115K Bitcoin? Welcome to Strategy (MSTR)This is already the third article I’ve written about Strategy (formerly MicroStrategy), and for good reason.

You don’t need to be a financial expert to ask: why buy a stock that simply mirrors Bitcoin’s price — but at a massive premium?

No matter how sophisticated the explanations may sound, or how many times you’re told that “if you don’t understand it, it must be brilliant,” the reality is much simpler — and much more absurd.

Buying Strategy today is like paying $250,000 for Bitcoin while the actual market price is $115,000.

It’s not about complexity. It’s about common sense.

I won’t dive too deep into it — no need to fight “financial sophistication” with even more sophisticated words.

The point is simple: buying Strategy is like paying me $10,000 just so I can hold your $10,000 and call it an “innovative capital deployment strategy.”

Sounds smart, right? Until you think about it for more than five seconds.

Now let’s look at the posted charts — simple and visual.

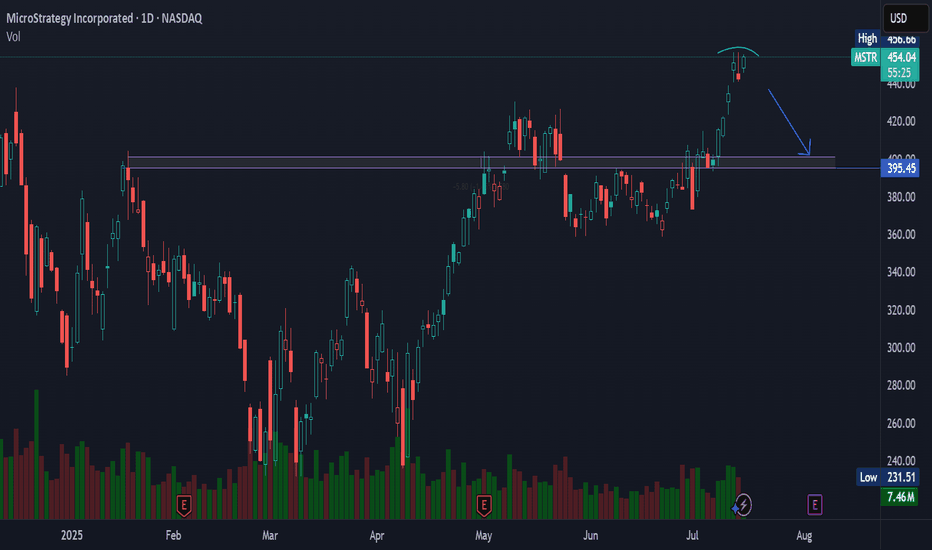

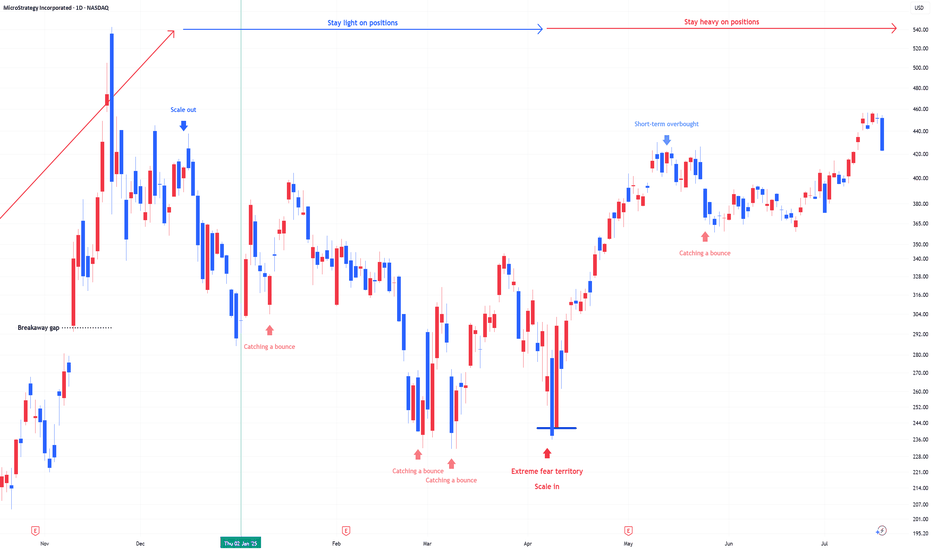

Strategy (MSTR) hit its all-time high in November 2024, right when Bitcoin first reached $100,000.

Then came a sharp correction of more than 50% for the stock.

Fast forward: even though Bitcoin went on to make new all-time highs, Strategy didn’t follow, it seems like people were finally starting to wake up.

When BTC peaked again in mid-July 2025, Strategy only managed to reach $455 — well below its November ATH.

