NKE trade ideas

NIKE Inverse Head & Shoulders start the recoveryNike Inc. (NKE) broke above the 118.70 Resistance of the Shoulder level of the Inverse Head and Shoulders (IH&S) pattern that started in August. Having rebounded last week on the 1D MA50 (blue trend-line) and already now above the 1D MA200 (orange trend-line), this IH&S bears resemblances with the one in early 2020 which kick started the post COVID crash recovery.

As you see even the 1D RSI sequences between the two are similar. It would appear that right now we are in the process of turning the 1D MA200 in a Support as in mid-June 2020. Two weeks after the price convincingly broke above the Right Shoulder and the rally stopped just below the 2.0 Fibonacci extension.

If the current pattern repeats the 2020 one, then the 2.0 Fib extension will get the price to 155.00. That is just below the 0.786 Fib retracement from the All Time High. Right now the price is on the 0.382 Fib.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NIKE: A POST EARNINGS PLAYNike reported earnings on the 20th after the market close. The stock increased by more than 12% the following day.

The price of the stock revisited the resistance level that was rejected in June and August of 2022. Before the rejections, this level acted as a support as seen in March and April of 2022. In this chart, the support/resistance zone is marked by the yellow box.

Additionally, this zone currently coincides with a VWAP anchored back to November of 2021. We observed that the price action rejected at both the anchored VWAP and the yellow box zone of resistance on December 21st of 2022. If price revisits this level, look for price action consistent with what we have observed in the previous rejections.

NIKE LONGS!Nike longs!

Nike (NKE) has surged over 12% in the premarket after the athletic footwear and apparel maker reported better-than-expected quarterly results and raised its revenue forecast.

Price action has formed an inverse head and shoulders pattern, looking for the price to run back towards $150, as we look to break out of the bearish market structure via the weekly.

NKE hitting MAJOR clusterWhat an interesting chart.

After price hit the 200 Daily SMA with a triple tap (divergence pattern), price has just arrived at a major support cluster where the Monthly Pivot, the 100 SMA and a previous support area meet. Below, the big round number 100 is waiting closely too.

A pullback into the 200 Daily SMA during the current year*s dowtrend is usuaully foreshadowing more bearishness to come. But the big support cluster will require some sort of catalyst in order for the price to break below it. And since we are heading into the last week of trading this year, I don´t see anything on the horizon. A sideways drift seems likely.

Below 100, the price will have quite some room thouhg.

Nike: 3 Black Crows with Hidden Bearish Divergence Earnings PlayNike is yet to release their earnings but they will be releasing them tomorrow and i'm anticipating that whatever they are will result in a downwards move towards the $65 area; I will be playing this move via Buying of the January and February $80 Puts and Selling the $100 January 20th calls.

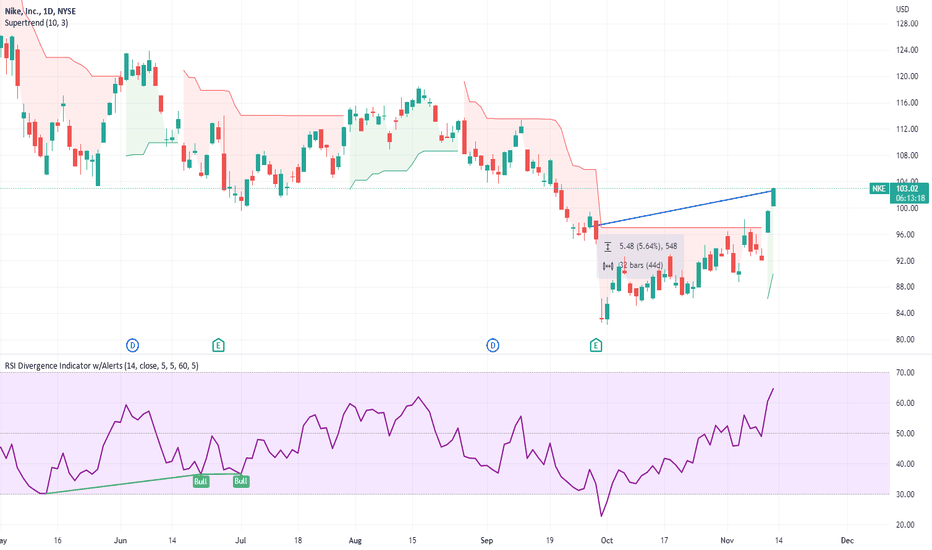

NKE - Could have bottomed?NKE tested bounced off a longer term horizontal support zone ($99 - $103) several times in the last 3 months and is now trading within a symmetrical wedge pattern. This could be both a continuation or reversal pattern depending on which side it broke out eventually.

However, I suspect the eventual break will be more likely to the upside as the resistence turned support zone ($99-$103) has been holding up in the past few months, plus a bullish divergence can be seen in the monthly chart.

Earnings expected on 29 Sep AMC. Guess we'll know by then where it is heading!

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Take care and Good Luck!

NKE LongThe all time uptrend of Nike has been supported by the EMA 100 on the monthly chart several times. Furthermore the current correction has formed a bullish flag, which we are starting to break out of. The daily 200 EMA could act as short term resistance, but overall I think Nike has the potential to move substantially higher in the future.

NKE - Just do itNike Inc - Intraday - We look to Buy at 99.72 (stop at 91.56)

Broken out of the channel formation to the upside. We have a Gap open at 99.72 from 10/11/2022 to 11/11/2022. Further upside is expected although we prefer to buy into dips close to the 99.72 level. Expect trading to remain mixed and volatile.

Our profit targets will be 118.44 and 139.00

Resistance: 109.31 / 113.36 / 118.47

Support: 99.72 / 92.10 / 82.22

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

$NKE: Bottom signal in the weekly chart$NKE has a very interesting basing pattern and reversal signal, according to weekly Time@Mode analysis here, while being down 40% from the top. A rare juncture, for a very valuable brand. Definitely an interesting setup here for mid to long term trade.

Best of luck!

Ivan Labrie.

Nike Is she gearing up to get back into breakdown of large symetrical trinagle previous support? Or are we just retesting it at resitamce ? If it

Does reclaim 107 as support then targeting 111 as downtrendinf resiatnce if we fail to reclaim the. I’d watch 99.40 to see if

That can now become support of trend

November Gainers (NKE, account up 1%)8th gainer in November is NKE . Holding period is 44 days (9/28/22-11/11/22). Account up 1%.

This month till today, my account is up 7%, average holding period is 21 days.

My trading method is mostly short term and is independent of market swings.

Will keep updating on my trades.

#NIKE to 123$? Just do it!Hello dear Traders,

Here is my idea for #NKE

Price closed above yellow line (previous month high)

Price closed (15min Chart) above purple trigger line to enter trade.

Targets marked in the chart (black lines)

Invalidation level marked with red line

Good luck!

❤️Please feel free to ask any question in comments. I will try to answer all! Thank you.

Please, support my work with like, thank you!❤️