NUGT trade ideas

Precious Metals should rebound HIGHER very stronglyPrecious Metals, Gold & Silver, should begin an upswing over the next 20~50 days with an almost immediate upside move to above $1350 for Gold happening within the next 30 days. Silver will follow this move about 10 to 30 days after gold.

The upside potential for this move in Gold is incredible. Likely targeting $1450 before mid-June and well above $1550 by July/Aug 2019.

This is the move you DON'T want to miss.

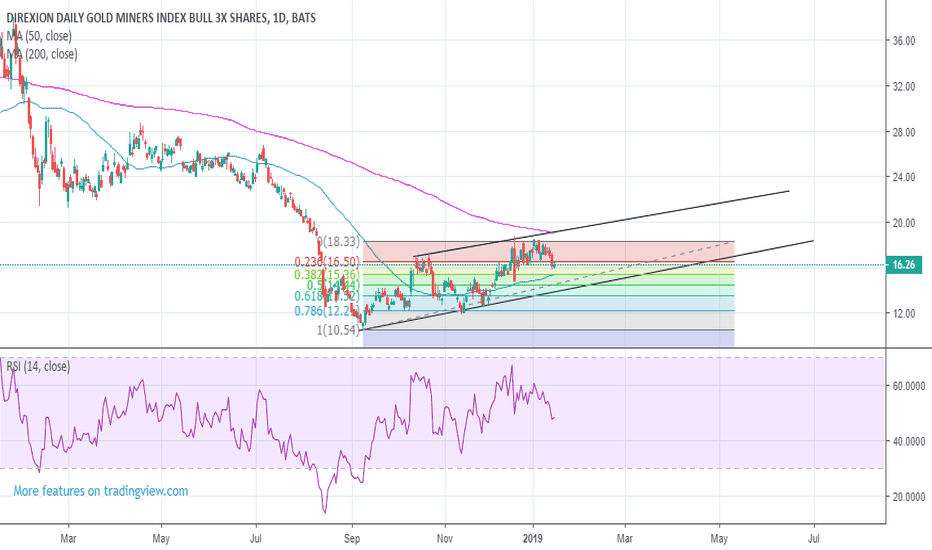

---DIREXION---GLD----1hr Fill the gap at 16.10$ Long Buy set up!-------------------------------------------------1hr Fill the gap at 16.10$ for long Buy set up! --------------------------------------------

Text cup and handle completing...

---------------------

Gold 1D 50MA has just crossed over the 200MA, and now will retest\close and escape!

On the 1W cup and handle detected, looks to be going for curl!

long

-----------------------------

4hr looks good

1hr RSI inverse head and shoulders

1D RSI still dropping

1D Stoch RSI needs to turn

---

Gold!

Gold Miners move down imminent.While the rally in gold miners is intact, gold miners is likely to make a significant move down in the immediate future.

This affects $GDX, $NUGT, and $GDXJ.

The print of the doji is pending a selloff confirmation tomorrow to start the move, which coincides with the Fibonacci time series analysis to project a move lower.

Traders banking on support being held at the trendline are likely in for disapopintment.

It's much more likely that gold miners will make a move lower to fill the open gap, down to the $15.50 support area as a first target, where $14.50 is a real possibility.

Skilled investors should protect their miner's investments now. Short traders an enter a position pending confirmation on tomorrow's print.

NUGT oversoldI've been silent the last few days. Last trade I got stopped out for a profit. No regrets there.

I'm taking a small position here, as NUGT is oversold. The red slow line in the stochastics is below 15 now.

The last few times this happened in the past, a small rally occurred. I expect the same here (and this position is a hedge against market weakness). I hope this isn't a crazy oversold signal (like summer of last year where stochastic was oversold for a very long time), thus, I have a usual 10% stop-loss.

Target #1 = 13-day EMA = $19.90. Let's see what happens.

Stay safe out there and book profits. If you have a winning position, consider taking some off the table and protect the rest with a stop-loss.

Long GoldLong Gold:

1.) Lower global growth projections and limited monetary policy flexibility (rates already low/negative)

2.) Potential Head and Shoulder pattern completion on S&P

3.) China trade deal hype has been bought and priced in

4.) USD showed strength, but gold prices remain supported. Indicating buyers are coming into the market.

5.) 2, 5, 10 yr yields are all falling, indicating more money being pulled from stocks and into bonds

Currently bullish on gold in the short term, medium and long term is still uncertain.

Defensive positioningLet's see. TLT is up. VIX is up. Gold price up. DXY cannot break though 97 again. Stock market indexes neutral.

I think some big money is moving into defensive positions. I'll open a position in NUGT as a hedge. Watching DXY to see if it goes higher than 97. If DXY drops from 97, NUGT should see a good return (hopefully).

descending triangle and hanging man looks bearishSelling pressure is strong here. Could mean a correction for the index and possibly also for gold prices which it is correlated with strongly. Gold has made short terem fresh highs above 1280 which could mean a small correction while other large index like NASDAQ and SP500 stage a recovery.