TradingView Show: Trade Ideas You Can't Miss with TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- New sectors to watch, like homebuilders

- Prio

Key facts today

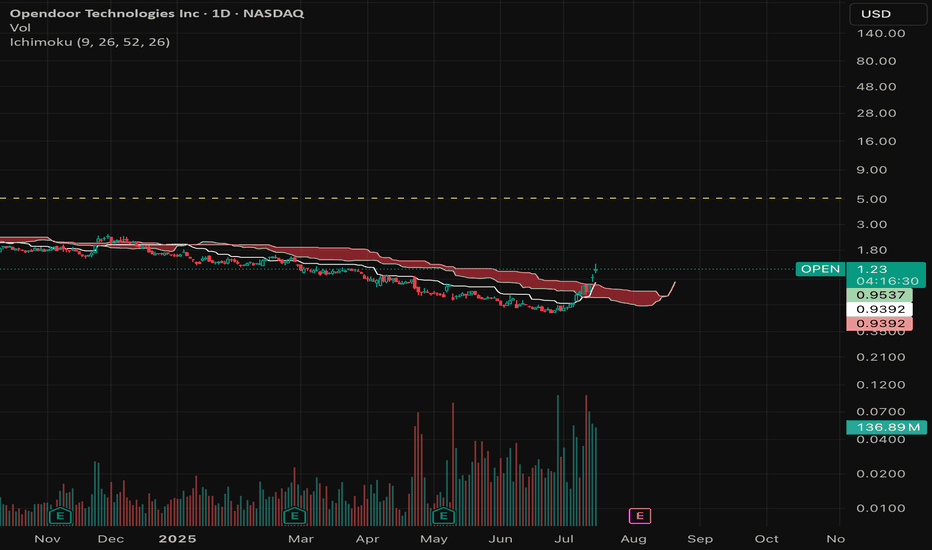

Opendoor Technologies (OPEN) has a short interest over 20%, making it heavily shorted. It recently joined a rally among such stocks, gaining since early April.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−10.62 MXN

−8.17 B MXN

107.44 B MXN

634.09 M

About Opendoor Technologies Inc

Sector

Industry

CEO

Carrie Ann Wheeler

Website

Headquarters

Tempe

Founded

2013

FIGI

BBG00ZR7T256

Opendoor Technologies, Inc. engages in the operation of buying, selling, and trading of residential properties online. The company was founded by Eric Wu on December 30, 2013, and is headquartered in Tempe, AZ.

Related stocks

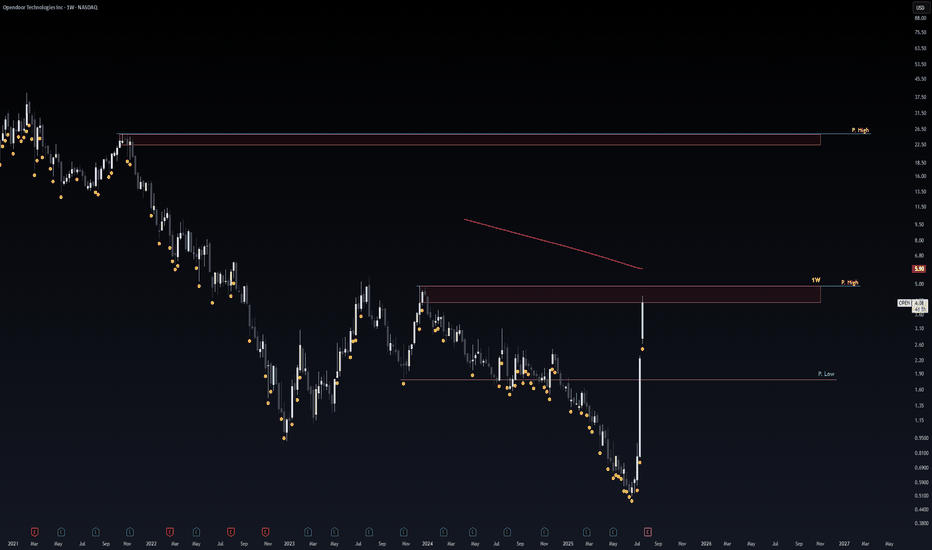

OPEN Risky AF!Sharing my crazy Thoughts ._.

the blue Lines Aka Red Zones consider As Strong Major Resistances and price will respect it !

