Triple Top Breakout and Analyst UpgradeNo doubt the analyst upgrade and new price target will be the catalyst for the next price move.

I need to see at least a 2h candle close above $1368.75 and would actually prefer a daily candle close. In January 2025 when the CCI indicator line closed above +100 there was a $94 price move up in 7-8 trading days. The CCI is again crossing +100.

Confluence- A bullish Pin bar type candle printed on 2.28.25 at the top BB line which is also the Triple Top line.

I expect the BB to start expanding and volume to increase, which for me will be confirmation to enter a trade.

Price target $1479 by end of March 2025.

I will be looking at calls.

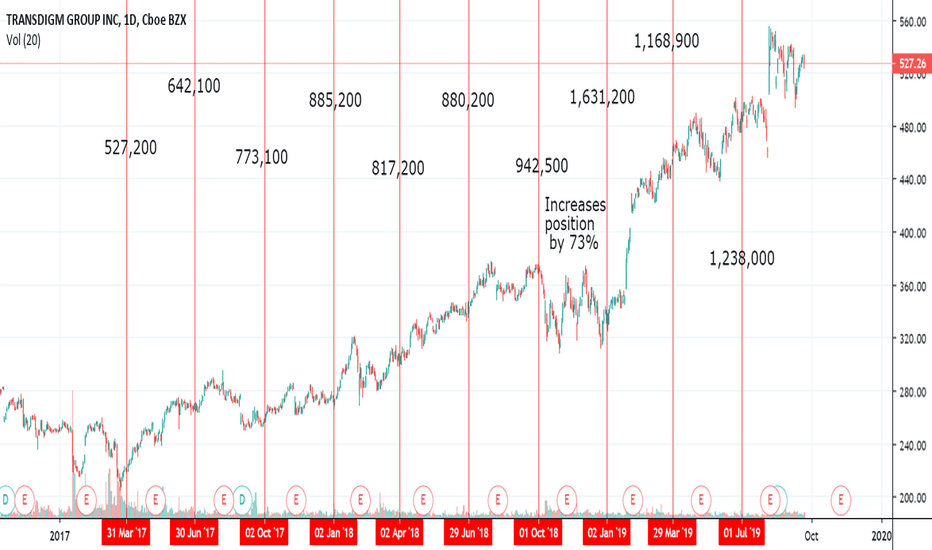

TDG trade ideas

#TDG LONG TERM TARGETSThis will be the second intend to break down trend. momentum seem right. ( failure will bring price around $ 500 to reload and try again, if that happen same entry lvls)

Until the bottom red line from last impulse is not taken out the trend is UP. Lines with white dots com from pass G Fans important expect price to react at those levels.

Short term price needs to be over $ 556, maybe we see $580 with a retrace to $550 and that will be another opportunity to re entry long.

As write at expecting price to react to the Target levels, multi year targets also $950 & 1085.

Peace!

Windacre Partnership LLC Makes a Nice Play On War/Aviation‘10-K’ for 9/30/18

We predominantly serve customers in the commercial, regional, business jet and general aviation aftermarket, which accounts for approximately 36% of total sales; the commercial aerospace OEM market, comprising large commercial transport manufacturers and regional and business jet manufacturers, which accounts for approximately 24% of total sales; and the defense market, which accounts for approximately 35% of total sales . Non-aerospace sales comprise approximately 5% of our total sales.

Our customers include: (1) distributors of aerospace components; (2) worldwide commercial airlines, including national and regional airlines; (3) large commercial transport and regional and business aircraft OEMs; (4) various armed forces of the United States and friendly foreign governments; (5) defense OEMs; (6) system suppliers; and (7) various other industrial customers. For the year ended September 30, 2018, Airbus S.A.S. (which includes Satair A/S, a distributor of commercial aftermarket parts to airlines throughout the world) accounted for approximately 11% of our net sales and The Boeing Company (which includes Aviall, Inc., also a distributor of commercial aftermarket parts to airlines throughout the world) accounted for approximately 10% of our net sales. Our top ten

customers for fiscal year 2018 accounted for approximately 43% of our net sales. Products supplied to many of our customers are used on multiple platforms.

