OCGN trade ideas

OCGN Breakout from Falling Wedge — Preparing for Next Bullish LeOCGN has shifted from bearish to bullish structure. As long as the price respects the rising channel and moving averages, this setup provides a favorable risk-to-reward for swing traders. Monitor volume and news catalysts, especially around biotech developments and earnings.

Bullish ActionSince what I believe to have been the bottom of a larger Wave 2, price action and most importantly volume has been very positive. This says to me, on a larger scale, this is the very beginning of Wave 3.

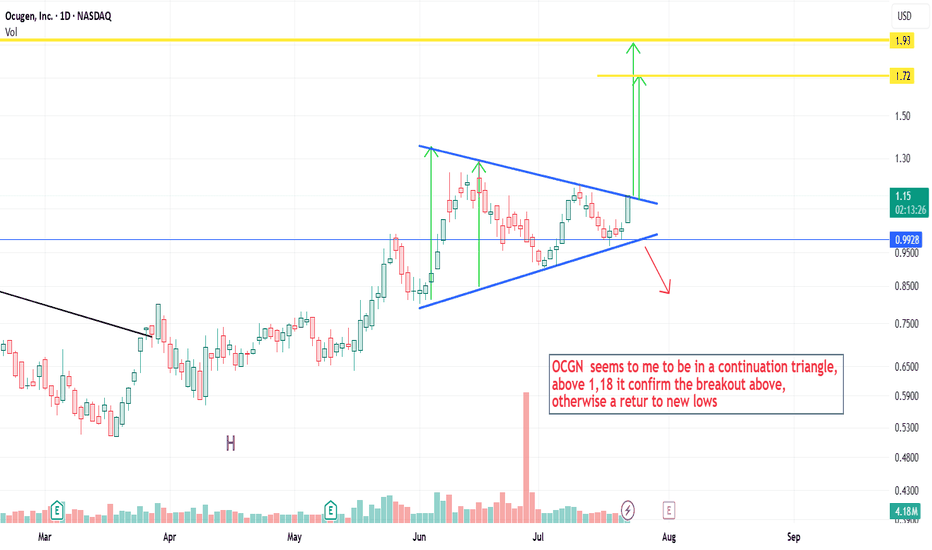

The question I am asking myself when looking at a smaller scale - was that first break out, with the minor pullback wave 1 and 2? Or, are we still in wave 1.1?

The pullback happened following the breakout, but I expected a deeper retracement to ~$0.76.

IF this is wave 1.3 we are in now, I have a newer short term target of $1.77.

Volume precedes price.

Nice volume today and over the past couple of weeks, almost double the average today.

For me, i'm accumulating whilst this sits under $1. A break of $1, which I think is coming soon and it could move quick; according to Finviz, the short interest on NASDAQ:OCGN is 20%!

Overall, this is looking very bullish and I find this a very appealing stock right now.

NFA.

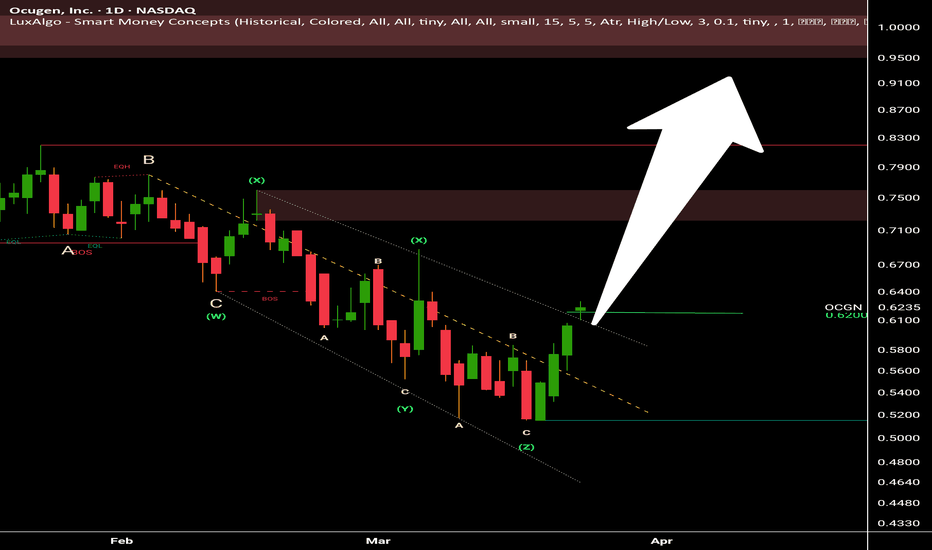

Ocugen DistributionAfter going through its accumulation and euphoric stage, it is currently in distribution. $0.84~ seems to be a point of non-movement. One stimulus and catalyst could turn this.

I'm going to keep an eye on upcoming trials cycles and dates and look to take a lotto. Under $1 this looks like an appealing stock. A company with huge potential. Its 3 month bullish cycle in Dec 23 to March 24 provided 484% in gains.

To me, this is the end of Wave 2, in a larger bull pattern. If so, we could see wave 3 hit ~$4. I think i'll take a very small position, in case it is still in a bear cycle.

One to keep an eye on.

Not financial advice.