Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

41.68 MXN

3.42 B MXN

129.08 B MXN

67.95 M

About Victorias Secret & Co.

Sector

Industry

CEO

Hillary Super

Website

Headquarters

Reynoldsburg

Founded

1963

FIGI

BBG01212ZD56

Victoria's Secret & Co. operates as a lingerie, clothing and beauty retailer. It offers bras, panties, lingerie, pajamas, sleep, sport and swim apparel, and beauty products. The company was founded in 1963 and is headquartered in Reynoldsburg, OH.

Related stocks

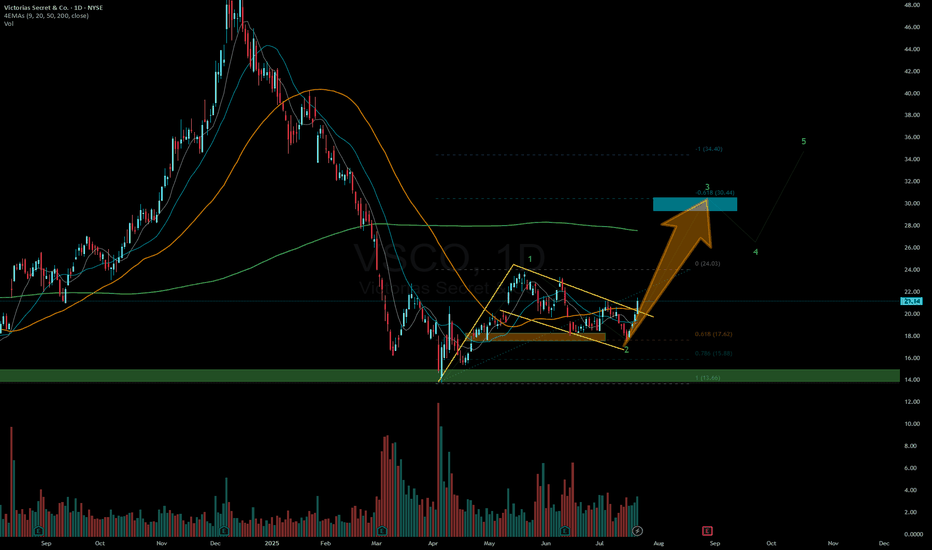

Victorias Secret (VSCO) Bull Run Incoming? Insider Signals?Victorias Secret & Co. (VSCO) Based in Ohio, USA has recently seen a dip in asset value to $16, but recovery could be imminent.

On the 1 Day chart both a bullish RSI divergence and CVD divergence seems to be forming. The DMI appears to show the bearish directional movement is slowing, and the AD

VSCO – 30-Min Long Trade Setup!📈

🔹 Ticker: VSCO (NYSE)

🔹 Timeframe: 30-Min

🔹 Setup Type: Falling Trendline Break + Support Bounce

🔸 Price at Breakout: ~$18.59

📊 Trade Plan (Long Position)

✅ Entry Zone: $18.50–$18.60 (trendline breakout + yellow reaction zone)

✅ Stop Loss (SL): Below $17.97 (structure support marked by white lin

VSCO/USD – 30-Min Long Trade Setup !📌 🚀

🔹 Asset: VSCO (Victoria's Secret & Co.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Reversal Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $22.21 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $21.19 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $23.55 (First Resistance Lev

VSCO to $37.50My trading plan is very simple.

I buy or sell when:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes above it's Bollinger Bands

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at 100 period channel

Stochastic

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LB5215097

Victoria's Secret & Co. 4.625% 15-JUL-2029Yield to maturity

6.77%

Maturity date

Jul 15, 2029

LB5219202

Victoria's Secret & Co. 4.625% 15-JUL-2029Yield to maturity

—

Maturity date

Jul 15, 2029

See all VSCO bonds

Curated watchlists where VSCO is featured.

Frequently Asked Questions

The current price of VSCO is 385.00 MXN — it hasn't changed in the past 24 hours. Watch VICTORIAS SECRET AND CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange VICTORIAS SECRET AND CO stocks are traded under the ticker VSCO.

VSCO stock has risen by 5.48% compared to the previous week, the month change is a 5.34% rise, over the last year VICTORIAS SECRET AND CO has showed a 30.51% increase.

We've gathered analysts' opinions on VICTORIAS SECRET AND CO future price: according to them, VSCO price has a max estimate of 525.83 MXN and a min estimate of 281.70 MXN. Watch VSCO chart and read a more detailed VICTORIAS SECRET AND CO stock forecast: see what analysts think of VICTORIAS SECRET AND CO and suggest that you do with its stocks.

VSCO reached its all-time high on Aug 16, 2021 with the price of 1,490.00 MXN, and its all-time low was 258.00 MXN and was reached on Oct 9, 2023. View more price dynamics on VSCO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

VSCO stock is 0.00% volatile and has beta coefficient of 2.10. Track VICTORIAS SECRET AND CO stock price on the chart and check out the list of the most volatile stocks — is VICTORIAS SECRET AND CO there?

Today VICTORIAS SECRET AND CO has the market capitalization of 28.24 B, it has decreased by −11.65% over the last week.

Yes, you can track VICTORIAS SECRET AND CO financials in yearly and quarterly reports right on TradingView.

VICTORIAS SECRET AND CO is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

VSCO earnings for the last quarter are 1.77 MXN per share, whereas the estimation was 1.43 MXN resulting in a 23.59% surprise. The estimated earnings for the next quarter are 2.05 MXN per share. See more details about VICTORIAS SECRET AND CO earnings.

VICTORIAS SECRET AND CO revenue for the last quarter amounts to 26.55 B MXN, despite the estimated figure of 26.36 B MXN. In the next quarter, revenue is expected to reach 26.46 B MXN.

VSCO net income for the last quarter is −39.24 M MXN, while the quarter before that showed 4.01 B MXN of net income which accounts for −100.98% change. Track more VICTORIAS SECRET AND CO financial stats to get the full picture.

No, VSCO doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 31 K employees. See our rating of the largest employees — is VICTORIAS SECRET AND CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VICTORIAS SECRET AND CO EBITDA is 11.23 B MXN, and current EBITDA margin is 9.65%. See more stats in VICTORIAS SECRET AND CO financial statements.

Like other stocks, VSCO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VICTORIAS SECRET AND CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VICTORIAS SECRET AND CO technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VICTORIAS SECRET AND CO stock shows the sell signal. See more of VICTORIAS SECRET AND CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.