Since then, BTC has pulled back about 10%, while Strategy dropped around 20%.

So much for the “outperformance” argument.

And here’s where things get even harder to justify:

In the past, some institutions bought MicroStrategy because they couldn’t hold Bitcoin directly. Fair enough.

But now? Spot Bitcoin ETFs are live, regulated, widely available, and charge tiny fees — without the leverage, dilution risk, or premium baked into Strategy.

So what’s the excuse now?

Where are we now?

At this moment, even though I’m not too happy about this week’s Bitcoin weakness, I remain cautiously bullish — emphasis on cautiously.

But let’s entertain a scenario.

If Bitcoin continues to correct, Strategy is sitting right on support. And if BTC breaks lower, Strategy will almost certainly follow — breaking support and heading toward the next level.

That next support? Somewhere around $240–250, depending on how deep the Bitcoin pullback goes.

But here’s the real question:

What happens if Bitcoin enters a true bear market?

Will Strategy — which just recently rebranded from MicroStrategy — be forced to rebrand again as…

NanoStrategy?

Just a Saturday thought.

MSTR trade ideas

8/1/25 - $mstr - Selling spot and buying MSTR8/1/25 :: VROCKSTAR :: NASDAQ:MSTR

Selling spot and buying MSTR

- keeping it (purposefully) short today for everyone's benefit

- sold a bit of OTC:OBTC (which is nearly 15% off spot, e.g. $100k/BTC) to buy NASDAQ:MSTR MSD exposure here

- why?

- 1.6x mNAV is lowest it's been (nearly ever in current BTC move)

- Saylor not going to hit the ATM sub 2.5x, will run it hot

- Latest product further augments this runway to value accretion

- BTC still remains REALLY well bid in this current tape

- So math is like this

- ROE of BTC in "conservative" sense is 25%

- Kc (cost of capital) for Strategy is 10% again (conservative, it's really sub 10%)

- so ROE/Kc (without growth) = 2.5x book.

- A real ROE for BTC (remember this is permanent capital he's tapping, so no asset-liability mis-match) is 35%

- True Kc for this is sub 10%, but let's still say 10%. that's 3.5x book.

Therefore let's even say 2x book (below both of the above) is 2/1.6 = 25% upside. If/do you think that BTC can go back to low 90s, ofc this might contract further (the 1.6x) but at the same time, you have EVEN higher implied ROE and R/R only improves.

So at a minimum, i'd guess your R/R is "balanced" here in the most conservative scenarios. And if we do get BTC bid, this will rocket at this stage thru YE and far exceed px appreciation of it's BTC pair.

Ok that was longer than I intended. Felt important to convey math and up/downside parameters.

Be well. Everyone loses money in correlation 1. Just make sure you find the betas that have the first bids. Right now that's BTC and some quality names doing 6-7% fcf yields and growing.

I like

OTC:OBTC (adding fuel w/ my NASDAQ:MSTR calls)

NASDAQ:NXT

NYSE:DECK

NASDAQ:LULU

NYSE:FI

<3

V

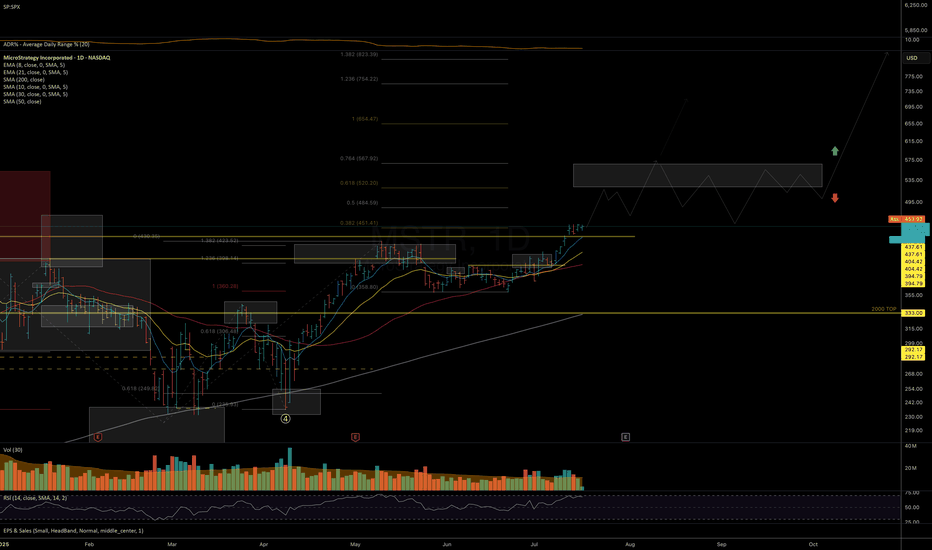

Long-Term Bitcoin Proxy Positioned for Next Upside RallyCurrent Price: $405.89

Direction: LONG

Targets:

- T1 = $418.50

- T2 = $425.99

Stop Levels:

- S1 = $399.50

- S2 = $386.20

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in MicroStrategy.

