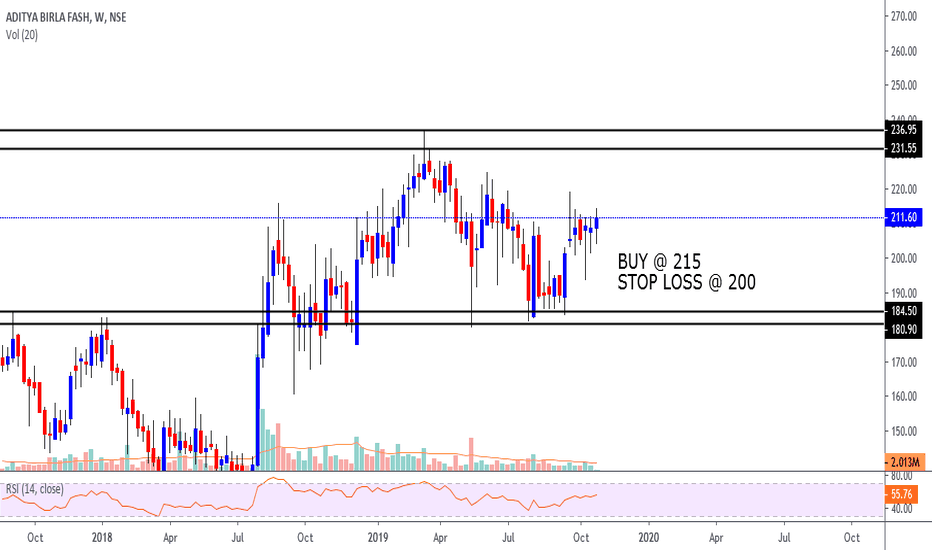

ABFRL trade ideas

Chart Study- ABFRL, BHEL, ITC, EDELWEISS, INFRATEL, BOSCHLTDThe analysis done below is purely based on price action & chart patterns.

Double Bottom (W) Pattern is a popular chart pattern in price action trading.

In ABFRL chart (Daily TF) that I have shared here, traders can note that the second bottom is formed above the first bottom. (same is described with help of small image in the chart)

In such cases where the second bottom is formed above the first bottom, the price usually breaks the next resistance level which is above the starting point of "W" pattern. (for clarity, refer the W pattern drawn in the box).

Same has happened in ABFRL twice.

I have observed similar patterns in formation in following stocks -

(1) ITC

(2) INFRATEL

(3) EDELWEISS

(4) BHEL

(5) BOSCH

Weekly Charts of above stocks are posted here with potential targets.

Traders can enter into the trade as per their own setup & risk management.

Also, pls comment the name of any other stock which is forming similar pattern.

ABFRL - Breaking out

Broke out on 13th August with a good candle and volume.

There is a wick on top. But it is less than 20% of body height.

Closure was near Pivot.

Awaiting for next candle for confirmation

A full body candle with a short tail which could indicate uptrend

Buy above 130.25. But due to long candle in day need to cross 13 August high.

1st Target 146.45 .

If broken , possibility to move to next target as it is a pivot

2nd Target 167.50

RSI and Stochastic are moving as per rules

Share buy date was today 17/08/2020 as it went above August 13 Candle

aditya birla fashion-tracking the accumulationthe business involves lot of common brands we see in everyday life- Allen Solly, Van Heusen, Louis Philippe and Peter

England, Pantaloons

already discovered brands, the core business maintaining a cagr of 7 to 10 percent topline growth, profit margins are not that attractive either, growth is around 10 to 15%..

plain vanilla established brand name play.

2 recent developments though

1. they are ramping up the innerware section by leaps and bounds, though the division forms only 5 percent of their topline with a net loss in the ebitda level, but they have expectations out of this divion in future.. no guidance available as of now regarding target revenue after a certain time frame, which cannot be expected atm

2. enthnic wear-

3 brands acquired Jaypore Shantanu and Nikhil

regarding jaypore the company have plans to open upto 20 stores in this year and the next , and bigger floor spaces than the existing stores

rest 2 are super premium category , where the company have plans to expand to around 7 stores, and offer the product at a lower cost than usual to favour penetration..

As of now the contribution of these two development to the top and the bottom line will look nonexistent, maybe for a number on coming years..

but that is the only remaining growth drivers apart from the growth of the core business..

coming to the market action..

given the strong pedigree of the management, and the brand name, it is clear since listing, the prices have not fallen and is constantly being supported by the institutions, infect the institutional value zone where they were acquiring position has shifted from 130-170 range to 180-200 range..

footprints of accumulation by the institutions are all over the chart..

question is when will this scrip start its markup..

as of now, it is stuck in a trading range in phase d of the basic accumulation structure, and in that trading range phase d is on going without any show of strength as yet..

kind of hope investment as of now looking at the fundamentals, until their expansion plan materializes in to new product mix and general demand picks up in the economy which is a very big question..

ABFRL attempting breakoutWe have seen good volume support for ABFRL emerging over last 3 months at lower levels indicating accumulation. ABFRL is attempting a breakout from a cup and handle on good volumes. RSI seem to be supporting the upmove. We can expect a good rally in the scrip. 242 may be a good initial price target for the up move.