NETFLIX 1D MA50 test is a new buy opportunity.Netflix (NFLX) has been rising non-stop since the April 07 bottom on the 1D MA200 (orange trend-line). This bottom has been the latest Higher Low of the 3-year Channel Up that started on the June 14 2022 bottom.

This kickstarted its third long-term Bullish Leg. The previous two have been fairly sim

Key facts today

Several firms raised their price targets for Netflix (NFLX), with new targets ranging from $1,295 to $1,560, reflecting positive sentiment among analysts.

Netflix raised its annual forecasts following continued membership growth, reflecting positive performance in its subscriber base.

BofA increased its 2025 revenue estimate for Netflix to $45.1 billion, with an operating margin of 30.1%, after Q2 revenue rose 16% due to subscriber growth and higher pricing.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

443.35 MXN

181.63 B MXN

810.56 B MXN

422.77 M

About Netflix, Inc.

Sector

Industry

Website

Headquarters

Los Gatos

Founded

1997

FIGI

BBG002S0Q880

Netflix, Inc operates as a streaming entertainment service company. The firm provides subscription service streaming movies and television episodes over the Internet and sending DVDs by mail. It operates through the following segments: Domestic Streaming, International Streaming and Domestic DVD. The Domestic Streaming segment derives revenues from monthly membership fees for services consisting of streaming content to its members in the United States. The International Streaming segment includes fees from members outside the United States. The Domestic DVD segment covers revenues from services consisting of DVD-by-mail. The company was founded by Marc Randolph and Wilmot Reed Hastings Jr. on August 29, 1997 and is headquartered in Los Gatos, CA.

Related stocks

NFLX CRACK!!Classic breakdown move from a rising F flag!

Massive Head and shoulders formed, that head test followed through, taking out stops, and now failing off the top of the channel.

Screaming CAUTION to the bulls!

Nice simple short setup for bears.

Click boost, follow, and subscribe. Let's get to 5,000

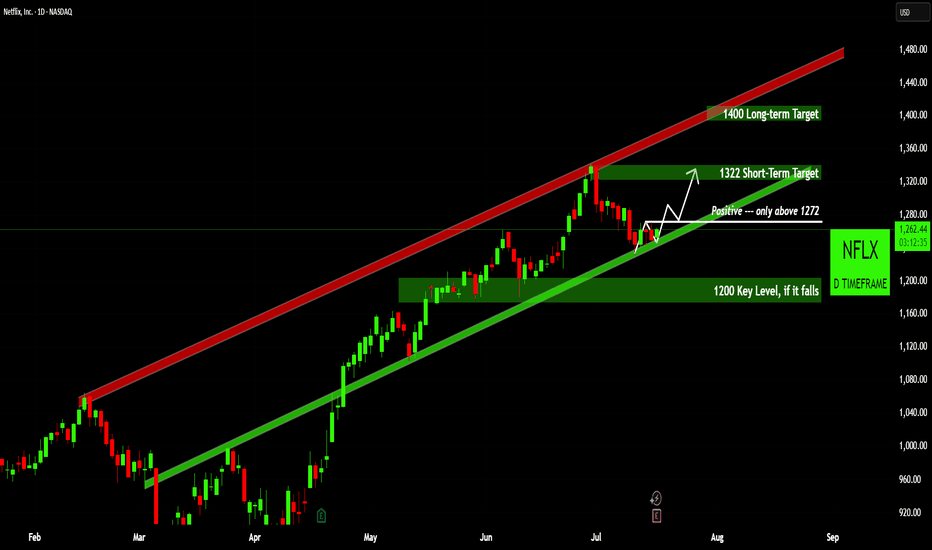

NFLX: Bullish Consolidation - Is a Move to $1322 Imminent?Overall Trend: Netflix is currently demonstrating a strong uptrend, effectively trading within a well-defined ascending channel since late February. This indicates robust buying interest and consistent higher highs and higher lows.