**Key Insights:**

MicroStrategy is uniquely positioned as the largest corporate Bitcoin holder, meaning its stock price is closely tied to Bitcoin's movements. The company holds over 68,000 BTC, making it a favored choice for investors aiming to benefit from Bitcoin's potential breakout. Recent bullish market sentiment and positive institutional positioning in cryptocurrency-related equities add strength to the Long scenario.

Short-term price metrics also confirm a bullish bias, with options flows targeting calls and aggressive price strikes above current levels. However, flexibility is required as Bitcoin remains highly volatile ahead of macroeconomic shifts and Bitcoin-specific technical resistance levels.

**Recent Performance:**

MicroStrategy's stock has gained momentum over the past month, trading in tandem with Bitcoin's recent stability in the $27,000-$28,000 range. Last week, MicroStrategy saw increased interest among institutional investors, as options targeting a sharp rally were opened at key resistance levels. This suggests confidence among professional traders about crypto recovery prospects.

**Expert Analysis:**

Analysts argue the stock could serve as a leveraged play on Bitcoin’s trajectory, especially during bullish setups like MicroStrategy’s upcoming quarterly reports. Some experts point to Bitcoin’s struggle to break above $30,000 as an immediate risk, yet highlight MicroStrategy’s firm association with Bitcoin as an advantage. Beyond crypto exposure, MicroStrategy’s operational restructuring and debt management efforts further bolster its appeal as a dual-tech and crypto equity.

**News Impact:**

MicroStrategy’s long-term strategy continues to blend Bitcoin maximization with tech-driven operational focus. Recent comments from management emphasize continued cryptocurrency accumulation despite market fluctuations, securing its place as a pro-Bitcoin institutional equity. The upcoming earnings report could provide deeper insights into strategic moves for 2024, driving a post-earnings rally.

**Trading Recommendation:**

MicroStrategy presents a compelling buy opportunity for investors betting on Bitcoin-led equity rallies. Technical setups align with improving sentiment and disruptive news catalysts around macroeconomic policies supporting crypto stability, triggering higher upside potential. Long setups above $405.89 show bullish targets to $418.50 and $425.99, while flexible stop placements provide downside protection amidst broader Bitcoin resistance risks.

