$SKX Sketchers $37 Target on earnings beat Skechers (NYSE:SKX) reports sales in the domestic wholesale business fell 47.3% in Q2 and sales in the international wholesale business decreased 37.8% during the quarter.

Comparable same store sales in the direct-to-consumer business were off 45.6%, including a decrease of 35.9% in the U.S. and 66.9% internationally.

Sales in China rose 11.5% during the quarter.

Gross margin improved 210 bps from a year ago as a result of a favorable mix of online and international sales. A net loss of $68.1M was recorded.

CFO update: "Despite the challenges of the second quarter, we are optimistic about the early-stage recovery we are seeing in much of our business, including a return to growth in China and the explosive growth of our e-commerce channel... We ended the second quarter in a position of significant financial strength, having grown our cash balances sequentially by more than $175 million through prudent inventory, working capital and operating expense management."

Full-year guidance was withheld by Skechers due to the pandemic.

SKX trade ideas

$SKX (Skechers) LONG SKX calls @28 OCT 16 2020

Thesis as follows,

Holding previous daily level resistance as support

RSI 4h,1H Buy signal

Bollinger bands bottom

Wedge and trendline bottom

Holding 0.382 Fib

Fundamentals ✅

More sensible to wait for a turnaround in sentiment as I risk more downside but this is a kangaroo market.

If this was a trade I would,

Exit : $30.2

Stop loss: $25.7

Skechers jumps on impressive earnings

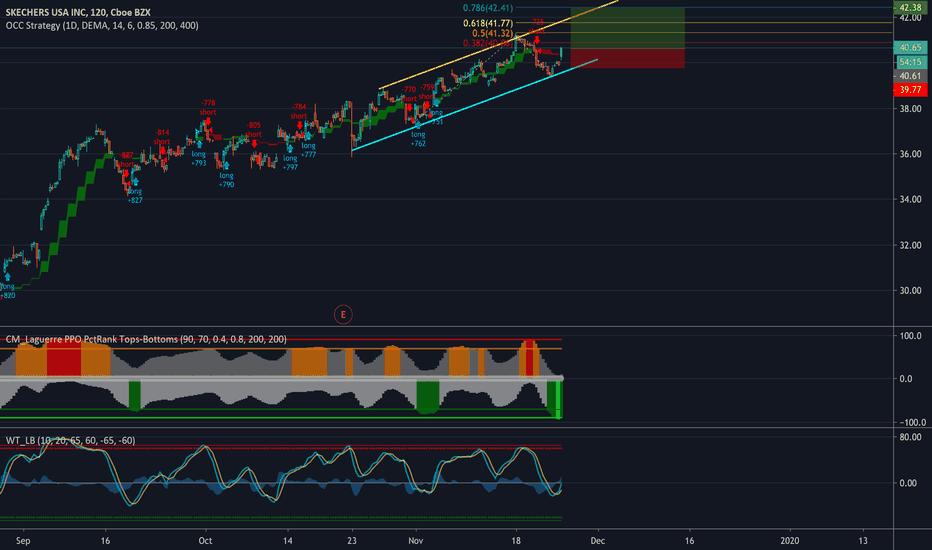

Possible entry $43.59

Target price $47.08

Stop loss $41.75

Fibonacci and horizontal price resistance levels as per chart

Earnings highlights

Skechers (NYSE:SKX) jumps after comparable sales in Q4 rise 9.9% to easily beat the consensus estimate of +6.3% and outpace peers.

The retailer's international wholesale business increased 32.8% during the quarter, the company-owned direct-to-consumer business increased 19.4% and the domestic wholesale business increased 10.4%.

Gross margin arrived at 47.9% vs 47.7% consensus. Operating margin was 7.1% vs. 8.0% consensus and 7.7% a year ago.

Looking ahead, Skechers sees Q1 sales of $1.400B to $1.425B vs. $1.41B consensus and EPS of $0.70 to $0.75 vs. $0.78 consensus. The guidance factors in current events in China.

SKX +7.98% AH to $41.00.

$SKX Sketchers bullish change of trend.Entry level $38.50 = Target price $42.50 = Stoop loss $37

Historically the stocks has been a nightmare to own, its has had a history of massive swings on earnings which serious investors avoid.

