Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

45.95 INR

106.49 B INR

628.81 B INR

886.60 M

About HINDUSTAN UNILEVER LTD.

Sector

Industry

CEO

Rohit Jawa

Website

Headquarters

Mumbai

Founded

1956

ISIN

INE030A01027

FIGI

BBG000CSMGW9

Hindustan Unilever Limited is engaged in fast-moving consumer goods business comprising home and personal care, foods and refreshments. The Company's segments are Soaps and Detergents, which includes soaps, detergent bars, detergent powders, detergent liquids and scourers; Personal Products, which includes products in categories of oral care, skin care (excluding soaps), hair care, deodorants, talcum powder, color cosmetics and salon services; Beverages, which includes tea and coffee; Packaged Foods, which includes branded staples (atta, salt and bread), culinary products (tomato-based products, fruit-based products and soups) and frozen desserts, and Others that includes exports, chemicals, water business and infant care products. The Others segment also includes export sale of marine and leather products. Its brands include Lux, Surf excel, Rin, Wheel, Fair & Lovely, Pond's, Vaseline, Lakme, Dove, Clinic Plus, Sunsilk, Axe, Brooke Bond, Bru, Knorr, Kissan, Kwality Wall's and Pureit.

Related stocks

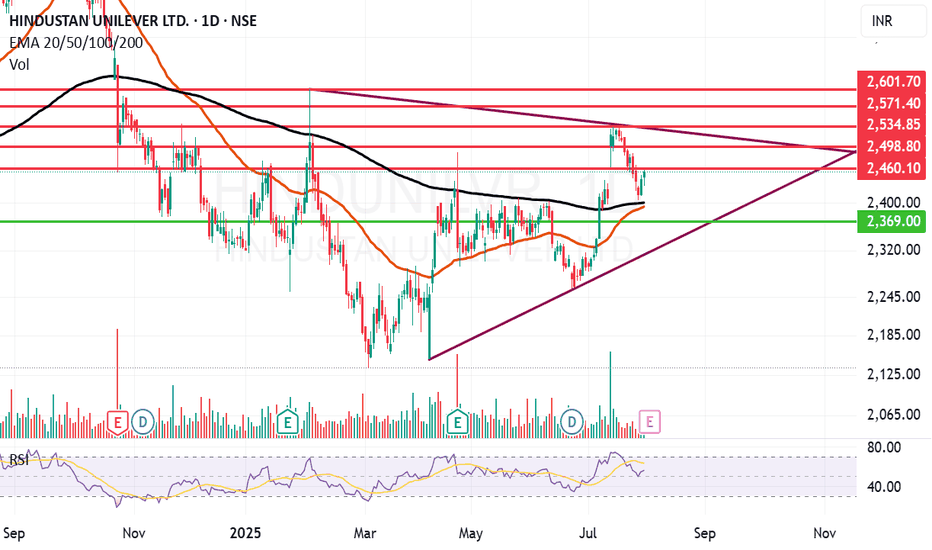

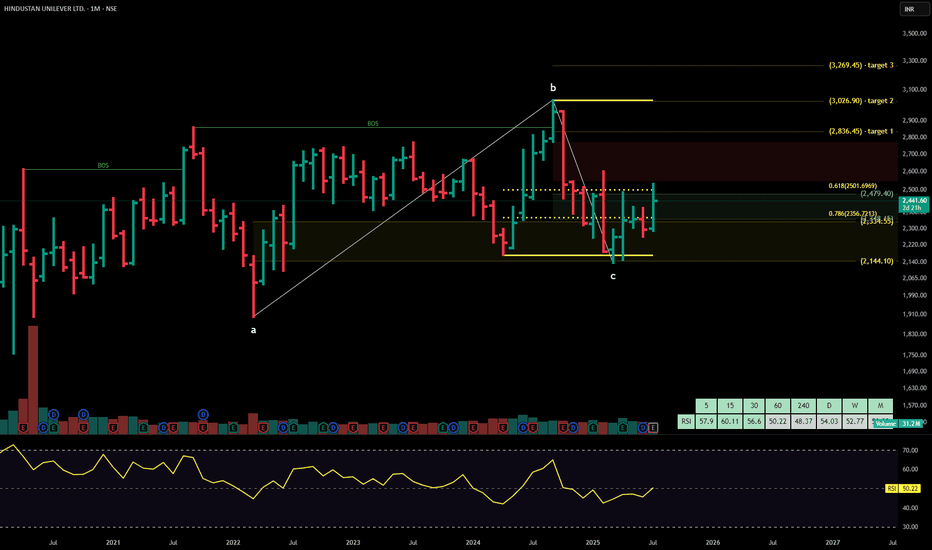

Hindustan Unilever looks strong. Hindustan Unilever Ltd. engages in the manufacture of consumer goods. It operates through the following segments: Home Care, Beauty and Personal Care, Foods and Refreshments, and Others. It is one of leading company in FMCG sector.

