APOLLOHOSP trade ideas

APOLLOHOSP - Apollo Hospitals (Daily chart, NSE) - Long PositionAPOLLOHOSP - Apollo Hospitals Enterprise Ltd. (Daily chart, NSE) - Long Position

Risk assessment: Medium {support structure integrity risk}

Risk/Reward ratio ~ 2.7

Current Market Price (CMP) ~ 7450

Entry limit ~ 7400 on Aug. 01, 2025

Target limit ~ 7845 (+6.01%; +445 points)

Stop order limit ~ 7235 (-2.23%; -165 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

Apollo Hospitals – Inverted Head & Shoulders BreakoutChart Pattern: Inverted Head & Shoulders

Timeframe: Daily

Breakout Level: ₹7,565

Target: ₹8,980

Potential Upside: +18.7%

Stop Loss: ₹7,250

Volume: Strong breakout volume confirms institutional activity

RSI: 71 – Momentum strong, no signs of exhaustion or divergence

Technical Thesis:

Apollo Hospitals has completed a multi-month inverted head & shoulders pattern with a breakout above the ₹7,565 neckline zone. The structure developed over 8 months, showing accumulation and basing under resistance. The breakout is supported by the highest volume since Oct 2023 and a clean bullish candle. There is no visible supply zone until the ₹8,800–₹9,000 area, suggesting potential for a swift move.

Trade Plan:

Entry: On breakout above ₹7,565 or on pullback to ₹7,450–₹7,500 (if offered)

Target: ₹8,980 (based on measured move projection)

Stop Loss: ₹7,250 (below neckline and prior range low)

Risk:Reward: ~3.5:1

Disclaimer:

This chart and analysis are intended for educational and informational purposes only. This is not a recommendation to buy, sell, or hold any financial instrument. The views expressed are based on technical patterns and personal interpretation and may not reflect actual market movement. Always do your own research and consult your financial advisor before making any trading decisions. Trading in equities involves risk of capital loss.

Review and plan for 30th June 2025Nifty future and banknifty future analysis and intraday plan.

Swing ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

APOLLO HOSPITALS: Symmetrical Triangle Breakout WatchApollo Hospitals (APOLLOHOSP) is currently forming a well-defined Symmetrical Triangle pattern on the daily chart.

Key Observations:

• Symmetrical Triangle: Price action has been consolidating within converging trendlines,

indicating indecision between buyers and sellers.

• Potential Breakout: A breakout above the upper trendline of the triangle, coupled with

increased volume, would signal a bullish continuation.

• Target 1 (Post-Breakout): The chart indicates a "Target 1 - for Positive Breakout" around

the 7300-7350 zone, which aligns with previous resistance levels.

• All-Time High Price Zone: The stock previously reached an "All Time High Price Zone"

around 7500-7600, which could be a further upside target if the bullish momentum

sustains.

Trading Idea:

• Entry: Look for a sustained breakout above the upper trendline of the symmetrical triangle. Confirm with strong volume.

• Target 1: 7300 - 7350 (Based on previous resistance and indicated target).

• Stop Loss: A break below the lower trendline of the symmetrical triangle would

invalidate the bullish setup. Traders can place stop-loss orders below a recent swing low

within the triangle or slightly below the lower trendline post-breakout confirmation.

Risk Management:

• Always use appropriate risk management and position sizing.

• Monitor volume closely during the breakout attempt.

Disclaimer : This is for educational purposes only and not financial advice. Do your own research before making any trading decisions.

Apollo Hospitals - Elliott Wave Analysis Apollo Hospitals - Elliott Wave Analysis (4H Timeframe) 📉

🔍 Key Observations :

1️⃣ The Stock Has Completed a Wave 3 Top and Is Currently in a Corrective Wave 4

In Elliott Wave Theory, Wave 3 is usually the strongest and most extended impulse wave in a five-wave structure.

The chart indicates that Apollo Hospitals reached a peak, marking the end of Wave 3 (labeled as (3) in black).

Following the completion of Wave 3, a corrective Wave 4 is now in progress, as expected in a typical five-wave sequence (1-2-3-4-5).

Wave 4 corrections tend to be complex and can take various forms, such as zigzags, flats, or triangles.

2️⃣ The Corrective Structure Appears to Be Unfolding in an ABC Pattern

Within Wave 4, the correction seems to be forming a standard ABC corrective structure, where:

Wave A represents the initial downward move.

Wave B is a counter-trend rally (temporary bounce).

Wave C is expected to complete the correction with another downward move.

The chart suggests that Wave A and Wave B have already been formed, and Wave C is now developing, likely moving towards lower levels.

Wave B can sometimes exceed Wave A in some cases (irregular flat), but in this case, it looks like a regular zigzag correction.

3️⃣ Important Fibonacci Levels Suggest Potential Targets Around ₹6,500 and ₹4,925

Fibonacci retracement and extension levels help in identifying potential support and resistance zones.

If Wave C follows the standard structure, a move towards these levels could be expected before a potential Wave 5 rally begins.

🚨 Disclaimer: The content shared is for educational and informational purposes only and should not be considered financial advice, investment recommendations, or trading signals. I am not a SEBI-registered analyst or advisor. Always conduct your own research and analysis before making any financial decisions. Trading and investing involve significant risk, and past performance is not indicative of future results. I may be completely wrong in my analysis. Please consult a professional financial advisor before making any investment decisions.y investment decisions.

APOLLO HOSPITAL

Apollo Hospitals' stock is currently showing a neutral to slightly bearish trend. The stock closed at ₹6,105.65, reflecting a 0.84% increase on the last trading day. Analysts have noted that the stock has experienced a negative price breakout recently, trading below its second support level.

