SPY FORECAST " CORRECTION IN PLAY "Right now, SPY is entering a corrective phase after completing a strong five-wave impulse sequence. Based on Elliott Wave Theory, we are now in an A-B-C correction, and here’s what I expect according to my analysis.

WAVE STRUCTURE EXPECTATION

- Wave A is in motion and is expected to hit support at $511 by March 18, 2025.

- Wave B will likely bring a relief rally toward $535 by March 24, 2025, before sellers take control again.

- Wave C is projected to finalize the correction at $487 by April 1, 2025, aligning perfectly with Fibonacci retracement levels.

HOW GANN CONFIRMS THIS MOVE

Gann Squares & Angles provide additional time and price validation:

- The breakdown below $562 confirms that SPY has lost key trend support.

- Gann's 1x1 and 2x1 angles are pointing to the same price zones where Elliott Wave suggests support.

- This means we are in a structured, time-based correction rather than a random sell-off.

WHAT THIS MEANS FOR TRADERS

- Short-term bearish bias until Wave C completes.

- If the price holds $511 (Wave A target), expect a bounce toward $535 (Wave B).

- A break below $511 signals more downside, with Wave C targeting $487 as the final correction zone.

FINAL THOUGHTS

market is moving exactly as expected, and this forecast is based on historically reliable market cycles. Whether you trade stocks or options, knowing where the market is headed helps you position yourself smarter.

SPY trade ideas

SPY target 563I do dowsing with a pendulum on stocks and indexes, and am trying to use my intuition more, but I have a hard time sitting still. I did "tune in" for a minute to ask about SPY this morning & got the mental visual of a kind of peak and strong reversal down, and then the number 63 kept flashing at me.

After a few minutes, I realized that 562-63 is my dowsing target from after we hit the high at $613 (which I posted as a target & hit to the dollar).

So, this is to say, this work can be legit & way more than coincidence or luck.

When I had asked about when the 562 area would hit (on 2/23), my answer was 11 days. That date comes in on Thursday.

If price and time can align, results may be sublime. I seriously had to do that, but it is true & ideal if they coalesce. I do have some dates coming for Wednesday as well, so it could be off. But I have strong conviction 562-63 hits & then some kind of bounce, which I will update.

SPY - support & resistant areas for today March 10, 2025The key support and resistance levels for SPY today are above.

Follow me to get this notified when I publish in the morning.

Understanding key levels in trading can provide valuable insights into potential market movements. These levels often indicate where prices might reverse or consolidate, serving as important signals for traders considering long (buy) or short (sell) positions.

Calculated using complex mathematical models, these levels are tailored for today's trading session and may evolve as market conditions change.

If you find this information beneficial and would like to receive these insights every morning at 9:30 AM, I invite you to support me by boosting this post and following me @OnePunchMan91. Your engagement is greatly valued! However, please note that if this post doesn’t receive more than 10 boosts, I will have to reconsider providing these daily updates. Thank you for your support!

SPY/QQQ Plan Your Trade For 3-10-25: Gap/BreakawayToday's Gap Breakaway pattern suggests the markets will attempt to gap at the open, then move into a breakaway trending phase.

Given the downward price trend currently in place, I believe the markets will gap downward, then possibly attempt to move higher as we pause above the 568 (pre-election) support level.

Ultimately, I see the markets entering a brief pause/sideways price trend (maybe 2 to 5 days) before rolling downward again into the April 14 and May 2 base/bottom patterns.

I see very little support in the markets right now - other than a potential BOUNCE setup this week and into early next week.

I'm not suggesting this bounce will be a very big bullish price reversion. My upper levels are still in the 590 to 600 area for the SPY. But I do believe the markets are likely to try to find support near the 565-575 level.

Gold and silver will move into a Harami Pattern today (sideways consolidation). I don't expect much related to a big move in metals today.

Bitcoin is still consolidating in a very wide range. I expect the next move for Bitcoin to be a bit higher over the next 3-5+ days, so I believe the SPY/QQQ may trend a bit higher for about 3-5 days.

Overall, I suggest traders stay very cautious of volatility this week. Obviously, the trend is still bearish and the current EPP phase setups suggests we are consolidating into a sideways channel before moving downward seeking the Ultimate Low patterns.

Therefore, any bounce/pause in price will be very short-lived.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY at a Critical Level! Will the Reversal Zone Hold?Market Structure Overview:

* SPY is currently testing a Reversal Zone, trading within a descending wedge pattern.

