BRLUSD trade ideas

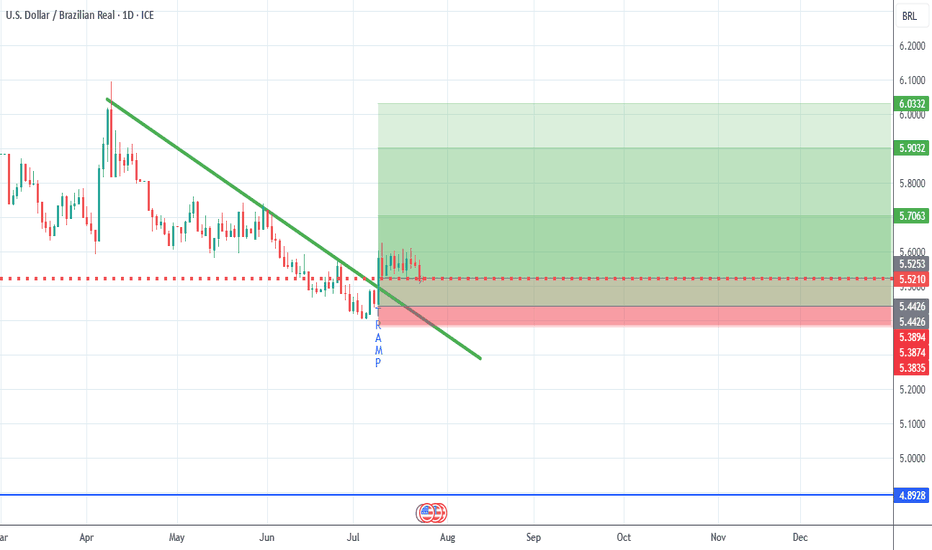

Trump’s 50% tariff sparks USD/BRL breakout The Brazilian real weakened sharply against the U.S. dollar after US President Trump announced 50% tariffs on Brazilian exports, effective 1 August.

In response, Brazilian President Luiz Inacio Lula da Silva announced Brazil would retaliate with the same rate on U.S. imports. Trump has already pledged to retaliate if Brazil retaliates.

USD/BRL rallied from just under 5.44 to a high near 5.63. On the 1-hour chart, the pair is now retracing but perhaps consolidating in a narrow range between the 61.8% and 38.2% Fibonacci zones.

With tariffs set to begin in under a month and both sides not ready to back down, USD/BRL remains sensitive.

Can Brazil’s Bonds Defy Global Chaos?In an era of escalating trade tensions and economic uncertainty, Brazil’s financial markets offer a compelling enigma for the astute investor. As of March 3, 2025, with the USD/BRL exchange rate at 1 USD = 5.87 BRL, the Brazilian real has shown resilience, appreciating from 6.2 to 5.8 this year. This strength, intriguingly tied to a bond market boasting 10-year yields near 15%, prompts a deeper question: could Brazil emerge as an unexpected sanctuary amid global turmoil? This exploration unveils a landscape where high yields and domestic focus challenge conventional investment wisdom.

Brazil’s bond market operates as an idiosyncratic force with yields dwarfing those of peers like Chile (5.94%) and Mexico (9.49%). Driven by local dynamics—fiscal policy, inflation, and a central bank unbound by global rate cycles—it has seen yields ease from 16% to 14.6% year-to-date, signaling stabilization. This shift correlates with the real’s rise, suggesting a potent inverse relationship: as yields moderate, confidence grows, bolstering the currency. For the inquisitive mind, this interplay invites a reevaluation of risk and reward in a world where traditional havens falter.

Yet, the global stage adds layers of complexity. U.S.-China trade tensions, while not directly targeting Brazil, ripple through its economy—offering trade diversion benefits like increased soybean exports to China, yet threatening slowdowns that could dim growth. With China as its top trade partner and the U.S. second, Brazil straddles opportunity and vulnerability. Investors must ponder: can its bond market’s allure withstand these crosswinds, or will global forces unravel its promise? The answer lies in decoding this delicate balance, a challenge that inspires curiosity and strategic daring.

Brazilian BRL big pumpTrump took office and pleased just over half of the country** with his promise to *"Make America Great Again,"* likely harkening back to his glory days in the 30 years, when he used deals and bravado to get what he wanted. Unfortunately, times have changed. Brazil, a major agricultural powerhouse – which Trump once claimed not to depend on "at all" – has solid plans to strengthen BRICS, with China and Russia as key partners. This has given the Brazilian Real significant strength against the usd and the Euro, because in a world of 8 billion people, only those who refuse to see are blind: **food is the new gold**.

The Truth About Brazil’s Economy: Is the Real Near R$6.63?It’s becoming clear that the market is no longer buying into the government’s optimistic narrative. The promise to eliminate the fiscal deficit, for example, has already lost momentum. What the market sees, in practice, is a series of populist measures and little fiscal responsibility.

The exchange rate reflects this reality. The real, already weakened, remains highly vulnerable to any internal shocks — whether it's political noise or disappointing economic data.