Hindustan Unilever Closing price is 2453.60. Dividend Yield @CMP =

HINDUSTAN UNILEVERHindustan Unilever Ltd. is India’s leading fast-moving consumer goods (FMCG) company, with a portfolio spanning personal care, home care, foods, and beverages. Backed by strong brand equity, extensive distribution, and consistent innovation, the company maintains dominant market share across categor

Hindustan Unilever Ltd. – Bullish Breakout with Strong MomentumHindustan Unilever opened the session with a gap-up accompanied by above-average volume, signaling strong buying interest right from the start. While the stock saw some early profit-booking, it quickly regained momentum and is currently trading near the day’s high—an encouraging sign of sustained de

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where HINDUNILVR is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of HINDUNILVR is 2,551.35 INR — it has increased by 1.17% in the past 24 hours. Watch HINDUSTAN UNILEVER LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange HINDUSTAN UNILEVER LTD. stocks are traded under the ticker HINDUNILVR.

HINDUNILVR stock has risen by 4.99% compared to the previous week, the month change is a 11.41% rise, over the last year HINDUSTAN UNILEVER LTD. has showed a −5.87% decrease.

We've gathered analysts' opinions on HINDUSTAN UNILEVER LTD. future price: according to them, HINDUNILVR price has a max estimate of 3,240.00 INR and a min estimate of 1,966.00 INR. Watch HINDUNILVR chart and read a more detailed HINDUSTAN UNILEVER LTD. stock forecast: see what analysts think of HINDUSTAN UNILEVER LTD. and suggest that you do with its stocks.

HINDUNILVR reached its all-time high on Sep 23, 2024 with the price of 3,034.50 INR, and its all-time low was 13.50 INR and was reached on Jul 23, 1991. View more price dynamics on HINDUNILVR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HINDUNILVR stock is 8.13% volatile and has beta coefficient of 0.56. Track HINDUSTAN UNILEVER LTD. stock price on the chart and check out the list of the most volatile stocks — is HINDUSTAN UNILEVER LTD. there?

Today HINDUSTAN UNILEVER LTD. has the market capitalization of 5.99 T, it has increased by 4.47% over the last week.

Yes, you can track HINDUSTAN UNILEVER LTD. financials in yearly and quarterly reports right on TradingView.

HINDUSTAN UNILEVER LTD. is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

HINDUNILVR earnings for the last quarter are 11.63 INR per share, whereas the estimation was 10.83 INR resulting in a 7.43% surprise. The estimated earnings for the next quarter are 11.44 INR per share. See more details about HINDUSTAN UNILEVER LTD. earnings.

HINDUSTAN UNILEVER LTD. revenue for the last quarter amounts to 161.78 B INR, despite the estimated figure of 159.82 B INR. In the next quarter, revenue is expected to reach 166.34 B INR.

HINDUNILVR net income for the last quarter is 27.56 B INR, while the quarter before that showed 24.64 B INR of net income which accounts for 11.85% change. Track more HINDUSTAN UNILEVER LTD. financial stats to get the full picture.

HINDUSTAN UNILEVER LTD. dividend yield was 1.90% in 2024, and payout ratio reached 94.87%. The year before the numbers were 1.85% and 96.02% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 26.67 K employees. See our rating of the largest employees — is HINDUSTAN UNILEVER LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HINDUSTAN UNILEVER LTD. EBITDA is 148.25 B INR, and current EBITDA margin is 23.65%. See more stats in HINDUSTAN UNILEVER LTD. financial statements.

Like other stocks, HINDUNILVR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HINDUSTAN UNILEVER LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HINDUSTAN UNILEVER LTD. technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HINDUSTAN UNILEVER LTD. stock shows the buy signal. See more of HINDUSTAN UNILEVER LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.