The most recent report has changed that trend, which may entice new investors.

P/E ratio 17.89

Average analysts price target $44 | Overweight.

Wedbush analyst Christopher Svezia maintains an Outperform rating on Skechers with a $38 price target.

Morgan Stanley analyst Kimberly Greenberger maintains at Equal-Weight, price target lifted from $34 to $35

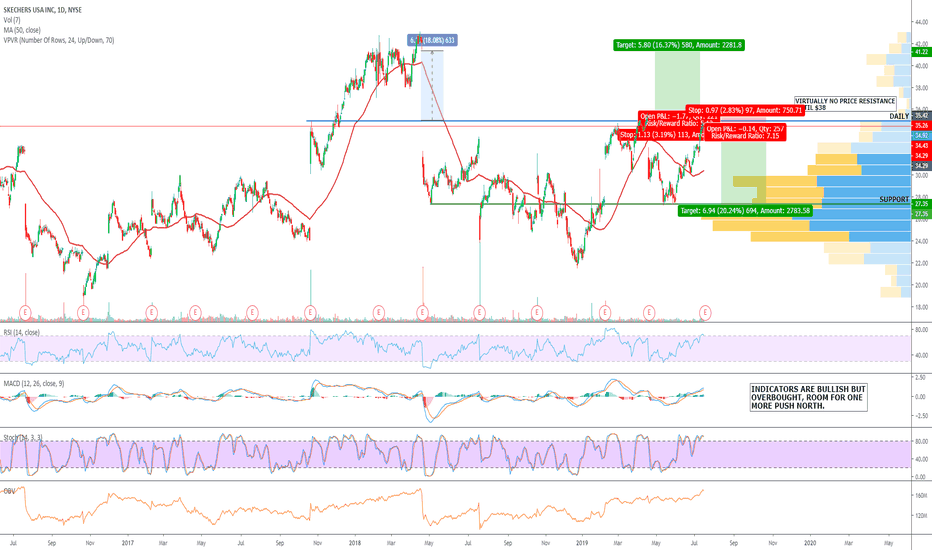

SKECHERS could pop 20% on earnings, up or down.It fair to say that NYSE:SKX make great product and trades at a reasonable P/E but it has horrific volatility on earnings, it is a high risk/reward event. Although the consumer is strong it is still a very difficult trading environment with a tight squeeze on margins, especially given the buying power of the big box stores, whom have such scale to allow for aggressive procurement.

The stock currently sits just below resistance, with a large gap above with little price history, which sets up a very fast rally.

AVERAGE ANALYSTS PRICE TARGET $34.70

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 18

SHORT INTEREST 7%

COMPANY PROFILE

SKECHERS USA, Inc. engages in designing, development and marketing of lifestyle footwear for men, women, and children of all ages. It operates through the following segments: Domestic Wholesale Sales, International Wholesale Sales, and Retail Sales. The Domestic Wholesale Sales segment distributes footwear through the domestic wholesale distribution channels: department stores, specialty stores, athletic specialty shoe stores and independent retailers, as well as catalog and internet retailers. The International Wholesale Sales segment includes international direct subsidiary sales and international distributor sales. The Retail Sales segment refers to e-commerce which operates through the concept stores, factory outlet stores, and warehouse outlet stores. The company was founded by Robert Greenberg and Michael Greenberg in 1992 and is headquartered in Manhattan Beach, CA.

Dollar: bulls are still in the game

USD index registered fresh yearly highs at 97.20 on Tuesday but failed to sustain the bullish momentum and corrected lower quite aggressively. A mils selling pressure remains today though the bulls are still in the game for now. After the initial spike, European currencies pared intraday gains and switched to a consolidation mode.

Traders decided to take profit at attractive levels on the back of rising optimism over trade talks across the markets. Trump said he might consider pushing back a March 1 deadline for trade negotiations with China if both sides are close to making a deal. This message sparked another wave of euphoria across the stock markets and suppressed demand for safe haven currency.

In a wider picture, the greenback prospects will depend not only on the general market sentiment but on the incoming US economic data as well. Signs of a relatively steady growth, especially in contrast with signals from Europe, will help the dollar to retain the advantage over its rivals, despite the Fed signaled a pause in hiking rates.

