Buy - SWKS - weekly chartsSWKS looks great on weekly charts in a strong move. we are testing the upward momentum line that I have drawn and I think this week should give us a good buying opportunity

Buy zone / Targets are mentioned on the chart

Close below 107.95 on daily candle may require us to reevaluate are trade

Indicative time for the play : 3 to 8 weeks

SWKS trade ideas

Skyworks: Momentum Chip Stock Pulls Back to Old HighSkyworks Solutions has been flying on strong demand for smart phones and hopes of a big 5G buildout. Now it's pulled back to a level where traders might want to take a look.

SWKS broke out to new record highs in December, above the $115 zone where it peaked in November 2017 and March 2018. As often happens, it was a case of "buy the rumor and sell the news." Earnings last Thursday were good, as expected, and traders responded by taking profits.

Several analysts raised their price targets, including Raymond James, Needham, Canaccord Genuity, Citi and Craig-Hallum.

SWKS continued its slide Monday as coronavirus fears dragged on the broader market. But now that the stock is trying to stabilize at the old resistance zone, some momentum players might get interested. It's also making a slightly higher low than its earlier pivot on January 6. Traders may want to use that same area for risk management.

SWKS could also move on Apple's earnings report this afternoon because it's an iPhone supplier.

Skyworks Solutions trade Pre earnings trade setup

Average Recommendation Overweight Average Target Price:$117

Company profile

Skyworks Solutions, Inc. engages in the design, development, and manufacture of proprietary semiconductor products. Its product portfolio includes amplifiers, attenuators, circulators, demodulators, detectors, diodes, directional couplers, front-end modules, hybrids, isolators, lighting and display solutions, mixers, modulators, optocouplers, optoisolators, phase shifters, synthesizers, power dividers and combiners, receivers, switches, and technical ceramics. The company was founded in 1962 and is headquartered in Woburn, MA.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, IT IS REALLY APPRECIATED

SWKS BUYBuy signal at 123.10 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

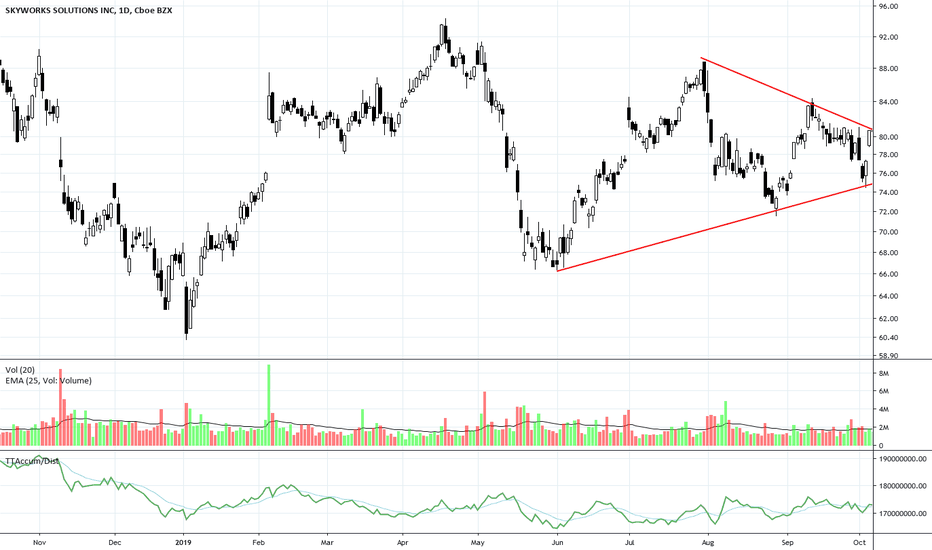

SWKS Bending TrendA commonly missed trendline pattern is the bending that occurs in a momentum trend as buyers begin to disappear. Profit-taking by professionals can create a sudden surge of selling, which can easily drive price into a retracement or correction. Speculative price action is riskier to enter at this level as the runs are shrinking. SWKS may have more speculation but this is an expert level for a trade, and is not suitable for a new or novice trader due to the risk factors.

SWKS Weekly Bull Flag WatchSWKS forming a weekly bull flag.

Bulls must break 102.87 with increasing bull volume this coming week to give confidence that we are going up.

Daily time frame is a clear equilibrium pattern. I expect low trading volume until a break.

If we do not break bullish, expect daily consolidation and a weekly higher low to form.

I would also watch for correlation with QQQ and SPY. We all know the market has been very bullish for the past weeks. If we get any pullbacks in the market, I expect the bears to take over for SWKS.

SWKS - DAILY CHART Hi, today we are going to talk about the Skyworks Solutions Inc and its current landscape.

