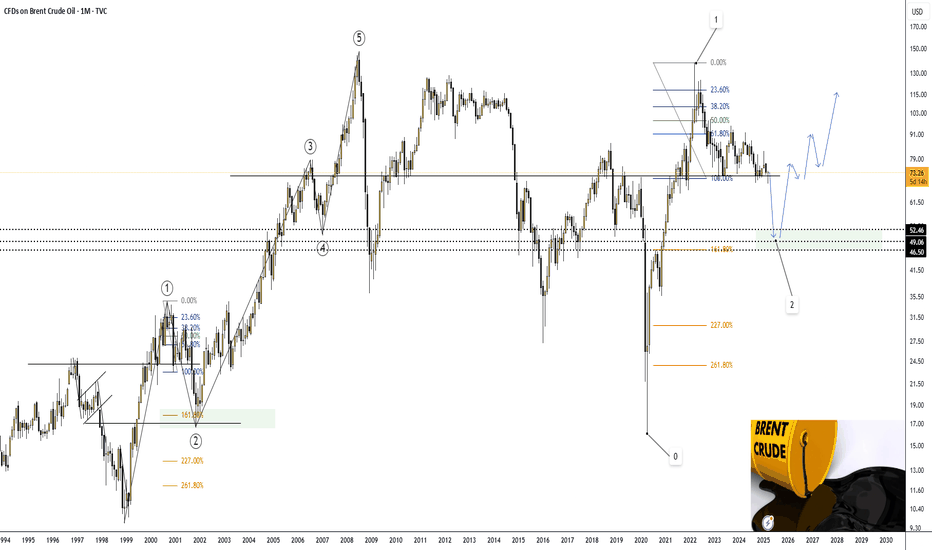

Oil at the Edge: Final Wave or One More Drop?🛢 Brent ICEEUR:BRN1! TVC:UKOIL FX:UKOIL has been correcting for nearly two years since its 2022 high — but looking at the current wave structure, we may be approaching the end of this cycle.

📌 Base Scenario

We’re likely in a classic ABC correction, with wave B being quite extended. The current wave C looks like a developing ending diagonal, and we may now be inside its final legs. In this case, Brent could dip into the $60–65 range before a potential trend reversal kicks in.

🔄 Alternative Scenario

If wave B was shallower than expected, we might be seeing a shorter wave C as well. That would mean Brent could bottom around current levels or slightly lower — with less downside left in play.

💡 Macro Factors That Still Support Oil:

Global demand isn’t falling — especially in Asia and emerging markets.

OPEC+ remains active, limiting supply and stabilizing price action.

Geopolitical tensions and logistical bottlenecks keep risk premiums alive.

Monetary easing cycles in the US and EU could soon put commodities back in the spotlight.

🧭 So, What’s the Play?

Regardless of the exact path, a major collapse looks unlikely. The final leg down may actually be a buying opportunity for long-term bulls. Targets and potential entry zones are highlighted on the chart — now it’s all about watching how wave C wraps up.

BRENT trade ideas

Brent Oil Smashes Support – Next Fib Level $61.74Brent crude plummeted after forming a tight flat flag near $72. A violent breakdown followed, pushing price to $63.71 with strong bearish candles. RSI near 27 suggests extreme conditions, but momentum still favors sellers. As long as $68.59 (previous support) is not reclaimed, the focus shifts toward $61.74 and $59.91 Fibonacci extensions.

"BRENT/UK Crude Oil" Energy Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "BRENT/UK Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (74.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 3H timeframe (72.000) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 78.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥"BRENT/UK Crude Oil" Energy Market Heist Plan (Day/Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"SPOT BRENT CRUDE OIL" Energy Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SPOT BRENT CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (71.200) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 30mins timeframe (69.500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 74.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ "SPOT BRENT CRUDE OIL" Energy Market Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Trump shakes up the markets: Strategies and impact on oilBy Ion Jauregui - ActivTrades Analyst

Former President Donald Trump's recent decision to impose across-the-board tariffs has had a strong impact on global markets. European and Asian stock markets reacted with significant declines, while the oil market experienced notable volatility.

Impact on the oil market

The announcement of tariffs has affected global demand and economic expectations, generating downward pressure on crude oil prices. Both Brent and West Texas Intermediate (WTI) recorded declines of more than 3%, reflecting uncertainty about economic growth and energy demand. In addition, the unexpected increase in US crude oil stocks has contributed to the bearish sentiment in the sector.

