PCG Weekly Swing Trade | High-Probability Reversal Zone📍 Ticker: PCG (Pacific Gas & Electric Co.)

📆 Timeframe: 1W (Weekly)

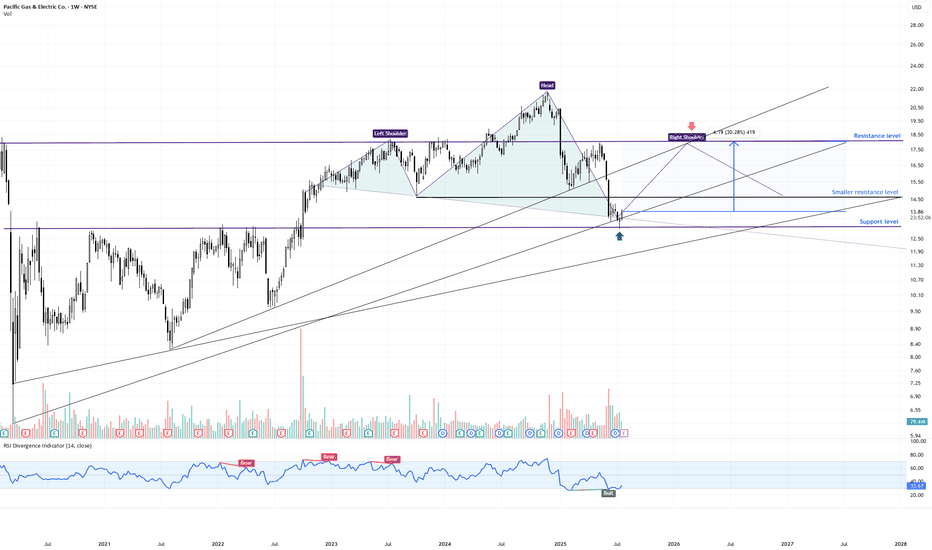

💡 Pattern: Head & Shoulders Formation – Testing Neckline & Long-Term Support

📉 Price: $13.87 (current weekly level)

📊 Volume: 78M

📉 RSI: 33.7 → oversold zone brewing

🔍 What the Chart is Showing

PCG is in the late stages of a Head & Shoulders pattern, but the right shoulder is still developing. Price is now pressing into a critical confluence area where multiple factors intersect:

✅ Neckline zone from the potential H&S structure

✅ Multi-year ascending trendline support (2020 origin)

✅ Horizontal support cluster from 2022–2023 consolidation

✅ Weekly RSI hovering near oversold, hinting at possible bullish divergence

Importantly, the H&S is not yet confirmed – it would require a decisive weekly close below the neckline to trigger a textbook breakdown.

🧠 Swing Trade Scenarios

➡️ Bullish Reversal Scenario (Failed Breakdown)

🟢 Entry Zone: $13.60–$14.00

🎯 Target 1: $14.62 (initial resistance pivot) - close 30-70% of the position

🎯 Target 2: $17.80–$18.50 (major resistance) - close the another 30-70% of the position.

⛔️ Stop-Loss 1: Close below $13.20 (neckline break confirmation)

➡️ Bearish Breakdown Scenario (Pattern Confirmation)

❌ If PCG closes below $13.20 on the weekly, it confirms the H&S → opens downside toward $11.50 (the lowest trendline support)

⚠️ What Makes This Week Critical

📌 A hammer-like candle is forming – but needs a strong weekly close to indicate buyer absorption

📌 A close above $14.00 would weaken the H&S formation, hinting at a failed pattern

📌 A close below $13.20 would confirm the bearish continuation

This is a decision zone: either the right shoulder fails, triggering a deeper swing lower, or buyers defend and negate the pattern.

💬 Will PCG confirm the weekly H&S breakdown or trap bears with a failed pattern bounce?

✅ This week’s close will define the next major swing move!

LIKE & FOLLOW for more professional swing setups with clean risk/reward.

#PCG #SwingTrade #Utilities #TargetTraders #TechnicalAnalysis #HeadAndShoulders

PCG trade ideas

PCG | SWINGGGG TRADE IDEA, BRUVS!Ahoy M8s.

We're sailing the swing trading seas today! PG&E (PCG) just pierced a multi-year support line. Doesn't mean it can't go lower, but that's why we're managing our position size with a small starter position.

Will follow up with an add message if I add to the position. Don't get cooked. LETS GOOOOOOOOOOOO!

PCG | Potential Reversal Zone at LT Support + Breakdown Retest📍 Ticker: NYSE:PCG (Pacific Gas & Electric Co.)