* Support: 570-572 zone aligned with the lower trendline.

* Resistance: 578.28, followed by 595 if bullish momentum sustains.

Supply & Demand Zones:

* Demand Zone: 565-570 is showing some buyer interest.

* Reversal Zone: Price action is rejecting from the trendline, indicating a potential short-term bounce.

Order Blocks & Key Levels:

* 572.54 – 574.71 acting as a consolidation zone before a decisive move.

* If the price clears 578-580, momentum could push toward 595.

Indicator Analysis:

* MACD: Flat momentum but attempting a bullish crossover.

* Stochastic RSI: Bouncing from the lower region, indicating a possible reversal attempt.

Options Flow & GEX Analysis:

* Put Wall at 565 & 560: High negative gamma suggests strong put positioning.

* Call Resistance at 610-620: Major resistance where calls start building pressure.

* GEX Indicator: PUTs are at 110.1%—indicating downside hedging is still strong.

Scenarios to Watch:

1. Bullish Scenario: If SPY holds above 572-574, we could see a push toward 578 and then 595.

2. Bearish Scenario: A breakdown below 570 may trigger a flush toward 565, where the next strong put wall is positioned.

Actionable Trade Setup:

* Bullish Entry: Above 574.90 → Target: 578 / 595.

* Bearish Entry: Below 572.50 → Target: 570 / 565.

* Stop-Loss: ±2 points from entry.

Conclusion:

SPY is at a key decision point within a reversal zone, and price action near 574-578 will dictate the next leg. If bullish volume increases, we could see a run toward 595, but failure to hold 572 might result in further downside.

🛑 This analysis is for educational purposes only and does not constitute financial advice. Trade responsibly. 🚀

Weekly $SPY / $SPX Scenarios for March 10–14, 2025 🔮🔮

🌍 Market-Moving News 🌍:

🇨🇳📉 China's Retaliatory Tariffs 📉: In response to U.S. tariffs, China has imposed up to 15% tariffs on U.S. products, including cotton, chicken, corn, and soybeans. This escalation raises concerns about a potential global trade war, which could negatively impact U.S. exporters and broader market sentiment.

🇪🇺💶 European Fiscal Expansion 💶: Germany has announced significant increases in defense and infrastructure spending, marking a shift in fiscal policy. This move may stimulate European economic growth, potentially affecting U.S. markets through interconnected global trade and investment channels.

📊 Key Data Releases 📊:

📅 Wednesday, March 12:

📈 Consumer Price Index (CPI) (8:30 AM ET) 📈:The CPI measures the average change over time in prices paid by urban consumers for a basket of goods and services, serving as a key indicator of inflation.

Forecast: +0.2% month-over-month

Previous: +0.3% month-over-month

📅 Thursday, March 13:

🏭 Producer Price Index (PPI) (8:30 AM ET) 🏭:The PPI reflects the average change over time in selling prices received by domestic producers, offering insights into wholesale inflation trends.

Forecast: +0.1% month-over-month

Previous: +0.2% month-over-month

📅 Friday, March 14:

🛒 University of Michigan Consumer Sentiment Index (10:00 AM ET) 🛒:This index measures consumer confidence regarding personal finances, business conditions, and purchasing power, providing insights into consumer sentiment.

Forecast: 95.0

Previous: 96.4

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY/S&P500: in the mid-term resistance zonePrice has approached the upper border of the mid-term resistance zone: 598-612.

Until price closes bellow 612, I am preparing for the start of a correction to mid-term support: 564-540.

If price moves confidently above 612, than next resistance target is at 635 level.

The macro-structure of the uptrend from 2022 lows is well intact until price holds above 540 level and assumes higher targets for 2025 at 635-640-670 levels.

I wish everyone Merry Christmas and successful and profitable 2025!

Thank you for your attention.

