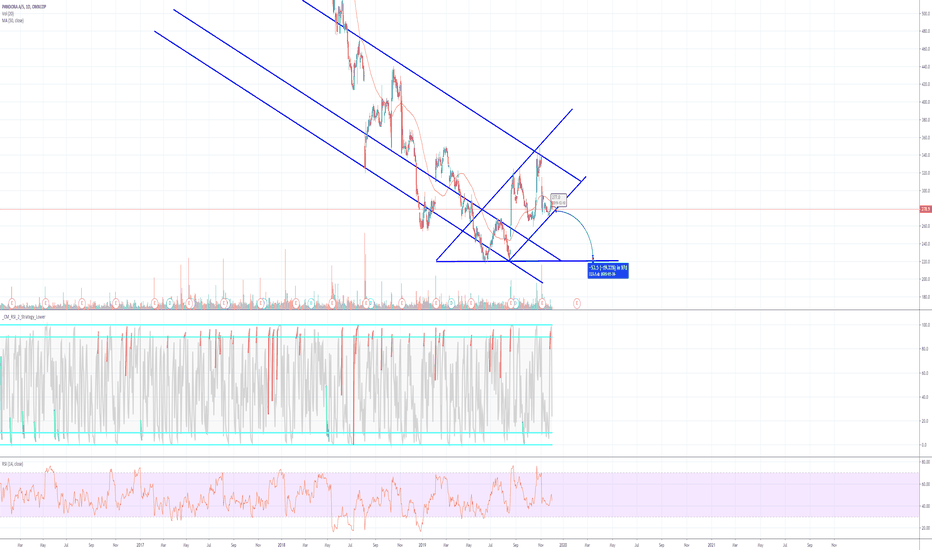

Pandora Bullish Technical AnalysisPandora is at a low point right now. It has a strong support under and some good support-points over. If Pandore gets a good support it will start a bullish trend. When is reaches the support it could go fast and go up a lot. Pandora will follow the OMX C25 Index and go up over the next few months.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

190.08 MXN

15.08 B MXN

91.41 B MXN

75.06 M

About PANDORA A/S

Sector

Industry

CEO

Alexander Lacik

Website

Headquarters

Copenhagen

Founded

2005

ISIN

DK0060252690

FIGI

BBG00N2Y6S31

Pandora A/S engages in the design, manufacture, and sale of hand-finished and modern jewelry. It operates through the Core and Fuel with More segments. The Core segments includes charms and carriers which focus on collectability. The Fuel with More segment refers to modern classics and Pandora lab-grown diamonds. The company was founded by Per Enevoldsen and Winnie Enevoldsen in 1982 and is headquartered in Copenhagen, Denmark.

Will Pandora continue up the channel?Tuesday the annual earnings report was released and the stock jumped 17,6%.

Several finincial institutions have increased their price targets, e.g. Danske Bank from 310 to 365,

and a lot of large players are heavily invested. On the other hand, american hedgefond,

Coltrane Asset Management, incre

Is time for Pandora bearish positions over? Bullish perspectiveThe technical analysis matches with the fundamental perspectives, suggesting a new bullish time ahead after

two years of bearish trend. Immediately after rebounding from the 61.8 Fibo level (measurement taken from the big bullish move on a weekly trend) some news have suggested the interest of some

See all ideas

An aggregate view of professional's ratings.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PNDORA/N is 3,861.68 MXN — it has increased by 25.04% in the past 24 hours. Watch PANDORA A/S stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange PANDORA A/S stocks are traded under the ticker PNDORA/N.

PNDORA/N stock has risen by 25.04% compared to the previous week, the month change is a 25.04% rise, over the last year PANDORA A/S has showed a 109.35% increase.

We've gathered analysts' opinions on PANDORA A/S future price: according to them, PNDORA/N price has a max estimate of 4,416.99 MXN and a min estimate of 3,049.15 MXN. Watch PNDORA/N chart and read a more detailed PANDORA A/S stock forecast: see what analysts think of PANDORA A/S and suggest that you do with its stocks.

PNDORA/N reached its all-time high on Oct 18, 2024 with the price of 3,088.38 MXN, and its all-time low was 819.67 MXN and was reached on Dec 27, 2019. View more price dynamics on PNDORA/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PNDORA/N stock is 20.02% volatile and has beta coefficient of 0.40. Track PANDORA A/S stock price on the chart and check out the list of the most volatile stocks — is PANDORA A/S there?

Today PANDORA A/S has the market capitalization of 302.54 B, it has increased by 3.29% over the last week.

Yes, you can track PANDORA A/S financials in yearly and quarterly reports right on TradingView.

PANDORA A/S is going to release the next earnings report on May 7, 2025. Keep track of upcoming events with our Earnings Calendar.

PNDORA/N earnings for the last quarter are 102.73 MXN per share, whereas the estimation was 102.88 MXN resulting in a −0.15% surprise. The estimated earnings for the next quarter are 36.72 MXN per share. See more details about PANDORA A/S earnings.

PANDORA A/S revenue for the last quarter amounts to 34.55 B MXN, despite the estimated figure of 34.18 B MXN. In the next quarter, revenue is expected to reach 21.06 B MXN.

PNDORA/N net income for the last quarter is 8.28 B MXN, while the quarter before that showed 1.75 B MXN of net income which accounts for 373.19% change. Track more PANDORA A/S financial stats to get the full picture.

Yes, PNDORA/N dividends are paid annually. The last dividend per share was 43.84 MXN. As of today, Dividend Yield (TTM)% is 1.34%. Tracking PANDORA A/S dividends might help you take more informed decisions.

As of Feb 8, 2025, the company has 41.33 K employees. See our rating of the largest employees — is PANDORA A/S on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PANDORA A/S EBITDA is 29.80 B MXN, and current EBITDA margin is 32.60%. See more stats in PANDORA A/S financial statements.

Like other stocks, PNDORA/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PANDORA A/S stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PANDORA A/S technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PANDORA A/S stock shows the strong buy signal. See more of PANDORA A/S technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.