Huawei and its suppliers received exciting news, as the U.S. Commerce Department renewed a 90-day period extension, that grants to American companies’ permission to continue to do business with the giant Chinese telecom companies. Commerce Secretary Wilbur Ross's announcement included that the need for extension was also due to the necessity of some rural communities of the Huawei 3G and 4G networks. The extension should keep the supplying chain going, principally of the Americans ones like Skyworks Solutions Inc that have its revenues highly exposed to Huawei demand (6% of its revenue) and have now another quarter of relief from the tension of loose a so significant company like Huawei. The concerning aspect it’s if this extension doesn't lift the results of its supplier on the next quarter, considering that the Chinese company might already be restructuring its supply chain, as the uncertainty created by the ongoing Trade War that ended blacklisting the company on the U.S. The Huawei CEO Ren Zhengfei also already have been clearly vocal that isn't concerned with the U.S decisions and said that Huawei could grow without the U.S markets.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

SWKS BUY 04.09.2019BUY signal at 74.17 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

ATTENTION this strategy may has downtrend about 10-15%, so you can split your buy order, that you have not big downtrend.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

The signals rare but useful.

*I've rewrite this idea because I wrote the same idea for English (IN).

SWKS Take-ProfitSell signal at 102.10 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

The signals rare but useful.

$SWKS Bullish but overbought conditions in SkyworksEarnings are tonight and expectation are very high, due to the companies reliance on Apple demand. Suppliers to AAPL have ran hard in the past month and it is not advisable to be jumping on the bandwagon now if not already holding shares. Our previous target has been hit and we will sit on the sidelines as indicators are extremely overbought, it is difficult to determine whether fundamentals will have dominance over technicalls post earnings.

We may very well miss out on another run higher but the overbought conditions can not be ignored and the gap at $90 is also a concern.

P/E ratio 19.

Short interest 4.3%.

Company profile

Skyworks Solutions, Inc. engages in the design, development, and manufacture of proprietary semiconductor products. Its product portfolio includes amplifiers, attenuators, circulators, demodulators, detectors, diodes, directional couplers, front-end modules, hybrids, isolators, lighting and display solutions, mixers, modulators, optocouplers, optoisolators, phase shifters, synthesizers, power dividers and combiners, receivers, switches, and technical ceramics. It operates through the following geographic areas: United States; China; South Korea; Taiwan; Europe, Middle East, and Africa; and Other Asia-Pacific. The company was founded in 1962 and is headquartered in Woburn, MA.

$SWKS Bullish upgrade for Skyworks solutions Highly dependent on trade discussions, if there is any sort of a deal its a buy, as it has lagged behind others within the sector.

Trading at a very reasonable 15.39 P/E ratio

Chart is on verge of a bullish break.

Indicators are bullish.

I Phone demand increased.

Alert set for break above $83

Upgrade details

Cowen analyst Karl Ackerman upgraded Skyworks (SWKS) to Outperform from Market Perform with a price target of $95, up from $80. The company's content continues to ramp this iPhone cycle, and higher radio frequency content in a 5G-enabled phone presents unit upside potential in 2020, Ackerman tells investors in a research note. Further, Huawei is 90% discounted into 2020 estimates, which could drive $350M in sales and 60c in earnings per share upside on a U.S./China trade resolution, adds the analyst. He also believes WiFi 6m which is "finally here," enables Skyworks to dominate in smart home applications. source Thefly

Skyworks Solutions gets a boost from I Phone 11 demand surgeI phone suppliers set for a major boost if reports are correct that Apple have instructed them to increase production for the I Phone 11 in particular., by as much as 10%.

Yield 2.28%

P/E ratio 14.73

4.41% short interest

Average analysts price target $85.22

Average analysts recommendation Overweight

Buyers return to Skyworks Solutions.Due to the tightening range, we think its best to wait for a break out.

Skyworks Solutions, Inc. engages in the design, development, and manufacture of proprietary semiconductor products. Its product portfolio includes amplifiers, attenuators, circulators, demodulators, detectors, diodes, directional couplers, front-end modules, hybrids, isolators, lighting and display solutions, mixers, modulators, optocouplers, optoisolators, phase shifters, synthesizers, power dividers and combiners, receivers, switches, and technical ceramics. It operates through the following geographic areas: United States; China; South Korea; Taiwan; Europe, Middle East, and Africa; and Other Asia-Pacific. The company was founded in 1962 and is headquartered in Woburn, MA.

Golden Cross after Earnings Surprise"Skyworks Solutions (SWKS) came out with quarterly earnings of $1.35 per share, beating the Zacks Consensus Estimate of $1.34 per share. This compares to earnings of $1.64 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 0.75%. A quarter ago, it was expected that this chipmaker would post earnings of $1.43 per share when it actually produced earnings of $1.47, delivering a surprise of 2.80%.

Over the last four quarters, the company has surpassed consensus EPS estimates three times." (Yahoo Finance)

As I write this Skyworks is making a major move and has formed a Golden Cross

Skyworks Solutions still 40% off the highs. Long into earnings.SKYWORKS is somewhat of a risky trade, but it has a very good earnings beat rate of around 88%. Just like AMAT and NVDA SWKS remains very far of the 2018 highs and has been afflicted by Chinese dependency. Tonights earnings may not move the stock quite as much as the commentary, future guidance could place a rocket under the stock.

The 4hr chart has turned quite bullish as buy side volume dominates and indicators have all taken a bullish trajectory, while looking at the weekly chart things look less bullish but still in a uptrend.