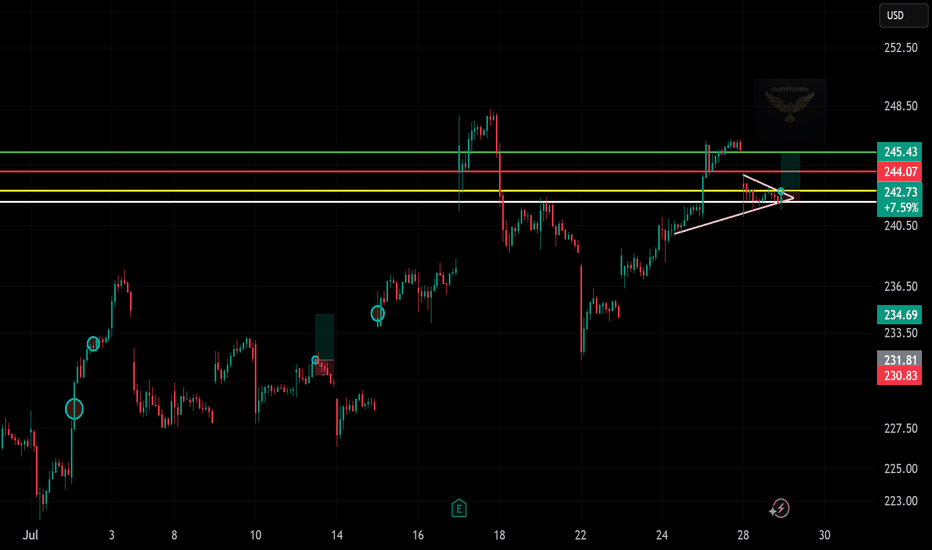

Trade Setup: LONG on TSM !📈 (Taiwan Semiconductor)

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Ascending triangle breakout

📉 Previous Trend: Recovery after drop

🔁 Setup: Bullish continuation with breakout confirmation

🧩 Technical Breakdown:

Support Zone:

~$242.50 (yellow horizontal support)

Uptrend line holding as dynamic support (pink diagonal)

Entry Zone:

Around $242.75, just above triangle breakout and support retest

Resistance / Target Levels:

TP1: $244.07 (red zone — minor supply)

TP2: $245.43 (green zone — prior high, resistance zone)

Stop Loss:

Below $241.80 or just under triangle trendline (~$241.25)

Risk-Reward Estimate:

Approximately 1:1.5 to 1:2 based on $1.5 risk and $3 reward potential

⚠️ What to Watch:

Volume confirmation during breakout or retest

Holding above yellow support zone and triangle trendline

Potential fake-out risk near $244 zone if volume fades

✅ Summary:

TSM is setting up a bullish continuation after reclaiming key levels and forming a tight ascending triangle. A clean breakout above $243 may trigger a move toward $245+ if buyers step in.

TSM/N trade ideas

TSM eyes on $194: Major Resistance to Break-n-Run or Dip-to-Buy TSM has been recovering with the chip sector.

Currently testing a Major Resistance zone.

Look for a Dip-to-Buy or Break-n-Retest entry.

$193.92-195.18 is the exact zone of concern.

$177.83-178.31 is the first major support.

$203.68-204.56 is the first resistance above.

========================================

.

TSMCThe Taiwan Semiconductor Manufacturing Company Limited (TSMC) is the world’s largest and most advanced semiconductor foundry, headquartered in Hsinchu Science Park, Taiwan. Founded in 1987 by Morris Chang, TSMC pioneered the pure-play foundry model, focusing exclusively on manufacturing chips designed by other companies, enabling fabless semiconductor firms like NVIDIA, AMD, and MediaTek to thrive.

Key Facts about TSMC (July 2025):

Market Position:

The dominant global semiconductor contract manufacturer, with a market capitalization exceeding $1.19 trillion (over $1 trillion USD), making it one of the most valuable tech companies worldwide.

Technology Leadership:

TSMC leads in advanced process technologies, producing chips at cutting-edge nodes including 3nm and moving toward sub-2nm by 2028. It was the first to commercialize extreme ultraviolet lithography (EUV) at scale.

Recent Growth:

In Q1 2025, TSMC reported a remarkable 42% year-over-year revenue increase, driven by surging demand for AI server chips, smartphones, and stockpiling ahead of US tariffs. Revenue for Q1 2025 was around NT$839 billion (~$25.5 billion USD).

