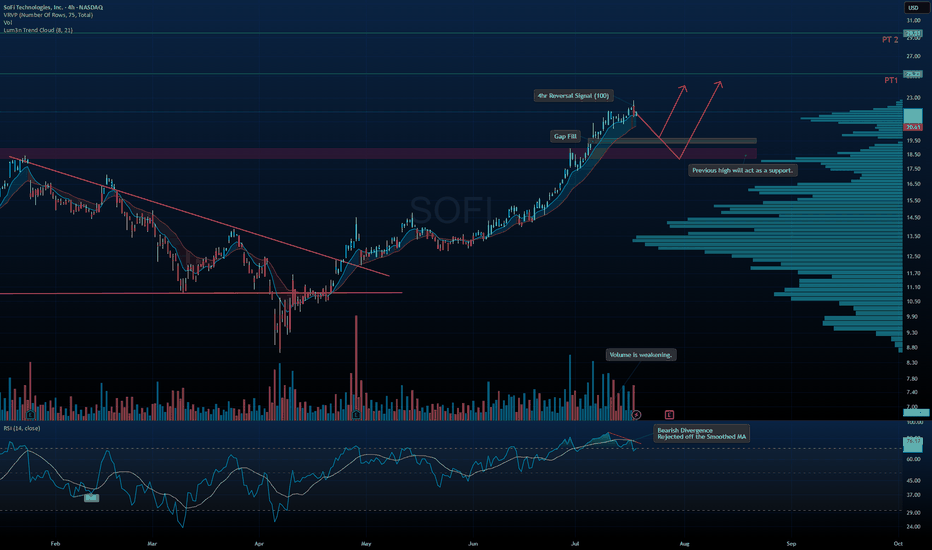

$SOFI - Long-Term Setup Brewing? Pullback First?I’m extremely bullish on SoFi long-term, but the chart is signaling a potential pullback opportunity before the next leg up.

🔹 Technical Breakdown:

• Bearish Divergence on RSI with rejection off the smoothed MA

• Volume weakening as price moves higher – classic sign of exhaustion

• 4hr Reversal Sig

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.90 MXN

10.40 B MXN

78.52 B MXN

1.08 B

About SoFi Technologies, Inc.

Sector

Industry

CEO

Anthony J. Noto

Website

Headquarters

San Francisco

Founded

2011

FIGI

BBG012CGP800

SoFi Technologies, Inc. is a financial service platform, which engages in the provision of student loan refinancing options to the private student loan market. It operates through the following segments: Lending, Technology Platform, and Financial Services. The Lending segment offers personal loans, student loans, home loan products, and related servicing activities. The Technology Platform segment focuses on technology products and solutions revenue. The Financial Services segment includes the SoFi Money product, SoFi Invest product, SoFi Credit Card product, SoFi Relay personal finance management product, and other financial services such as lead generation and content for other financial services institutions. The company was founded in 2011 and is headquartered in San Francisco, CA.

Related stocks

How to Do Your “Trading Homework” (The Smart Way)

If you’ve been following this channel, you’ve heard me say it many times:

Trading is war — and you should never enter a battle unprepared.

But here’s the real question:

How exactly do you prepare?

The answer lies in a powerful strategy I use called:

💡 Thematic Investing

Read more here →

Instead of

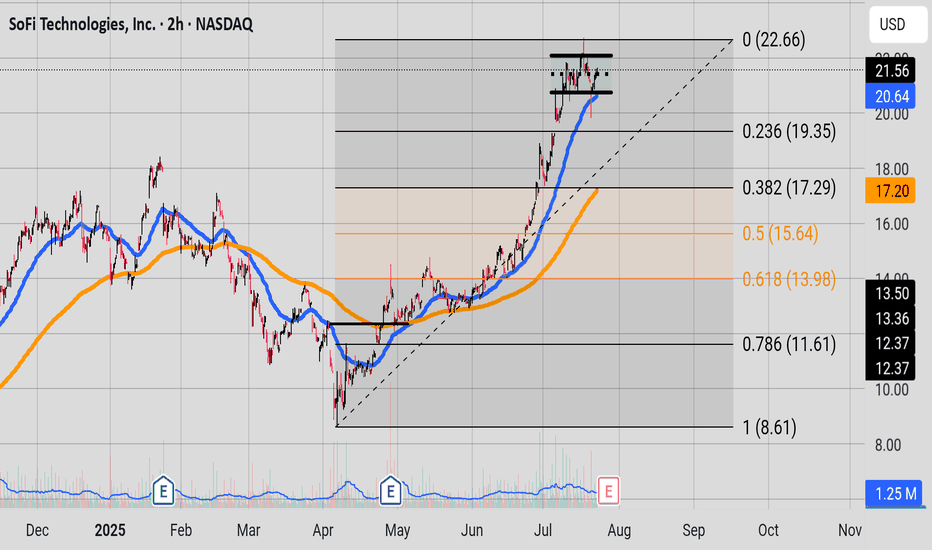

Parallel StructureWe have a nice parallel structure sitting on top of a 50 EMA (in blue). A consolidation is happening. Interestly enough the 200 EMA(in orange) is close to the 0.382 Fib level. On the weekly chart you can see the bears gearing up. But the bulls are still in charge. Price needs to hold the 20.64 price