📆 Timeframe: 1W (Weekly)

💡 Pattern: Head and Shoulders Breakdown → Testing Key Support

📉 Price: $14.79 (as of last candle close)

📊 Volume: 87M

📉 RSI: 32.92 (approaching oversold)

🔍 Technical Setup:

A Head and Shoulders top has completed, with price breaking down below the neckline. However, PCG is now approaching a major confluence zone:

✅ Multi-year ascending trendline support (dating back to 2020)

✅ Previous horizontal support from 2022–2023

✅ RSI nearing oversold (32.9) — potential for bullish divergence

✅ Volume spike on breakdown — possible capitulation

The blue zone marks a potential retest area. If price holds and forms a reversal candle here, a bounce toward $16–$17 is possible (prior support zone).

🧠 Trading Plan:

Bullish Bias: If price shows bullish price action at/above trendline (~$14.40–$14.70)

🟢 Entry Idea 1: $14.75–$14.90

🟢 Entry Idea 2:$13.60–$14.20

🎯 Target 1: $16.20

🎯 Target 2: $17.00

⛔️ Stop1: Close below $14.20 (trendline + neckline invalidation)

⛔️ Stop 2: Close below $12.50 (Bearish Continuation: Close below ascending trendline + neckline = further downside risk toward $12.50)

⚠️ Watchlist Notes:

PCG is defensive (utilities), but often reacts to regulatory/news-driven catalysts.

Recent weakness may offer a risk/reward setup near major support.

RSI bearish structure is weakening — watch for divergence or failed breakdown.

💬 What do you think? Bounce or breakdown from here?

📌 Like & Follow for more setups! #TargetTraders #PCG #HeadAndShoulders #RSI #Utilities #SwingTrade #TechnicalAnalysis

$PCG - Did market just panic dumped the wrong stock?The recent wildfires in California, particularly the Palisades and Eaton Fires in Los Angeles County, have primarily affected Southern California.

This recent wildfire news caused NYSE:PCG to crash alongside NYSE:EIX (which bounced as well).

However, PG&E's service area is predominantly in Northern and Central California. PG&E will not have to pay back the wildfire fund if deemed prudent.

Furthermore, PG&E is a stable utility with monopoly-like dominance in California’s massive market. It benefits from regulated pricing, essential services, wildfire liability caps, and state support for clean energy and infrastructure upgrades. With strong cash flows, improving safety measures, and alignment with decarbonization trends, PG&E offers resilience, growth potential, and a compelling "buy the fake fear" opportunity. Don’t let short-term noise overshadow its solid fundamentals.

So, did market just panic dumped the wrong stock?

PCG PG&E Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PCG PG&E Corporation prior to the earnings report this week,

I would consider purchasing the 18usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $0.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PCG is putting in a BasePCG is oversold in RSI at 36 and the MCAD is beginning to show a slow down. A base seems to be building on the daily with volume. The news of the new leadership position has hit the market and the stock has broken below the 200 day MA.

The Time Frame Continuity is not showing the best promise; however, the Hourly is reversing.

The targets are the prices listed on the chart.

PCG caught my attention to continue bullishI want to Buy this Stock base on 2 main approach.

1.Technical Analysis: base on technical, using the ICT I trade with, The market sweeps liquidity and create a valid order blocks and expanded with Fair value gaps, target equal highs, this is good sing of strength to go bullish.

2. FOUNDAMENTAL REPORT: in this case, PCG stocks is own by 93% institutions , and the institutions has the highest number of transaction with 13%. on my on view, they accumulated BUYs to target the price of $18.50 or above

PG&E corp is in for an ELECTRIC RIDE UPWARDSPG&E isn't going anywhere, California is helplessly dependent on it. they are investing in their infrastructure (after its horrendous wildfire fiasco due to infrastructure negligence). This situation lead to a tremendous sell-off because it seemed like a risky company to hold stocks for and overall the company was just hated throughout California after the fires. I think that very soon the stock price is set for a very aggressive bounce back to its past high value levels

PCG: Can utilities stand the bears?PG&E Corporatio n

Short Term - We look to Buy at 12.25 (stop at 11.57)

Price action has formed an expanding wedge formation. This is positive for sentiment and the uptrend has potential to return. Support is located at 12.00 and should stem dips to this area. Preferred trade is to buy on dips.

