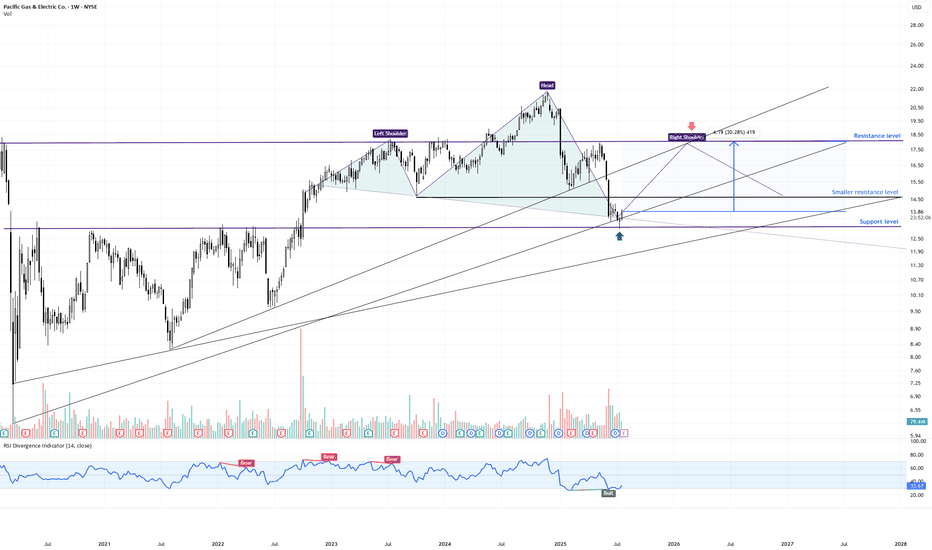

PCG Weekly Swing Trade | High-Probability Reversal Zone📍 Ticker: PCG (Pacific Gas & Electric Co.)

📆 Timeframe: 1W (Weekly)

💡 Pattern: Head & Shoulders Formation – Testing Neckline & Long-Term Support

📉 Price: $13.87 (current weekly level)

📊 Volume: 78M

📉 RSI: 33.7 → oversold zone brewing

🔍 What the Chart is Showing

PCG is in the late stages of a Head &

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

22.32 MXN

52.37 B MXN

509.12 B MXN

2.19 B

About Pacific Gas & Electric Co.

Sector

Industry

CEO

Patricia K. Poppe

Website

Headquarters

Oakland

Founded

1995

FIGI

BBG01B1CK9L1

PG&E Corp. operates as a holding company, which engages in generation, transmission, and distribution of electricity and natural gas to customers. It specializes in energy, utility, power, gas, electricity, solar and sustainability. The company was founded in 1995 and is headquartered in Oakland, CA.

Related stocks

PCG | SWINGGGG TRADE IDEA, BRUVS!Ahoy M8s.

We're sailing the swing trading seas today! PG&E (PCG) just pierced a multi-year support line. Doesn't mean it can't go lower, but that's why we're managing our position size with a small starter position.

Will follow up with an add message if I add to the position. Don't get cooked.

PCG | Potential Reversal Zone at LT Support + Breakdown Retest📍 Ticker: NYSE:PCG (Pacific Gas & Electric Co.)

📆 Timeframe: 1W (Weekly)

💡 Pattern: Head and Shoulders Breakdown → Testing Key Support

📉 Price: $14.79 (as of last candle close)

📊 Volume: 87M

📉 RSI: 32.92 (approaching oversold)

🔍 Technical Setup:

A Head and Shoulders top has completed, with price

$PCG - Did market just panic dumped the wrong stock?The recent wildfires in California, particularly the Palisades and Eaton Fires in Los Angeles County, have primarily affected Southern California.

This recent wildfire news caused NYSE:PCG to crash alongside NYSE:EIX (which bounced as well).

However, PG&E's service area is predominantly in No

PCG PG&E Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PCG PG&E Corporation prior to the earnings report this week,

I would consider purchasing the 18usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $0.40.

If these options prove to be profitable prior to the

PCG is putting in a BasePCG is oversold in RSI at 36 and the MCAD is beginning to show a slow down. A base seems to be building on the daily with volume. The news of the new leadership position has hit the market and the stock has broken below the 200 day MA.

The Time Frame Continuity is not showing the best promise; how

PCG caught my attention to continue bullishI want to Buy this Stock base on 2 main approach.

