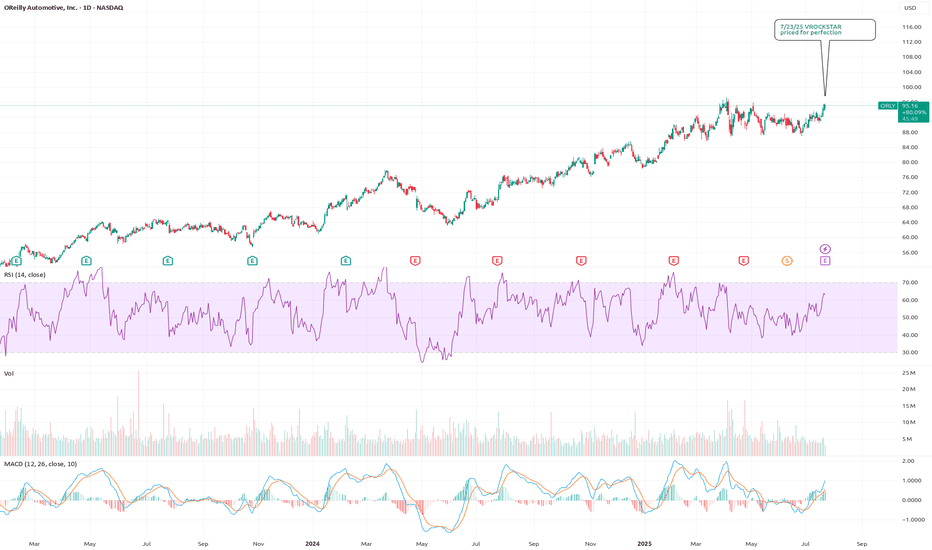

7/23/25 - $orly - priced for perfection7/23/25 :: VROCKSTAR :: NASDAQ:ORLY

priced for perfection

- hard to not consider this as a hedge to my NYSE:DECK long (into tmr print)

- stock has had series of weak Q's

- google trends remains meh

- stock not cheap at <3% fcf yield (staples closer to 3.5%+)

- IV on the chain seems lazy... not

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

52.74 MXN

49.76 B MXN

348.36 B MXN

848.10 M

About O'Reilly Automotive, Inc.

Sector

Industry

CEO

Brad W. Beckham

Website

Headquarters

Springfield

Founded

1957

FIGI

BBG00BNKGPP5

O'Reilly Automotive, Inc. owns and operates retail outlets in the United States. It engages in the distribution and retailing of automotive aftermarket parts, tools, supplies, equipment, and accessories in the U.S., serving both professional installers and do-it-yourself customers. It provides new and remanufactured automotive hard parts, including alternators, starters, fuel pumps, water pumps, brake system components, batteries, belts, hoses, temperature controls, chassis parts and engine parts, maintenance items consisting of oil, antifreeze products, fluids, filters, lighting products, engine additives, and appearance products, and accessories, such as floor mats, seat covers, and truck accessories. Its stores offer auto body paint and related materials, automotive tools, and professional service provider service equipment. The firm stores also offer enhanced services and programs consisting of used oil, oil filter and battery recycling, battery, wiper, and bulb replacement, battery diagnostic testing, electrical and module testing, check engine light code extraction, a loaner tool program, drum and rotor resurfacing, custom hydraulic hoses, professional paint shop mixing and related materials, and machine shops. O'Reilly Automotive stores provide do-it-yourself and professional service provider customers a selection of brand name, house brands, and private label products for domestic and imported automobiles, vans, and trucks. The company was founded by Charles F. O'Reilly and Charles H. O'Reilly in November 1957 and is headquartered in Springfield, MO.

Related stocks

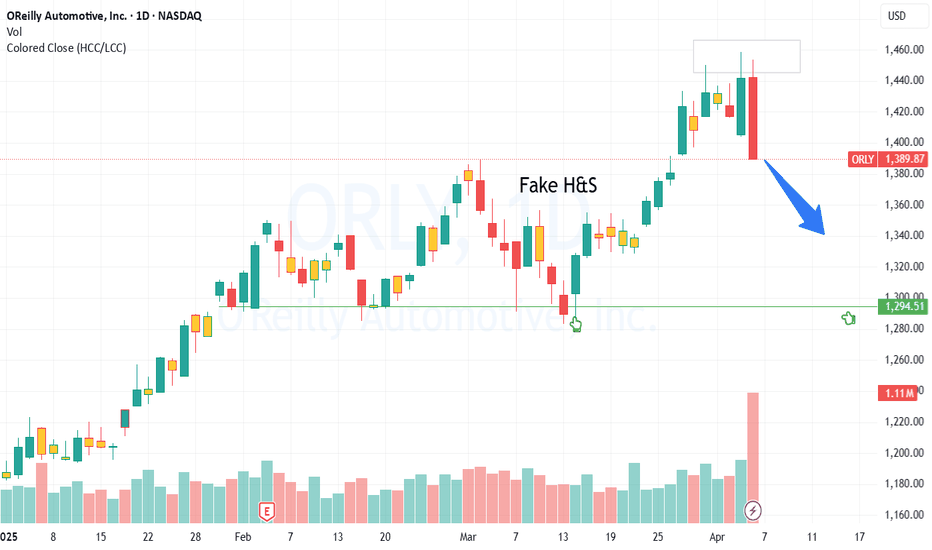

Looks certain to test previous high at 1450 areaAfter a turbulent week, as things start to normalize a bit, the oversold areas are continuing to step up further. The one thing that stands out is the last candle beating the previous high, as pointed out on the arrow, but also testing resistance. This shouldn't be a great area of concern for bulls

OReilly Long!I've entered a long position in $ORLY. Since this US stock reached its high in late July of this year, it has been continuously in a sideways correction, which is very bullish. In the last few trading days, it broke out of this channel to the upside and re-tested it on the last trading day.

