SPY trade ideas

$SPY - Trading Levels for March 13 2025

Alright, y’all. We are dangling, unsupported underneath the 200DMA and that Bear Gap. I am trading cautiously today because inflation data days I tend to make a lot of mistakes.

35EMA - this level is a BEAST. We were unable to get above it yesterday. Trace it back 3 weeks and you’ll see it’s been there every time to push us back lower.

I will be looking to the outer spreads and even then I might push it out a little.

If and when I take a position I will update it here.

GL, y’all.

Nightly $SPY / $SPX Scenarios for March 13, 2025 🔮 🔮

🌍 Market-Moving News 🌍:

🇰🇷🇺🇸 South Korea's Trade Minister Visits U.S. 🇰🇷🇺🇸: South Korea's Trade Minister, Cheong In-kyo, is visiting Washington, D.C., from March 13 to 14 to discuss trade issues, including reciprocal tariffs and investment opportunities, with U.S. counterparts. This visit aims to address concerns about tariffs following President Trump's comments regarding disparities between U.S. and South Korean tariffs. The outcome of these discussions could impact sectors reliant on U.S.-South Korea trade relations.

🇩🇪🛠️ German Debt Reform Debates 🇩🇪🛠️: Germany's Bundestag is set to begin debates on debt reform plans starting March 13, focusing on increasing infrastructure spending and reforming state borrowing rules to fund defense. The proposed creation of a €500 billion infrastructure fund aims to stimulate the economy. These reforms could influence European economic stability, indirectly affecting U.S. markets through global economic interconnections.

📊 Key Data Releases 📊:

📅 Thursday, March 13:

🏭 Producer Price Index (PPI) (8:30 AM ET) 🏭:The PPI measures the average change over time in selling prices received by domestic producers, offering insights into wholesale inflation trends.

Forecast: +0.3% month-over-month

Previous: +0.4% month-over-month

📉 Initial Jobless Claims (8:30 AM ET) 📉:This weekly report indicates the number of individuals filing for unemployment benefits for the first time, providing insight into the labor market's health.

Forecast: 226K

Previous: 221K

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY PRINTS RARE 'BUY' SIGNAL FOR THE FIRST TIME SINCE MAR 2020!!On the 2 Day chart, AMEX:SPY is signaling its intent to print a buy signal on our CM Ultimate RSI Indicator as soon as tomorrow, for the first time since March 2020

In this video, we look at that exact signal & see what the past 11 years of price action says about what's the next move for AMEX:SPY

uh owell we've so far passed all my support points and are like in super duper oversold territory. Traders want to bounce but I'm going to finally change my 6 month outlook. BEARISH. Short term it depends on how the chips fall -- if we get some straws to grasp at on the economic data side of things, we could bounce easily to $580.

But people are not liking the current field, even after all the panic selling, there aren't many management firms snatching up the deals. Except for NVDA, people really fell on that knife these past 2 days, hoping its profits remain magnificent and its costs don't increase. Maybe TSLA will be a buy soon -- Musk owns less than 50% of the company right? They can vote him out in June? I mean I was expecting a bounce and extra profits from the CEO being so close to the POTUS but maybe people are sensing he's too MIA, off playing video games or something.

Worst of all, the administration isn't even giving people platitudes. There's no, 'we're doing everything we can to prevent a full Biden recession'. There's almost a calm acceptance that it might happen and we'll be better off for it. At first it was just uncertainty around rate cuts but its blossomed into caution around CapEx and MA (because somehow the outlook on tariffs is even murkier now than in December) and dent in employment activity due to mass layoffs at the federal level. Like this year just cannot get any worse -- and any bullish reversals will be due to that sentiment; that we're impervious to further drops in the stock market because the bad news is already priced in. But we haven't accounted for all the people who will have to cash out of their 401k's this fall and therefore cannot discount the possibility of a 25% market correction or more. Like, I'll change my mind when the administration starts acting like recessions are bad and we should work our hardest to avoid them rather than just making sure Biden gets some of the blame (no way Trump escapes all the blame anymore, he'll be lucky if he can avoid a government shutdown Friday).

Like usually treasuries move inverse to stock market action, but what if the pause in business activity is because of unpredictability at the federal government? How long before we float the idea of reneging on our debts and we get downgraded to a B+? Like we talk about protectionist policies and fiscal conservativism; what could be more of an America first policy than just defaulting on our owed debt? I just hope we can default in tranches so that not all $36 trillion becomes worthless all at once. Maybe the Fed can look into that -- stop selling short term notes for example and commit to honoring our immediate debts...

SPY - L3 Bullish Daily Exhaustion SignalAMEX:SPY first level 3 bullish exhaustion signal on the daily since Jan 2016, when in marked the exact bottom. The other 3 times it happened in the past 30 years were during the 2000-2003 dot com bust.