Either by price Re-test or Reject.

Pink Line Consider As Strong Support level.

MY scenario of upcoming Days.

Stock Reject by Blue Line. and Re-test Pink Line as the support

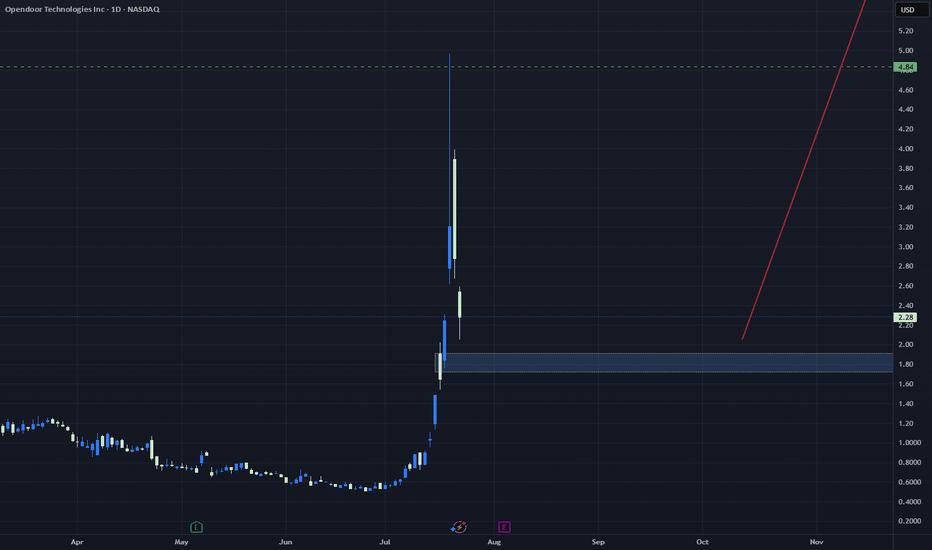

OPEN (Opendoor Technologies)Opendoor (OPEN) is emerging from a brutal real estate cycle with a leaner, smarter operation and a business model that could thrive as the housing market finds footing. While the company is still working toward consistent profitability, the current setup offers asymmetric upside due to improving fun

OPEN WEEKLY TRADE SETUP — 07/23/2025

🏠 OPEN WEEKLY TRADE SETUP — 07/23/2025

📈 Volume Surge + Call Flow = Bullish Bias Confirmed

⸻

🔍 MARKET SNAPSHOT

All major models signal STRONG WEEKLY BULLISH bias, supported by:

• 📊 Weekly RSI = 85.9 (RISING) → 🚀 Momentum confirmed

• 📉 Daily RSI = 83.3 (FALLING) → ⚠️ Overbought zone, short-term

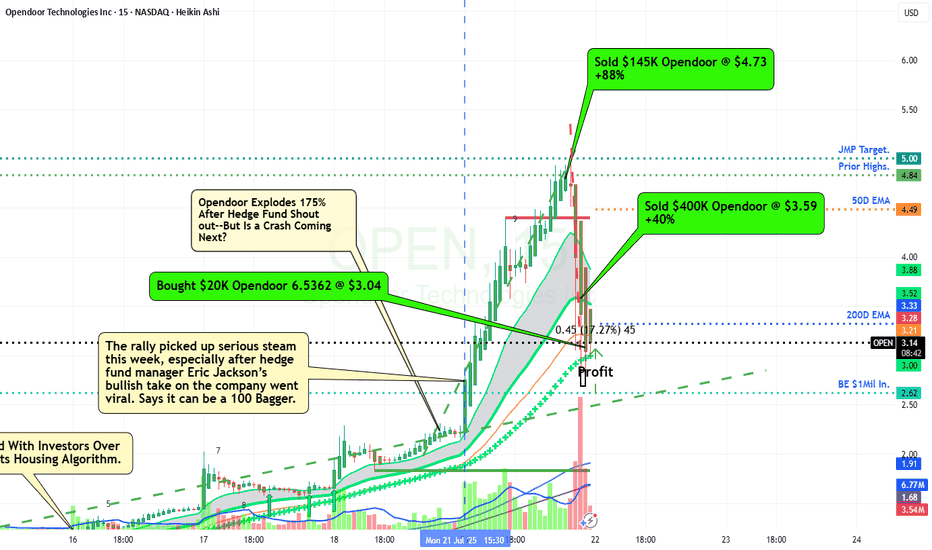

Open Door Cloud Trend Amazing StudyOpen was one of my holdings that surprised to the upside due to certain Hedge Fund Speculators, as seen on my Chart.

