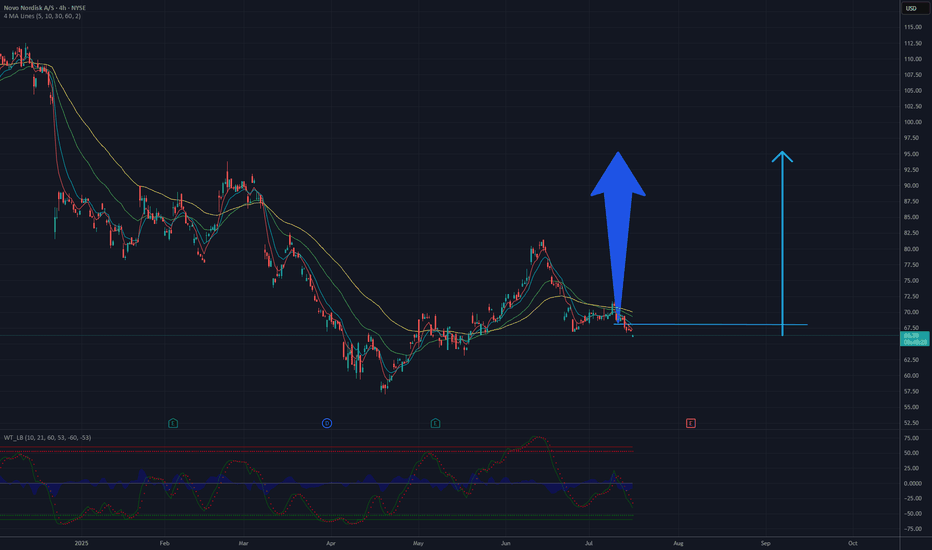

Potential Upside Move in Novo Nordisk Stock Toward the $90–$100 Based on the 4-hour chart of Novo Nordisk A/S (NYSE: NVO), the stock has undergone a strong downward correction from above $165, but is now showing signs of a potential technical bottom near the $65 level. Price action has stabilized, and oscillators indicate oversold conditions, suggesting a possib

Key facts today

The FDA will fully discontinue Novo Nordisk's Insulin Aspart products, including the FlexPen, Penfill Cartridge, and Vial, effective December 31.

Novo Nordisk ended its partnership with Hims & Hers on June 25, 2025, over concerns about misleading marketing of Wegovy®, resulting in securities class action lawsuits against Hims & Hers.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

69.73 MXN

291.41 B MXN

837.97 B MXN

3.16 B

About NOVO NORDISK B A/S

Sector

Industry

CEO

Lars Fruergaard Jørgensen

Website

Headquarters

Bagsværd

Founded

1931

ISIN

DK0062498333

FIGI

BBG01292CB20

Novo Nordisk A/S is a global healthcare company, which engages in the discovery, development, manufacturing and marketing of pharmaceutical products. It operates through the Diabetes and Obesity Care, and Rare Disease segments. The Diabetes and Obesity Care segment includes diabetes, obesity, cardiovascular, and emerging therapy areas. The Rare Disease segment refers to rare blood disorders, rare endocrine disorders, and hormone replacement therapy. The company was founded by Harald Pedersen and Thorvald Pedersen in 1923 is headquartered in Bagsværd, Denmark.

Related stocks

NVO: Trend Continuation With 4.74 R/R SetupNovo Nordisk ( NYSE:NVO ) is showing classic strength — bouncing off the cloud, reclaiming structure, and flashing early signs of momentum rotation. This is how you catch continuation trades without chasing.

📊 Technical Breakdown

Ichimoku: Price reclaimed the top of the cloud and is now building a

Cup & Handle to 81$ (and much more)Breakout successful from the red descending channel where we had left it in the previous idea.

The price is now completing the 'handle' of the pattern in question.

Resistance is around $81.5, and a close above it, accompanied by strong volume, could push the price back toward $100

NVO to 107 USDTechnical Analysis Summary – NVO

After a prolonged downtrend, the stock established a potential reversal structure:

Wave 1: Initial impulsive rally, marking the first significant move against the prevailing bearish trend.

