PG Approaching Oversold Discount Zone Ahead of Q4 Earnings BTFD?📝 Procter & Gamble (NYSE: PG) is trading at $153.73 (-10.8% YTD), lagging the S&P 500’s +6.5% YTD gain. Despite recent weakness, a confluence of technical support, dividend resilience, and a looming catalyst could signal a tactical entry. Let’s break it down:

🔍 Fundamentals & Catalysts

Q4 Earnings Webcast (July 29):

P&G will webcast Q4 results at 8:30 AM ET, with focus on organic sales growth (guided at +2% FY25) and margin trajectory 14.

EPS Expectations: Q4 consensus at $1.43 (+2.1% YoY); FY25 core EPS guided at $6.72–6.82 (2–4% growth) 410.

Dividend Fortress:

Quarterly payout raised to $1.0568/share (ex-div: July 18), marking 69 consecutive years of increases and a 2.75% yield 612.

Payout ratio at 67% of earnings – sustainable for a consumer staple 6.

Cost Pressures & Mitigation:

Tariff Headwinds: $1B–$1.5B annual cost hit from U.S.-China tariffs 410.

Offsets: $2.4B dividend payouts + $1.4B buybacks in Q3; 280bps gross productivity savings 10.

🌍 Macro & Risk Factors

Consumer Softness: Q3 net sales fell -2% YoY; volume declines in Baby Care (-2%) and Fabric & Home Care (-1%) segments 10.

Pricing Power: Average +1% pricing in Q3 (led by Grooming/Health Care), though mix/elasticity risks persist 104.

Structural Shifts: Portfolio pruning (minor brand exits) and job cuts to offset tariff impacts 4.

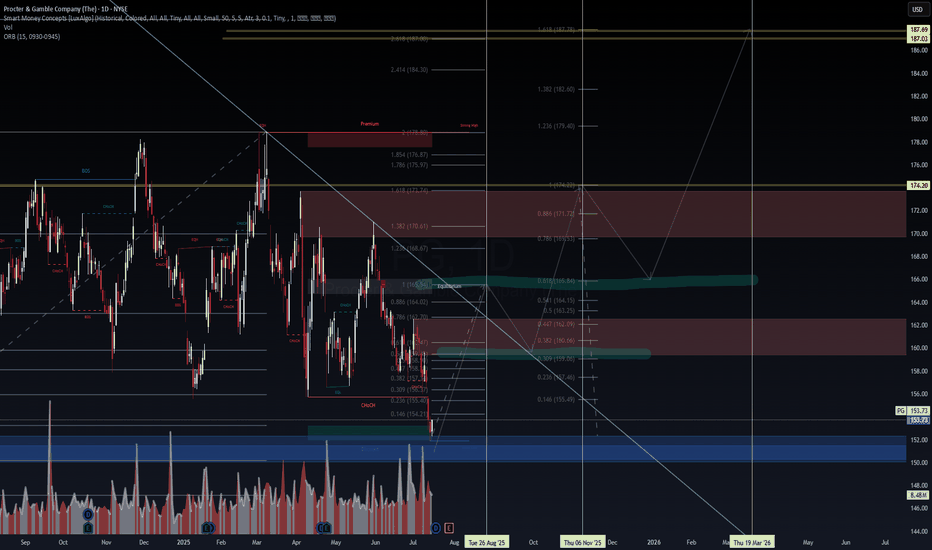

📉 Technical Setup: Oversold with Base-Building Potential

RSI 31.5 (Neutral but nearing oversold) 511.

Price vs. MAs: Below all key MAs (20-day: $159.17, 50-day: $161.59, 200-day: $165.56) – signaling bearish momentum but extreme discounts 5811.

Support Zone: $152–153 aligns with 52-week lows ($151.90) and the 2025 dividend-capture floor 212.

MACD -1.57: Suggests potential reversal if momentum shifts 5.

Technical Indicators Summary:

Indicator Value Signal

RSI (14) 31.45 Neutral

MACD (12,26) -1.57 Buy

Price vs. 200D SMA -7.1% Sell

Bollinger Bands (25) $157–161.94 Sell

🎯 Probabilistic Price Targets

Scenario Target Probability Rationale

Bounce to 20D MA $158–160 60% Mean reversion + dividend ex-date support

Reversion to 50D MA $162–164 45% Technical confluence + tariff resolution hopes

Rally to 200D MA + ATH $174 25% Bull case: Macro stabilization + guidance upgrade

📌 Trade Strategy

Entry: $152–154 (aligns with structural support) 28.

Stop Loss: $149.50 (1–2% below July 16 low of $152.27) 2.

Targets: Scale out at $160 → $164 → $174.

