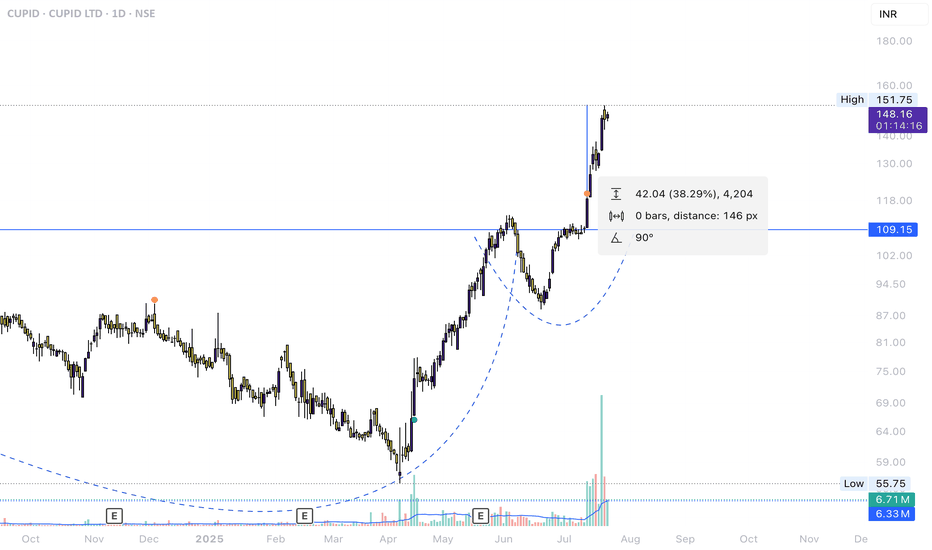

Cupid Ltd: Strong Weekly Volume Breakout!🚀 Cupid Ltd: Strong Weekly Volume Breakout! 🚀

📉 CMP: ₹141

🔒 Stop Loss: ₹88

🎯 Target: ₹220

🔍 Why Cupid Looks Promising?

✅ Rounding Bottom Breakout: Clear breakout on the weekly chart with strong volume support

✅ Volume Confirmation: High volumes indicate genuine buying interest and strength behind the move

✅ Big Stop Loss Strategy: Due to the nature of such breakouts, stocks often show large squats before continuing upward. Maintaining a big stop loss with controlled position sizing is critical to ride the trend.

💡 Strategy & Risk Management:

📈 Staggered Entry: Accumulate in phases to manage volatility

🔒 Strict SL: Keep stop loss at ₹88 and adjust position size to protect capital effectively

📍 Outlook: Cupid Ltd's technical setup suggests potential for significant upside, aligning with strong volume breakout patterns.

📉 Disclaimer: Not SEBI-registered. Please do your own research or consult a financial advisor before investing.

#CupidLtd #BreakoutTrade #VolumeBreakout #TechnicalAnalysis #SwingTrading #MarketInsights #InvestSmart

Let me know if you want breakout educational templates prepared for your upcoming weekend LinkedIn content plan.

CUPID trade ideas

Ye Chart Kuch Kehta Hai - Cupid LtdTactical (Short-Mid Term): Wait for a confirmed breakout above ₹134–135 on strong volume before initiating new positions. With high RSI and Stochastic, expect potential short-term pullbacks.

Strategic (Long Term): If the fundamental growth and profitability remain intact, Cupid Ltd. remains a compelling long-term hold. Consider accumulating on dips or after consolidation phases for better risk-adjusted returns.