Expansion Plans:

TSMC is aggressively expanding capacity with nine new facilities planned in 2025, including eight fabs and one packaging plant across Taiwan and overseas locations such as the US, Germany, and Japan. Fab 25 in Taichung is set to begin construction by year-end 2025, supporting the company’s roadmap toward sub-2nm chip production by 2028.

Global Importance:

TSMC is central to the global semiconductor supply chain, producing chips used in high-performance computing, smartphones, automotive electronics, AI applications, and more. It plays a strategic role amid US-China trade tensions and global tech competition.

Leadership:

The CEO is C. C. Wei, who has overseen TSMC’s continued technological innovation and expansion.

TSMC remains a cornerstone of the global semiconductor industry, driving innovation and capacity expansion to meet the growing demand for advanced chips powering AI, 5G, automotive, and consumer electronics worldwide.

#AI #STOCKS

TsmEdged up to the top of resistance here.

Expecting a correction back to 176-185 area here

1hour chart

Here's the uptrend since april..

The support would now be around 227.

I expect a pullback to that area this week and if support holds price could bounce back and tag weekly resistance around 240 but I don't think price will linger long above 230. A correction is coming for tsm

TSM (Taiwan Semiconductor)-Breakout Play with Strong FundamentaTicker: TSM (NYSE)

Recommendation: BUY

Current Price: $216.62

Entry Zone: $216 - $218 (Breakout confirmation)

Stop Loss: $190 (Key support level, -12.3% from entry)

Take Profit: $270.04 (+24.7% upside)

Risk/Reward Ratio: 1:2

📈 Technical Analysis

Trend: Strong bullish momentum across all timeframes (Daily/4H/1H).

Key Levels:

Support: $200 (SMA-50), $190 (Major swing low).

Resistance: $218 (Bollinger High), $270 (Fibonacci extension).

Indicators:

RSI (Daily): 72.98 (Approaching overbought but with room to run in strong trends).

MACD: Bullish crossover, positive momentum.

Volume: Rising on upward moves, confirming buyer interest.

💡 Fundamental Catalyst

Strong Growth: Revenue +33.8% YoY, Net Income +36% YoY.

Undervalued Metrics: P/S Ratio of 0.35 (Sector avg: ~5.0).

Low Debt: Debt-to-Equity of 0.22, Interest Coverage Ratio of 174x.

🎯 Why This Trade?

Breakout Potential: TSM is testing multi-week highs with volume support.

Semiconductor Sector Strength: NVDA/AMD leading sector rally, TSM as a key supplier.

High Reward/Risk: Clear SL level with 2x upside potential.

⚡ Trade Management

Add-on: Consider adding at $225 if momentum continues.

Trailing Stop: Move SL to breakeven at $220 if price reaches $240.

Watchlist: Monitor NASDAQ/SOX index correlation.

📉 Risks:

Broad market pullback.

Geopolitical tensions (Taiwan exposure).

✅ Verdict: TSM combines technical breakout strength with undervalued fundamentals. A high-conviction trade for swing traders.

Like & Follow for more data-driven ideas! 🔥

#TSM #Semiconductors #Breakout #Investing

TSM - Bullish Trade IdeaENTRY ZONE & STRIKE ANALYSIS

Optimal Entry Range: $209.80–$210.60 (Pullback Zone into Arc FVG base)

Momentum Entry: Above $214.35 with 15m/30m breakout + bull volume

Strike Focus: TSM 215c / 220c

Expiration Range: June 28 → July 5 (prefer IV pop from short consolidation breakout)

🛡 SL/TP LADDER & RISK STRUCTURE

Stop-Loss: 208.74 (2H WTMA break confirmation)

TP Ladder:

TP1: 214.35

TP2: 217.39

TP3: 220.53

TSM Weekly Options Setup – Overbought with Max Pain Pressure (20📉 TSM Weekly Options Setup – Overbought with Max Pain Pressure (2025-06-11)

Ticker: NYSE:TSM (Taiwan Semiconductor)

Bias: 🔻 Moderately Bearish (Short-Term)

Setup Type: Max Pain Reversion Play | Confidence: 65%

Expiry: June 13, 2025 | Entry Timing: Market Open

🔍 Technical & Sentiment Snapshot

📍 Price: ~$214.10

📈 Short-Term Trend (5-min): Strong bullish momentum, price > EMAs, MACD positive

📉 Daily Chart: RSI ≈ 80.79 → extremely overbought, price above upper Bollinger Band