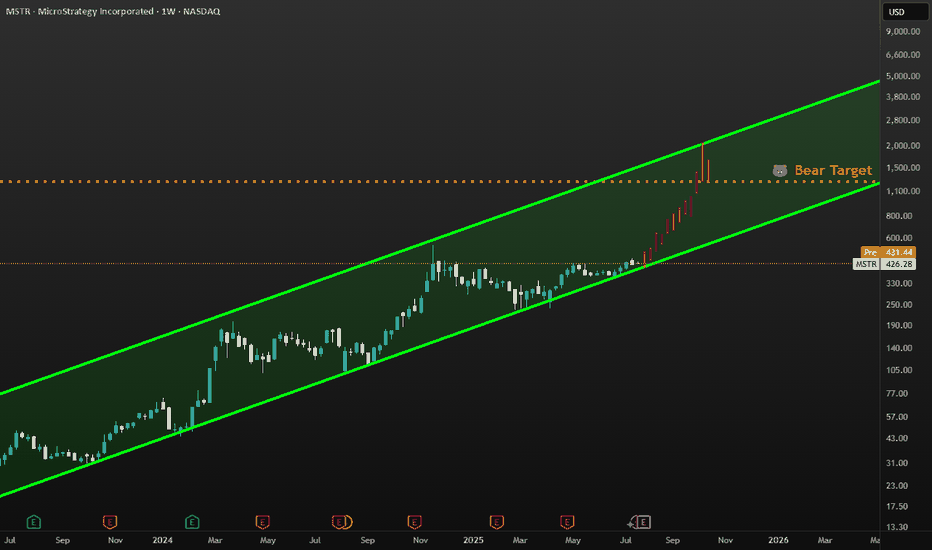

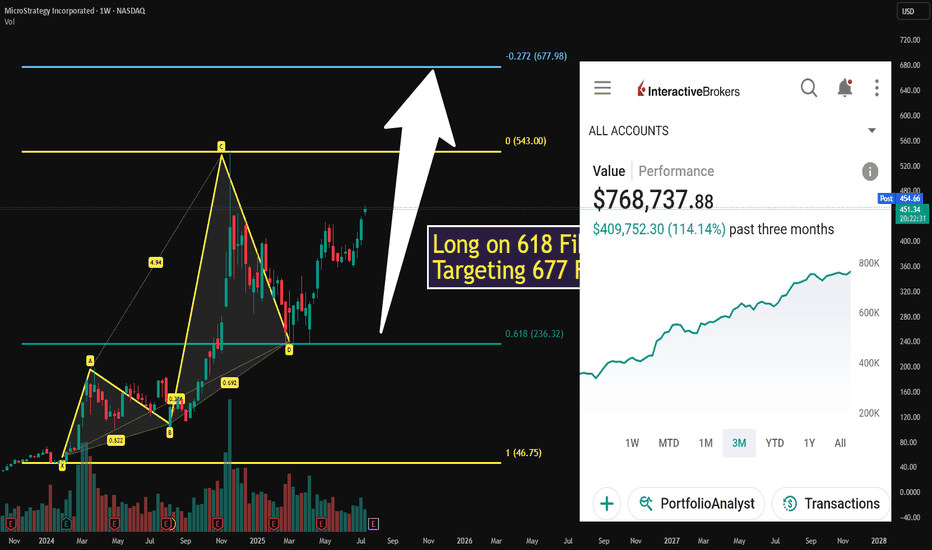

$MSTR Weekly Ascending TriangleMicroStrategy has been consolidating within a textbook ascending triangle pattern, with a clear resistance around $520 and rising higher lows forming solid support. Price action remains inside a strong bullish channel, hugging the 50-week MA and riding above the 200/350 MAs.

A breakout above $520 could trigger a strong continuation toward the upper bounds of the channel, with potential long-term targets around $1300 if momentum aligns with Bitcoin strength.

Watching for volume confirmation and weekly close above resistance for validation. Breakdown below the yellow trendline would invalidate the setup.

MSTR Holding VWAP Support – Reversal Attempt but Earnings AheadMSTR bounced nearly 2% today after testing anchored VWAP support near $390. This recovery comes after a steady pullback from the recent $460 high. Price is holding above the yellow VWAP and just above the green zone, signaling possible short-term support.

However, volume remains light (3.72M vs. 11.47M average), indicating cautious buying — and earnings are scheduled for tomorrow, which introduces added volatility risk. A close above $410 post-earnings would strengthen the bullish case.

Until then, this remains a speculative long setup with event risk.

Indicators used:

Anchored VWAP (support zone: $390–395)

Volume vs. Volume MA (light = indecision)

Earnings date = risk trigger

Entry idea: Only after earnings reaction; ideally above $410

Target: $430–440

Stop: Below $388 or earnings miss

Monthly $MSTR Bullflag MicroStrategy is forming a textbook bull flag on the monthly, right after a massive vertical leg from sub-$200 to over $500.

Strong pole ✅

Tight consolidation near the highs ✅

Monthly closes holding above prior resistance ✅

This thing is coiling under ~$455. Once it breaks, it could easily send toward $800–1000+, especially if CRYPTOCAP:BTC keeps surging. BTC already confirmed a major cup & handle — MSTR just lagging a bit.

High timeframe structure + BTC correlation = explosive potential.

Watching for volume + breakout confirmation. Let’s see if it rips.

MSTR WEEKLY OPTIONS SETUP (2025-07-28)

### 🔻 MSTR WEEKLY OPTIONS SETUP (2025-07-28)

**Bearish Divergence with High Confidence — Time to Strike with a PUT?**

---

📊 **Momentum Recap:**

* **RSI:** Bearish 📉

* **Volume:** Weak (institutional exit risk)

* **Options Flow:** Mixed (calls > puts, but no alignment with price)

* **Sentiment Models:** Split 4:1 → **Only Claude/Anthropic** goes bearish with conviction

🧠 **Model Consensus:**

> “Momentum is weak, volume fading, and no upside confirmation = bearish edge.”

---

### ✅ SETUP OVERVIEW

* 🔍 **Trend:** Bearish (declining RSI)

* 📉 **Volume:** Weak = reduced institutional conviction

* 💬 **Options Flow:** Bullish bias, but **contradicts price trend**

* ⚙️ **Volatility:** Elevated, potential reward for directional plays

**Overall Bias:** 🔴 *Moderately Bearish*

---

### 💥 TRADE IDEA: MSTR \$400P

* 🎯 **Strategy:** Long Weekly Put

* 🔻 **Strike:** 400.00

* 📆 **Expiry:** Aug 1, 2025

* 💸 **Entry Price:** \$8.65

* ✅ **Profit Target:** \$12.50

* 🛑 **Stop Loss:** \$4.00

* 📈 **Confidence Level:** 72% (backed by Claude model)

