RL trade ideas

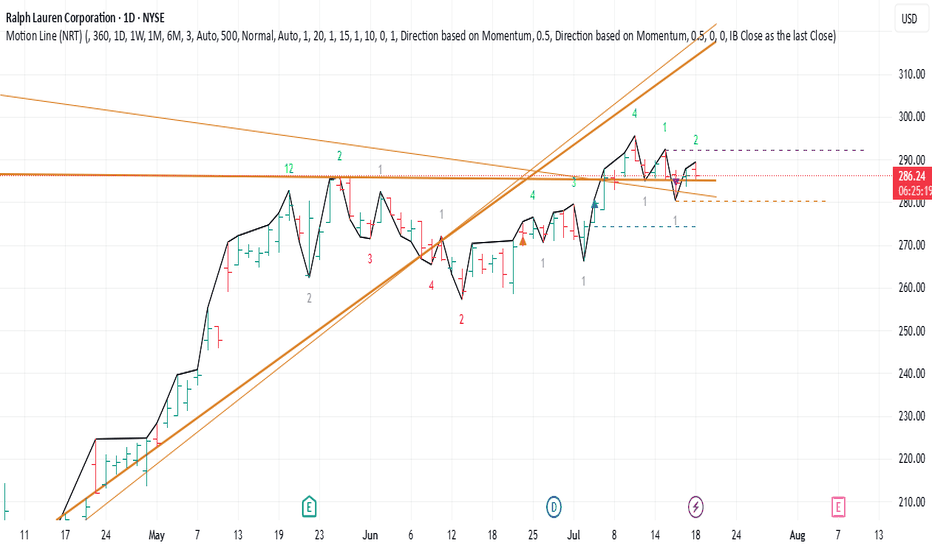

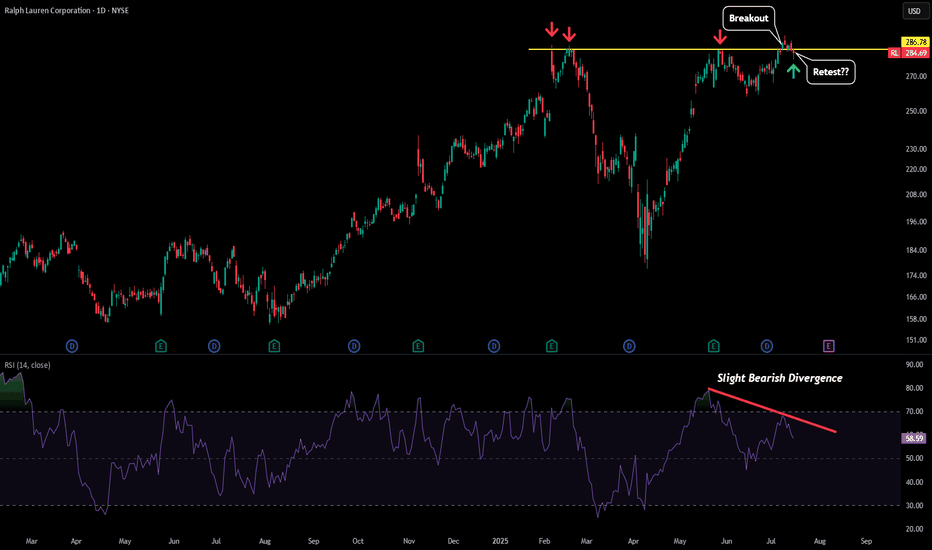

RL - One to WatchRalph Lauren is trying to breakout above the highs. So far we have seen a breach of the key $286-287 level and currently price is in the process of retesting that level as potential new support.

Its to early to say right now as this could end up being a failed breakout as the RSI has a slight bearish divergence.

But if we see price start to rise back above that level and have a successful retest then we should see a rapid increase above $300 (given other catalysts as well).

(RL) ralph lauren A chart to view Ralph Lauren through some visual of my indicators for anyone who wants to see. Make what you will from the image and make up your own mind about the fear and greed concept for Ralph Lauren right now. Will the price continue, or will the price not?

The shares represents shares bought. The green line would then mean there are few shares bought and the shares are soon to go negative against the price of the stock. The more shares bought the higher the line spikes, pertaining to the lineMath_v3 (shares) indicator.

(RL) ralph lauren Crazy high price for Ralph Lauren right now. The RL stock is doing excellently; as I just noticed today. I was unable to find any clothing that fit me or fashion styles that looked both vintage and modern at the same time during the Holidays this year; or any year. On average, inside the RL store in Lehi, UT the quality of styles is limited and the prices are typical of what one would expect from RL. I wish RL would offer more styles that they used to based on the 90s and early 2000s here in Utah. I wish the discounted styles in my size were offered or not completely gone as soon as the sale arrives during the Holidays. RL is a highly sought after brand but I've only ever owned one piece of cotton blue button up Ralph Lauren Levi's-esque shirt that ripped at the elbow due to the cotton material being so tender. I'm not rating RL as a short due to the fact that I don't own the clothing and can't afford the clothing. The MACD is really high right now.