The pric

O'Reilly Automotive Hit All-Time High In March, Nosedived AprilOn March 21, O'Reilly Automotive ( NASDAQ:ORLY ) stock hit an all-time high at 1169.11. However, in April, the stock nosedived and is currently trading at $1074.27 on Friday's session, down by 0.81%.

Despite the confusion in the auto market, O'Reilly Automotive ( NASDAQ:ORLY ), a leading retailer

RectangleRectangles are a horizontal consolidation pattern and is neutral pattern until broken.

Price is on the support line today.

Recent fall from a bearish Rising Wedge. Both lines slope up narrowing at the apex and represents too much supply within the wedge. This pattern is not valid unless the bott

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ORLY5871711

O'Reilly Automotive, Inc. 5.0% 19-AUG-2034Yield to maturity

4.99%

Maturity date

Aug 19, 2034

ORLY5043546

O'Reilly Automotive, Inc. 1.75% 15-MAR-2031Yield to maturity

4.82%

Maturity date

Mar 15, 2031

ORLY5425701

O'Reilly Automotive, Inc. 4.7% 15-JUN-2032Yield to maturity

4.71%

Maturity date

Jun 15, 2032

ORLY4340931

O'Reilly Automotive, Inc. 3.55% 15-MAR-2026Yield to maturity

4.63%

Maturity date

Mar 15, 2026

ORLY5702604

O'Reilly Automotive, Inc. 5.75% 20-NOV-2026Yield to maturity

4.39%

Maturity date

Nov 20, 2026

ORLY4632340

O'Reilly Automotive, Inc. 4.35% 01-JUN-2028Yield to maturity

4.21%

Maturity date

Jun 1, 2028

See all ORLY bonds

Frequently Asked Questions

The current price of ORLY is 1,869.04 MXN — it has increased by 1.91% in the past 24 hours. Watch OREILLY AUTOMOTIVE INC NEW stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange OREILLY AUTOMOTIVE INC NEW stocks are traded under the ticker ORLY.

ORLY stock has risen by 11.32% compared to the previous week, the month change is a 11.32% rise, over the last year OREILLY AUTOMOTIVE INC NEW has showed a 68.47% increase.

We've gathered analysts' opinions on OREILLY AUTOMOTIVE INC NEW future price: according to them, ORLY price has a max estimate of 2,227.58 MXN and a min estimate of 1,596.44 MXN. Watch ORLY chart and read a more detailed OREILLY AUTOMOTIVE INC NEW stock forecast: see what analysts think of OREILLY AUTOMOTIVE INC NEW and suggest that you do with its stocks.

ORLY reached its all-time high on Jul 29, 2025 with the price of 1,869.04 MXN, and its all-time low was 187.02 MXN and was reached on Jul 7, 2017. View more price dynamics on ORLY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ORLY stock is 1.88% volatile and has beta coefficient of 0.23. Track OREILLY AUTOMOTIVE INC NEW stock price on the chart and check out the list of the most volatile stocks — is OREILLY AUTOMOTIVE INC NEW there?

Today OREILLY AUTOMOTIVE INC NEW has the market capitalization of 1.60 T, it has decreased by −0.72% over the last week.

Yes, you can track OREILLY AUTOMOTIVE INC NEW financials in yearly and quarterly reports right on TradingView.

OREILLY AUTOMOTIVE INC NEW is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

ORLY earnings for the last quarter are 14.63 MXN per share, whereas the estimation was 14.65 MXN resulting in a −0.10% surprise. The estimated earnings for the next quarter are 15.69 MXN per share. See more details about OREILLY AUTOMOTIVE INC NEW earnings.

OREILLY AUTOMOTIVE INC NEW revenue for the last quarter amounts to 84.88 B MXN, despite the estimated figure of 85.00 B MXN. In the next quarter, revenue is expected to reach 88.43 B MXN.

ORLY net income for the last quarter is 12.54 B MXN, while the quarter before that showed 11.03 B MXN of net income which accounts for 13.68% change. Track more OREILLY AUTOMOTIVE INC NEW financial stats to get the full picture.

No, ORLY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 4, 2025, the company has 93.05 K employees. See our rating of the largest employees — is OREILLY AUTOMOTIVE INC NEW on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. OREILLY AUTOMOTIVE INC NEW EBITDA is 70.86 B MXN, and current EBITDA margin is 22.23%. See more stats in OREILLY AUTOMOTIVE INC NEW financial statements.

Like other stocks, ORLY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade OREILLY AUTOMOTIVE INC NEW stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So OREILLY AUTOMOTIVE INC NEW technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating OREILLY AUTOMOTIVE INC NEW stock shows the strong buy signal. See more of OREILLY AUTOMOTIVE INC NEW technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.