Catalysts: Q4 earnings (July 29) + clarity on tariff mitigation 14.

Position Size: Allocate 3–5% of portfolio; pair with long-volatility hedge.

⚠️ Key Risks

Guidance Miss: Sluggish volumes or tariff escalation could pressure FY26 EPS projections.

Technical Breakdown: Close below $151.90 invalidates support, inviting a slide to $145.

Macro Sensitivity: Consumer staples underperformance if inflation rebounds.

💎 Final Take

PG offers a rare combo: defensive yield (2.75%) + oversold technicals + imminent catalyst. While tariffs and consumer weakness justify caution, the $152–154 zone is a high-probability dip-buying opportunity. Earnings day vol could amplify moves – enter pre-event with tight stops.

#PG #ConsumerStaples #DividendKing #EarningsPlay #Tariffs

Disclaimer: This is not financial advice. Conduct your own due diligence.

PG trade ideas

$PG - Charting is Therapeutic NYSE:PG forming solid base at $159 support after 15% pullback from Feb highs.

Strong fundamentals intact with 19% profit margins in Q3. Recent analyst actions positive RBC upgraded to BUY in April, Evercore just raised PT to $190 (19% upside).

Defensive consumer staple with reliable dividend (65% payout ratio). Patient investors rewarded here. #ValueInvestment #Dividends

Bullish $PGNYSE:PG forming solid base at $159 support after 15% pullback from Feb highs. Strong fundamentals intact with 19% profit margins in Q3. Recent analyst actions positive - RBC upgraded to BUY in April, Evercore just raised PT to $190 (19% upside). Defensive consumer staple with reliable dividend (65% payout ratio). Patient investors rewarded here. #ValueInvestment #Dividends

Can P&G Weather the Economic Storm?Procter & Gamble, a global leader in consumer goods, currently faces significant economic turbulence, exemplified by recent job cuts and a decline in its stock value. The primary catalyst for these challenges stems from the Trump administration's tariff policies, which have directly impacted P&G's supply chain by increasing costs for raw materials and finished goods imported from China. This financial burden, estimated to be hundreds of millions of dollars, compels P&G to reassess sourcing strategies, enhance productivity, and potentially raise product prices, risking a reduction in consumer demand.

In response to these escalating pressures and a noticeable slowdown in category growth rates within the U.S., P&G has initiated a substantial restructuring program. This includes the elimination of up to 7,000 jobs, representing approximately 15% of its non-manufacturing workforce, over the next two years. The company also plans to discontinue sales of certain products in specific markets as part of its broader strategic adjustments. These decisive measures aim to safeguard P&G's long-term financial algorithm, although executives acknowledge they do not alleviate immediate operational hurdles.

Beyond the direct impact of tariffs, a pervasive sense of economic uncertainty and declining consumer confidence in the U.S. further complicates P&G's operating environment. Recent data indicates a sustained drop in consumer sentiment, directly influencing discretionary spending and prompting households to become more cautious with their purchases. This shift, combined with broader negative economic indicators such as rising jobless claims and increased layoffs across various sectors, creates a challenging landscape for companies reliant on robust consumer spending. P&G's immediate future hinges on its strategic agility in mitigating tariff impacts, managing pricing, and adapting to a volatile economic climate.

Procter&Gamble: Short-Term Strength Still Fits the PlanPG has extended its rally, pushing turquoise wave C higher. While some selling pressure is starting to show, we’re sticking with our primary view: the stock should still break above $180.43 to complete beige wave b before turning lower. However, in our 37% likely alternative scenario, beige wave alt.b would have already topped, and the stock would next drop below $148.87.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

PROCTER & GAMBLE: This volatility implies a major market bottom.Procter & Gamble is neutral on both the 1D (RSI = 47.822, MACD = 0.180, ADX = 17.832) and 1W (RSI = 49.820, MACD = 0.340, ADX = 20.781) technical outlooks as despite last week's rebound and this ones early strong rise, it pulled back and is about to close the 1W candle flat. We are exactly on the 1W MA50, which inside the 2 year Channel Up has always been a fair level to go long. The 1W RSI indicates that last week's low may be the symmetric low to December 11th 2023. This kickstarted a rally that hit the 1.5 Fibonacci extension. Consequently we are bullish long term, aiming at just under the new 1.5 Fib (TP = 190.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

PG - Procter & Gamble Company (Daily chart, NYSE)PG - Procter & Gamble Company (Daily chart, NYSE) - Long Position; Short-term research idea.