-Active commercial production programs include the Boeing 737 (including the 737MAX), 747, 767, 777 and 787, the Airbus A220 (previously known as the Bombardier CSeries), A320 family (including neo), A330, A350 and A380, the Bombardier CRJs, Q400/Dash-8 aircraft, Challenger and Learjets, the Embraer regional and business jets, the Cessna Citation family, the Gulfstream aircraft family, the Dassault aircraft family, the HondaJet and the ATR42/72 turboprop. Military platforms include aircraft such as the Boeing AH-64 Apache, CH-47, C-17, F-15, F-18, KC46 Tanker, P-8 and V-22, the Airbus A400M, the Lockheed Martin C-130J, F-16 and F-35 Joint Strike Fighter, UH-60 Blackhawk helicopter, the Northrop Grumman E-2C Hawkeye, the General

-Important factors that could cause actual results to differ materially from the forward-looking statements made in this Annual Report on Form 10-K include but are not limited to: the sensitivity of our business to the number of flight hours that our customers’ planes spend aloft and our customers’ profitability, both of which are affected by general economic conditions; future geopolitical or other worldwide events; cyber-security threats and natural disasters; our reliance on certain customers; the U.S. defense budget and risks associated with being a government supplier; failure to maintain government or industry approvals; failure to complete or successfully integrate acquisitions; our indebtedness; potential environmental liabilities; liabilities arising in connection with litigation; increases in raw material costs, taxes and labor costs that cannot be recovered in product pricing; risks and costs associated with our international sales and operations; and other factors.

- Our two largest customers for fiscal year 2018 were Airbus S.A.S. (which includes Satair A/S) and The Boeing Company (which includes Aviall, Inc.). Airbus S.A.S. accounted for approximately 11% of our net sales and The Boeing Company accounted for approximately 10% of our net sales in fiscal year 2018. Our top ten customers for fiscal year 2018 accounted for approximately 43% of our net sales. A material reduction in purchasing by one of our larger customers for any reason, including but not limited to economic downturn, decreased production, strike or resourcing, could have a material adverse effect on our net sales, gross margin and net income.

-We maintain approximately 80 manufacturing facilities

-As of September 30, 2018, we had approximately 10,100 full-time, part-time and temporary employees.

-Although we manufacture a significant portion of our products in the United States, we manufacture some products in Belgium, China, Germany, Hungary, Japan, Malaysia, Mexico, Norway, Sri Lanka, Sweden and the United Kingdom. Although the majority of sales of our products are made to customers (including distributors) located in the United States, our products are ultimately sold to and used by customers (including airlines and other end users of aircraft) throughout the world.

-Mergers and acquisitions have resulted in significant increases in identifiable intangible assets and goodwill. Identifiable intangible assets, which primarily include trademarks, trade names, trade secrets, and technology, were approximately $1.8 billion at September 30, 2018, representing approximately 15% of our total assets. Goodwill recognized in accounting for the mergers and acquisitions was approximately $6.2 billion at September 30, 2018, representing approximately 51% of our total assets. We may never realize the full value of our identifiable intangible assets and goodwill, and to the extent we were to determine that our identifiable intangible assets or our goodwill were impaired within the meaning of applicable accounting standards, we would be required to write-off the amount of any impairment.

Transdigm short term bull ScenarioTransdigm has established an upward channel after a run which actually resembles a bull flag on higher timeframes. For now, this move will be a short term gainer. If this plays out, it could also possibly invalidate the higher timeframe bull flag and simple be moving up a bullish channel.

Transdigm has had a pattern last 2 years of a midterm fall between Q3 and the following Q1, but prior to this last 2 years, we haven't seen this pattern. Also, their fiscal year ended a few days ago and it seems things are going very well.

This company has exceeded profit expectations consistently for years. They focus on aftermarket product manufacture which as higher margins and tend to outperform OEM products during industry downturns. They are the only supplier of more than 75% of products they sell, which allows them to control their margins. This can be reflected in their acquisition model as they acquired Kirkhill and Extant in March, 2018.

***Any information represented here is my opinion only and not intended to be used for financial gain. None of the information posted here is to be considered financial advice. Information posted here is strictly for entertainment purposes only. Please consult your financial professional before making any kind of investment. Investments can be very risky and any investor should educate themselves before investing by enlisting the help of a licensed financial professional. Past results are not indicative of future results in any construable way.***