Within 10 candles after the signal:

75% win rate

+3.5% average move

4 data points over 30 years

Where were these, "the world is about to end" folks during 2022?I've seen waaaaaaay to many posts recently on multiple sites/apps regarding the stock market and how it's crashing under Trump... I dreaded politics when I was younger because it was always so divisive and more importantly, in my eyes, neither party was transparent. As I've gotten older, my feelings aren't as bad regarding politics as a whole but my feelings, towards each party in regards to the divisiveness they create and carry on has gotten worse. These feelings sometimes carry over to my network of friends, family, and community because a lot of times differences of opinion or feelings toward a political party or person also create a divide.

The main reason for this post is to point out a few reasons why people shouldn't have your panties all in a bunch regarding Trump... I included a screenshot of the stock price action for AMEX:SPY in 2022. As you can see, there were 4 different occasions, from Jan to Oct, where the market dropped double digit percentage points. Let's recap...

1/4/22 to 2/24/22, in 51 trading days the price dropped over 14%

3/29/22 to 5/20/22, in 52 trading days the price dropped over 17%

6/2/22 to 6/16/22, in 14 trading days the price dropped almost 13%

8/16/22 to 10/13/22, in 58 trading days the price dropped 19%

With that being said, from Jan to Oct of 2022, the market tumbled almost 27%. I don't recall seeing as many frantic posts, news commentators dragging and blaming the president everyday, or the POTUS supporters or non-supporters of the democratic party pointing fingers as much as I have recently.

I say this with all due respect to everybody and their individual opinion towards a party or person... I have never nor will I, ever attach my beliefs or moral compass to any specific political party or person so much that I need to block a friend (maybe not a friend to begin with), family member, or anyone else just because they disagree with me. I always loved diversity and it seems to be have become a distant memory to some just because of a difference in opinions. Obviously, this is a conversation that can go on for awhile but I just wanted to get that off my chest while also reminding some to reserve their panicking of a stock market crash or that the world is about to end because of the price of eggs or talks of changes in tariffs.

Again, just take a look back at the market in the year 2022 and remind yourself... the market has always had corrections throughout it's history and every time, it has rebounded and continued to evolve.

SPY - support & resistant areas for today March 12, 2025The key support and resistance levels for SPY today are above.

Follow me to get this notified when I publish in the morning.

Understanding key levels in trading can provide valuable insights into potential market movements. These levels often indicate where prices might reverse or consolidate, serving as important signals for traders considering long (buy) or short (sell) positions.

Calculated using complex mathematical models, these levels are tailored for today's trading session and may evolve as market conditions change.

If you find this information beneficial and would like to receive these insights every morning at 9:30 AM, I invite you to support me by boosting this post and following me @OnePunchMan91. Your engagement is greatly valued! However, please note that if this post doesn’t receive more than 10 boosts, I will have to reconsider providing these daily updates. Thank you for your support!

Need any other charts daily, comment on this.

SPY daily chart for March 12, 2025Hey traders! Checking out the SPY daily chart for March 12, 2025, and it’s looking like a critical moment. We’re sitting in a reversal zone ($556-$562), with the downtrend still in play via that sloping trend line (~$560-$565). MACD’s bearish, but the histogram is flattening, and Stochastic RSI is oversold—hinting at a possible bounce. Key levels: support at $556 (break below targets $540-$545), resistance at $562, $571.36, and $577.05, with $606-$607 as the big hurdle.

My plan: Long if $556 holds with a strong bullish candle, stop below $554, targeting $562 then $571. Short if we break $556 with volume, stop above $558, aiming for $545. Risk-reward 1:2, and I’ll watch volume closely—low moves can fake you out. News today could shake things up, so I’m staying flexible. What do you think—bullish bounce or more downside? Let’s discuss!

* Key Levels:

* Green resistance: ~$606-$607

* Red support/resistance zones: ~$562, $571.36, $577.05

* Current reversal zone: ~$556-$562

* Downward-sloping trend line intersecting around $560-$565

* Current Price: Appears to be in the $556-$562 range, near the lower end of the reversal zone.

* Indicators: MACD shows a bearish crossover with declining momentum, while Stochastic RSI is oversold (below 20), hinting at a potential bounce.

Technical Analysis

The SPY chart reflects a clear short-term downtrend, marked by the downward-sloping trend line and a series of lower highs and lower lows. The price has recently entered a reversal zone ($556-$562), which could serve as a support area. The MACD’s bearish crossover suggests continued selling pressure, but the widening histogram is starting to flatten, indicating a possible slowdown. The Stochastic RSI being oversold is a strong signal that a bounce or consolidation might be on the horizon, though it’s not a guaranteed reversal without price confirmation.

Key levels to watch include:

* Support: $556 is the critical level. A break below could push toward $540-$545.