* 📉 **Breakdown Trigger:** Below \$405 confirms bearish flow

* ⚠️ **Invalidation:** Break above \$415 → exit early

---

### 📦 TRADE\_DETAILS (Backtest/Algo Ready JSON)

```json

{

"instrument": "MSTR",

"direction": "put",

"strike": 400.0,

"expiry": "2025-08-01",

"confidence": 0.72,

"profit_target": 12.50,

"stop_loss": 4.00,

"size": 1,

"entry_price": 8.65,

"entry_timing": "open",

"signal_publish_time": "2025-07-31 09:30:00 UTC-04:00"

}

```

---

### 🧠 TRADE INSIGHTS

* 🟥 4/5 models say **no trade** due to signal divergence

* 🧠 **Claude’s bearish thesis = cleanest directional setup**

* 🚨 Volume + RSI combo = downside confirmation

* 🧭 Watch key price reaction zones: **\$400–\$405 (support)** / **\$415 (resistance cap)**

---

**#MSTR #PutOptions #WeeklyTrade #BearishSetup #OptionsFlow #QuantTrading #ClaudeModel #MarketMomentum**

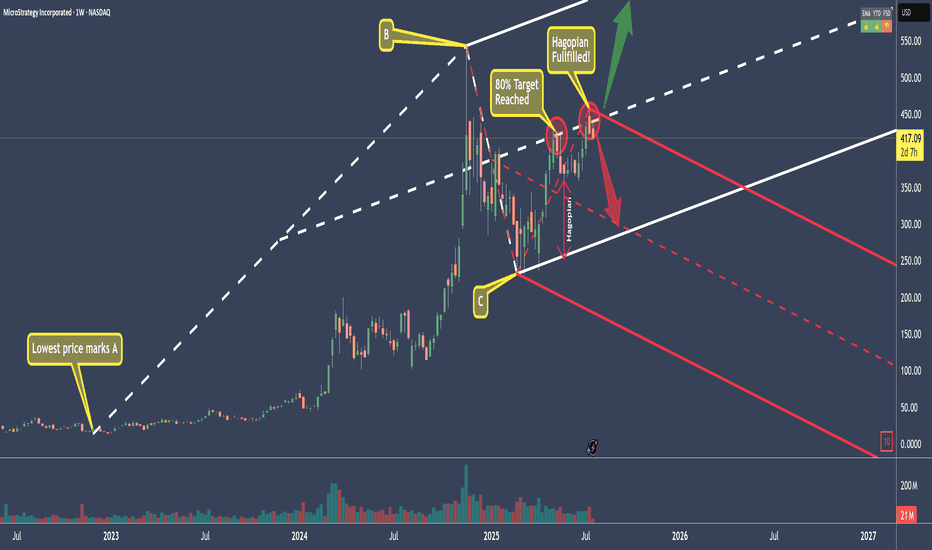

MSTR - Microstrategy Short...for now.The White Fork is created by choosing point A, which must be the lowest price before the swing.

B and C are the natural high and low of the swing we want to measure.

What this gives us is a Pitchfork that projects the most probable path of price.

Additionally, with the three lines that make the Fork, we have the natural extremes above, below, and the center—the mean.

We can see that price started to rise in March 2025.

The 80% rule states that price will reach the Centerline around 80% of the time.

And as we see, it did this time as well. Price reached the CL (Center Line), and immediately the big whales dumped positions.

Then price fell—only to be picked up before reaching the Lower Line, also called the L-MLH or Lower Median Line Parallel.

When price can't make it to this (or any of these) lines, we call this a 'Hagopian,' because it follows 'Hagopian's Rule.' This rule says that if price can't reach 'the line' (the L-MLH in this case), there is a high chance that price will reverse in the previous direction (up in this case), and even go further than where it came from (the Centerline).

And as we see, price indeed traded upwards—beyond where it came from—and overshot the Centerline (CL).

Unfortunately for long-positioned traders, the gas in the goose was empty, and price now starts to head south again, missing the target, which would have been the U-MLH (Upper Median Line Parallel).

So, the open happened below the CL!

If we also see a close this week, I'm ready to initiate a short trade.

Why?

Well, as before, Hagopian’s Rule applies—an indication that price will trade further down than where it came from, which is below $361.

And since we know that the natural target is the Centerline about 80% of the time, we have a heck of a good chance that we’ll be happy campers in a couple of weeks. :-)

With a risk/reward of about 2 to 3, and such a high chance of a profitable trade, I’ll sleep like a baby in the coming weeks.

The trade idea would be cancelled if price closes above the CL this Friday.

Let’s stalk it closely...

Possibility for MSTRIf bitcoin moves, Strategy moves.

I am no expert, so this is just for entertainment purposes.