🎯 Max Pain: $205 → possible gravitational pull

💬 Options Sentiment: Heavy open interest at $205 Puts; cautious tone across models

🧠 AI Model Consensus Breakdown

🔹 Bullish Bias (Short-Term Momentum)

• Grok/xAI & Llama/Meta: Favor riding remaining upside with $217.50 Calls

• Justification: Intraday signals strong, MACD bullish, RSI not peaking yet on M5

🔹 Bearish Bias (Daily Overextension & Max Pain)

• Gemini/Google & DeepSeek: Favor reversion to $205 using $205 Puts

• Justification: RSI > 80, price extended, high put OI & max pain align around $205

✅ Recommended Trade Plan

🎯 Direction: PUT

📍 Strike: $205

📅 Expiry: June 13, 2025 (Weekly)

💵 Entry Price: $0.63

🎯 Profit Target: $1.20 (+100%)

🛑 Stop Loss: $0.30 (–50%)

📈 Confidence: 65%

📏 Size: 1 contract

⏰ Entry Timing: Market Open

⚠️ Key Risks & Considerations

• 🚀 A breakout above $215.50 could invalidate the bearish thesis

• ⏳ Theta decay is aggressive in weeklys – move must come quick

• ⚡ Intraday bullish signals are still strong → this is a contrarian trade

• 🛡️ Use disciplined stops and size conservatively to manage risk

💭 Will NYSE:TSM fade off its overbought highs or keep ripping?

📉 Put or 📈 call — what’s your play? Drop your take 👇

Inside The Eye Of The Storm - $90 Target On TSMCIf you've seen my posts on Minds (particularly the board for NASDAQ:SOX ), it’s no secret that I’ve been bearish on semiconductors for some time. My bearish thesis is based on several factors: technical indicators, overvaluation of certain companies, and skepticism that AI-driven demand will result in broad-based prosperity. As the charts grow increasingly overbought, unfolding geopolitical developments could soon deliver a shock to the semiconductor sector, reinforcing the technical signals I’m observing.

At the time of writing, the market is turning bearish. Futures are down over 1%, and the TVC:US10Y is up nearly 2%. Institutional investors remain cautious about the U.S. economy due to its high debt levels and efforts to raise the debt ceiling to accommodate an additional $2 trillion in debt-financed tax cuts. Meanwhile, on the trade war front, the U.S. and China have agreed to deescalate tensions, a surprisingly smooth shift after weeks of posturing and brinkmanship. Although SP:SPX surged over 2% on the news, something feels off—worthy of speculation.

Recent articles in Foreign Affairs (www.foreignaffairs.com) and The Economist (www.economist.com) suggest that President Xi may now see his best opportunity to fulfill his longstanding goal of reunifying China.

I encourage reading those articles if you're interested, but here’s my take—and how it relates to a low-risk/high-reward short trade in semiconductors. By striking a tariff-reduction deal with the Trump administration, China has removed a key obstacle that could have otherwise hindered military action against Taiwan. While Trump has flip-flopped on Taiwan over the years, he has previously threatened sanctions and tariffs as deterrents. But with the economy already strained, reimposing tariffs of 145% or higher would be self-defeating.

This opens the door for China to escalate. Over the past month, we’ve seen “gray zone” tactics: military drills, suspicious Chinese fishing vessels dragging anchors near undersea cables, and reports that China may use its coast guard to “quarantine” vessels heading to or from Taiwan—potentially inflicting serious economic pain. Such moves would place the U.S. in a precarious position.

To compound the risk, Taiwan imports 90% of its energy—mostly LNG—and just shut down its last nuclear reactor on Friday (5/16), which supplied around 4.5% of the nation’s power. In 2023, NYSE:TSM alone used more than 8% of Taiwan’s electricity, according to Business Insider. Any disruption to power or communications would halt production.

This leads me to believe that China may attempt to annex Taiwan before 2027. (After all, why announce an invasion years in advance?) According to WIRED, NYSE:TSM produces at least 90% of the world’s most advanced chips, and Taiwanese companies control 68% of total global chip production. These fundamentals make Taiwan Semiconductor Manufacturing Company arguably the most vulnerable firm to any disruption in Taiwanese exports.

