MTCH1 trade ideas

BUY $MTCH (Love, loves, love)Any dip currently is a buy IMHO to enjoy the ride up for a 5th wave. We are completing a 4th wave currently and will be testing new ATHs on the next leg up. fibonnaci retracements implies we've hit a 38% retracement and MTCH is forming a bull-flag on the daily (which is typical for a 4th wave). be on the lookout for confirmation on the Stochastic RSI. PT on the chart

Match breaking out of basing formation into a flagAlso note decreasing volume as the price went down into the flag. Earnings happened nov. 5 so the earnings symbol on the chart is wrong. Ive seen lots of huge call positions being taken that expire in December with strikes up to 150. A breakout of this flag on Monday seems pretty likely

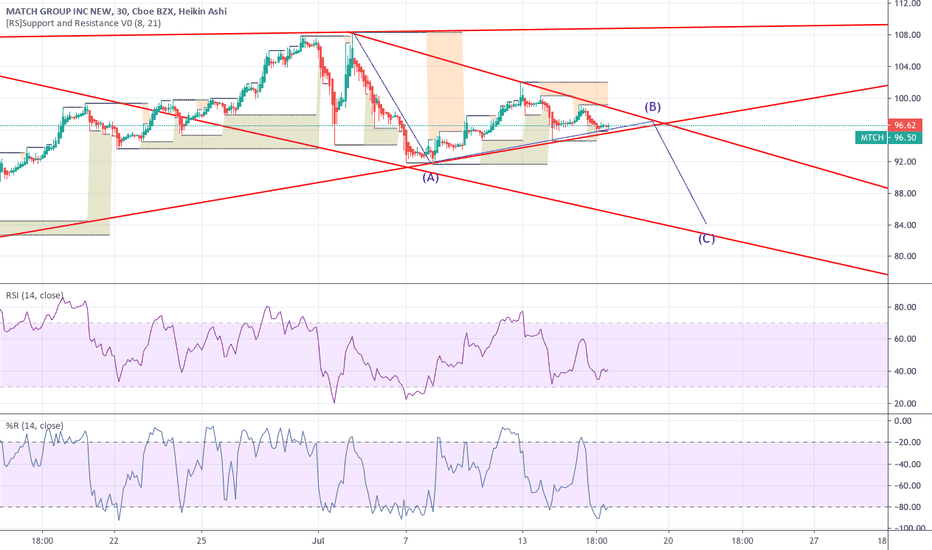

$MTCH Bullish Ascending Triangle - Unusual Options Activity$MTCH Bullish Ascending Triangle - Unusual Options Activity

Big $6M bet on Jan 2021 $100.00 strike high premium calls traded yesterday.

Monitor for strong breakout above $100.

Holding $95.50 support level from Aug'19 high.

Near term target: $113-$116 range

Note: Not investment advice.

MTCH was a top quarterly gainer, rising +107.39%. Match Group (MTCH, $98.2) was one of top quarterly gainers, jumping +107.39% to $98.2 per share. My A.I.dvisor analyzed 105 stocks in the Internet Software/Services Industry over the last three months, and discovered that 101 of them (96.15%) charted an Uptrend while 4 of them (3.85%) trended down. My A.I.dvisor found 493 similar cases when MTCH's price jumped over 15% within three months. In 312 out of those 493 cases, MTCH's price went up during the following month. Based on these historical data, A.I. thinks the odds of an Uptrend continuation for MTCH are 63%.