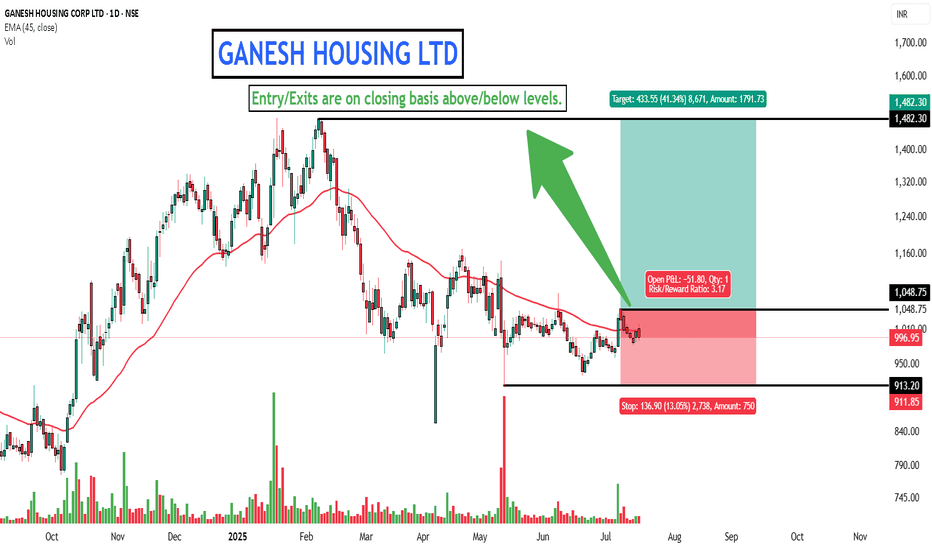

GANESH HOUSING - DON'T MISSEverything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

Kindly dm for further assistance it is for free just for this stock.

Thank you and invest wisely.

GANESHHOUC trade ideas

Darvas Box Strategy - Break out Stock - Swing TradeDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:2

Stop loss can be Trail when it make new box / Swing.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

Ganesh Housing - Inverse HnS PatternGanesh Housing Corporation Ltd.

Inverse Head n Shoulders Pattern in Daily Timeframe

Increasing Relative Strength.

High Delivery Quantity.

Close within 52 Week High Zone.

Making Higher Highs Past 2 Days.

Disclaimer:

For educational purpose only.

Please do your own research before taking any trades.

Happy Trading!

GANESH HOUSING CORP LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Ganesh Housing Corp Ltd Strong Volume With Breakout Ganesh Housing Corp Ltd Strong Volume With Breakout

Stock Look Good Above 660-680

Target Near 780-850

Holding time Upto 3 month

Stop loss 550

Disclosure : I am not SEBI registered.The information provided here is for education purposes only.I will not be responsible for any of your profit/loss with this channel suggestions.Consult your financial advisor before taking any decisions.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in GANESHHOUC

BUY TODAY SELL TOMORROW for 5%

Resistance breakoutPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

GANESH HOUSING - ASCENDING TRIANGLE BREAKOUT📊 Script: GANESHHOUC (GANESH HOUSING CORPORATION LIMITED)

📊 Nifty50 Stock: NO

📊 Sectoral Index: NIFTY REALTY

📊 Sector: Realty

📊 Industry: Residential Commercial Projects

Key highlights:

📈 GANESHHOUC (GANESH HOUSING CORPORATION LIMITED) is giving Ascending Triangle Breakout.

📈 There is Crossover in MACD.

📈 There is also crossover in Double Moving Average.

📈 Stock is trading at upper band of BB and given breakout of upper band.

📈 Right now RSI is around 70.

🟢 Target 🎯🏆 - 365

⚠️ Stoploss ☠️🚫 - 319

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Happy learning with trading. Cheers!

Ganesh Housing - Meduim-Term; CBSL 123, Targets 170-180-190 Ganesh Housing Corporation Ltd

NSE Symbol: GANESHHOUC

CMP: 150.8, P/e: 10.05, P/Bv - 0.49, Mcap/sales: 1.02, Div. Yld: 1.38%, D/Eq: 0.90

One can look for buying opportunity in Ganesh Housing, with the Closing basis SL of 123 for the targets of 170-180-190

Key Technicals

* Good volumes

* Cup and Handle Break out

* Trend line break out

Key Fundamentals

* Fundamentally Good stock

* Valuation wise - Under valued compared to peers

* Financially Strong