I’ve covered the market’s broader setup in other posts, so I’ll keep the technical analysis here brief. On the weekly chart (right), NYSE:TSM ’s price rose from October 2022 to January 2025 in five distinct waves. That uptrend has now been broken, and the price appears to be in the right shoulder of a large Head & Shoulders pattern. While the downside potential is open-ended, we can estimate a target using technicals. I expect the price to slice through the entirety of Wave (3) and find support in the blue-box, which aligns with the volume profile and 0.618–0.786 Fibonacci retracements. A break below the weekly 200MA would be a very bearish sign. For now, I’ve set my target for NYSE:TSM at $90.

Zooming in, the daily chart (right) shows numerous gaps and doji candles. The high-volume days were dominated by selling. On the 100R chart (left), including after-hours trading, the Fisher Transform oscillator shows bearish divergence. Although Friday closed flat (0.00%), the stock dropped nearly 2% after hours. I expect a move back to VWAP, especially if the broader market trends lower this week.

To gauge how TSMC stacks up against the broader industry, let’s look at some peers. On the semiconductor index NASDAQ:SOX , there are two key gaps worth watching—similar to what we see in other indexes. The price is currently at the 0.618 retracement of Wave (A) and briefly peaked above the 200MA. I expect it to move lower from here, likely filling those gaps and setting new lows.

For NASDAQ:NVDA , I’m seeing a Head & Shoulders pattern forming, with the price currently in Wave (B). Several downside price gaps exist, and more notably, there’s a volume gap between $95 and $102.

On the 500R chart (left), Nvidia is clearly overbought and facing resistance at the upper VWAP band. A move to the 1.618 extension would be extreme—but there’s an order block around that level, along with a gap down near $31, visible on the daily chart (right). Such a steep drop would require a major catalyst. While it’s unclear how reliant NASDAQ:NVDA is on Taiwan, it’s reasonable to assume the leading AI chipmaker depends on a supply chain anchored by the company producing 90% of the world’s advanced chips.

NASDAQ:AMD , another company heavily reliant on TSMC’s fabs, shows a very bearish setup on the weekly chart (right) when using a logarithmic scale. However, price action from the past year on the 500R chart (left) suggests it could move higher if basic Elliott Wave principles hold. AMD’s beta is 2.14 versus TSM’s 1.68, indicating lower correlation with the broader market. It may therefore be less compatible with wave theory, but it's still an essential ticker to monitor, especially as it diverges from NASDAQ:SOX and peers.

To conclude, considering the current overbought level of NYSE:TSM , coupled with the broader market pivoting back to a bearish trend, and its unique position at the center of a geopolitical and trade crisis, I think shorting TSMC provides a low risk/high reward setup with a target of $90. All of this to say, I am not a coldhearted opportunist, and I hope Taiwan can remain a free, democratic, country that is able to withstand China’s grey-zone tactics. Unfortunately, we should be prepared for Xi to use this opportunity to find out just how committed to Taiwan the Trump administration is, and as we saw during the COVID shutdown and subsequent supply shortages, microprocessors are some of the most essential products in the world that just so happen to be produced in the most vulnerable country in Asia. I suspect that there is trouble afoot.

Thank you for reading and let me know what you think.

TSM great potential before earnings call? Value to be collected!Hi guys we would be taking a look into our analysis for TSM!TSMC (TSM) Stock: Positioned for

Strong Growth Despite Tariff Pressures -

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading contract chipmaker, continues to shine as a long-term winner in the semiconductor space, even amid renewed trade tensions and potential tariffs.

1. Resilience Amid Tariffs and Trade Tensions

While the U.S. has recently introduced or hinted at higher tariffs on tech-related imports from China, TSMC stands out due to its strategic positioning. As a Taiwan-based company with increasing investments in the U.S., including a major Arizona facility, TSMC is well-insulated from the harshest tariff implications. In fact, the shift toward U.S. domestic chip production could boost TSMC's presence and government support, solidifying its role in global supply chains.

2. Unmatched Technological Leadership

TSMC is years ahead of competitors in cutting-edge semiconductor manufacturing, particularly in advanced nodes like 3nm and 2nm chips. This technology edge secures high-value contracts with top-tier clients like Apple, NVIDIA, and AMD, ensuring a steady and growing revenue stream.

