Long TeckThe fundamentals are good and macroeconomic factors contribute to the positive outlook. It seems to be trading above its intrinsic value but I'm going to take it anyways with the earnings report coming out soon the volatility should be interesting. Putting a couple percent of my portfolio to it and see how it goes. Probably hold it until the end of the year if it goes good.

TECK/N trade ideas

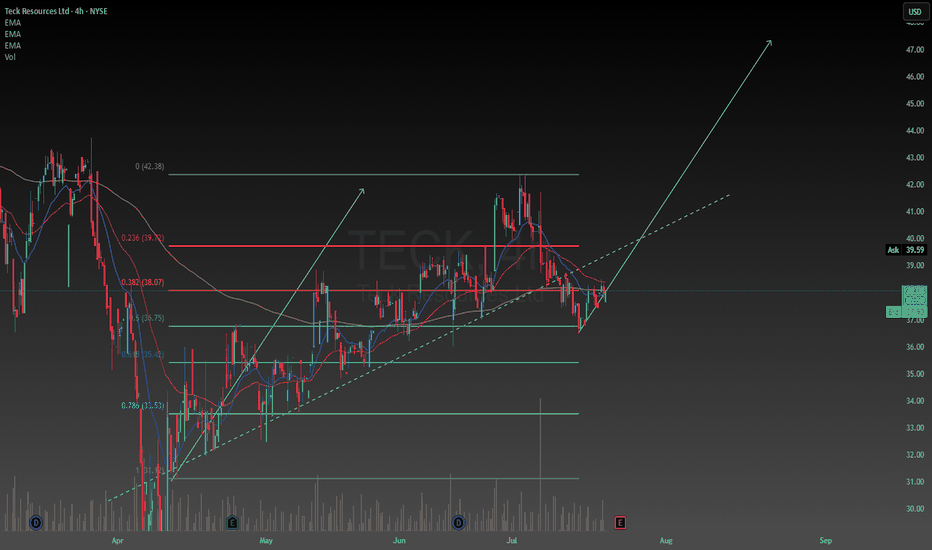

TECKgetting slightly higher highs, and higher lows which tells me its on its way up, the DI+ has spiked up which tells me the ADX will soon follow, once ADX is above 25 its considered a strong trend. RSI has just moved above the 14 day average RSI line which is a positive for it to gain in price. i think its breaking out for next highs,the 2 very bullish candles tells me its on its way up for higher highs

TECK , Long ( Re-entry attempt 1)So, the original Teck play , as posted, was stopped out. But Teck is working at a comeback today and is closed fairly strongly above the 10/21 EMA near the top of its daily price action . Volume looks pretty good too.

So back in I go ~

Stop vs 21 ema

with a 2R target to de-risk .

TECK , LONG TECK has been in a pretty strong daily uptrend since early 2020 and has shown considerable strength these past few months .

Decided to enter on the wedge pop here.

Also, looks like some decent volumes flowing in .

Institutions hold 68 % of float and transactions are positive .

Avg daily volume 5.32 M passes my 500K requirement with flying colors too .

I don't follow advice of analyst upgrades/recommendations but it also doesn't hurt to see two upgrades from

Jan 10th and Mar 9th too .

* Earnings is coming up soon on Apr-27th . I will drop the trade early if it stagnates ect ect and I can not de-risk it pre earnings . Probably still a healthy amount of time for TECK to do its thing imo . None the less have set an alert on calendar .

Entry - 40.44

Initial PT - 44.83

Stop - 38.28

3/6/22 TECKTeck resources Ltd ( NYSE:TECK )

Sector: Non-Energy Minerals (Other Metals/Minerals)

Market Capitalization: 22.179B

Current Price: $41.49

Breakout price: $38.65 (hold above)

Buy Zone (Top/Bottom Range): $40.30-$37.10

Price Target: $30.80-$31.20 (Reached), $38.20-$38.90 (Reached), $46.00-$47.80 (3rd)

Estimated Duration to Target: 21-22d (3rd)

Contract of Interest: $TECK 4/14/22 43c

Trade price as of publish date: $2.18/contract

TECK - Teck ResourcesEARNINGS TOMORROW (2/24) - BMO

Stock is in a healthy bull after breaking out of a 3-month base. Coiling nicely, showing tremendous relative strength. Trying to catch a price expansion through key level.

Earnings are tremendous and accelerating in 6 consecutive quarters, on a YoY and QoQ basis.

2/9/22 TECKTeck Resources Ltd. ( NYSE:TECK )

Sector: Non-Energy Minerals (Other Metals/Minerals)

Market Capitalization: 19.179B

Current Price: $35.95

Breakout price: $34.75 (hold above)

Buy Zone (Top/Bottom Range): $32.10-$29.85

Price Target: $38.20-$38.90 (2nd)

Estimated Duration to Target: 58-60d (2nd)

Contract of Interest: $TECK 5/20/22 40c

Trade price as of publish date: $1.88/contract

TECK gearing up for an explosive 2022TECK outpacing bearish market conditions as minerals are exploding in value over the last few months. Chart showing a strong double bottom set up on the weekly. Daily also showed a falling wedge onto that double bottom resistance area and has ran 10% from that bounce. Resistance off volume profile showing that 37 and 45 will be key areas to break. After that, 50s and 60s will come fast and are likely to be easier to break as not much volume by price stands there. Personally, this is my favorite set up and have been in leap calls since 31. I can see TECK touching ATH again very soon (soon = around 365 days from now). Also, I would not be discouraged if we drop 10 points after making a strong run (maybe resistance at 45 will be a bit strong), as pullbacks are healthy and as long as we hold 30 support more room to run higher will come. Saying that, remember this is not a weekly play, either hold common swings or leap contracts will benefit most from a potential massive run.

Side note: This is an opinion and should not be taken as correct or predictive of future price action. Manage risk at your own expense.