Key Support & Resistance: The $1200 level is acting as a crucial

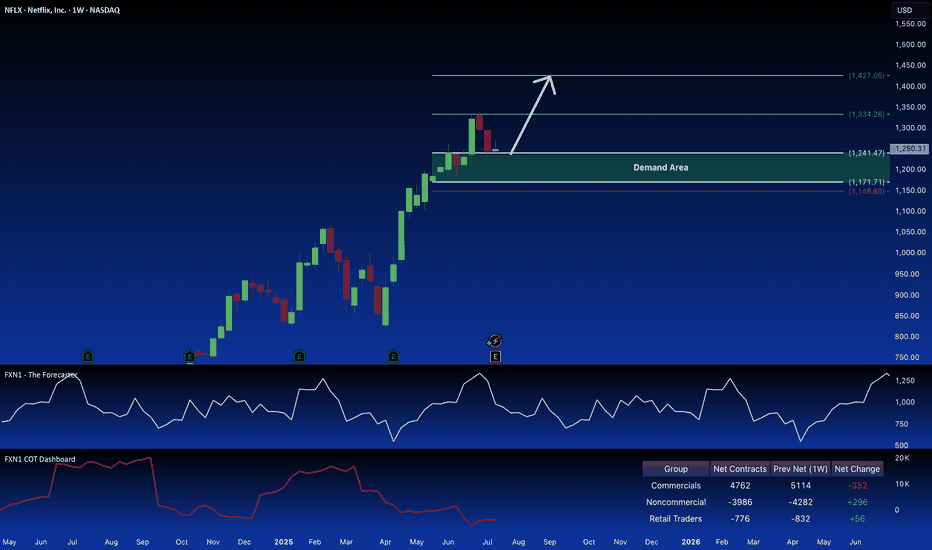

NFLX: Bullish Signal in Demand ZoneNetflix (NFLX) recently retraced within a key weekly demand zone, potentially presenting a long opportunity. Non-commercial traders are also accumulating long positions in the stock. This suggests a possible bullish setup. Your thoughts?

✅ Please share your thoughts about NFLX in the comments

How Earnings Reporting Could Impact Netflix (NFLX) Share PriceHow Earnings Reporting Could Impact Netflix (NFLX) Share Price

Earnings season is gaining momentum. Today, after the close of the main trading session, Netflix (NFLX) is set to release its quarterly financial results.

Analysts are optimistic, forecasting earnings per share (EPS) of $7.08, up from

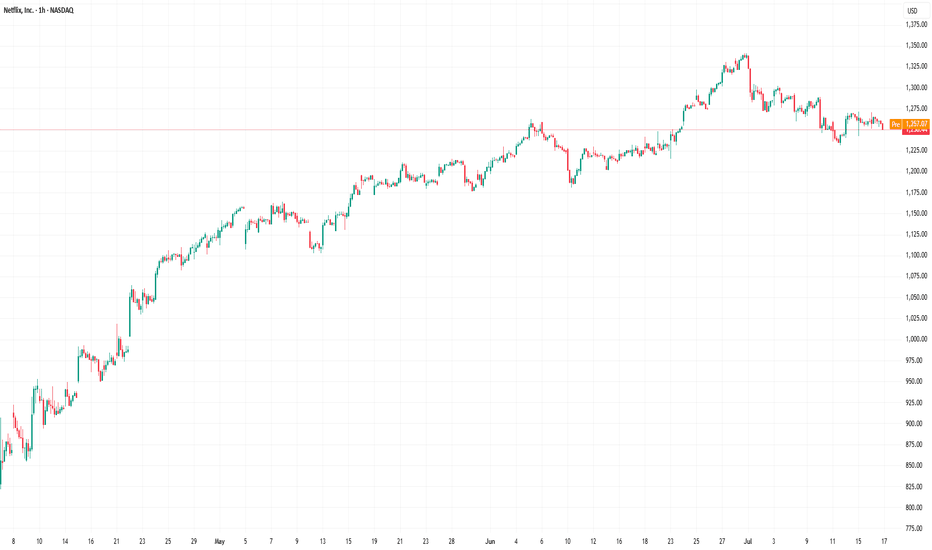

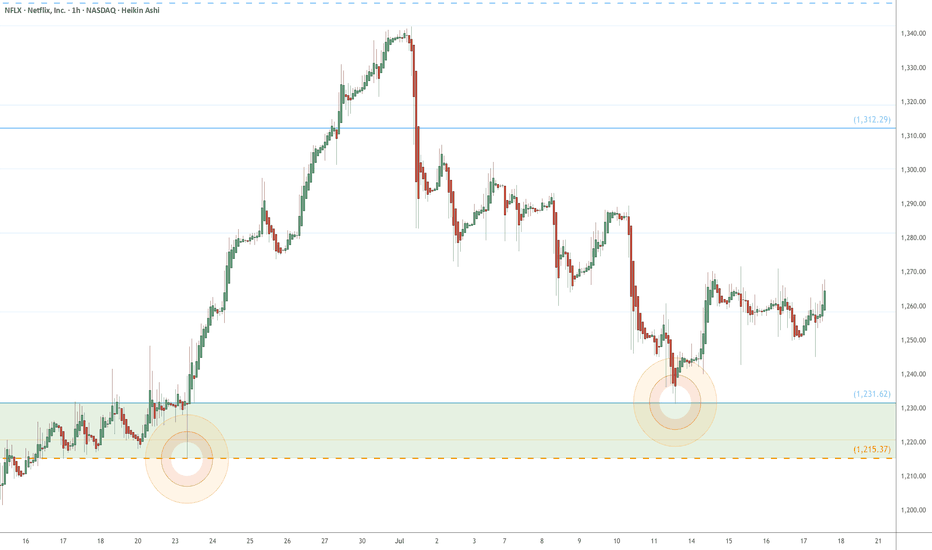

NFLX eyes on $1215-1232: poised for next leg UP with earningsNFLX broke and retested a key resistance zone.

Loud PING's on two major fibs announced support.

It is perfectly set to LAUNCH if earnings are good.

Positive earnings may push to mid $1500's above.