High Wave CandleSOFI has finally reached it's resistance level around 23.84. Last week candle was a High Wave Candle. If we get a strong close above 23.84 that probably means the bulls are marching on, if we get a bearish close below 19.55 that may mean the bears have stepped in and are looking to pull prices do

LONG 4HR Wave Count Possibilities

Using the Weekly time frame, Wave 1+3 of a larger degree shows a possible extension to the 1.68 extension which is a common wave 5 of a larger degree target . That Price Target being $26.35.

In April of this year the price reacted to a Reversal Pivot Point but failed to form a proper impulse for

SOFI 4-Hour — “Measured-Move” Breakout Toward $20.8 → $22Structure: Price broke out of a year-long falling-wedge and then punched through an ascending trend-line confluence at ≈ $17.00–$17.50.

Impulse Leg (Yellow): The vertical rally that followed is ≈ $3.75 tall. Projecting that height from the breakout pivot ($17.00) gives 100 % extension = $20.78.

Ta

Long for now but would suggest taking profits. Even though major move already happened, I can see it going to 20-21.5 before we hit supply and head lower into next buy zone, unfortunately I don't see strong support until 15 area. Macd's play a role as momentum from buying is going to turn into selling soon.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US83406FAA0

SOFI TECH. 21/26 ZO CVYield to maturity

−12.27%

Maturity date

Oct 15, 2026

US83406FAC6

SOFI TECH. 24/29 CV 144Yield to maturity

−15.30%

Maturity date

Mar 15, 2029

See all SOFI bonds

Curated watchlists where SOFI is featured.

Frequently Asked Questions

The current price of SOFI is 398.00 MXN — it has increased by 2.35% in the past 24 hours. Watch SOFI TECHNOLOGIES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange SOFI TECHNOLOGIES INC stocks are traded under the ticker SOFI.

SOFI stock has risen by 0.89% compared to the previous week, the month change is a 40.35% rise, over the last year SOFI TECHNOLOGIES INC has showed a 194.81% increase.

We've gathered analysts' opinions on SOFI TECHNOLOGIES INC future price: according to them, SOFI price has a max estimate of 501.04 MXN and a min estimate of 111.34 MXN. Watch SOFI chart and read a more detailed SOFI TECHNOLOGIES INC stock forecast: see what analysts think of SOFI TECHNOLOGIES INC and suggest that you do with its stocks.

SOFI reached its all-time high on Nov 11, 2021 with the price of 498.99 MXN, and its all-time low was 79.00 MXN and was reached on May 15, 2023. View more price dynamics on SOFI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SOFI stock is 1.13% volatile and has beta coefficient of 2.53. Track SOFI TECHNOLOGIES INC stock price on the chart and check out the list of the most volatile stocks — is SOFI TECHNOLOGIES INC there?

Today SOFI TECHNOLOGIES INC has the market capitalization of 442.31 B, it has increased by 4.96% over the last week.

Yes, you can track SOFI TECHNOLOGIES INC financials in yearly and quarterly reports right on TradingView.

SOFI TECHNOLOGIES INC is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

SOFI earnings for the last quarter are 1.23 MXN per share, whereas the estimation was 0.67 MXN resulting in a 84.00% surprise. The estimated earnings for the next quarter are 1.11 MXN per share. See more details about SOFI TECHNOLOGIES INC earnings.

SOFI TECHNOLOGIES INC revenue for the last quarter amounts to 15.79 B MXN, despite the estimated figure of 15.14 B MXN. In the next quarter, revenue is expected to reach 15.09 B MXN.

SOFI net income for the last quarter is 1.46 B MXN, while the quarter before that showed 6.93 B MXN of net income which accounts for −78.98% change. Track more SOFI TECHNOLOGIES INC financial stats to get the full picture.

No, SOFI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 25, 2025, the company has 5 K employees. See our rating of the largest employees — is SOFI TECHNOLOGIES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SOFI TECHNOLOGIES INC EBITDA is 11.99 B MXN, and current EBITDA margin is 16.72%. See more stats in SOFI TECHNOLOGIES INC financial statements.

Like other stocks, SOFI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SOFI TECHNOLOGIES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SOFI TECHNOLOGIES INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SOFI TECHNOLOGIES INC stock shows the strong buy signal. See more of SOFI TECHNOLOGIES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.