Zai Lab (ZLAB) – Biotech Growth & Profitability PathCompany Overview:

Zai Lab NASDAQ:ZLAB , a leading Chinese biotech firm, is on track for non-GAAP profitability by Q4 2025, driven by strong revenue growth & cost management.

Key Catalysts:

Financial Discipline & Expansion 💰

Operating losses fell 45% in Q4 2024, highlighting cost efficiency while scaling operations.

Analysts project $2 billion in annual revenue by 2028, reinforcing long-term value creation.

Blockbuster Drug Pipeline 💊

VYVGART generated $93.6M in its first full launch year, demonstrating strong adoption.

KarXT & bemarituzumab are key upcoming growth drivers, expanding ZLAB’s market footprint.

Investment Outlook:

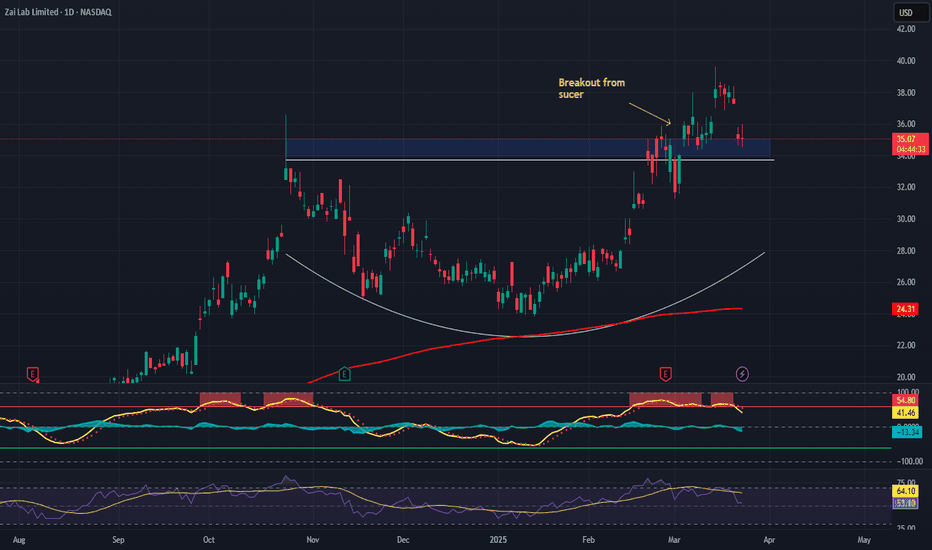

Bullish Case: We are bullish on ZLAB above $34.00-$35.00, supported by financial execution & product expansion.

Upside Potential: Our price target is $54.00-$55.00, driven by strong product adoption & long-term growth trajectory.

🔥 Zai Lab – Unlocking the Future of Biotech Innovation. #ZLAB #Biotech #GrowthStocks

ZLAB/N trade ideas

ZLAB $23.60 | Finding Value for 2025-2027 Payoutstumbled upon under rated pharma research preventive bio project in China

and is staged to be a big player when it goes commercial and licensing deals with it

new discoveries

price is just decent at around $2.x bn cap

yet as promising as illumina crispr moderna perhaps Eli Lily someday

who knows when Vanguard takes into acount McKinseys study

this can magically moon back to at least half way to all time highs

Strategy: buy and forget

$ZLAB: Interesting weekly base$ZLAB is an interesting biotech stock, with a couple potentially explosive catalysts during 2023. There's a nice weekly signal here indicating the stock is accumulated and ready to move up strongly over time.

Remember to size these names considering the extreme volatility that can occur after drug trial data comes out, or if they receive an FDA approval, etc.

Best of luck!

Cheers,

Ivan Labrie.

Long $ZLAB for a while$ZLAB is a Chinese biotech company specializing in the treatment of cancer, among other things. In December an insider bought 4,000 shares. Also, hedge funds have been increasing their exposure to $ZLAB for the last 4 quarters. The stop is 7% below at the red line. There are 2 upper trend lines (yellow). My feeling is that $ZLAB will be unsuccessful at getting through both of these levels of resistance. However, they are about 31% above. This is a more than 4:1 reward/risk ratio. Also note that $ZLAB has earnings on Mar 1 after hours. 87M float on this one

Zai Lab Soon To Release Clinical Trial DataZai Lab has partnered with Five Prime Therapuetics in the making and testing of the cancer treatment drug FPA144 + chemo (FIGHT). The stock is projected to rise 20+% on Friday, January 15, when the data is released. The data will be released 10:00-11:15 EST. Like and Follow if you want to see more trades like this.

Retraced All Gains, Like This For Short Term SwingSecondary offering of 7.5 million shares at $20 per share.

Sell $20.00ish

I think the overreaction is due to investors starting to tighten up the belt due to market conditions.

Again, this is just a quick swing off this full retracement. This just seems a bit overly reactionary to me.

Stop 10%