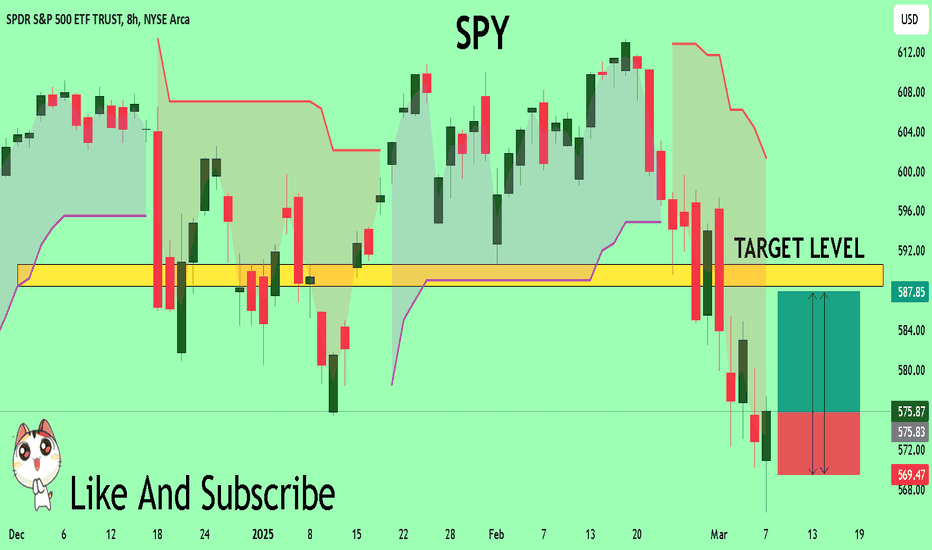

SPY Expected Growth! BUY!

My dear followers,

This is my opinion on the SPY next move:

The asset is approaching an important pivot point 575.87

Bias - Bullish

Safe Stop Loss - 569.47

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 588.44

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

———————————

WISH YOU ALL LUCK

SPY SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

SPY pair is in the downtrend because previous week’s candle is red, while the price is evidently falling on the 9H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 593.41 because the pair oversold due to its proximity to the lower BB band and a bullish correction is likely.

✅LIKE AND COMMENT MY IDEAS✅

$SPY March 10, 2025AMEX:SPY March 10, 2025

60 Minutes

Last week we managed to hit 565 as projected.

Now we are having LL with oscillator divergence.

Also, we can see in the channel LL 566.63 is a green bar with close near top of bar.

Now from Marcg 4 to 7 AMEX:SPY struggling to cross the mid channel line.

Foe the fall 597.43 to 565.63 a retracement up to 585 is possible.

583 is 50 averages.

On Monday holding 573-573.5 I expect a move towards577 - 581 range.

Due to oscillator divergence, I will not short.

No trade day for me on Monday as long is also above 598 for the moment.

On the other side if 564 is broken my target is 560 which will end the extension move as drawn.

Some consolidation is coming this week which will give us a better picture hopefully by Wednesday.

SPY: Summary for Next Week (March 10)Hey guys,

Going to post just a written idea and just give you a summary of the data.

The math levels are in the chart above.

We are in a pretty strong downtrend on the hourly and daily as you can see from the Tradingview Linreg tool.

The reference target on the week (yellow line) corresponds to retracing to the top of the range, from there we see either rejection or a breakout.

Projections have spy retracing/selling -2% on the week from where it opens on Monday.

Best fit bullish target on the week: 583.69.

Best fit bearish target on the week: 569.32.

Expect retracement to 572 range on Monday.

SPY and SPX broke the 200 EMA then reclaimed it. This is actually not a bullish sign, traditionally during pullback we would expect ultimate support at 200, not a break and reclaim. More on that in the details that will follow in this idea.

We are seeing a ton of selling volume and almost an absence of buying volume (more on that in the bulk of the idea).

We have now adopted the bear market forecast from my annual forecast projections I shared earlier this year (more on that in the bulk of the idea below)

The relevant EMA targets are visible in the chart above.

Great, now that the summary is out of the way, let's go into a few more details about things and stuff.

First for the DRAMATIC! Let's talk about the bear market.

Oh yeah, I'm saying it, BEAR MARKET.

But I don't actually know if we are heading for a bear market. What I mean by bear market is, if you followed my annual outlook at the beginning of the year, I had R generate 2 forecasts for the year, 1 Bullish and 1 Bearish. I did this as I discovered this was something that other quant firms do, and anything they can do I can do better :-p.

So at the time we had been not really following any forecast, but the assessment was bullish based on closest proximity to forecast, just meaning the trend looked more like it was following the bullish forecast, but not really well.

However, that has since deviated for some weeks, and we are not having a really huge and strong match for the bear market forecast. Let me share this with you below:

As you can see, we are bouncing where it says we are to bounce and we are selling where it says we are to sell. And the correlation and distance measures are now happy because this trend is actually following the projection.

But please understand that I am not saying we follow this to end of year; because frequently I see from looking at other forecasts like this, we can flip between trends throughout the year.

But as of right now, we are following the bear trend.