Ralph Lauren: Elevate Your Wealth with the Essence of Luxury◉ Abstract

Ralph Lauren is thriving in the booming luxury apparel market. The company, founded in 1967, has a market cap of $11.83 billion and generates nearly 44% of its revenue from North America, totaling $2.93 billion. The industry is valued at approximately $110.13 billion in 2024 and projected to reach $151.32 billion by 2029, growing at a CAGR of 6.56%.

Recent technical analysis shows Ralph Lauren's stock has outperformed the NYSE Composite index with a 66% annual return. Despite a slight revenue increase of 2.9% year-on-year, EBITDA soared to $1,024 million, reflecting strong financial health. With a current P/E ratio of 17.4x, Ralph Lauren presents an attractive investment opportunity amidst rising global wealth and consumer demand for luxury goods.

Read full analysis here . . .

◉ Introduction

The global luxury apparel market is currently experiencing significant growth, driven by various factors including increasing disposable incomes, brand loyalty, and the rising influence of social media on consumer behaviour.

Here’s a detailed overview of the market size and growth outlook:

◉ Current Market Size

According to Mordor Intelligence, the global luxury apparel market was valued at approximately USD 110.13 billion in 2024, with expectations to grow to USD 151.32 billion by 2029, reflecting a CAGR of 6.56%.

◉ Growth Drivers

● Increasing Wealth: The rising number of millionaires globally and growing middle-class affluence, particularly in regions like Asia-Pacific, are significant contributors to luxury apparel demand.

● Consumer Trends: There is a growing perception that luxury goods enhance social status, which fuels consumer interest in high-end fashion.

● Digital Influence: Enhanced online shopping experiences and the effective use of social media for marketing have opened new avenues for luxury brands to reach consumers.

◉ Regional Insights

● Europe

Dominant Market: Holds a market share of approximately 34% to 43%. The presence of numerous luxury brands and high purchasing power among consumers drive demand, supported by significant tourist spending on luxury goods.

● North America

Strong Demand: The U.S. is a key player, characterized by a wealthy consumer base and increasing brand loyalty, particularly among younger generations who view luxury items as status symbols.

● Asia-Pacific

Fastest Growing Market: Anticipated to grow rapidly due to rising disposable incomes and brand awareness, especially in countries like China and India.

● Latin America

Emerging Potential: Currently holds a smaller market share but shows promise for growth as consumer awareness and travel increase.

● Middle East & Africa

Limited Contribution: This region contributes the least to the luxury apparel market, although countries like the UAE are seeing growth due to tourism.

The overall outlook for the luxury apparel market remains optimistic, supported by evolving consumer preferences and increasing global wealth.

Amidst the global luxury apparel market's promising growth prospects, we have identified Ralph Lauren as a prime opportunity for investment. With its robust financial performance and impressive technical indicators, Ralph Lauren is well-positioned to propel success.

◉ Company Overview

Ralph Lauren Corporation NYSE:RL is a renowned American fashion company known for its high-quality, luxury lifestyle products. Founded in 1967 by the iconic designer Ralph Lauren, the company has become a global symbol of timeless style and sophistication. The company offers a wide range of products, including apparel, footwear, accessories, home goods, fragrances, and hospitality. Ralph Lauren's iconic polo shirt and strong brand identity have contributed to its success, making it a global leader in the luxury fashion industry.

◉ Investment Advice

💡 Buy Ralph Lauren Corporation NYSE:RL

● Buy Range - 190 - 193

● Sell Target - 245 - 250

● Potential Return - 27% - 30%

● Approx Holding Period - 8-10 months

◉ Market Capitalization - $11.83 B

◉ Peer Companies

● Tapestry NYSE:TPR - $10.59 B

● Levi Strauss NYSE:LEVI - $8.57 B

● PVH Corp. NYSE:PVH - $5.44 B

● Columbia Sportswear Company NASDAQ:COLM - $4.87 B

◉ Relative Strength

The chart clearly illustrates that Ralph Lauren has greatly outperformed the NYSE Composite index, achieving an impressive annual return of 66%.

◉ Technical Aspects

● Monthly Chart

➖ The monthly chart clearly shows that the stock price faced several rejections near the 190 level, which ultimately triggered a significant drop, brought the price down to the 66 level.

➖ Afterward, the price experienced various fluctuations and, after a prolonged consolidation phase, developed an Inverted Head & Shoulders pattern.