But Strategy is acquiring bitcoin like there is no tomorrow and bitcoin inelastic supply tend to give a way to radical and fast grow in price.

Hence why I'd be keen to see MSTR move as much as I show in this chart.

MSTR - Where it goes only BTC knows📊 MSTR – MicroStrategy Technical & Bitcoin Correlation

Ticker: MSTR | Sector: Bitcoin Treasury Proxy / Enterprise Software

Date: July 26, 2025

Current MSTR Price: ~$405.89

Current Bitcoin Price: ~$118,127

🔍 Chart & Price Structure

Recent Action: MSTR declined from the ~$430–450 range and has consolidated around the $405 level, forming a tight base.

Support Zone: $395–$400 — prior volume cluster, recent dip buyers stepped in.

Weak Resistance: $415–$420 — a shallow supply zone; bigger resistance lies at ~$430.

Volume & Candles: Mixed volume, with small-bodied candles showing indecision near $405. Buyers are attempting to hold.

📈 Bitcoin Outlook & Influence

MicroStrategy remains tethered to Bitcoin’s trajectory. Recent BTC consolidation around $118K closely influences MSTR sentiment.

BTC Projections

From Citi (Jul 25):

Base Case: $135K by year-end

Bull Case: $199K

Bear Case: $64K if equities falter or ETF flows wane

Other Views:

Hashdex sees BTC reaching up to $140K in 2025

Omni Ekonomi

Global X ETF-based models anticipate $200K within 12 months

The Australian

Kiyosaki warns of potential crash despite optimism

These imply a possible 25–70% upside in BTC, which could drive MSTR toward $500–$600+ if holdings are stable.

⏱️ Short-Term Outlook (1–2 Weeks)

✅ Bullish Scenario

Trigger: Hold above support at $400, reclaim $415–$420

Immediate Upside Targets:

First: $430

Break above $430 → $450

Drivers: Bitcoin breaking back above recent highs, ETF inflows, favorable regulatory headlines

❌ Bearish Scenario

Trigger: Break below $395

Downside Targets:

$380 → $360 → $350

Drivers: BTC weakness → below $110K, altcoin rotation, broader equity weakness

🔭 Long-Term Outlook (H2 2025 / beyond)

🚀 Bull Case

If Bitcoin reaches $135K–$200K (Citi bull case, institutional demand, ETF momentum), MSTR could rally alongside to $550–$650.

MicroStrategy’s business fundamentals (data analytics/AI) may contribute optionality beyond BTC.

🐻 Bear Case

If Bitcoin retraces toward $64K or below due to risk-off sentiment or regulatory changes, MSTR could fall back toward $300–$350.

📊 Summary Table

View Trigger Level Targets Bitcoin Scenario Confidence

Short-Term Bull Above $405 and reclaim $415–420 $430 → $450 BTC > $118K and flat-to-up Moderate

Short-Term Bear Below $395 $380 → $360 → $350 BTC dips < $115K Moderate

Long-Term Bull BTC to $135K–$200K $550 → $600+ ETF inflows + adoption acceleration High (if BTC strength)

Long-Term Bear BTC drops below $110K $350 → $300 Sentiment collapse or regulation Moderate

🧠 Conclusion

MicroStrategy’s stock remains inherently tethered to Bitcoin performance. The $395–$405 zone acts as critical support, while a push above $415–$430 could signal renewed upside. Longer-term, BTC strength into the $135K–200K range would propel MSTR toward $600+ levels; a BTC pullback could drag it toward $300 or lower.

Watch Bitcoin flows, ETF updates, and pillar crypto adoption trends—these are likely to dictate MSTR’s next leg.

MSTR still bullish. MSTR bullishness is still intact but it should close above the upper yellow line for the bullishness confirmation intact. If that happens then there's a big possibility that we will see a big sharp last parabolic run to new ATH. Of course this is not financial advised.

If this failed then the last hope is on the Red Line.

MSTR....Free FallingMSTR looks like it is nosediving straight down. When one is bullish on BTC, it is important to also understand that volatility is a big part of the game - a very costly game with many losers! BTC has past several key TAs and we only just started - crossing $300 is in the horizon. Always do your own due diligence, and received ultrabear signal earlier to exit, and cut your losses soon.

MSTR – On the Path to New ATHI was initially skeptical about the recovery structure unfolding since the April lows — it looked like a possible macro lower-high before deeper correction (as outlined in my previous idea).

However, given the strength in underlying #BTC price action (covered in my recent video-idea on crypto trend structure) and clear signs of constructive consolidation and accumulation during the July breakout, Isee strong odds for follow-through toward the 520–570 resistance zone in the coming weeks.