Based on this trend, we could see a bit of a bounce going into next week; but mostly a tame consolidation period before a pretty drop again in the following week. This is just based on this trend analysis.

Now volume!

I like volume, since my little volume forecast that I was very dismissive about in my last video idea called the complete collapse this week, I think I will be more attentive in the future 😂.

I usually share my fancy 3D volume profiles on my videos. Unfortunately I can't share 3D stuff on a written idea, but I modified a similar function to actually create a heatmap and breakdown the actual composition of the volume, so is mostly buying, selling etc. The more red, the more selling the more green, the more buying.

Here is the volume composition at various intervals:

The implications of these plots are to probably be short biased towards the 585 range, as there is a ton of recent selling in this zone.

On the larger look (25 days and above) it has been all selling for a quite a while.

I know some other traders using OBV have pointed this out that, for a while, volume has been very tilted heavily in the bearish direction, hence why SPY was at a stand still at the recent highs, but you can really visualize the reality of the situation with this function/plots.

Another thing we can see from these plots is that there is not enough buying happening currently to really sustain a huge bounce. However, like I said before, volume can decide to show up whenever she wants!

You can also see a lot of trapped bulls in the volume, who were buying at highs.

EMA Nonsense

All eyes were on the EMA 200 this week. People betting their life on the 200 EMA bounce.

There was a fake breakdown and then recovery.

But let me tell you my little trader love muffins, its not bullish.

I quickly created a function to just scan when we cross below the EMA 200 and then close above it, how often do we end up actually giving it up and falling and closing below it, how long does it take and what is the anticipated decline from this happening.

And by god, R always delivers. Here are the results for SPY, SPX, ES1!:

When looking at the results, good to know, the length of the data contained.

For SPX, n number of data points = 24932, start date 1871-02-01

For ES1!, n number of data points = 6955, start date 1997-09-09

For SPY, n number of data points = 8082, start date 1993-01-29

The data tells us that we can potentially see a 2% bounce to the upside next week.

However, the overarching bias of these results actually align well with the annual assessment, which has this upcoming week as consolidation before another drop (with the average n days elapsing between the initial test of the EMA and the loss of the EMA being 8 days, bringing us to losing the EMA 200 next week).

That is the data.

I have no opinions.

In this idea, I am just sharing the objective data, you do with it as you wish.

As always, not advice, I do really strongly encourage everyone to position defensively and be careful!

Safe trades to all!

SPY: Bullish Continuation is Highly Probable! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current SPY chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

There's A Setup For A BounceFor fun, no idea what I'm doing.

Same as all the last times really, just see how it goes tomorrow morning, right now futures are flat but it's early. Going off the futures chart I think it'll meet my requirements short of a huge gap up.

Depending on what happens tonight going into tomorrow it's setting up for a bounce as crazy as that looks and sounds (again). Yeah it's been a little bad recently, and every day who knows what is done or said that can move markets either way, and we are not THAT far off from ATH, but the bounce setup is there, and potentially will actually follow through for the first time since the end of October 2023.

The bottom graph has a line that suggests oversold. In my mind it is set up if the line remains below the dotted line Mar 7. If it goes up above then maybe toss the idea. I literally only post when this is set up.

Maybe down early in the first part of the day due to something like jobs, then reverse up and hard for the next few days?

From the low of Mar 7 -

I usually say

5% chance of ~10% by Mar 12 (top yellow circle)

40% chance of +5.5% by Mar 12 (lower yellow circle)

60% chance of +5.5% by Mar 21 (right yellow circle)

But I really really really don't think we will get +10% with how things are set up that's ATHs, but just saying it does happen sometimes (not when it's like this though). So much so that I didn't even put it on the chart this time around.

Green eclipse is things going according to the idea, above is a bonus, below is a fail. If it does bounce, no idea how long it'll last.

You might be asking 40%? 60%? so you're flipping a coin? could go up, could go down? Well it's 40-60% chance of +5.5%, nothing is guaranteed and that's why you have responsible stops in place.

SPY - support & resistant areas for today March 7, 2025The key support and resistance levels for SPY today are provided above.

Understanding these levels in trading can offer valuable insights into potential market movements. They often indicate where prices may reverse or consolidate, serving as important signals for traders considering long (buy) or short (sell) positions.

These levels are calculated using complex mathematical models and are specifically tailored for today’s trading session. They may change as market conditions evolve.