This one could be a 100 bagger - he said. And possible correct.

Huge volume and range - shows how that this is now a Meme Stock.

As always if you are unsure please consult with your

Trump firing Jerome is bullish for $OPEN - Trump firing Jerome is bullish for physical assets like real estate, gold, materials.

- Trump would most likely appoint a FED chair which will lead to lower interest rates.

- Lower Interest rates (Macro tailwinds) + Improving business model (fundamentals) + technical breakout = 🚀

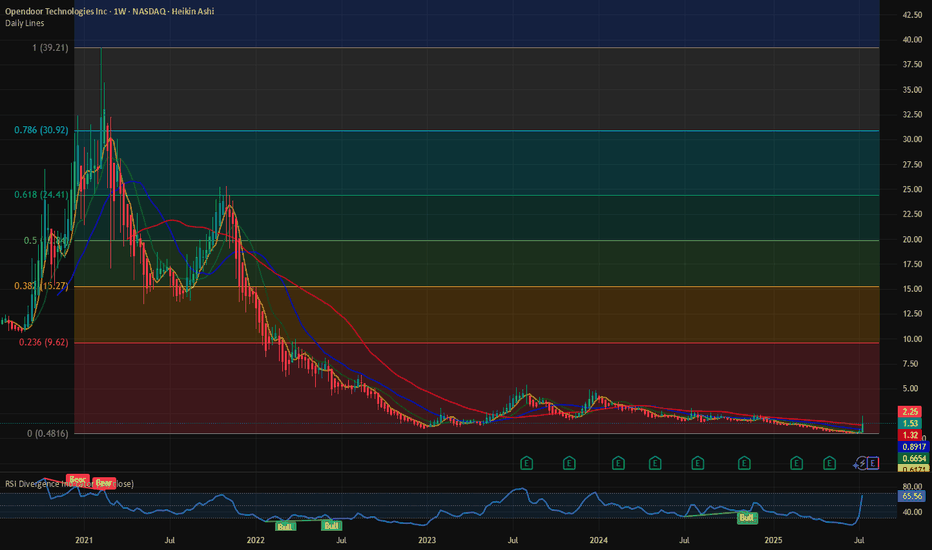

$OPEN: Ongoing short squeeze. What are the Fib levels telling? Are these the sign of a mature bull market? Drone cos, Space cos, SPACs, Biotech and Penny stocks are rallying. NASDAQ:OPEN is one such stock which hit the lowest of 0.5 $ last week before rallying more than 200% until July 18, 2025. NASDAQ:OPEN has a high short interest of almost 20% and short