📉 Why do I believe the dollar could reach R$ 6.63?

1️⃣ Fiscal Situation Weighs Heavily

Brazil is spending more than it collects, and public accounts remain under pressure. The market no longer believes that the government will achieve balance without significant spending cuts. Promises alone don’t pay the bills — and anyone involved in currency trading knows that.

2️⃣ The Dollar Remains Strong Abroad

In the U.S., the Federal Reserve continues its firm stance on fighting inflation. This strengthens the dollar globally, which in turn puts additional pressure on emerging market currencies — and the real is no exception.

3️⃣ Weak Economic Growth Without a Solid Foundation

Even with the growth Brazil has seen, it becomes irrelevant when viewed in the context of irresponsible fiscal management. Instead of being celebrated, this growth raises questions about its sustainability. The market knows that growth without structural adjustments is unsustainable — and Brazil hasn’t shown any commitment to addressing its weaknesses.

The increase in GDP ends up overshadowed by populist measures and a lack of spending cuts. Without fiscal balance, growth turns into a house of cards that collapses at the first sign of instability. For investors, the risk of holding positions in the real remains high, especially as necessary reforms continue to be postponed.

The Result?

The market remains cautious, pricing in uncertainty and distrust.

📢 Disclaimer:

The opinions expressed here are for informational purposes only and reflect personal market analyses. They do not constitute investment advice. The currency market is volatile and carries significant risks. Always consider your investor profile and seek professional guidance before making any financial decisions.

Can the Brazilian Real Survive its Perfect Economic Storm?In the intricate world of global finance, few narratives are as compelling as Brazil's current economic crucible. The Brazilian real stands at a precipice, buffeted by a confluence of domestic policy missteps and international economic pressures that challenge the very foundations of its monetary stability. President Lula's administration finds itself wrestling with a complex challenge: balancing ambitious social spending with the cold, hard realities of fiscal discipline.

The currency's dramatic decline—losing nearly 20% of its value in recent months—represents more than a mere statistical fluctuation. It is a profound referendum on investor confidence, reflecting deep-seated concerns about Brazil's economic management. The potential depreciation to 7 reals per dollar looms like a specter, threatening to unleash inflationary pressures that could destabilize the entire economic ecosystem, from local markets to international trade relationships.

What emerges is a high-stakes economic drama with global implications. The Brazilian real's struggle is not just a national issue, but a microcosm of the broader challenges facing emerging economies in an increasingly unpredictable global financial landscape. As central bank governors, international investors, and policymakers watch with bated breath, Brazil stands at a critical juncture—its choices will not only determine its economic trajectory but potentially reshape perceptions of emerging market resilience in the face of unprecedented economic volatility.

USDBRL will dump to R$5,00 strong bearish divergences at the topUSDBRL is forming huge bearish divergences at the top indicating the movement exhaustion that could lead the price to plummet to R$5,00 iniatilly , a reaction in that R$5,00 region will be a safe call going to the R$5,20 and R$5,30 (relief rally) and after that the real dump to the region R$4,25 and R$4,17.

USDBRL might be building its 3rd impulsive wave.Not a financial advice.

To support Biden's plan "Invest in America", FED will need to keep raising interest rates to contain #inflation, and make it attractive for international investors.

Meanwhile, Brazilian economy is shrinking, with President looking to lower interest rates which it is what was done in 2003. but this time is indeed different, since the USA isn't willing to see its money plowing into emerging markets.

TVC:DXY is also building a nice comeback. this is momentarily about to change in my POV.

USDBRL_1W_Buyhello

Analysis of the Brazilian real in the medium and long term

Elliott wave analysis style

The market is in an upward trend and in the medium term we are in wave 3, which wave 3 includes 5 waves.

The target of wave 3 is 6.5500 and again we can have a correction as wave 4 to 5.8800 and continue to climb for the big wave 5 towards 7.4400

Sincerely, I am a dear Brazilian and the country is extremely beautiful and the entire continent of America ends in the great country of Brazil. I traveled around the continent of America in 2024 and I have not seen a country like Brazil, especially Sao Paulo.

I wish all the best for Brazil

Dolar at R$ 6,20The day the Dollar reached R$6.20 and for some "miraculous" reason the Brazilian central bank intervened and dropped it to R$5.67.

The sideways cut of a few hours indicates strong manipulation in the market database.

Would an investigation be necessary?

Perhaps.

After all, who provides the data?

U.S.Dollar / Brazilian Real Hey traders as you can see we are approaching a supply area on the USD / BRAZILIAN , my weekly fundamentals are telling me we have got a potential good set up here to sell.

Sell limit trade

Entry 5.6514

SL 5.7832

TP 5.1315

This chart material is for educational purposes only / Demo account should be traded only

USDBRL Possible Long

Possible Long in USDBRL, with a good target. This is not only technical analysis, but combined with the idea that USD Index will start to increasce against other currencies that was performing well. Plus the actual strong left governemt can cause more inflation and investors-run to dollar safety.