3. Surging Demand for AI and High-Performance Computing

With the global explosion of demand for AI infrastructure, data centers, and high-performance computing, TSMC is perfectly positioned. It is the go-to foundry for the most advanced AI chips, giving it a critical role in powering the next generation of tech innovation.

4. Strategic Global Expansion

TSMC’s global expansion—including new plants in the U.S., Japan, and Germany—reduces geopolitical risks and enhances its ability to serve major markets locally. These moves also align with government incentives and support from the CHIPS Act and similar programs.

Outlook:

TSMC is not only weathering the global trade climate—it’s thriving. Its dominant market share, world-class technology, and expanding global footprint give it a strong competitive moat. With rising AI demand and the shift toward local production, TSM is set to benefit on multiple fronts.

TSM stock remains a high-conviction play for investors looking to capture the future of tech.

TSMC has consistently delivered impressive financial results, with the company surpassing analyst expectations in the past 12 consecutive quarters. For instance, in the fourth quarter of 2024, TSMC reported earnings per share (EPS) of $2.24, exceeding the consensus estimate of $2.16. This track record underscores the company's robust operational efficiency and market demand for its advanced semiconductor solutions.

Upcoming Earnings Call

Investors are anticipating TSMC's next earnings call scheduled for Thursday, April 17, 2025, before the market opens. Analysts expect the company to report an EPS of $2.02 for the first quarter of 2025. Given TSMC's history of exceeding expectations, there is optimism that the company will continue its trend of strong financial performance.

EPS beat estimates 16 times in 17 quarters!!!!!

We are targeting approximetly 18% increase!!!

📌 Trade Plan

📈 Entry: 152

✅ Target 183

❌ SL: 128

TSMC: The Silent Giant Leading the AI RevolutionBy Ion Jauregui – Analyst at ActivTrades

Taiwan Semiconductor Manufacturing Company (TSMC) has become the heart of today’s technological revolution. In a world where artificial intelligence (AI) sets the pace for economic and geopolitical development, this Taiwanese company plays a key role as the dominant manufacturer of advanced chips. In an environment marked by trade tensions, currency fluctuations, and regulatory pressure, TSMC demonstrates exceptional strength, positioning it as one of the most strategic companies on the planet.

During the first quarter of 2025, TSMC reported revenues of $18.865 billion, representing a 16.5% year-on-year increase, and a net profit of $7.22 billion. Its gross margin reached 53.1%, while earnings per share stood at $2.12, beating market expectations. This performance reflects not only flawless execution but also strong demand in key sectors such as high-performance computing (HPC), mobile devices, and above all, applications linked to artificial intelligence. The boom in generative AI has driven up the need for advanced chips with massive processing capabilities. Companies like Nvidia, AMD, and Apple rely on TSMC for the production of the most sophisticated semiconductors, manufactured using 3nm processes and, soon, 2nm. According to the company’s own statements, revenue from AI accelerators is expected to double in 2025 compared to the previous year, confirming its central role in this new digital era.

TSMC leads not only in technology but also in scale and efficiency. With over 50% of the global chip foundry market, the company has maintained EBITDA margins above 65%, a cash position exceeding $60 billion, and a highly competitive cost structure. Its “pure foundry” business model, which avoids competing with its clients in chip design, has made it an irreplaceable strategic partner. Its expansion plans include new facilities in the U.S. and Japan, with a global investment of over $100 billion aimed at strengthening its production capacity outside Taiwan. This strategy responds both to the national security demands of developed countries and to the growing fragmentation of the global supply chain.

On the currency front, amid escalating trade tensions and a highly volatile exchange rate environment, the Taiwanese dollar (TWD) has posted its largest advance since 1988, appreciating more than 10% against the U.S. dollar (USD) over the past month. This rally has coincided with growing speculation over a potential trade agreement between Taiwan and the U.S., as well as a pullback in the dollar driven by macroeconomic uncertainty and more aggressive tariff policies from Donald Trump. This poses a risk to the company’s operating margins. TSMC has acknowledged that each 1% strengthening of the TWD can negatively impact its margins by 0.4%. However, the strong growth in demand and its ability to pass on part of the costs to customers help mitigate this effect.

Technical Analysis (TSM.US)

Looking at the company’s stock price, since Monday, April 7, it has been recovering toward the mid-point of the bell curve at $172.23, the closing price from the previous session. Its January highs act as resistance, creating a range between the highs at $222.66 and the support at $132.32. The RSI is slightly imbalanced at 58.84%. Currently, the moving average crossover has expanded upward, with the 50-day average crossing above the 100-day average, although the 200-day average remains above both. It is possible that we may soon see a bullish move aiming to surpass $196 as a first step toward new highs.

