POOL trade ideas

POOL - Pool Corporation Bullish PivotPool Corp is giving off a bullish pivot signal today as it closed within the Keltner Channel bands. As price action crosses into the Keltner Channel, we'll watch to see if it continues moving across. In this case, the lower Keltner channel was crossed and therefore, could indicate some bullish days ahead. There will be some resistance ahead as POOL will need to plow through the 13 and 21 day EMAs. Let's see what happens.

REMEMBER: Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for educational and informational purposes only. YouCanTrade is an online media publication service which provides investment educational content, ideas and demonstrations, and does not provide investment or trading advice, research or recommendations.

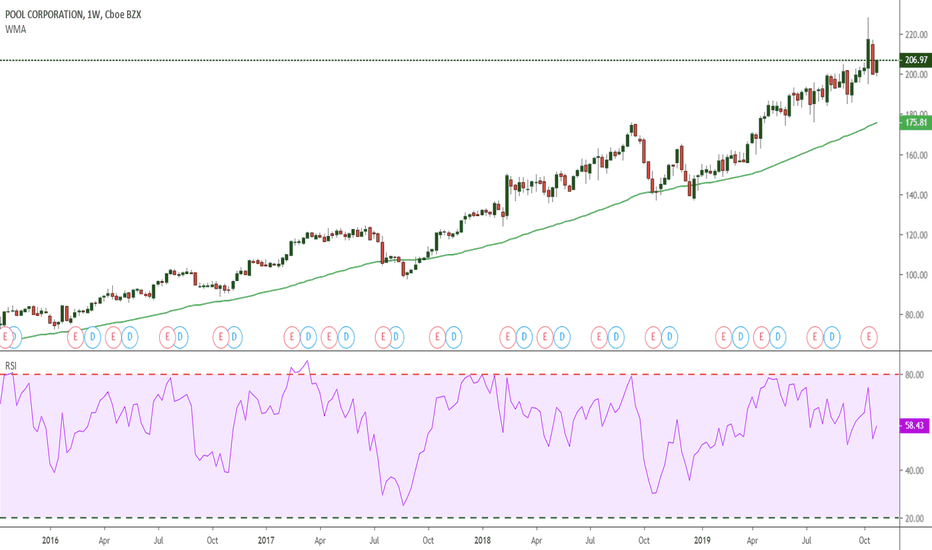

$POOL posting earnings with a 33%+ surprise$POOL posted earnings on the positive side with it exceeding expectation by 33%, the PEAD is projecting as bullish outlook for the stock, as the stock is currently trading just below the upper boundary of the PEAD cone.

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

$POOL can rise in the next daysContextual immersion trading strategy idea.

Pool Corporation distributes swimming pool supplies, equipment, and related leisure products in North America, Europe, South America, and Australia.

The share price rose after good earnings. I see some preconditions the share price will continue growing.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $238,54;

stop-loss — $231,00.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

I think POOL is a great long term holdEvery year since 2009 POOL has beaten the prior year’s earnings and revenue reports. It has grown at an average of 9% year over year and has future forecasts of 9.75%. Today their yearly EPS stands at $6.35 and pays a dividend of $2.20. Free cash flow per share is $14 and book value per share is $8.73. They have a 2% buyback rate and their P/E ratio is 35.

POOL is the world’s leading independent distributor of swimming pool equipment including irrigation and water management products (duh). I love this company because of its sustainability and growth. Invest at your own risk

ISM Play With Massive Alpha And Lots More To ComeSo this play is a complex spread that pits a strong machinery company and a strong retail / cons. disc. company against two weak chemical makers. While the play may initially not make much sense, the alpha here is generated from the comments that companies in these sectors made in the last ISM and NMI reports. Expected weakness in chemicals as input prices increase, and expected strength in consumer spending and capital investment by manufacturing and non-manufacturing firms alike. This spread is pitted perfectly for the current environment and is efficient as I could make it. I was in this morning @ 11.97, and plan to hold for an expected 30% upside from here. My stop on this one remains around 11. I may write some OTM calls on my longs here to even further increase the value here. DO NOT FORGET TO BETA-HEDGE.

Cheers,

Andrew

Insipid and BoringThis is about making money

This is not about find emotions and be the more Intelligent

An idea do not need to be plenty of lines and indicators that do not let see the price

And the more important to accept that I can not control the price because I draw lines.

With a price action mentality I accept that I am one step behind the price

and that I'm just an observer and follower and apart from that I'm always wrong

Humility and patience for wait that the price show me the way,

Insipid Analysis:

Resistance becomes support

(For discretionary traders) wait for a retracement around 131.00 and 141.00

(For mechanical traders) use your favorite indicator for entry. But only one indicator

Do not use Stochastic for entry and RSI for exit.