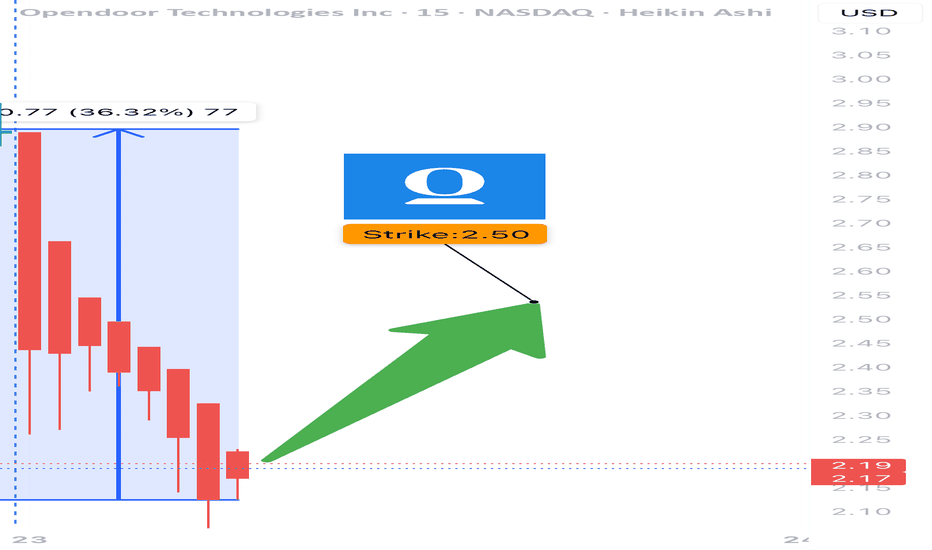

$2.50 Battle Zone: Breakout Fuel or Bull Trap?Candlestick Context & Psychology

This rally comes after a huge drift lower. That context matters a lot. Here's why:

After long downtrends, sharp rallies are common (“dead-cat bounce” or true reversals). The last 3–5 candles (large white Marubozu) show massive momentum. But the latest candle is star

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

OPEN6076147

Opendoor Technologies Inc. 7.0% 15-MAY-2030Yield to maturity

−2.12%

Maturity date

May 15, 2030

See all OPEN1 bonds

Frequently Asked Questions

The current price of OPEN1 is 38.40 MXN — it has decreased by −10.04% in the past 24 hours. Watch OPENDOOR TECHNOLOGIES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange OPENDOOR TECHNOLOGIES INC stocks are traded under the ticker OPEN1.

OPEN1 stock has fallen by −20.36% compared to the previous week, the month change is a 246.59% rise, over the last year OPENDOOR TECHNOLOGIES INC has showed a −4.00% decrease.

We've gathered analysts' opinions on OPENDOOR TECHNOLOGIES INC future price: according to them, OPEN1 price has a max estimate of 24.29 MXN and a min estimate of 12.70 MXN. Watch OPEN1 chart and read a more detailed OPENDOOR TECHNOLOGIES INC stock forecast: see what analysts think of OPENDOOR TECHNOLOGIES INC and suggest that you do with its stocks.

OPEN1 reached its all-time high on Oct 18, 2021 with the price of 501.76 MXN, and its all-time low was 9.90 MXN and was reached on Jun 25, 2025. View more price dynamics on OPEN1 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

OPEN1 stock is 20.28% volatile and has beta coefficient of 2.20. Track OPENDOOR TECHNOLOGIES INC stock price on the chart and check out the list of the most volatile stocks — is OPENDOOR TECHNOLOGIES INC there?

Today OPENDOOR TECHNOLOGIES INC has the market capitalization of 25.34 B, it has increased by 69.67% over the last week.

Yes, you can track OPENDOOR TECHNOLOGIES INC financials in yearly and quarterly reports right on TradingView.

OPENDOOR TECHNOLOGIES INC is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

OPEN1 earnings for the last quarter are −2.46 MXN per share, whereas the estimation was −2.70 MXN resulting in a 8.83% surprise. The estimated earnings for the next quarter are −0.61 MXN per share. See more details about OPENDOOR TECHNOLOGIES INC earnings.

OPENDOOR TECHNOLOGIES INC revenue for the last quarter amounts to 23.62 B MXN, despite the estimated figure of 21.67 B MXN. In the next quarter, revenue is expected to reach 28.19 B MXN.

OPEN1 net income for the last quarter is −1.74 B MXN, while the quarter before that showed −2.36 B MXN of net income which accounts for 26.09% change. Track more OPENDOOR TECHNOLOGIES INC financial stats to get the full picture.

No, OPEN1 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 1, 2025, the company has 1.47 K employees. See our rating of the largest employees — is OPENDOOR TECHNOLOGIES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. OPENDOOR TECHNOLOGIES INC EBITDA is −4.47 B MXN, and current EBITDA margin is −4.72%. See more stats in OPENDOOR TECHNOLOGIES INC financial statements.

Like other stocks, OPEN1 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade OPENDOOR TECHNOLOGIES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So OPENDOOR TECHNOLOGIES INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating OPENDOOR TECHNOLOGIES INC stock shows the neutral signal. See more of OPENDOOR TECHNOLOGIES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.