Technical Analysis (Chart Insights)

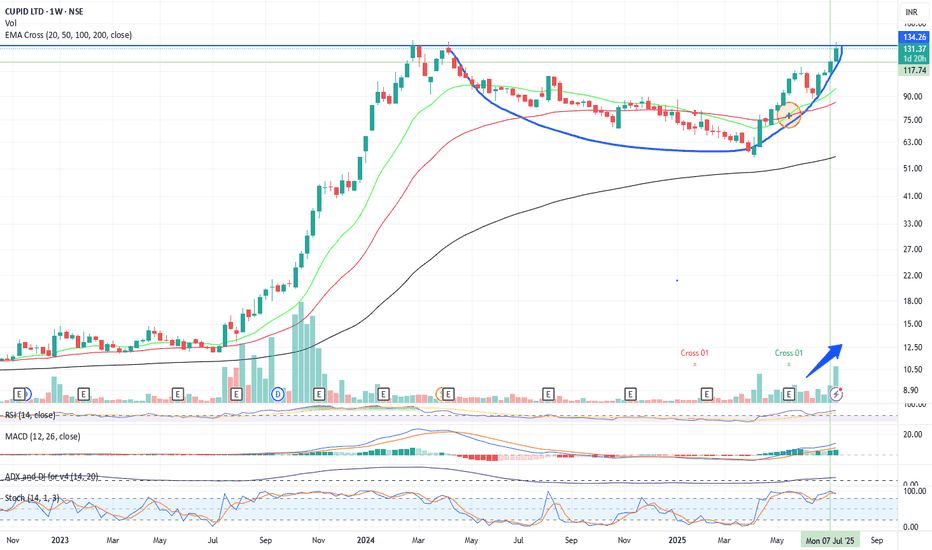

Cup and Handle Breakout: Cupid Ltd.'s weekly chart reveals a classic "cup and handle" pattern, typically signaling bullish continuation if broken with strong volume.

Resistance Level: The price is testing a major resistance around ₹134–135. A successful close above this level with heavy volume may open further upside.

Moving Averages: The stock is trading well above key EMAs (21, 50, 100, 200), indicating a strong uptrend.

Volume Spike: Noticeable increase in volume supports the recent upward movement, suggesting institutional interest.

Momentum Indicators:

RSI: Around 75, in overbought territory, which can lead to short-term pullbacks but also indicates strong momentum.

MACD: Shows bullish crossover and positive momentum.

Stochastic: Also overbought (>90), further reinforcing short-term caution.

ADX: Above 35, confirming a strong trend.

Fundamental Analysis Overview

(You requested fundamentals alongside technicals. Here’s a concise evaluation based on typically available metrics for Cupid Ltd:)

Business: Major Indian player in condom and lubricant manufacturing, catering to both domestic and export markets.

Profitability: Historically strong EBITDA margins, healthy net profits, and consistent dividend payouts.

Growth: Steady revenue and profit growth over recent years, supported by both government contracts and retail expansion.

Financial Health:

Minimal to no long-term debt; strong cash reserves.

Good return ratios (ROE, ROCE), suggesting efficient capital usage.

Valuation: As of recent data, the stock trades at a premium to sector peers on PE and PB, justified only if growth continues to accelerate.

Strengths

Market Leadership: Niche player in a high-barrier industry.

Exports: Significant export revenue implies diversification beyond India.

Financial Stability: Debt-free, good cash flows, and payouts to shareholders.

Risks

High RSI/Stochastic: Stock is technically overbought, susceptible to corrections.

Sectoral Constraints: Dependent on public sector/government orders, making earnings lumpy.

Valuation Premium: Sustained high valuation requires continuous growth execution.