* Resistance: $562 (top of the reversal zone), $571.36, and $577.05, with the trend line acting as dynamic resistance around $560-$565.

* Major Resistance: $606-$607, where prior resistance held firm.

Potential Scenarios

* Bullish Case: If SPY holds $556 with a strong bullish candle (e.g., hammer or engulfing pattern) and the Stochastic RSI begins to rise, we could see a move to $562 or even $571.36. Volume confirmation would be key.

* Bearish Case: A decisive break below $556 with high volume could accelerate the downtrend, targeting $540-$545. Watch for MACD to reinforce bearish momentum.

* Consolidation: The price might range between $556 and $562 if momentum remains indecisive, especially given the oversold conditions.

Game Plan for Today’s Trading Session

* Entry Points:

* Long: Enter long if the price respects $556 with a bullish reversal signal (e.g., a strong green candle). Set a stop-loss below $554. Target $562 initially, then $571.36 if momentum builds.

* Short: Enter short if the price breaks below $556 with confirmation (e.g., high volume, bearish MACD). Set a stop-loss above $558. Target $545, with a stretch to $540.

* Risk Management:

* Aim for a 1:2 risk-reward ratio. Risk $2 to make $4 per trade.

* Monitor volume—low volume moves are less reliable.

* Be cautious of macroeconomic news (e.g., FOMC updates or inflation data) that could sway the market today.

* Execution Tips:

* For day trading, consider a 1-hour or 15-minute chart to fine-tune entries.

* Watch the trend line rejection around $560-$565 for bearish confirmation or a potential bounce.

My Thoughts and Suggestions

I’m keeping a close eye on this reversal zone ($556-$562) as it feels like a make-or-break point. The oversold Stochastic RSI gives me hope for a bounce, but the downtrend isn’t done until we see a clear reversal signal. I’d lean toward a cautious long if $556 holds, but I won’t chase it without volume backing it up. On the flip side, a break below $556 could signal more pain, so I’ll be ready to short with tight stops. Today’s market moves might hinge on news, so staying flexible is key. Let’s see how it plays out—any thoughts from you all?

SPY/QQQ Plan Your Trade for 3-12-25 : Rally111 PatternToday's Rally pattern in Carryover mode may prompt a powerful base/bottom move in the SPY/QQQ.

In today's video, I explain in great detail how I read these charts and why the Excess Phase Peak (EPP) patterns are so important.

We are moving into the Consolidation Phase of the EPP patterns for the SPY/QQQ.

We are already into the Consolidation Phase of an EPP pattern for Bitcoin

Gold and Silver are a bit mixed. Yet Silver has already broken above the upper EPP Peak, rallying into a new EPP Peak level. Meanwhile, Gold is still struggling to find momentum for a bullish breakout.

While I don't believe the US markets are poised for a big downward price move, today's video shows you what may be likely 4 to 12+ months into the future.

So, pay attention to today's video. It clearly illustrates how to use the EPP patterns with Fibonacci and shows you what I believe could happen over the next 6 to 12+ months.

If the SPY/I continues to try to rally higher today, it will be interesting. This means we have potentially found our consolidation base and are now moving into a very volatile sideways consolidation phase.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Time for EWJ outperformanceI do think the best way to play the US underperformance story is through Japanese equities. Europe has moved too fast in a short time frame, China seems to me like a short term story whereas Japan seems to be the best way to play it.

Corporate earnings growth has been present in Japan post GFC unlike China and Europe to a lower extent.

Japanese valuations are great and the economic story is starting to be interesting.

S&P underperformance against global marketsIn addition to previous post on spy/efa we can see the spy/urth actually testing the historic support and breaking down. The valuation differential + The destruction of US competitiveness as a result of tariffs would be tailwinds for the continued outperformance of row equities over the US

Multi decade asset allocation shift in the process?Rest of world equities (in particular europe) had been underperforming the US for essentially the post GFC era. It seems we are close to getting a test of the support for this decade+ trend. If we get a clear breakdown it might mean its time to bet on equities outside the US.

A few months ago we have gotten a gold breakout against the S&P which seems to me to be the start of a multi year trend.

If rest of world equities outperform that should mean that value would outperform growth. There is value in the US market in particular in the Energy, Healthcare and Small cap financials.

SPY S&P 500 etf Oversold on the RSI ! 2025 Price Target ! The SPDR S&P 500 ETF Trust (SPY) is flashing a major buy signal, with its Relative Strength Index (RSI) currently sitting at 28.33 — firmly in oversold territory. Historically, every time SPY has entered oversold levels on the RSI, institutional buyers have stepped in aggressively, driving sharp rebounds in the following weeks and months.

The last time SPY dipped below the 30 RSI threshold was during market pullbacks in 2022 and 2023 — both of which were followed by significant rallies as institutions capitalized on discounted valuations. The current setup is no different. With earnings growth stabilizing, inflation cooling, and the Federal Reserve signaling a potential shift toward rate cuts in the second half of the year, the backdrop for a recovery is aligning perfectly.