With a still reasonable valuation compared to other tech giants, TSMC represents a strategic investment opportunity at the epicenter of the digital transformation. Its technological leadership, financial strength, and geopolitical role make it a fundamental piece of the new global technological order.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

TSM To continue breaking new highs as it progresses to break its previous highs from years prior, as volume is starting to develop within this sector. The road to recovery may be near as the looming expectation of Taiwan being attacked is apparently no longer of topic. For now TSM continues with good buying pressure on the weekly as we observe the chart to the left, and price breaking certain technical indicators providing more value to the upside in the near to intermediate term. I am leaning towards a price target of 140 end of year.

The monthly timeframe is looking even better for overall confirmation as price as received significant buying pressure within the last three monthly candles if you were to view it in real time, this is leading to a possible breakout further past the low to mid 110s.

Breaking: $TSM Surge 3% As Chipmaker's Results Top EstimatesThe price of Taiwan Semiconductor Manufacturing Company Limited (NYSE: NYSE:TSM ) saw an uptick of 3%, after the world's largest contract chip manufacturer reported first-quarter results that topped analysts' estimates and stuck with its 2025 revenue outlook despite the growing trade war.

TSMC, which supplies tech heavyweights Apple (AAPL) and Nvidia (NVDA), registered earnings per share (EPS) of 13.94 New Taiwan dollars ($0.43) on revenue that rose 42% year-over-year to NT$839.25 billion ($25.85 billion). Analysts polled by Visible Alpha expected NT$13.61 and NT$835.92 billion, respectively.

The company projected second-quarter revenue of $28.4 billion to $29.2 billion. Analysts were looking for about $27.1 billion.

Shares of TSMC, which entered Thursday having lost nearly a quarter of their value in 2025, were up about 3.5% up in premarket session following the results.

CEO C.C. Wei said on the earnings call that the company understands:

"there are uncertainties and risk from the potential impact of tariff policies," according to a transcript provided by AlphaSense. "However, we have not seen any change in our customers' behavior so far. Therefore, we continue to expect our full-year 2025 revenue to increase by close to mid-20s percent in U.S. dollar terms."

Technical Outlook

As of the time of writing, NYSE:TSM is up 2.76% in Thursday's premarket session, with the last close RSI at 39.91, NYSE:TSM might be on the cusp of a breakout amidst the earnings beat. A break above the $180 resistant might clear the path to $200 zone albeit the stock market is still plaque with Trumps Tariff woes. Similarly, failure to break above that pivot could resort to a correction to the recent support point.

TSM respects levelsI have not looked at this chart in a long time. The levels are still holding up strong. It's in a rising channel. Currently it is weathering the channel well. Earnings 4/17 premarket. The day candle close 4/16 was bearish. Good earnings moves could change that.

*I just know that this company keeps semi & chips looking amazing for users & investors. I'll be watching and tuned in.

4/7/25 - $tsm - Bot more pre mkt <$1364/7/25 :: VROCKSTAR :: NYSE:TSM

Bot more pre mkt <$136

- normalized fcf yield of nearly 5% (but 4% on an investment year this year), goes to implied >6% next year

- buying this, you don't pick horses, but only the ones that can afford the slots/ are growing fastest. e.g. if you think googl's silicon deployed locally will eat away at nvda share, or you think amd eats share... or you think ____, NYSE:TSM will serve it

- i think the *only* albeit valid counterpoint to stock-work-from-here is the china-taiwan risk <>

- yes and no. china is in process/ has developed own semi supply chain that it won't be sharing. it's own tsm, it's own asml, it's own nvda... this is an arms race, you don't share your arms suppliers.

- so i don't think anything dramatic is likely to take place in the real world. just the headline world. but that's just a belief and so it's not a core position (TSM).

- the big dawgs, nvda as best example, is objectively a buy here. at the same time, it's the most liquid/ lagest and subject to index flows and leverage. so i'm shooting using TSM bc it offers me similar exposure to the category, in theory it can run a bit more unbounded (because the terminal is less in question vs. say NVDA - from the market's perspective) and i think drawdown here is probably similar to something like NVDA.