Possible scenarios and trading strategies

1. Technical perspective: The drop in oil prices has taken Brent to the $72 level and WTI to $69. If these key levels are lost, we could see an extension of the falls towards $70 and $67 respectively.

2. Hedging strategy: In the face of increased volatility, traders can consider hedging strategies through options or futures contracts, reducing exposure to risk.

3. Opportunities in safe-haven assets: Uncertainty could continue to drive demand for safe-haven assets such as gold and the Japanese yen. The VIX index has shown a rebound, indicating an increase in risk aversion.

BRENT Analysis

Yesterday the US market closed with a very pronounced bearish candle that de-escalated the price by more than 3 dollars. Despite having a previous sequence of candlesticks with relative volume, this did not prevent the day from closing negative for crude oil. Currently, after an Asian session without volume and the price recovering to the POC zone at $72.98, the European market has opened with a bearish session without excessive volume. A clearly oversold RSI can be seen at 29.55% so there could be a price reversal to the upside above the check point as soon as this downtrend eases. However, there has been a crossing of the 50-average below the 100-average that could indicate a bearish continuation until it meets the 200-average at a price that coincides around the indicated control point. It would not be unusual for the market to neutralize possible bullish attempts after a significant pullback after touching the high zone at least 3 times this week near the highs of $75.17. The central channel that has formed seems to be supporting at the lows of $71.88 so perhaps there could be a drop to this price zone to then gain momentum to the middle zone again. If this price does not hold, it could test the $70.27 area.

Conclusion

The U.S. tariff increase, bringing the average rate to 22% (its highest level since 1910), has dramatically changed the global economic landscape. Trade retaliation from the EU and China could further intensify volatility. In this context, it is crucial for investors to closely follow market trends and adapt their strategies to this new environment.

Brent Analysis 02-Apr-2025Possible scenarios on Brent amid the ongoing supply worries and sanctions.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Brent Crude Oil INTRADAY key trading level at 74.20Brent Crude Oil maintains a bullish sentiment, aligned with the prevailing uptrend. The recent price action suggests a corrective pullback toward a key support zone.

Key Level: 74.20

This level represents the previous consolidation range and now acts as a crucial support area.

Bullish Scenario: A bounce from 74.20 could see Brent resuming its upward trajectory, targeting 75.80, followed by 76.40 and 77.40 in the longer term.

Bearish Scenario: A break below 74.20 with a daily close under this level would weaken the bullish outlook, potentially leading to further declines toward 73.00 and 72.00.

Conclusion:

Brent Crude Oil remains bullish unless it loses support at 74.20. Traders should monitor this level for either a bounce or a breakdown to confirm the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

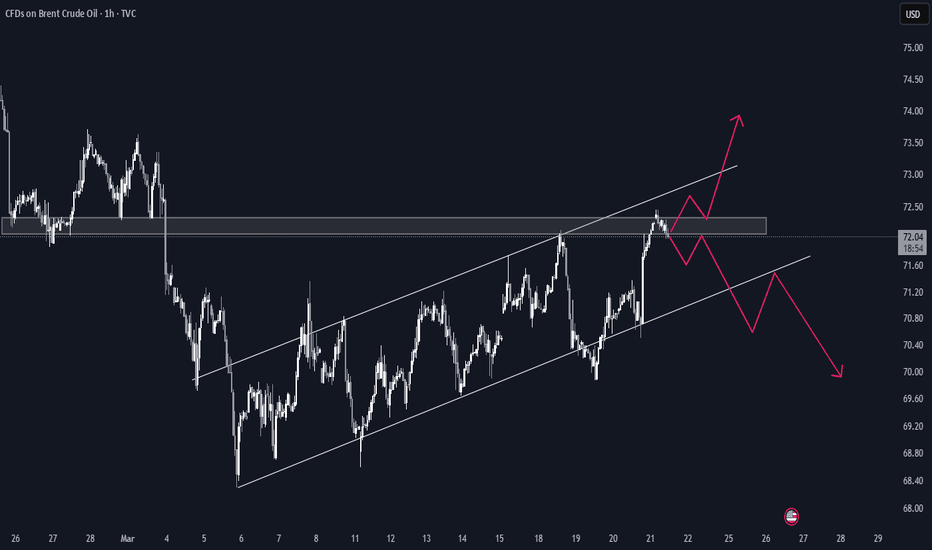

Potential short in OilOil is declining from the 50-day moving average, and on higher timeframes, the price remains in a downtrend.