Technically, SPY is also approaching key support levels that have held strong in past market corrections. The combination of an oversold RSI and strong institutional appetite at these levels creates a compelling case for a bounce.

My price target for SPY by year-end is $640, representing over 15% upside from current levels. With sentiment stretched to the downside and technical indicators flashing green, SPY looks primed for a sharp and sustained rebound. Now could be the perfect time to position for the next leg higher.

Nightly $SPY / $SPX Scenarios for March 12, 2025 🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇦🇷🇺 Ceasefire Proposal in Ukraine 🇺🇦🇷🇺: Ukraine has expressed willingness to accept a month-long ceasefire proposal, leading to a surge in the euro to five-month highs. This development has introduced volatility in European and U.S. equity markets, influenced by ongoing U.S. tariff plans.

🇺🇸🇨🇦 U.S. Tariff Increases on Canadian Imports 🇺🇸🇨🇦: President Trump has threatened to double tariffs on Canadian steel and aluminum imports to 50%, escalating trade tensions and contributing to a deepening stock market sell-off. This move has raised concerns about inflation and economic growth, affecting investor confidence.

📊 Key Data Releases 📊:

📅 Wednesday, March 12:

📈 Consumer Price Index (CPI) (8:30 AM ET) 📈:The CPI measures the average change over time in prices paid by urban consumers for a basket of goods and services, serving as a key indicator of inflation.

Forecast: +0.2% month-over-month

Previous: +0.3% month-over-month

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY...for those why spy, let's eye n find some levelsUsing a still in progress gap detector tool and the classic CyQo-B0wStr1ng method, we arrive at some interesting levels.

As always, use the Log function on the bottom of the scale and see what's on another level for levels...yeah

remember to just credit CyQoTek if it interests you or yah pass it on- more attention so more people make money is important. I don't sell things cause im not a shill or grifter.

"If someone tells you they will charge you for a service you don't want to do or can't do and they know what they are doing and all goes well, great, benefit all around. When someone tells you you need to pay them for something cause they want to help spread their findings and make everyone successful...it is called a con or ploy. Your parents ever charge you to teach you to eat; your grandfather ever need a subscription to teach you to fish: When someone can make money...good money...trading, and needs to sell something or wants you to be part of the "Sub-Club", run...don't walk away." Top 3 Hedgefund founder speaking over a private dinner I got to attend.

He followed with a simple statement:

- When you starve your kingdom, you eat well until the last peasant falls. But if you give your kingdom gold and serve fair justice, your grandkids will still be ruling as if no one realizes there is a monarchy...just an all knowing person who gives to all if everyone gives it their all.

anywho....enjoy:

4hr gap fill far:

4 hr gap fll view close:

4hr gap fill n fib channel:

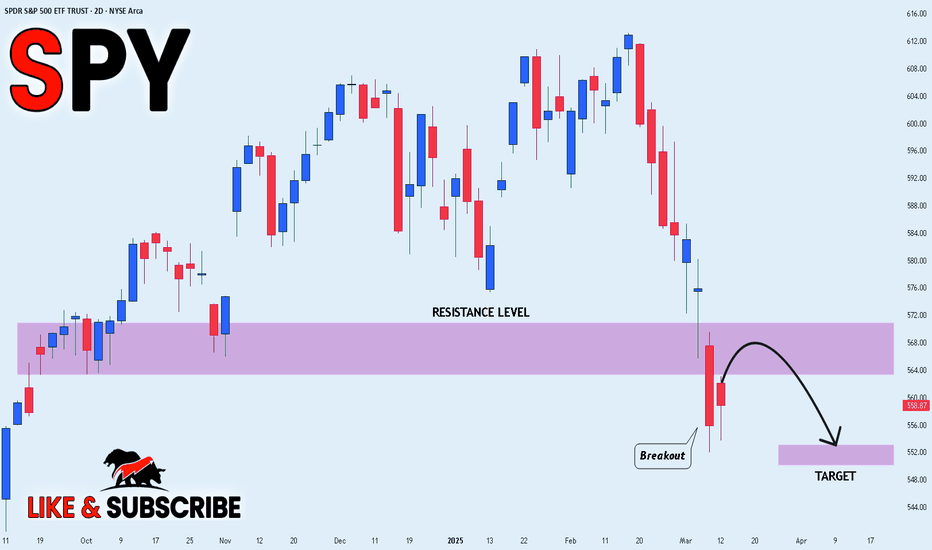

Have we finally broke the down trend?!Prices looks to have broke the down trend from late February and seems to be coming back to test the low prior to breaking that line ($555.56) and will hopefully that has happened, bounce to fill the gap ($574.44)… have the bulls finally stepped back into the market? 👍 or 👎?