Negative may drop to $1061 Golden Genesis below.

Neutral report should continue uptrend from here.

.

Netflix is going to fall sharply soonNetflix is in the huge 5th wave extension. I expect it to complete wave (v) of 5 very soon, probably within the next week.

RSI divergence on 3-days, weekly frames is quite visible and supports the upcoming trend reversal.

When wave 5 is extended, retracement typically goes to the bottom of wave (i

Netflix: Hovering Just Below Key Target ZoneNetflix has rebounded over the past two sessions after falling below the beige Short Target Zone ($1,270–$1,432) and is now trading just beneath it. A renewed push into this range could complete turquoise wave 3, followed by a corrective wave 4 likely dipping below $1,180. Alternatively, with a 33%

Netflix Faces Rising Volatility and Bearish Technicals Ahead of Netflix (NASDAQ: NFLX) will announce its results after the close of trading in New York on Thursday, 17 July. Analysts forecast the NASDAQ-listed streaming media company to report second-quarter earnings growth of 45%, reaching $7.08 per share, while revenue is expected to increase by 15.6%, amounti

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NFLX5862368

Netflix, Inc. 5.4% 15-AUG-2054Yield to maturity

5.72%

Maturity date

Aug 15, 2054

NFLX5862367

Netflix, Inc. 4.9% 15-AUG-2034Yield to maturity

4.77%

Maturity date

Aug 15, 2034

NFLX4901374

Netflix, Inc. 4.875% 15-JUN-2030Yield to maturity

4.45%

Maturity date

Jun 15, 2030

USU74079AN1

NETFLIX 19/29 REGSYield to maturity

4.40%

Maturity date

Nov 15, 2029

NFLX4764899

Netflix, Inc. 4.875% 15-APR-2028Yield to maturity

4.21%

Maturity date

Apr 15, 2028

NFLX4908613

Netflix, Inc. 6.375% 15-MAY-2029Yield to maturity

4.19%

Maturity date

May 15, 2029

NFLX4826528

Netflix, Inc. 5.875% 15-NOV-2028Yield to maturity

4.19%

Maturity date

Nov 15, 2028

US64110LAN64

NETFLIX 4.375% CALL 15NV26Yield to maturity

3.96%

Maturity date

Nov 15, 2026

XS198938050

NETFLIX 19/29 144AYield to maturity

3.48%

Maturity date

Nov 15, 2029

XS207282979

NETFLIX INC. 19/30 REGSYield to maturity

2.77%

Maturity date

Jun 15, 2030

XS198938017

NETFLIX 19/29 REGSYield to maturity

2.71%

Maturity date

Nov 15, 2029

See all NFLX bonds

Curated watchlists where NFLX is featured.

Frequently Asked Questions

The current price of NFLX is 22,624.20 MXN — it has decreased by −5.21% in the past 24 hours. Watch NETFLIX INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange NETFLIX INC stocks are traded under the ticker NFLX.

NFLX stock has fallen by −2.75% compared to the previous week, the month change is a −2.39% fall, over the last year NETFLIX INC has showed a 95.65% increase.

We've gathered analysts' opinions on NETFLIX INC future price: according to them, NFLX price has a max estimate of 30,069.54 MXN and a min estimate of 15,654.95 MXN. Watch NFLX chart and read a more detailed NETFLIX INC stock forecast: see what analysts think of NETFLIX INC and suggest that you do with its stocks.

NFLX reached its all-time high on Jun 30, 2025 with the price of 25,091.87 MXN, and its all-time low was 101.65 MXN and was reached on Sep 25, 2012. View more price dynamics on NFLX chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NFLX stock is 6.40% volatile and has beta coefficient of 1.27. Track NETFLIX INC stock price on the chart and check out the list of the most volatile stocks — is NETFLIX INC there?

Today NETFLIX INC has the market capitalization of 10.19 T, it has increased by 3.08% over the last week.

Yes, you can track NETFLIX INC financials in yearly and quarterly reports right on TradingView.

NETFLIX INC is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

NFLX earnings for the last quarter are 134.87 MXN per share, whereas the estimation was 132.55 MXN resulting in a 1.75% surprise. The estimated earnings for the next quarter are 130.04 MXN per share. See more details about NETFLIX INC earnings.

NETFLIX INC revenue for the last quarter amounts to 207.83 B MXN, despite the estimated figure of 207.42 B MXN. In the next quarter, revenue is expected to reach 215.30 B MXN.

NFLX net income for the last quarter is 54.22 B MXN, while the quarter before that showed 59.22 B MXN of net income which accounts for −8.44% change. Track more NETFLIX INC financial stats to get the full picture.

No, NFLX doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 14 K employees. See our rating of the largest employees — is NETFLIX INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NETFLIX INC EBITDA is 514.86 B MXN, and current EBITDA margin is 66.68%. See more stats in NETFLIX INC financial statements.

Like other stocks, NFLX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NETFLIX INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NETFLIX INC technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NETFLIX INC stock shows the buy signal. See more of NETFLIX INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.