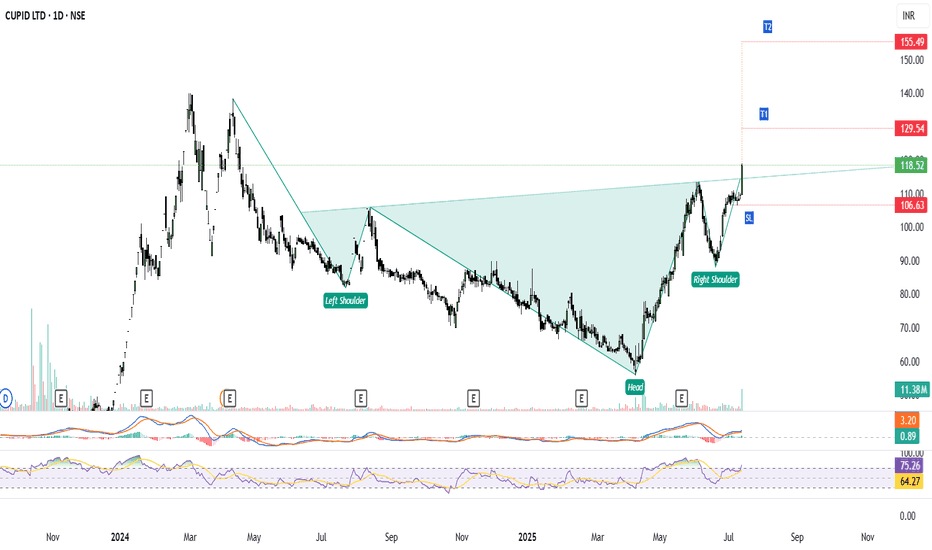

“CUPID LTD – Inverted Head & Shoulders Breakout | Swing TradePattern :- Inverted Head & Shoulders

Scrip :- CUPID LTD

Timeframe :- Daily (1D)

Breakout Confirmation :- Strong breakout above neckline with volume spike

Entry : ₹118.50 (after successful breakout)

SL :- ₹106.60 (below neckline support)

Target 1:- ₹129.50

Target 2 :- ₹160.00

Technical Analysis :-

- Volume spike confirms buying Pressure

- RSI above 65 = bullish momentum

- MACD crossover is the Confirmation

Disclaimer :- This analysis is shared for educational purposes only. Please do your own research or consult a financial advisor before making any trading decisions.

CUPID, breakout, inverted head and shoulders, NSE, swing trade, volume analysis, bullish setup

Cupid Limited - Towards Cup and handle break outCupid limited has formed a cup and handle pattern . RSI is strong and the stock has done a decent quarter. Q3 is usually the best . Promoter has been buying shares. look out for a break out above 87. Can easily give 15% returns in the short term. Company has incorporated a subsidiary in UAE . There is a new plant in the works which will be operational from next years some time.

BULLISH ON CUPIDCUPID stock reached from 880 to 1660 in just 10 days aka 100% return

stock trajectory in intraday = 5% daily most of the time aka bullish

view is bullish on this stock

stock can gain upto 2200 in 1-2 months

can expect returns 100-200%

positive news inflows about stock

Cupid Secures Domestic Orders Worth INR162 Million

link

www.tradingview.com

#CUPID TRADE IDEA SETUP Greetings Folks,

today i have prepared a setup on CUPID on NSE

the analysis is as follows

- price is at all time high

- weekend break of structures requires some retracement for further move

- following a dynamic support trendline

- if tomorrow's 11/09/23 is a slow market

then we would want the price to form some minor range

dont play with fire, always use predefined stoploss

CUPIDNSE:CUPID

please note that we are not a SEBI Registered Investor Adviser/PMS/ Broking House.

All the contents over here are for educational purposes only and are not investment advice or recommendations

offered to any person(s) with respect to the purchase or sale of the stocks / futures and options.

You are also requested to apply your prudence and consult your advisers in case you choose to act on

any such content available as WE claims no responsibilities for any of your actions or any outcome of

such action

CUPID ... SWING TRADENSE:CUPID

Please note that we are not a SEBI Registered Investor Adviser/PMS/ Broking House.

All the contents over here are for educational purposes only and are not investment advice or recommendations

offered to any person(s) with respect to the purchase or sale of the stocks / futures and options.

You are also requested to apply your prudence and consult your advisers in case you choose to act on

any such content available as WE claims no responsibilities for any of your actions or any outcome of

such action