If you find this information helpful and would like to receive these insights every morning at 9:30 AM, I invite you to support me by boosting this post and following me @OnePunchMan91. Your engagement is greatly appreciated! However, please note that if this post does not receive more than 10 boosts, I will have to reconsider providing these daily updates. Thank you for your support!

$SPY Trading Levels for March 7 2025

Y’all doing ok after this pullback down to the 200DMA? Now the question… do we hold this level.

200 Day Moving Average right in the middle today.

Weekly 35EMA right above just underneath yesterday’s bear gap.

Top of the implied move on the day is 583 and 586 on Mondays contract.

Then if we break the 200DMA then the bottom of the implied move is 563 and there is a support gap there.

559 on Mondays contract.

Let’s go Traders!!!

SPY/QQQ Plan Your Trade For 3-7-24 : Rally PatternAs many of you know, I've been expecting the SPY/QQQ to find support (seeking a base/bottom) for the past 3+ days. The amount of selling has been somewhat extreme. We are currently in a downtrend.

So, my expectation of a base/bottom is related to the breakdown of the Excess Phase Peak pattern and the previous support levels (pre-election and recent lows) that suggest price will attempt to hold/base/bottom near recent support.

As of yesterday's close, price had broken downward, still within the support range.

So, again, I urge caution as I believe price will be very volatile while attempting "hammer out a base/bottom" (if it happens).

Overall, my bias is to the downside because of the current trend. Yet, The RALLY pattern today suggests we may see a recovery above 577 on the SPY which may lead to a rally targeting 580+.

Gold and Silver are holding up well and should setup a base/bottom today on the Counter-Trend Top/Resistance Pattern. I don't expect Gold and Silver to rally very strong today. I expect more of a melt-up in trend for metals.

Bitcoin is still consolidating and moving into a very tight Flag Apex range. As I pointed out in today's video, a shorter-term Flag apex will be reached on Sunday (3-9). I believe Bitcoin will become very volatile over the next 3+ days - attempting to break away from a GETTEX:13K consolidation range.

This apex volatility could drive the SPY/QQQ into extreme volatility as well.

Unless you are very skilled at targeting short-term price swings - stay very cautious of this volatility as it could end up turning and biting back.

It's Friday. I'm planning on watching and only trading when I believe there is a very clear opportunity for profits.

I got dinged around (took some lumps yesterday) trying to trade while driving and handling family issues. Lesson learned - don't force it.

The markets will settle into a trend next week. So, be prepared to sit and watch if you don't like what you see on the charts today.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

Spy correction 📉 SPY Technical Analysis: Potential Upcoming Correction 📉

Several periods have been identified where volume compresses significantly before suddenly expanding. Historically, these movements have preceded prolonged corrections over time, repeating consistently.

Currently, SPY is showing similar signals, with a volume exhaustion structure and an accumulation phase that could trigger a corrective move in the coming sessions. I’ll be watching for pattern confirmations and key levels.

📊 What do you think? Do you see a possible correction ahead? 🚀📉 #SPY #TechnicalAnalysis #Trading

$SPY March 7, 2025AMEX:SPY March 7, 2025

Time frame monthly analysis.

Monthly.

The current move started from Covid low.

So, for the move 218.26 to 613.3 holding 520 is important now as it represents 23.6% retracement.

And for the extension 218.26 to 480 to 318 we have completed 100% move 614 levels. for the rise 218 to 480.

Hence, we are having some resistance.

Also 520 is 21-month average and in important.

Weekly.

Starting from low 348 if we connect 409 low taking top channel as 609 and draw a channel, we see AMEX:SPY in channel.

Here 560-565 is important to hold being 50 week average and mid channel line.

I expect pull back as oscillator is losing strength and we have red volume bars above average last 3 weeks.

Daily.

Too many above average sell volumes.

My stochastic false bar indicator became red.

So, any rise is only sold on rise until I get a green false bar.

My Eliott oscillator is red.

Price touching 200 averages last 3 days.

A steep fall from 613 to 570.

So, if we take the last rise from 510.27 to 613.23 38.2% correction done.

If AMEX:SPY breaks this then it is weaker.

At the moment if break 569 levels will bar close near low my target is 560 levels. which is 50% retracement for the rise.

And in daily if we take the rise from 540 to 613 565-568 represents 61.8% retracement for the rise.

That will be my target today.

So, for the day if 570 breaks target 565-568.

And for the last fall 613.23 to 570.12 605 need to cross for ant longs in daytime frame.

At the moment.

And any pull back to 576-578 will be a good level to short.

Not the time to go long.