Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

22.50 INR

14.72 B INR

217.50 B INR

228.46 M

About HAVELLS INDIA LTD

Sector

Industry

CEO

Anil Rai Gupta

Website

Headquarters

Noida

Founded

1971

ISIN

INE176B01034

FIGI

BBG000D44ZV0

Havells India Ltd. engages in the development of electrical and power distribution equipment. It operates through the following segments: Switchgears, Cables, Lighting and Fixtures, Electrical Consumer Durables, and Lloyd Consumer. The Switchgear segment comprises of domestic and the industrial switchgears, electrical wiring accessories, industrial motors, pumps, and capacitors. The Lighting and Fixture segment offers energy saving lamps and luminaries. The Cable segment includes flexible cables and industrial underground cables. The Electrical Consumer Durables segment composes of fans, water heaters and domestic appliances. The Lloyd Consumer segment consists of air conditioner, television, washing machine, and domestic appliances. The company was founded by Qimat Rai Gupta in 1971 and is headquartered in Noida, India.

Related stocks

Review and plan for 23rd July 2025Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar

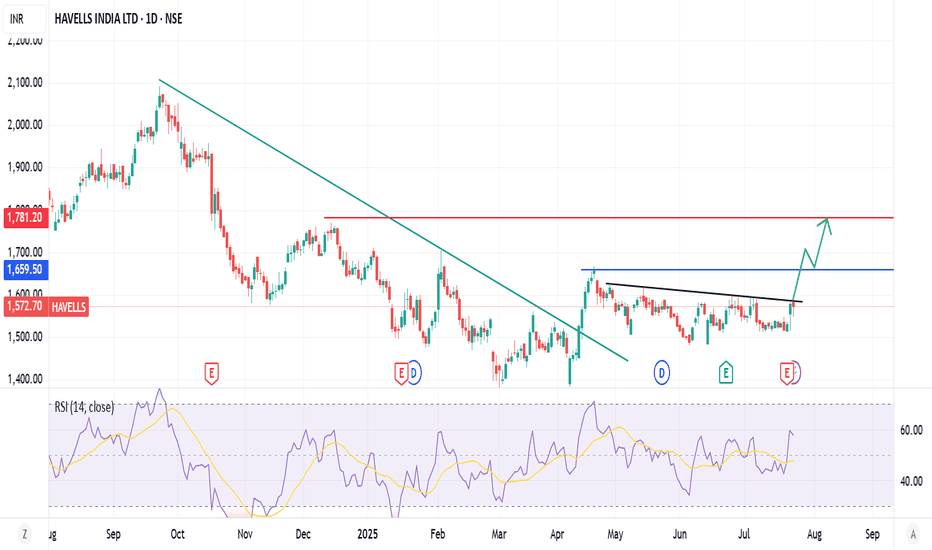

Havells India - Tend ChangeNSE:HAVELLS Trend has changed. 1st Target would be 1782 and this can go upto 1960, if it sutains, which is Risk Reward. However if you are planning for the 1960, please keep stop loss as 1782 and proceed. This is to ensure you get the Virtual Money for which you have put your efforts!!

Havells India Ltd view for Intraday 24th April #HAVELLS Havells India Ltd view for Intraday 24th April #HAVELLS

Resistance 1630 Watching above 1633 for upside movement...

Support area 1600 Below 1600 ignoring upside momentum for intraday

Watching below 1595 for downside movement...

Above 1630 ignoring downside move for intraday

Charts for Educational

Trade Idea for HAVELLS INDIA LTDTimeframe: 4H Chart

Technical Analysis:

Falling Channel Breakout Setup : The stock has been trading inside a downward-sloping channel. A breakout from this channel could lead to a strong upward move.

Key Levels:

Entry Zone: Around ₹1,540 - ₹1,560 (Breakout confirmation above resistance).

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where HAVELLS is featured.

Frequently Asked Questions

The current price of HAVELLS is 1,524.25 INR — it has decreased by −1.79% in the past 24 hours. Watch HAVELLS INDIA LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange HAVELLS INDIA LTD. stocks are traded under the ticker HAVELLS.

HAVELLS stock has fallen by −1.18% compared to the previous week, the month change is a −2.29% fall, over the last year HAVELLS INDIA LTD. has showed a −14.50% decrease.

We've gathered analysts' opinions on HAVELLS INDIA LTD. future price: according to them, HAVELLS price has a max estimate of 1,915.00 INR and a min estimate of 1,219.00 INR. Watch HAVELLS chart and read a more detailed HAVELLS INDIA LTD. stock forecast: see what analysts think of HAVELLS INDIA LTD. and suggest that you do with its stocks.

HAVELLS reached its all-time high on Sep 23, 2024 with the price of 2,104.95 INR, and its all-time low was 2.20 INR and was reached on May 17, 2004. View more price dynamics on HAVELLS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HAVELLS stock is 2.19% volatile and has beta coefficient of 1.25. Track HAVELLS INDIA LTD. stock price on the chart and check out the list of the most volatile stocks — is HAVELLS INDIA LTD. there?

Today HAVELLS INDIA LTD. has the market capitalization of 956.02 B, it has decreased by −0.23% over the last week.

Yes, you can track HAVELLS INDIA LTD. financials in yearly and quarterly reports right on TradingView.

HAVELLS INDIA LTD. is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

HAVELLS earnings for the last quarter are 5.62 INR per share, whereas the estimation was 6.67 INR resulting in a −15.74% surprise. The estimated earnings for the next quarter are 5.43 INR per share. See more details about HAVELLS INDIA LTD. earnings.

HAVELLS INDIA LTD. revenue for the last quarter amounts to 54.38 B INR, despite the estimated figure of 59.54 B INR. In the next quarter, revenue is expected to reach 49.66 B INR.

HAVELLS net income for the last quarter is 3.48 B INR, while the quarter before that showed 5.18 B INR of net income which accounts for −32.85% change. Track more HAVELLS INDIA LTD. financial stats to get the full picture.

HAVELLS INDIA LTD. dividend yield was 0.65% in 2024, and payout ratio reached 42.58%. The year before the numbers were 0.59% and 44.38% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 36.38 K employees. See our rating of the largest employees — is HAVELLS INDIA LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HAVELLS INDIA LTD. EBITDA is 21.18 B INR, and current EBITDA margin is 10.06%. See more stats in HAVELLS INDIA LTD. financial statements.

Like other stocks, HAVELLS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HAVELLS INDIA LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HAVELLS INDIA LTD. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HAVELLS INDIA LTD. stock shows the neutral signal. See more of HAVELLS INDIA LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.