- if i owned nvda here, would i sell it? no. would i add? maybe/ yeah. but give the way i'm setting up my book to be a bit more picks and shovels-i'd like to think it's a big more defensive (i lol'd writing that bit, but i'm mostly serious)... i just like this beta better.

- and yeah... >40% net margins, PE sub 15x in the pre-market sub $136/shr and CAGR'ing a fat 25+ for N2Y is good beta. i have ammo to go. will add lower, strategically.

will comment more on the mkt as it unfolds today. but i've been mostly heads down. my TL;DR is that i'd like to believe we're closer to a floor now given attempted breakdown this weekend and we're floating above the lows. tough guess here, and guesses are wrong, but if we do puke today and tmr, i think you have a very solid setup for a tradable floor. i don't think these tariff rates actually stick. i do think countries (like vietnam we saw friday, argentina recently) do have to come to the table. the rate goes closer to 10% for most. we march on.

friends. we r not gonna be making toaster ovens in toledo.

stay focused on stuff that generates tons of cash, even if there is disruption. keep leverage low, or if you are using leverage, liquidation points or expires deep ITM, far away (why u think i keep using LEAPS in this environment).

DM me if you wanna chat. or comment below if u wanna troll. just call em like i see em.

remember - wealth isn't measured in USD's ;)

it's just a game. let's play to win, though.

V

TSMC (TSM) - Chart AnalysisAs of April 3, 2025, TSM has broken down through key support zones following a sharp -5.19% move on elevated volume (47.57M), closing at $157.50. This move marks the deepest downside follow-through since the broader topping pattern began in Q1 2025 and puts TSM at a critical confluence of Fibonacci levels and prior support.

Key Technical Landscape

Current Price: $157.50

Recent Breakdown: Below $163.17 and $157.38 (mid-range support)

I

mmediate Support:

$153.95 (prior structure)

$141.52 – $135.33 (First Buy Zone) aligned with the 0.618 Fibonacci retracement

Secondary Support:

$127.24 – $118.03 (Second Buy Zone) and trendline intersection

Anchored VWAP from Oct 22 lies just above the second buy zone

Long-Term Support: $109.05, $98.92, $90.02, $85.33 (1.618 extension)

Levels & Momentum

Price has decisively broken below the EMA cloud, indicating loss of short- and medium-term trend structure.

EMA ribbon has turned downward, confirming momentum shift.

Fibonacci Levels:

0.618 retracement aligns directly with the $141.52–$135.33 zone — a high-probability area for a bullish response. 0.786 zone and 1.0 retracement converge with anchored VWAP and diagonal trendline support around $127–$118, forming a broader accumulation range.

Trendline Structure:

Major uptrend from late 2023 remains intact — current pullback has not violated the primary ascending channel.Breakdown below the anchored VWAP and 1.0 level would shift the long-term outlook bearish.

Scenario Outlooks

Scenario 1: Short-Term Relief Rally

Trigger: Support holds at/near $153.95 or $150 psychological level.

Move: Bounce toward $163.17–$167.54 resistance range.

Risk: Rejection from EMA Cloud or trendline underside could cap the move.

Scenario 2: Deeper Pullback into First Buy Zone

Trigger: Continued breakdown through $153.95.

Target Zone: $141.52–$135.33 (0.618 Fib + local structure)

Setup: This is the first major accumulation zone for buyers; watch for higher volume reaction and bullish candle structure.

Reclaim Path: If support is confirmed, path back toward $163.17 and possibly $175.14 is viable.

Scenario 3: Full Retest of Long-Term Support (Second Buy Zone)

Trigger: Breakdown through $135.33

Target: $127.24–$118.03 (anchored VWAP + long-term trendline confluence)

Implication: Deep retracement into prior consolidation zone from mid-2023; high conviction

long-term level

Failure Below: Would expose $109.05 and potentially as low as $85.33 (1.618 Fib extension), shifting broader structure to bearish.

Summary

TSM has entered a key retracement phase after a sustained trend and breakout failure. The breakdown below $157.38 shifts short-term structure bearish, but two strong buy zones exist below — first at the 0.618 retracement ($141–$135), and second at the intersection of historical demand and anchored VWAP ($127–$118).

Current price action favors caution on the long side until either a reclaim of $163 or a clean, high-volume reaction within one of the two buy zones. This remains a structurally intact long-term uptrend unless $118 is violated with momentum.