Wave 2: Healthy corrective pullback that retraced precisely to the 61.8% Fi

$NVO Trade Idea – Potential Bullish Reversal Setup📊 Market Structure Insight

After a clear downtrend marked by consecutive Lower Highs (LH) and Lower Lows (LL), NYSE:NVO is beginning to show early signs of a trend reversal.

🔹 Recent price action has shifted into a Higher High (HH) and Higher Low (HL) formation – a classic sign of bullish momentu

NVO Soaring Towards TargetsOur NVO call debit spreads and LEAPS options soaring towards targets at the 233 EMA here.

Beautiful thing when fundamentals, valuations and technicals align.

Impulse move from the bottom gave us a hat trick - triple green tags (white circles) for bullish A+ momentum signals into a consolidation p

NOVO is looking at a strong bullish bottoming outNYSE:NVO is looking at a strong bullish reversal and is likely to head higher after stochastic shows overbought AND long term stochastic shows clear confirmation of oversold crossover.

Price action shows a clear break out of the downtrend line and with the rounding bottom, the stock is likely to

Novo Nordisk: Massive buying opportunityNovo has been struggling big time, december and march hit especially hard.

American institutions have held large positions in Novo, and this was felt when they had to sell off due to risk management with the looming tariffs.

However, the sheer devaluation & importance of their export, is going to

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where NOVOB/N is featured.

Frequently Asked Questions

The current price of NOVOB/N is 1,269.65 MXN — it hasn't changed in the past 24 hours. Watch NOVO NORDISK A/S stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange NOVO NORDISK A/S stocks are traded under the ticker NOVOB/N.

NOVOB/N stock has fallen by −5.06% compared to the previous week, the month change is a −16.16% fall, over the last year NOVO NORDISK A/S has showed a −51.17% decrease.

We've gathered analysts' opinions on NOVO NORDISK A/S future price: according to them, NOVOB/N price has a max estimate of 2,620.85 MXN and a min estimate of 1,019.22 MXN. Watch NOVOB/N chart and read a more detailed NOVO NORDISK A/S stock forecast: see what analysts think of NOVO NORDISK A/S and suggest that you do with its stocks.

NOVOB/N reached its all-time high on Jun 14, 2024 with the price of 2,708.33 MXN, and its all-time low was 948.02 MXN and was reached on Jan 24, 2022. View more price dynamics on NOVOB/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NOVOB/N stock is 0.00% volatile and has beta coefficient of 1.43. Track NOVO NORDISK A/S stock price on the chart and check out the list of the most volatile stocks — is NOVO NORDISK A/S there?

Today NOVO NORDISK A/S has the market capitalization of 5.36 T, it has decreased by −3.50% over the last week.

Yes, you can track NOVO NORDISK A/S financials in yearly and quarterly reports right on TradingView.

NOVO NORDISK A/S is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

NOVOB/N earnings for the last quarter are 19.38 MXN per share, whereas the estimation was 18.12 MXN resulting in a 6.95% surprise. The estimated earnings for the next quarter are 17.74 MXN per share. See more details about NOVO NORDISK A/S earnings.

NOVO NORDISK A/S revenue for the last quarter amounts to 231.80 B MXN, despite the estimated figure of 231.36 B MXN. In the next quarter, revenue is expected to reach 227.71 B MXN.

NOVOB/N net income for the last quarter is 86.19 B MXN, while the quarter before that showed 81.46 B MXN of net income which accounts for 5.80% change. Track more NOVO NORDISK A/S financial stats to get the full picture.

NOVO NORDISK A/S dividend yield was 1.83% in 2024, and payout ratio reached 50.28%. The year before the numbers were 1.35% and 50.35% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 22, 2025, the company has 76.3 K employees. See our rating of the largest employees — is NOVO NORDISK A/S on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NOVO NORDISK A/S EBITDA is 465.55 B MXN, and current EBITDA margin is 50.95%. See more stats in NOVO NORDISK A/S financial statements.

Like other stocks, NOVOB/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NOVO NORDISK A/S stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NOVO NORDISK A/S technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NOVO NORDISK A/S stock shows the sell signal. See more of NOVO NORDISK A/S technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.