This move may align with CRYPTOCAP:BTC testing its macro resistance near 130K (see my macro BTC analysis on the idea section).

If NASDAQ:MSTR can break above 570 and sustain a close above it, it opens the door to a potential immediate follow-through toward the 650–755 macro resistance zone. But a scenario for more prolonged consolidation around 570 would in fact serve as a solid base for more stable and prolonged next long-term leg higher.

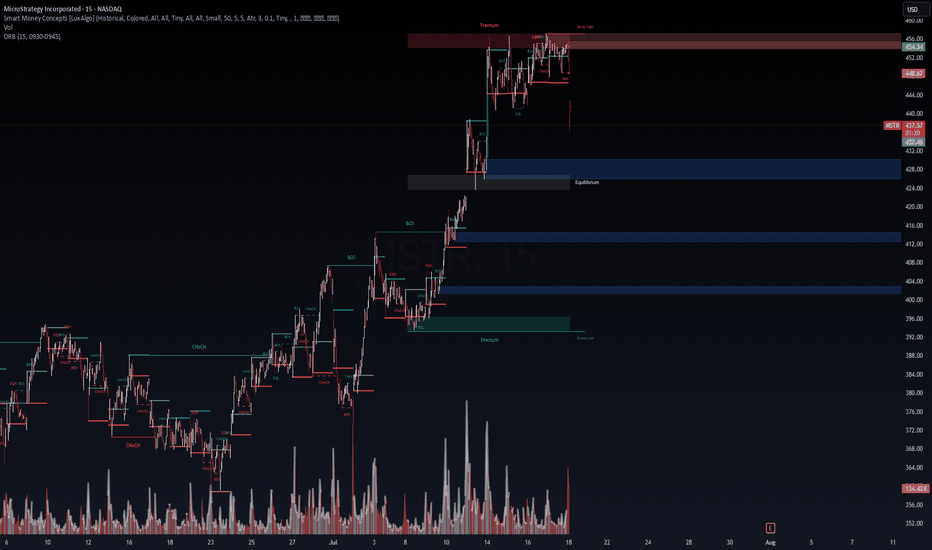

WaverVanir VolanX Protocol – Short Thesis: MSTR🔻 WaverVanir VolanX Protocol – Short Thesis: MSTR

Timeframe: 15-Min | Bias: Bearish | As of: July 18, 2025

Disclaimer: For educational and illustrative purposes only. Not financial advice.

🧠 Thesis Summary:

MicroStrategy (MSTR) has broken market structure at a key premium zone, rejecting from the weekly high, with strong volume confirming distribution. The smart money appears to have exited positions, leaving behind a clear imbalance and liquidity void below.

🔍 1. Smart Money Concepts Breakdown

Premium Zone Rejection (454–456): Price rejected from a premium inefficiency pocket, tagged liquidity, and failed to make a new high.

Internal CHoCH and BOS at Top: Multiple Change of Character (CHoCH) and Break of Structure (BOS) events indicate smart money is offloading.

Fair Value Gap (FVG) Below: Several unmitigated FVGs below (≈412, ≈404, ≈396) serve as magnets for price.

⚠️ 2. Liquidity Sweep Confirmed

Equal Highs Taken Out: Perfect setup for liquidity engineering – retail traders trapped long above 454.

Displacement Candle: Sharp move down post-sweep confirms institutional sell-off.

Volume Spike at Breakdown: Selling volume surged on the red candle through 440 support, indicating urgency from sellers.

🧮 3. ORB Breakdown & VolanX ORB Confluence

Opening Range Breakdown (ORB 15min): ORB low at 448.67 was decisively broken.

Current price: 436.30, firmly below both ORB midpoint and low – signaling bearish continuation.

🧭 4. Probabilistic Price Targets

Target Area Price Level Rationale

TP1 428.00 Equilibrium block

TP2 412.00 Imbalance fill + previous BOS

TP3 396.00 Deep discount zone + Strong Low

Stop Loss: Above 456

Risk-Reward (TP2): 1:3+

Volatility: Elevated (Vol: 129.97K)

🧩 5. Macro & Correlation Risk

Bitcoin Correction Imminent: MSTR is heavily correlated to BTC. Any weakness in crypto adds pressure.

Rate Cut Uncertainty: Hawkish Fed tone or delayed cut could hurt growth narratives and tech multiples.

📉 Summary:

This is a high-probability short setup powered by:

Premium zone rejection

Clear BOS and CHoCH pattern

Strong volume confirmation

ORB breakdown alignment

Liquidity engineering dynamics

VolanX Protocol flags this as a Strategic Short Opportunity targeting liquidity zones below.