A short trade could be considered, with the first target at 70.50 and the next at 68.00 .

Stop-loss at 73.50 .

For several reasons, I’m not a fan of short positions and prefer to trade short setups intraday without holding them overnight. Because of this, the trade is suboptimal for me. However, if shorts fit well into your trading system, this could be a good opportunity to capture the move.

Is there more room for OIL to the upside??? BUY BRENT (OIL)All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

A major correction in Brent crude oil (UKOIL).A major correction in Brent crude oil (UKOIL).

- This idea is invalidated if the price exceeds $73.755.

On the monthly chart, it shows that we are forming a 50% Fibonacci correction from wave 1, from where we will further expect growth toward the $115 area, and possibly even a new all-time high due to a military conflict in the Middle East.

I’ve marked potential downside targets on the chart at $46.50, $49.06, and $52.46, from where we will look for entry points for long positions lasting 2 years or more.

Brent Crude INTRADAY oversold bounce back The Brent Crude Oil price action remains bearish, in line with the prevailing downtrend. The recent move suggests an oversold bounce, but overall sentiment remains weak unless a significant breakout occurs.

Key Levels to Watch:

Resistance Levels: 74.25 (critical level), 74.90, 75.90

Support Levels: 71.70, 70.70, 69.13

Bearish Scenario:

A rejection from the 74.25 resistance level could confirm the bearish outlook, leading to further downside movement toward 71.70, with extended losses targeting 70.70 and 69.13 in the longer timeframe.

Bullish Scenario:

A breakout above 74.25 with a daily close above this level would challenge the bearish sentiment, opening the door for further gains toward 74.90, followed by 75.90.

Conclusion:

The market sentiment remains bearish, with the 74.25 level acting as a key resistance zone. A rejection from this level could reinforce the downside trend, while a confirmed breakout would shift the outlook to bullish, favoring further upside. Traders should closely monitor price action at this critical level for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Institutional Supply: OIL shortsHey,

Many good things happening in the markets, been a while that I updated though.

Everything I watch and trade is of course posted in my community.

But let's get back to it.

UKOIL is in supply and ready to roll, but USOIL supply is slightly higher, so price might want to wait a little bit before both are ready.

I love it when they move in sync and both are at value.

Studying correlation and different pov's is always good.

Regards,

Max

Brent crude oil Wave Analysis – 24 March 2025

- Brent crude oil broke resistance zone

- Likely to rise to the resistance level 73.60

Brent crude oil recently broke the resistance zone between the resistance level 71.30 (top of wave A), resistance trendline of the daily down channel in January and the 38.2% Fibonacci correction of the downward impulse from February.

The breakout of this resistance zone accelerated the C-wave of the active intermediate ABC correction (2) from the start of March.

Brent crude oil can be expected to rise to the next resistance level 73.60 (top of the previous minor correction 4 from the end of February).

XBR/USD Analysis: Price Near Resistance ZoneXBR/USD Analysis: Price Near Resistance Zone

As seen on the XBR/USD chart, Brent crude oil prices are hovering near last week’s highs this morning as market participants assess various influencing factors, including:

→ New U.S. sanctions on Iran, which are limiting its export capacity and tightening global supply, particularly to China.

→ Ongoing negotiations between the U.S., Ukraine, and Russia in Saudi Arabia, which could potentially lead to increased Russian oil exports.

→ OPEC+ plans to raise oil production starting in April.

Technical Analysis of XBR/USD

From a technical perspective, Brent crude oil is trading near a key resistance zone, which consists of:

→ A bearish Fair Value Gap (highlighted in purple).

→ The upper boundary of the descending channel.

→ The upper boundary of a narrowing triangle (shown in black), which can be interpreted as a Rising Wedge pattern.

The Rising Wedge may represent a corrective rebound within a broader bearish trend. If buyers fail to break through this resistance zone, Brent crude prices could resume their downtrend within the red channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Brent Crude INTRADAY ahead of US inventories reportThe Brent Crude price action remains bearish, driven by the prevailing downtrend. Recent price movements indicate persistent selling pressure, with rallies being met with resistance.