Key support levels for the stock are around ₹6,000–₹6,050, while resistance levels are near ₹6,200–₹6,250. If the stock breaks above ₹6,200, it could signal upward momentum, but a dip below ₹6,000 might lead to further selling pressure.

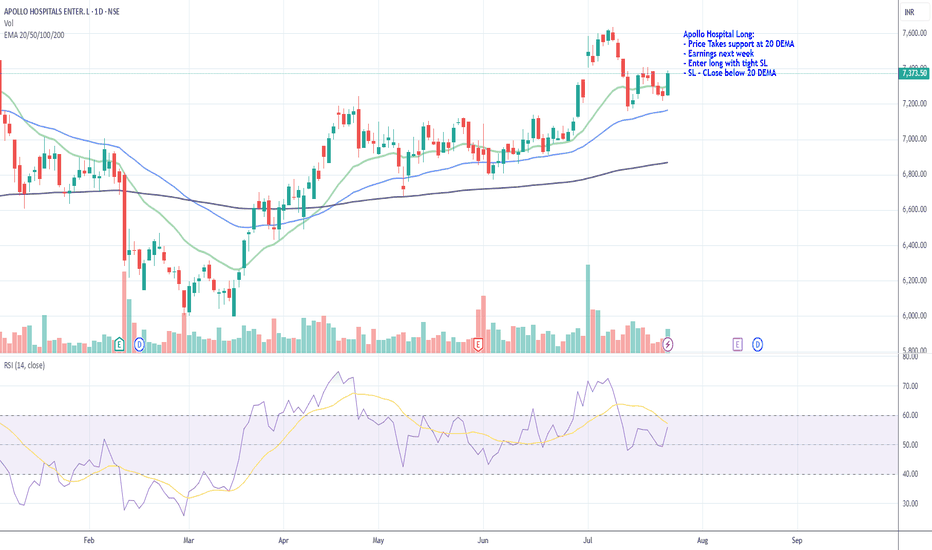

APOLLO HOSPITALS: SWING TRADE SETUP ALERT!**🚨 APOLLO HOSPITALS: SWING TRADE SETUP ALERT! 🚨**

**💹 Current Price Action:**

Apollo Hospitals is approaching a **key support zone** at **₹6,717**, setting up for a potential **BIG MOVE**. The battle between bulls and bears is heating up—will earnings decide the breakout?

### **📊 Key Levels to Watch:**

🔥 **Resistance Zone:** ₹7,381 – If the price crosses this, it could trigger a **bull rally**.

🔵 **Support Zone:** ₹6,717 to ₹6,679 – Bulls must defend this area to avoid further downside.

⚠️ **Critical Level:** ₹6,506 – Breaking below this signals a **bearish continuation**.

### **💡 Swing Trade Strategy:**

- **Bullish Play:** Enter above ₹6,717 with a target of ₹7,119 and ₹7,381.

- **Bearish Play:** Short below ₹6,679, aiming for ₹6,506.

---

**📅 Weekly Earnings in Focus:**

The upcoming **earnings report** (📉 purple icon on the chart) is the **wildcard**! Positive results can catapult prices back above the 44-day SMA (₹7,119), reigniting the **bullish momentum**. Weak earnings? Expect a test of ₹6,506.

### **🔥 Today’s Takeaway:**

Apollo Hospitals is at a **make-or-break point**. Whether you're bullish or bearish, this is the perfect swing trade opportunity. **Don't blink—this one’s about to move! 🚀**

Broadening Wedge Formation in Apollo Hospitals (NSE: APOLLOHOSP) Implications of the Pattern:

Market Psychology:

The expanding triangle reflects growing uncertainty and volatility, often seen during periods of fundamental shifts or major market news.

Breakout Potential:

The pattern typically resolves in the direction of the prevailing trend (upward in this case, given the stock's long-term ascending channel).

Current Scenario:

The stock is currently near the lower boundary of the triangle, aligning with the long-term ascending channel support. This creates a dual-support zone, increasing the probability of a bounce.

RSI in Oversold Zone:

Oversold conditions combined with a strong support zone suggest a likely reversal.

Trading Strategy

Entry Point:

Enter near the current support zone (above ₹6,750).

Ensure the stock holds above ₹6,600 to confirm the support remains intact.

Target Levels:

Target 1: ₹7,400 (mid-point of the expanding triangle and previous resistance).

Target 2: ₹7,777 (upper boundary of the channel and triangle).

Stop Loss:

Place a stop loss below ₹6,600 to protect against a breakdown.

Breakout Strategy:

If the stock breaks out of the upper boundary of the expanding triangle with high volume, it could accelerate toward ₹8,000+ levels.

APOLLOHOSPITAL 240 MINS TIME FRAME - MY VIEW ONLYThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy KG

Apollo Hospitals Enterprises Ltd – Technical AnalysisCurrent Price: ₹6,891.95 (-1.35%)

Key Levels:

Resistance: ₹7,037

Support: ₹6,875 (immediate), ₹6,700–₹6,600 (critical)

Trend:

Price has broken the lower boundary of the upward channel.

Watch for a potential reversal around ₹6,700–₹6,600.

RSI: Neutral, trending lower.

Moving Averages :

Testing the 50-day MA.

200-day MA at ₹6,200 acts as strong support.

Volume: Decreasing, signaling less buying pressure.

Strategy:

Buy if reversal occurs at ₹6,700–₹6,600, targeting ₹7,037.

Stop-loss : Below ₹6,500 for risk management.

Note: A break below ₹6,600 may lead to further downside.

APOLLOW HOSPITALS S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.