ODFL trade ideas

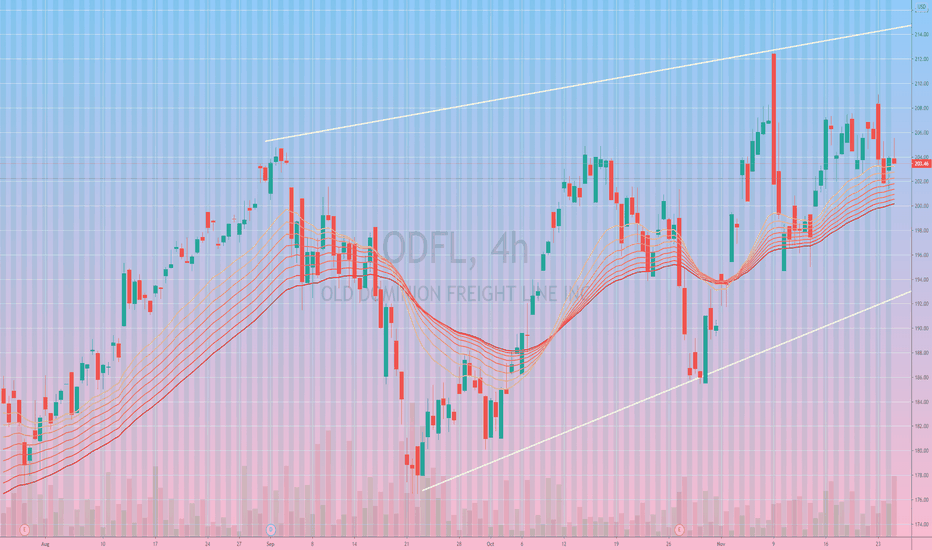

ODFL - Elliottwave analysis - ABC correction downODFL - It has completed impulse up cycle in 4 hr time frame from major low. The sharp drop looks more like a wave A and expected to correct in B wave in choppy fashion. Sell it near 206-210 with stop level above 213.15 for target zone near 190 or even lower level. If it crosses above new high, then it starts extending 5th wave and can go much higher thereafter.

Give thumbs up if you really like the trade idea.

Cup and Handle Patterns above Patterns A Triangle 10/27 BMOEarnings 10-27 BMO and they do miss

But Zack says it is a buy..lol...Zack is not always right so do your research

Not to long entry level/this pattern is only valid at or over entry level

NV is high on this one as is OBV

ODFL fell from a Risng wedge but seems to have recovered

Transport having a bit of a pull back as of late

Go with your gut on this one if you trade it before earnings

Not a recommendation

If you wants Zack's opinion, just type in the stock

www.zacks.com

Old Dominion Freight Lines should have a $190 price targetOld Dominion is a jewel of a company, and is very well run. I feel confident targeting $190/share if we get a nice bullish confirmation candle.

21.47B Market Cap

Income 615.4M

Sales 4.11B

Div% 0.33%

P/E 35.19

Forward P/E 31.24

P/FCF 46.5

Quick Ratio 1.90

EPS this Y 3.7%

EPS Next Y 21.97%

Sales Q/Q -0.3%

EPS Q/Q 1.5%

ROA +15.8%

ROI +19.5%

Profit Margin +15%

Short Float 2.47%

Freight Line to the Top!What I see...

+ 10ma support

+ prices pulled back from last week's high

+ bullihs MACD

+ RSI is side way

+ Consecutive NR7 on descending volume

- Upper shadows in the past few days

- Both RSI and MACD look to be turning bearish

- Higher price stock

What I setup...

+ Long entry above -1d high

- Stop is today's low

+ Target is at $177

:: Duration - 4 to 10 sessions

** Comments and Likes are appreciated; New Subscribvers are Beautiful! **

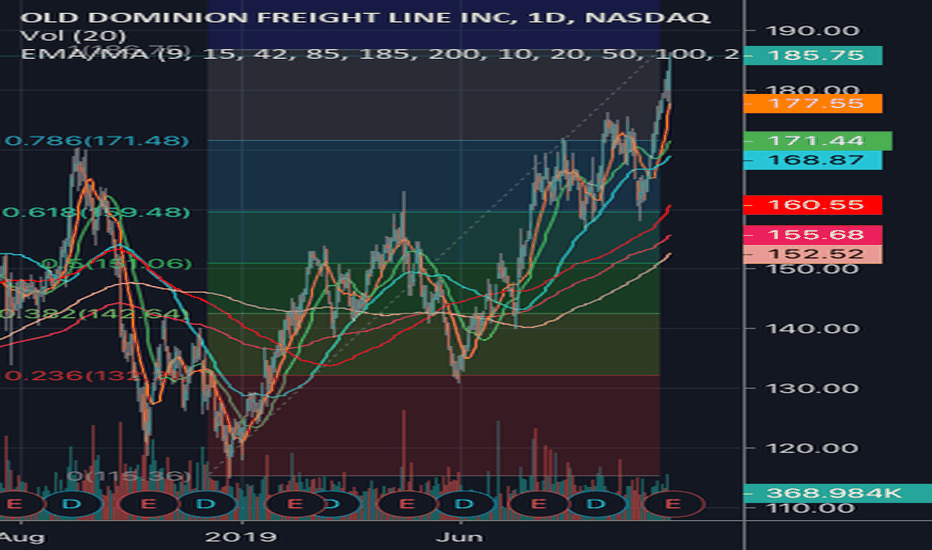

Old Dominion Freight - Long entry setupWhat I see...

+ Prices bounced back from mid-March low of $110 forming a v-shape pattern

+ Along the way, prices zig zac along major Fib marks

+ Huge vol. back in Dec!

+ Prices moved side way in the past few sessions

+ MACD has crossed upward

+ Both 10 and 50 MA are above 200MA

+ RSI at 62

+ 52 week & all-time high

- prices are distance from 10MA

- prices could continue to go side way, within channel, until 10 MA has pulled closer

- Slight upper shadows across the past few sessions

What I setup...

Long entry if break above last week's high

Target at 0.618 Fib

Stop at -4d low

ODFL approaching $80ODFL is a good trending stock, but volume is fairly thin. This can affect liquidly when entering and exiting trades.

The weekly uptrend has been long and linear - the pullbacks have become a little deeper but are more than acceptable on this timeframe.

On the daily chart, however, the pullbacks have caused a bit more of a concern. During early 2014 there were better charts to trade. Since the October 2014 pullback the trend does seem to have settled down. If you're comfortable with fairly large stops and low volume this could well be a long-term buy opportunity.