Our profit targets will be 13.79 and 14.50

Resistance: 14.00 / 18.00 / 40.00

Support: 12.00 / 10.00 / 8.50

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Still Green on Pacific Gas and Electric. PCGA respite of some sort that is looking to be very temporary. A very tenuous picture and very dependent on how exactly the markets will open on Monday. Be careful and remember: Markets can never truly be timed. Fibtime is at best a very flimsy tool.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

PCG - Going as Planned***None of the idea I share, including this one, should be taken as financial advise. Tread lightly and if ever you find yourself certain of something, think again.***

Previous Idea and Trend

In my previous idea (linked) on PCG I said I'd expect this stock to struggle downward most of the summer and reach a strong support level in the low $9.00 range. This has been the case so far and there's not much that's changed to affect my view, at this point.

Reiteration

I still believe the current price level is this stock's bottom until there are other catalysts. It will remain around this level for the remainder of the summer with a possible break-out later this year (October or November).

Other News

PCG's decision to burry 10,000 miles of cable to mitigate fire risk is, in my view, an attempt to save face given the present concerns over PCG's role in the Dixie fire and sensitivity around the wildfire subject at large. I say this because cable burial, even when done as cheaply as feasible, is very expensive when compared to overhead installations. My preference would have been for PCG to make large investments in overhead protection of assets (specifically fuse-linked cutouts and surge-arrester failures). There are plenty of asset protection devices that almost completely mitigate the chance of asset failure and subsequent fire creation. This could have been done with fractions of the cost of cable burial and could have been done system wide instead of only across select segments (where the likelihood the most effectual burial segments could be miss-identified is high).

In my estimation, this move's short-sightedness it mitigated by the comfort provided from concern management is showing toward future fire prevention.

Dixie Fire and PCG

From what I've read, it seems very unlikely PG&E had a role in starting the Dixie fire; more so considering the exact verbiage of any legal challenge would include the word "negligent". Thus far, legal "challenges" have been political in nature rather than legally interesting: All fear, loathing, and grand-standing. Even if PG&E is found to have behaved negligently resulting in the Dixie fire, the structure of AB 1054 provides reasonable downside protection.

The Fed's Role

As always, in this current market, we have to consider Fed actions. If talk of asset tapering manifests into actual tapering I would expect this stock to fall. We shall see.

Position Additions

I'm still not looking to add to my position until the common stock reaches mid-to-low $7.00 range.

Pacific Gas & Electric Price Prediction for Second Half of 2021***THIS IS NOT FINANCIAL ADVISE. DO YOU OWN RESEARCH AND FORM YOUR OWN CONCLUSIONS.***

Historical Preface:

Having just come off an update on policy from a (un-surprisingly) hawkish federal reserve, it's been said that rates are unlikely to rise precipitously until 2023. The news of unlikely tapering sent many of the utilities stocks into a sharp short-term decline. I do predict these severe declines to be short term and utilities ($PCG included) will soon return to their established trends. For PG&E, the established trend is bearish.

Prediction:

My prediction for the remainder of the summer is the stock will likely struggle downward until it finds strong support around $9.00-$9.05 (see trended chart below). This downward pressure is a result of investors seeking ever higher returns in more speculative sectors throughout the summer. The less "sexy" sectors (Energy and Utilities) will likely languish until Fall. I also think the perception of Utilities has suffered since PG&E's and ERCOT's most recent gaffs; deserved or otherwise. ESG minded investors are avoiding these equities on a principled basis rather than financial. I anticipate this trend to eventually fade.

I will continue to add to my position at the $9.25-$9.30. Once a new strong support level is found I expect a quick, multi-week bull run to $15.00 during the last part of the year. I don't foresee prices exceeding $20.00 in 2021.

Pervasive Risks:

The location of PG&E's service area remains its biggest and most obvious risk. Most will cite the indebtedness as PG&E's largest negative mark but I don't consider this the case since the debt structure is understood and the re-payment plan is well defined. PG&E's location in California's most arid region will dominate the future risk of investing with this company. Obviously, there's little PG&E can do to rectify the issues introduced within its service area. These same challenges would be faced by any utility who exists in this location and the service outcomes would likely be the same. But, the companies leaders are taking steps to better alleviate concerns of future wildfire liabilities.

Future Confidence:

I like that PG&E understands its locational challenges and is working to mitigate them. Though I work in the Electrical utility industry, I don't know how the problems posed can be easily or cheaply addressed beyond better maintenance programs. PG&E seems to understand their position on that front is fragile and they need help finding other ways to meet their challenges; even if they don't understand what those challenges precisely are or how to mitigate them. This makes the close work they're doing with Palantir a very bullish indicator of PG&E's future success.

Final Remarks:

I remain very bullish in the long term.