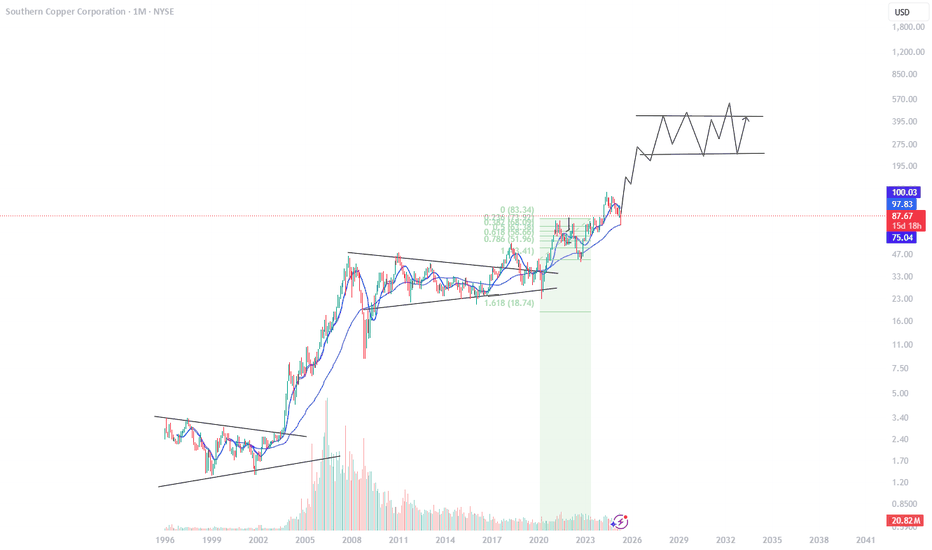

SCCO trade ideas

SCCO watch $87.05 above 83.65 below: Key fibs to determine trendSCCO may have bottomed but not yet flying.

Currently fighting Genesis fib above at $87.05

Likely dips need to hold Golden Covid at $83.65

Of course we have the Copper > Econ > China thing,

No way to know effects but the fibs say "look here".

=============================================

Copper Equities Breaking Down, Is tthe economy?Copper is very close to losing criyical support.

If this daily chart trendline breaks, there is a big move down into the next support.

Copper Equity stocks are already teing us aa likely breakdown in the commodity is coming.

Is this base metal signaling weaker economic demand & growth?

SCCO bulls struggle at current highs.SOUTHERN COPPER CORPORATION - 30d expiry - We look to Sell at 77.48 (stop at 81.21)

We are trading at overbought extremes.

Posted a Double Top formation.

Bespoke resistance is located at 78.70.

Resistance could prove difficult to breakdown.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

We look for a temporary move higher.

Our profit targets will be 68.22 and 67.22

Resistance: 73.30 / 76.00 / 78.76

Support: 69.88 / 66.47 / 63.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Southern Copper top?Southern Copper Corporation has been on a tear the past 2 weeks since the China reopening news. Eventually within another week or so, copper will hit its top resistance level. Here's a SCCO 1 week chart and HG1! comparison using my TTCATR(beta) indicator set to 9 with my commodity channel index comparison indicator(beta) set to 9.

SMA50 = $58

VWMA 9 TTCATR(beta):

top = $75

R3 = $70

R2 = $65

R1 = $60

pivot = $55

S1 = $50

S2 = $45

S3 = $40

bottom = $35

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

BBMC - bollinger bands

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

www.tradingview.com

SCCO:Correction or Reversal?SOUTHERN COPPER CORPORATION

Short Term - We look to Buy a break of 48.98 (stop at 45.51)

Price action produced another positive week, last week. Trading within the Wedge formation. The bias is to break to the upside. A higher correction is expected.

Our profit targets will be 58.22 and 60.00

Resistance: 48.90 / 60.00 / 80.00

Support: 46.80 / 42.00 / 34.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

$SCCO Bullish Copper ChartSCCO is a nice setup in my opinion. After a nice +250% rally, SCCO has formed a solid VCP pattern with nice rounded base and appears to be ready for the next leg up.

Started a position here and will add on a break above 80.

For those looking for less, risk can alarm the breakout and go long there, as we may get one more dip to shake out weak hands before more upside.

I'm long the JUN 90 calls to give this trade time to work , with 2,300 OI

First price target $96

Southern Copper Corporation USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

SCCO at KEY resistance: $66.88 a MAJOR Golden fib already provenShown here are two different fib sequences.

Thick fibs are from its "Genesis Sequence".

Thin fibs are from the "Covid Stimulus" wave.

Currently struggling against the Golden Genesis fib at $66.88

The entire world is now keenly aware of it thanks to the Pings.

So what happens here will say a LOT to a LOT of traders/holders.

Rejection here could lead to lower lows.

Break and retest could lead to new highs.

This signal could apply to the entire sector.

Here is a snap of the full Genesis Sequence:

.

I do not use "Fibs" in the "traditional" manner (retracements).

I use Fibs to plot "Ripples" (extensions) created by "Impulses".

Then look for "Confluences" to map the "interference Pattern".

My TV collection of ideas detailing the Concepts:

Chapter 1: Introduction and numerous Examples

Chapter 2: Detailed views and Wave Analysis

Chapter 3: The Dreaded 9.618: Murderer of Moves

Chapter 4: Impulse Redux: Return to Birth place

Chapter 5: Golden Growth: Parabolic Expansions

Chapter 6: Give me a ping Vasili: 'one' Ping only

Chapter 7: The Mighty 2.618: like a Rook in Chess

.