🔻 Suggested Trade (Illustrative)

plaintext

Copy

Edit

Entry: 440–436

Stop: 456

Target 1: 428

Target 2: 412

Target 3: 396

#WaverVanir #VolanXProtocol #MSTR #SmartMoneyConcepts #ORB #ShortSetup #LiquiditySweep #DirectionalBias

Strategy Finished Consolidating, New High With BTC Leading MicroStrategy (MSTR), the stock is currently demonstrating significant volatility and a strong correlation with Bitcoin's price movements, acting almost like a leveraged play on the cryptocurrency.

From a charting perspective, MSTR has been in a long-term bullish trend since its pivot to a Bitcoin acquisition strategy. However, it's prone to sharp corrections following Bitcoin's pullbacks, indicating high risk and reward. Key technical levels to watch would include its 200-day and 50-day moving averages as potential support and resistance zones.

The charts are now flashing strong signals that this sideways accumulation phase is drawing to a close. With Bitcoin (BTC) showing renewed strength and eyeing fresh all-time highs, MSTR, as the largest corporate holder of the digital asset, appears poised to break out. The correlation remains a potent force, and the current setup suggests MSTR is ready to re-engage its upward trajectory, targeting new price peaks in tandem with BTC

MSTR Bull DivergenceMSTR has seen a fast and sharp correction after rallying nearly 70% into some key levels of resistance , and currently pulling back into the longer term downtrend VWAP, as an attempt to flip the current downtrend.

This zone around $360 is very crucial for me personally, as we are attempting to hold the previous pivot high, and setting a firm low for continuation of the uptrend.

On the hourly timeframe we are finally starting to see some potential absorption here as price continues to make new lows, however the overall strength on the RSI is unable to continue making progress lower.

This is suggesting that the selling pressure may be running low, and MSTR can be due for a bounce.

I have laddered into this current position , and would de-leverage my risk if we start to break the lows as that could be quite a bearish sign, in the meantime, I would like to see some relief after such a harsh downtrend.

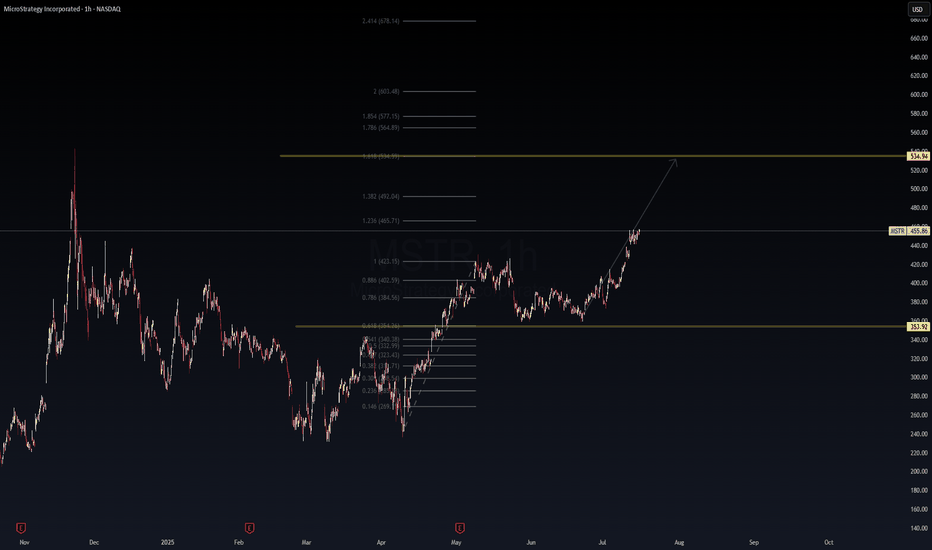

MSTR: Fibonacci Momentum Building Toward $534 🔺 MSTR: Fibonacci Momentum Building Toward $534 🚀

MicroStrategy (MSTR) continues its bullish ascent, following a clean Fibonacci extension pattern. After reclaiming key levels and holding above the 0.786–0.886 retracement zones, it now trades around $455 with strength.

📊 Technical Breakdown:

Breakout held above $423 (1.0 Fib)

1.236 Extension: $465.71 (short-term resistance)

1.618 Extension: $534.94 (main target)

Final leg: 2.0 Extension at $603 for full stretch

🟨 Support zone: $353.92

🟩 Trend: Higher highs and strong momentum

🧭 Bias: Bullish continuation unless price loses $402

💡 Macro Note: MSTR trades like a BTC-leveraged equity. Continued BTC strength could accelerate this move. Watch for potential catalysts like ETF flows, earnings, or Fed commentary.

📈 Thesis: As long as MSTR stays above $423, the bullish case toward $534 remains intact with high conviction.

🔔 Disclaimer: This analysis is for educational purposes only. Not financial advice. Always manage risk.