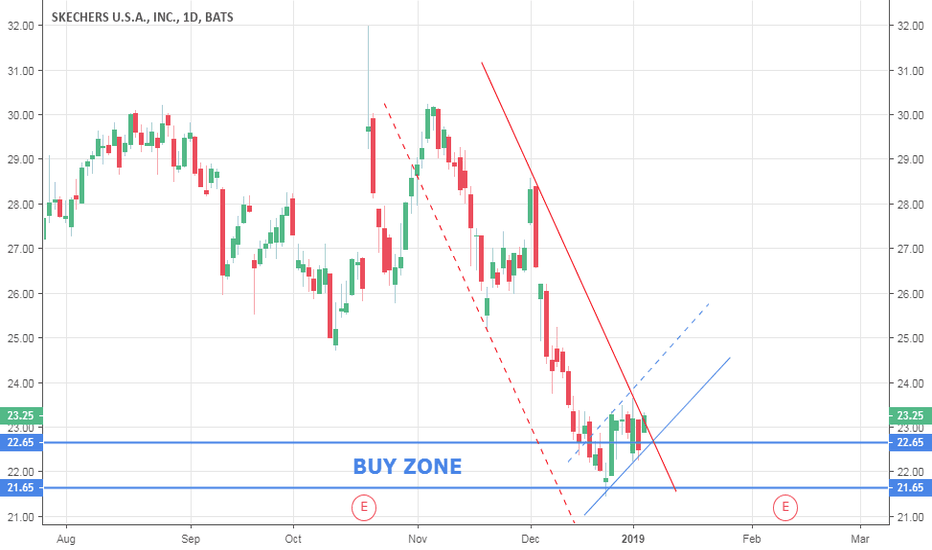

Bearish gap fill for Sketchers? SKXLook out for confirmation, we have seen recently with the Sketchers SKX stock that the gaps tend to get 50% filled, so this could mean a possibility to short this stock in the next few days. RSI is very oversold today.

Let me know what you think in the comments, like the idea if you agree, and follow me for more tips like this.

SKX - Long Call EntrySKX has done really well since the huge gap down on last ER. I have scalped puts on SKX for 50% and 75% profit respectively. But I think I think it is time for some calls. Once 30 breaks, the MACD should cross bullish above 0. That's one of the strongest long buy signals. The downtrend will offically be broken. Also, 30 has acted as resistance in this previous run up. I don't like SKX fundamentally, so I only plan to hold for a few days until chart shows reversal. Hopeful for a run back to 32 as this fills the gap.

SKX - Watching with no position SKX had a large fall after their last earnings. It has been climbing ever since with the only dips being during periods of consolidation. After a great trading day on 8/17/18, this will be looking to break above the 30.00 range. The downtrend resistance is right around this level at about 30.25 while there is some horizontal resistance sitting right around 30.00. The MACD is trying to cross back above 0 for the first time since their last earnings report. I expect a lot of resistance right around this area. The price is currently using the 9 and 21 EMA as support as they just crossed back into bullish territory. Volume has been trading below average for the last couple weeks, which is a slight sign that the current uptrend is not being supported. SKX has historically been a strong dividends stock and is getting a lot of love from budget analysts that see great upside from this point. In the short term, I am looking for another consolidation dip early this upcoming week (possibly on 8/20/18). This is because of the bearish divergence forming on the 30 min chart and the below average volume. It could dip back to 28.00, but more then likely, the 29 area should hold and bounce from there. If 29.00 support holds strong this may be a decent long entry looking for the strong break of 30.50. If this doesn't dip, then this will need some larger volume to break the 30.50 mark. This would be a sign of confirmation that this will continue to move up in hopes of a gap fill to 34 then 40. Regardless of direction, this will likely be a slow and steady grind. Will continue to watch this week as it is approaching a strong pivot zone.

SKX is going to pop very soon!It is looking like SKX wants to take a rise. It has been on a rise since 2016 and then it suddenly took a massive gap down. The stock is going to rise back up to fill in the gap. Look to buy soon, then look to sell when it nears the resistance line, because it will then be inside of the upward trend that it has been on for so long.