➖ Upon breaking out, the price surged upward but encountered resistance again at the previous resistance zone.

➖ However, after a pullback, the stock has successfully surpassed this resistance for the first time in almost 11 years.

● Daily Chart

➖ On the daily chart, the price has formed a Rectangle pattern following a brief consolidation phase and has recently made a breakout.

➖ If the price can hold above the 190 level, we can expect a bullish movement in the coming days.

◉ Revenue Breakdown - Location Wise

Ralph Lauren Corporation is a global luxury brand with a strong presence in various regions.

➖ North America remains Ralph Lauren's biggest market, contributing nearly 44% of its total revenue, which amounts to $2.93 billion.

➖ In Europe , the brand is seeing consistent growth, with revenue reaching around $2 billion, making up about 30% of total earnings.

➖ Asia , especially China, is becoming a key player for Ralph Lauren, generating approximately $1.58 billion, or 24% of total revenue.

◉ Revenue & Profit Analysis

● Year-on-year

➖ In the fiscal year 2024, the company achieved a modest revenue increase of 2.9%, totaling $6,631 million, compared to $6,443 million in the prior year.

➖ On the other hand, EBITDA growth has been remarkable, soaring to $1,024 million from $801 million in FY23. The current EBITDA margin stands at an impressive 15.5%.

➖ Additionally, diluted earnings per share (EPS) experienced a substantial year-over-year rise of 28%, reaching $9.71 in FY24, up from $7.58 in FY22.

● Quarter-on-quarter

➖ In terms of quarterly performance, the company reported a decline in sales over the last three quarters, with the most recent quarter showing sales of $1,512 million, down from $1,568 million in March 2024 and $1,934 million in December 2023.

➖ Nevertheless, EBITDA demonstrated significant growth in the June quarter, climbing to $265 million from $176 million in March 2023.

◉ Valuation

● P/E Ratio

➖ Current P/E Ratio vs. Median P/E Ratio

The current price-to-earnings ratio for this stock stands at 17.4x, which is notably elevated compared to its four-year median P/E ratio of 5.7x. This suggests that the stock is presently overvalued.

➖ Current P/E vs. Peer Average P/E

When evaluating the stock's Price-To-Earnings Ratio of 17.4x, it shows a more attractive valuation, as it is lower than the peer average of 25.5x.

➖ Current P/E vs. Industry Average P/E

RL is positioned at a more appealing price point, with a Price-To-Earnings Ratio of 17.4x, which is significantly less than the US Luxury industry's average of 19.x.

● P/B Ratio

➖ Current P/B vs. Peer Average P/B

The current P/B ratio reveals that the stock is considerably higher than its peers, with a ratio of 5x compared to the peer average of 3x.

➖ Current P/B vs. Industry Average P/B

In comparison to the industry average, RL's current P/B ratio of 5x indicates that it is substantially overvalued, as the industry average is only 2.2x.

● PEG Ratio

A PEG ratio of 0.54 suggests that the stock is undervalued relative to its expected earnings growth.

◉ Cash Flow Analysis

In fiscal year 2024, operational cash flow experienced remarkable growth, reaching $1,069 million, a substantial increase from $411 million in fiscal year 2023.

◉ Debt Analysis

The company currently holds a long term debt of $1,141 million with a total equity of $2,367 million, makes long-term debt to equity of 48%.

◉ Top Shareholders

➖ The Vanguard Group has significantly increased its investment in this stock, now owning an impressive 8.23% stake, which marks a 3.9% rise since the end of the March quarter.

➖ Meanwhile, Blackrock holds a stake of around 4.11% in the company.

◉ Conclusion

After a thorough evaluation, we find that Ralph Lauren Corporation is strategically poised to thrive in the expanding luxury apparel market, driven by increasing disposable incomes and a growing appetite for high-end products.

RL - 7 months RECTANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

Breakout Area, Target, Levels, each line drawn on this chart and any other content represent just The Art Of Charting’s personal opinion and it is posted purely for educational purposes. Therefore it must not be taken as a direct or indirect investing recommendations or advices. Entry Point, Initial Stop Loss and Targets depend on your personal and unique Trading Plan Tactics and Money Management rules, Any action taken upon these information is at your own risk.

═════════════════════════════

RL Possible buy emergingToday, I am looking at American fashion company, Ralph Lauren Corp. with ticker #RL. It has been growing steadily for quite some time now, and it looks like it doesn't plan on stopping.

Though fundamentals of the company seem pretty good, I will not be going through them, I will only focus on technical analysis here, as I always do.

What am I looking at?

1. When you check the Weekly chart, you can see a massive bullish run. Stock price have increased more then 40% in the last 10 weeks.