1.Technical Analysis: base on technical, using the ICT I trade with, The market sweeps liquidity and create a valid order blocks and expanded with Fair value gaps, target equal highs, this is good sing of strength to go bullish.

2. FOUNDAMENTAL REP

PG&E corp is in for an ELECTRIC RIDE UPWARDSPG&E isn't going anywhere, California is helplessly dependent on it. they are investing in their infrastructure (after its horrendous wildfire fiasco due to infrastructure negligence). This situation lead to a tremendous sell-off because it seemed like a risky company to hold stocks for and overall

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PCG4431716

Pacific Gas and Electric Company 4.0% 01-DEC-2046Yield to maturity

7.93%

Maturity date

Dec 1, 2046

PCG5002763

Pacific Gas and Electric Company 3.5% 01-AUG-2050Yield to maturity

7.79%

Maturity date

Aug 1, 2050

PCG3889501

Pacific Gas and Electric Company 3.75% 15-AUG-2042Yield to maturity

7.60%

Maturity date

Aug 15, 2042

PCG4570769

Pacific Gas and Electric Company 3.95% 01-DEC-2047Yield to maturity

7.52%

Maturity date

Dec 1, 2047

PCG4307744

Pacific Gas and Electric Company 4.25% 15-MAR-2046Yield to maturity

7.52%

Maturity date

Mar 15, 2046

PCG4181017

Pacific Gas and Electric Company 4.3% 15-MAR-2045Yield to maturity

7.49%

Maturity date

Mar 15, 2045

PCG4570765

Pacific Gas and Electric Company 3.3% 01-DEC-2027Yield to maturity

7.46%

Maturity date

Dec 1, 2027

PCG.JR

Pacific Gas and Electric Company 4.5% 15-DEC-2041Yield to maturity

7.35%

Maturity date

Dec 15, 2041

PCG5145842

Pacific Gas and Electric Company 4.2% 01-JUN-2041Yield to maturity

7.31%

Maturity date

Jun 1, 2041

PCG3843184

Pacific Gas and Electric Company 4.45% 15-APR-2042Yield to maturity

7.30%

Maturity date

Apr 15, 2042

See all PCG bonds

Curated watchlists where PCG is featured.

Frequently Asked Questions

The current price of PCG is 253.44 MXN — it hasn't changed in the past 24 hours. Watch PG&E CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange PG&E CORP stocks are traded under the ticker PCG.

PCG stock has risen by 2.40% compared to the previous week, the month change is a −2.52% fall, over the last year PG&E CORP has showed a −21.27% decrease.

We've gathered analysts' opinions on PG&E CORP future price: according to them, PCG price has a max estimate of 445.43 MXN and a min estimate of 315.52 MXN. Watch PCG chart and read a more detailed PG&E CORP stock forecast: see what analysts think of PG&E CORP and suggest that you do with its stocks.

PCG stock is 0.00% volatile and has beta coefficient of 0.29. Track PG&E CORP stock price on the chart and check out the list of the most volatile stocks — is PG&E CORP there?

Today PG&E CORP has the market capitalization of 574.30 B, it has decreased by −2.30% over the last week.

Yes, you can track PG&E CORP financials in yearly and quarterly reports right on TradingView.

PG&E CORP is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

PCG earnings for the last quarter are 6.76 MXN per share, whereas the estimation was 6.99 MXN resulting in a −3.29% surprise. The estimated earnings for the next quarter are 5.92 MXN per share. See more details about PG&E CORP earnings.

PG&E CORP revenue for the last quarter amounts to 122.57 B MXN, despite the estimated figure of 125.69 B MXN. In the next quarter, revenue is expected to reach 117.03 B MXN.

PCG net income for the last quarter is 12.99 B MXN, while the quarter before that showed 14.05 B MXN of net income which accounts for −7.57% change. Track more PG&E CORP financial stats to get the full picture.

Yes, PCG dividends are paid quarterly. The last dividend per share was 0.47 MXN. As of today, Dividend Yield (TTM)% is 0.60%. Tracking PG&E CORP dividends might help you take more informed decisions.

PG&E CORP dividend yield was 0.27% in 2024, and payout ratio reached 4.77%. The year before the numbers were 0.06% and 0.95% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 28.41 K employees. See our rating of the largest employees — is PG&E CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PG&E CORP EBITDA is 188.99 B MXN, and current EBITDA margin is 37.50%. See more stats in PG&E CORP financial statements.

Like other stocks, PCG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PG&E CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PG&E CORP technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PG&E CORP stock shows the sell signal. See more of PG&E CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.