Consider Holding TSM for Long-term Gains Amidst Market Volatilit

- Key Insights: TSM is a cornerstone in the semiconductor industry. Despite

current market caution, its strategic partnerships with leaders like Nvidia

position it well for long-term growth. Short-term volatility should not

deter long-term investors as TSM continues to drive technological advances.

- Price Targets: For next week, consider a long position. Target Levels: T1 =

181, T2 = 194. Stop Levels: S1 = 174, S2 = 171.

- Recent Performance: TSM is facing short-term technical market caution,

reflected in its fluctuating stock price. Despite this, its key role in

advancing semiconductor technology maintains its appeal to investors with a

focus on future growth.

- Expert Analysis: Analysts emphasize caution due to market volatility, yet

recognize TSM's potential through strategic industry partnerships that

strengthen its long-term value. The integration with Nvidia is particularly

noted for future growth prospects.

- News Impact: Nvidia's investment in American infrastructure, alongside its

partnership with TSM, underscores TSM's integral role in technological

progress. This positions TSM favorably within broader industrial

collaborations, enhancing its growth trajectory.

TSMC Q1 FY25 : Taiwan in the middle of all this trade warDue to the trade wars the market had some sell offs

beta effect on tsmc however as trump plans to reduce deficit and advance local industrialisation

what could the future be for tsmc

currently im waiting for global market sell of especially on the nasdaq at around 23 to 24 k

so my long term outlook could be 44% worstcase 14% yield then bearish continuation

TSM Breaks Out of Downtrend! Can This Rally Hold? 📌 Key Observations from the Charts

1. Market Structure & Price Action:

* TSM broke out of a falling wedge pattern and is now retesting 181-182 resistance.

* Support Levels:

* 172.97 (key demand zone).

* 171.07 (critical support; failure here invalidates bullish move).

* Resistance Levels:

* 182.70 (current resistance; needs a breakout to confirm bullish momentum).

* 190+ (potential next target if momentum sustains).

* If TSM fails at 182, we could see a pullback toward 175-172 before another attempt higher.

2. Volume Profile & Auction Levels:

* POC: 180 → Major liquidity zone; expect consolidation around this level.

* Value Area High (VAH): 182.70 → A break above could open doors to 190+.

* Value Area Low (VAL): 171.07 → A loss here shifts control back to the bears.

3. Indicators Review:

* MACD: Strong bullish crossover, signaling momentum shift upward.

* Stochastic RSI: Overbought territory, suggesting possible short-term consolidation before continuation.

🛠️ Options GEX Analysis

* Call Resistance:

* 200-210 → Strong gamma resistance; unlikely to break without strong momentum.

* Put Walls & Support Zones:

* 175-170 → High negative GEX zones, indicating strong support.

* If TSM drops below 170, expect high volatility and a possible flush lower.

* Implied Volatility (IVR & IVx):

* IVR 54.3 | IVx Avg 51.4 → Moderate IV, with increased put activity.

* Call Positioning 4.7% → Bears still in control, but a shift in momentum is possible.

📈 Trade Setups & Game Plan

🟢 Bullish Scenario (Breakout Play)

🔹 Entry: Long above 183 breakout confirmation.

🔹 Target 1: 190 (next resistance).

🔹 Target 2: 200 (gamma squeeze potential).

🔹 Stop-Loss: Below 180 invalidates breakout.

🔹 Options Strategy:

* Buy 185C/190C expiring in 2-3 weeks for breakout confirmation.

* Sell 170/175 Put Credit Spread if bullish momentum holds.

🔴 Bearish Scenario (Failed Breakout)

🔹 Entry: Short below 179 breakdown.

🔹 Target 1: 175 (first demand zone).

🔹 Target 2: 170 (highest negative GEX & major support).

🔹 Stop-Loss: Above 183 invalidates short thesis.

🔹 Options Strategy:

* Buy 180P/175P for downside play if rejection at 182-183 confirms.

* Sell 190/195 Call Credit Spread if momentum weakens.

🎯 My Thoughts & Suggestions

* Main Bias: Bullish, but watch for confirmation.

* Key Pivot: 182.70 breakout = upside continuation, failure = pullback to 175.

* Gamma Risk: Heavy put support at 170—below this level, expect strong downside volatility.

⚠️ Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. All trading involves risk, and past performance is not indicative of future results. Please do your own research and consult a professional financial advisor before making any investment decisions.