2. Daily chart, is giving us the opportunity to position ourselves. If you missed the initial run, you still have a chance to enter at this stock.

3. Formation we can currently see on the chart is called Cup and Handle, it is forming perfectly fine. What I usually like to see in such formations is volume drying up a bit, but price is rising step by step. No unusual moves.

4. Bottom of the Cup formed perfectly, it hit the 21EMA-red line, and bounced of off it. After that, the Handle as well bounced of off the exact same moving average.

5. My first position would be the break of the previous high, sitting at $190.47 price level. Once I enter at that price level, my stop loss will be below the 21EMA. To be precise, it will most likely be put just below the Handle low, at around $181-182.

6. Once I enter, I will be closely monitoring what is the price doing, and as always, I will be updating you.

Please do your due diligence with investing your hard earned money. Thanks and good luck!

Rise in Ralph Lauren Corp.'s earnings. Stock idea for 14/02/2024Following the close of the Q3 2024 financial year (ended on 30 December 2023), renowned clothing brand Ralph Lauren Corp. announced a notable 6% year-on-year increase in quarterly revenue, reaching 1.93 billion USD. This impressive performance enabled the company to elevate its adjusted earnings by 24% year-on-year to 275 million USD, or 4.17 USD per share.

These figures significantly exceed the modest forecasts of Wall Street analysts, who had projected earnings to rise to 3.54 USD per share on revenue of approximately 1.87 billion USD.

This is why we are looking at the Ralph Lauren Corp. (NYSE: RL) stock chart today.

On the D1 timeframe, support has formed at 146.00, with resistance at 178.32. A fairly wide channel has developed between the levels within the uptrend. Resistance may be broken through with high probability, potentially leading to the quotes surging to update the historical maximum.

On the H1 timeframe, a breakthrough of the 178.32 level could set a short-term target for a price increase at 192.25, while in the medium term, it could hover around 220.75.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66.02% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

RL Ralph Lauren Corporation Options Ahead of EarningsAnalyzing the options chain of RL Ralph Lauren Corporation prior to the earnings report this week,

I would consider purchasing the 100usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $8.30

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Ascending Triangle in Ralph LaurenAn under-the-radar trend in recent weeks has been strength in legacy retailers like Macy’s , Gap and Ross Stores. Today’s chart focuses on a potentially bullish pattern in peer Ralph Lauren.

Notice the series of higher lows since November 10, when earnings and revenue beat estimates. There’s also a resistance zone around $104.50. The result is an ascending triangle, a potentially bullish pattern.

Second, the top of the triangle is near RL’s previous peak in August (also following a strong quarterly report). This could make the current resistance area and triangle more important.

Third, the stock is trying to push above its 200-day simple moving average.

Next, RL is in the process of forming its second consecutive inside candle on the weekly chart. That also highlights its tightening price action (with subsequent breakout potential.)

Finally, MACD has been steadily rising.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. You Can Trade, Inc. is also a wholly owned subsidiary of TradeStation Group, Inc., operating under its own brand and trademarks. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

Ralph Lauren USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Symmetrical TrianglePrice pulled back after earnings yesterday even though i think they beat estimates.

I did see a few rising wedges on hourly before earnings and bottom trendlines were broken during pull back yesterday. Appears to be recovering. Price waas also over the top band set on 80 right before earnings which often indicates overbought status.

Short interest is 8.04% which is higher than I thought it would be, but always is a bit high on RL. Negative volume is high.

Possible stop under top trendline of triangle which is now support.

No recommendation.

Ralph Lauren Dividend WeekRalph Lauren gapped up post earnings. Currently in a downtrend, about to fill the daily gap downward towards 110.

Ex-Dividend is on the 23rd, so I'd expect a sell off on the 23rd, likely to the 110 region.

Short term: RL could spike to 120 on dividend hype this week , then see a sell off starting on the 23rd to the 110 level. Anchored VWAP from earnings is at 118, so if we reach that level, expect selling pressure from traders who bought the hype post earnings.

Medium term Outlook: Currently in a downtrend, and the weekly looks like this will see 100 in the upcoming weeks.

Bull case: There is a loading zone in the 109 - 110 area that has been wicked out already and acted as support. If RL can find a base here, a reversal would test the 115, then the 120.

No entry for now.

Ralph Lauren Post EarningsRL ER is supposed to be significantly better post COVID. With positive ER, expect price to move towards, and potentially fill the gap.

Setup

1. Breakout of recent downtrend with growing volume.

2. Support from daily 200MA.

3. Price jumped to daily 50MA and anchored VWAP from last volume spike.

4. Chart Gap

Entry

1. Confiration on current support with loading zone.

Scale out

T1. First support above VWAP

T2. Gap start

T3. Gap end.