Risk assessment: High {volume & support structure integrity risk}

Risk/Reward ratio ~ 1.33

Current Market Price (CMP) ~ 170.40

Entry limit ~ 169

1. Target limit ~ 174 (+2.96%; +5 points)

Stop order limit ~ 165.25 (-2.22%; -3.75 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

- hyphen = fixed value

Harmonically Bullish on Procter and Gamble. PGXABC bullish zigzag, within a structure harmonically consistent with a developing XABCD. In harmonic reactions, retracements are often indicative of extensions to follow, which in this case is 1.618. This conveniently aligns in a Fibonacci cluster with a .886 larger retracement, consistent with a Bat Harmonic. One thing about Bats is that they are the most common and the most reliable out of the harmonic family. Interestingly, MIDAS, VZO, Stoch and BB%PCT all flipped on literally the same candle? Fractal resonance anyone?

Upgoing on Procter and Gamble. PGReady to gamble with tight stops that we might be having and upgoing ABC here. We are monitoring this position incase this is not the actual break out. Price action is suggestive. Now, what do we mean by that? Anytime we have a plateau or flat price action after any short burst, it can be taken as and indication of more price action in the initial direction.

Procter & Gamble: Target Zone Ahead!Wave in dark green has been successfully completed, creating a new support level at $157.47 with its low. PG is currently working on the countermovement of wave , and we have outlined a Target Zone for the expected top (between $171.66 and $177.84). This price range could be an opportunity to take profits from long trades or establish new short positions. However, our alternative scenario, which allows for a breakout to the upside, holds a 34% probability. If the stock manages to climb above the resistance at $180.43, this will suggest that the broader uptrend continues. In this case, the low observed would not correspond to wave in dark green, but rather to wave alt.(IV) in blue. So, potential short positions could be secured with a stop-loss set 1% above the upper boundary of our Target Zone.

Procter & Gamble (P&G) Overview and AnalysisProcter & Gamble (P&G) is a global leader in consumer goods, offering a wide range of household, personal care, and health products. Their iconic brands, including Tide, Gillette, Pampers, and Olay, have made them a household name worldwide.

1️⃣ Past Performance: In their last two earnings reports, the stock jumped by ~12% after strong results.

2️⃣ Current Price: The stock has dropped to a key support level ($159), attracting buyers at a discount.

3️⃣ Upcoming Earnings: Set for January 22, 2025—a potential catalyst for movement.

4️⃣ Outlook: Analysts predict a price target of $209 by year-end, highlighting strong growth potential.

$NYSE:PG Setting up againAfter this bull flag breakout idea:

NYSE:PG has retraced back and giving 4 confluences to go long here:

* Bouncing off the Weekly 50 SMA

* Bouncing off the Daily 200 SMA

* 0.618 fib retracement bounce

* Bounce off of the ascending support line since 22'

The risk is weekly close under 50 SMA

The profit targets would be 175 & 180

I am looking at the 180C for February to cover earnings, can also go with LEAPS for peace of mind

PG heads up at $177: Possible double top here for a good reasonPG previously topped at this double fib zone for a reason.

Golden Genesis reinforced by a Covid fib for strong resistance.

Now to see if we get a "double top" here or a Break-and-Run.

$ 177.03-177.52 is the key zone of interest.

Looking for a rejection to supports below.

Or a Break-and-Retest entry for next leg.

======================================================

Bullish PG Bullish Call Options!Options Call for PG January 17, 2025!

Bullish Call: $170 Call at $5.30 on Robinhood, target price is $180 so it would be aproximetly a $11-13 option by the end of January 17th (+41D). The conditions are favorable with a Delta of 0.5902, an implied Volatility of 15.16%, and a Chance of Profit of 37.08%.

Stock Targets: 178 Target Profit, 170 Entry, 168 Stop Loss, it's a 2.58 Risk to reward ratio with a 7.65% Price Swing or 15% if PG overshoots to $190!

Chart Analysis: Bullish XABCD Chart pattern. Confirmed Bullish Breakout on the Regression Trend with a Bullish 3 Bars FVG.

Technical Indicators: Gabriel's Fractal TRAMA Dragon indicates a recent Bullish Reversal. There also is a Rising Buy Volume over the past 4 days with a Bullish Delta RSI 5 days ago, that is comfortably away from the Overbought condition. Next is the SMI-MFI Bullish KD% Crossover that was 6 days ago. Finally, there is my personal QQEMOD with a Bullish Momentum (-3D), Divergence(-8D), and a DMI Reading of a Weak Uptrend (-2D).

Market Sentiment: Bullish on Daily Charts, Bullish on Weekly Charts, and Strong Bullish on Monthly Charts!!!

Volatility Conditions: Wide Squeeze on Daily Charts, Normal Squeeze on Weekly Charts, but there is a Fired Squeeze on the Monthly Charts. This means that the price might overshoot to $190-195, if both the Squeezes on the Daily and Weekly charts are fired as well.