Key Levels:

Resistance: The critical resistance level to watch is 7240, the current intraday swing high. An oversold rally toward this level followed by a bearish rejection would reinforce the downtrend.

Support: On the downside, the next key support levels are located at 6975, 6875, and 6780, marking potential targets over a longer timeframe.

Bullish Scenario: A confirmed breakout above the 7240 resistance level, accompanied by a daily close above this point, would invalidate the bearish outlook. Such a move could signal renewed buying interest, paving the way for a rally toward the 7300 resistance level, followed by 7450.

Conclusion: The sentiment remains bearish as long as the 7240 resistance holds. Traders should be cautious of oversold rallies, as they could present selling opportunities near resistance. A decisive breakout above 7240 would indicate a potential shift in sentiment, favoring further gains.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Will Oil Prices Ignite Amid a Middle East War?The global oil market is critical, with geopolitical tensions in the Middle East potentially leading to significant price fluctuations. Recent military actions by the U.S. against Yemen's Houthi group have contributed to rising oil prices, as Brent crude futures reached $71.21 per barrel and U.S. West Texas Intermediate crude futures hit $67.80 per barrel. Positive economic indicators from China, including increased retail sales, have supported oil prices despite global economic slowdown concerns.

The Middle East remains a focal point for oil price volatility due to its strategic importance in global oil supply. Iran, a major oil producer, could face disruptions if tensions escalate, potentially driving prices higher. However, global spare capacity and demand resilience might cap long-term increases. Historical events like the 2019 Saudi oil facility attacks demonstrate the market's sensitivity to regional instability, with prices spiking by $10 following the incident.

Analysts predict that if the conflict escalates to close the Strait of Hormuz, oil prices could exceed $100 per barrel. Nevertheless, historical data suggests that prices may stabilize within a few months if disruptions prove temporary. The delicate balance between supply shocks and market adjustments underscores the need to closely monitor geopolitical developments and their economic ripple effects.

As global economic uncertainties overshadow geopolitical risks, maintaining market confidence will depend on sustained positive economic data from countries like China. The potential for peace negotiations in Ukraine and changes in U.S. sanctions could also impact oil prices, making this a pivotal moment for global energy markets.

The Crossroads of Decision of BRENT

Alex had been sitting in front of his computer for several days, the glow of the screen illuminating his anxious face. He was a novice trader, and the world of forex felt both exhilarating and overwhelming. Today, his focus was on Brent crude oil, a commodity that had captured his attention and his curiosity.

As he stared at the chart, he noticed that resistance was firmly set at 70.60. The price had flirted with that level multiple times but had failed to break through. To make matters more complicated, the chart also displayed a bearish wedge pattern, a formation that suggested potential downside movement. Alex felt his stomach tighten as he tried to decipher the conflicting signals.

"What to do next?" he thought, biting his nails nervously. He had read countless articles and watched numerous tutorials, but the information seemed to swirl in his mind without offering any clarity. Each time he thought he had a grasp on the market, new doubts crept in.

He glanced back at the chart, heart racing. Should he take a position now, betting that the price would drop, or wait for confirmation? He felt the weight of uncertainty pressing down on him. Trading was supposed to be about making informed decisions, but all he felt was confusion.

In a moment of frustration, Alex pushed back from his desk and took a deep breath. He remembered the advice he had read: "Stay calm and stick to your strategy." He had promised himself that he would not rush into trades based on fear or anxiety. Instead, he needed to focus on what the data was telling him.

Returning to the screen, he pulled up a few indicators—momentum oscillators and moving averages. He wanted to see if they aligned with the bearish wedge pattern and the resistance level at 70.60. As he analyzed the data, a clearer picture began to form. The indicators suggested a weakening momentum, reinforcing his sense that a pullback might be imminent.

Feeling a bit more confident, Alex decided that patience would be his ally. He would watch for the price to approach the resistance level again, looking for signs of weakness before making any move. He would set alerts to notify him if Brent approached 70.60, keeping his emotions in check while waiting for the right moment.

With a newfound sense of determination, Alex refocused on his screen. Trading was a journey, and he was learning that sometimes the best action was no action at all. The market would always be there, and he was committed to becoming a smarter, more strategic trader, one decision at a time.