IDEA trade ideas

VI Stock(India) Looking for bullish Rally! {5/07/2025}Educational Analysis says that VI Stock (India) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

Vodafone Idea: Moving to a Buy trajectory

Vodafone Idea: Moving to a Buy trajectory

Recovered quite well from the support with back to back Greens as displayed on the Chart

Tough road ahead with multiple Red Band Resistances.

MACD is positive almost approaching an important level of 0.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

IDIA Range Accumulation – Bullish Only With Fundamental TriggerThe stock is currently trading inside a tight range, indicating a phase of consolidation.

📉 Buy Zone: ₹6.38

I’m planning to accumulate if price drops near this zone. From a technical view, it’s a strong demand area. However, for the bullish breakout to sustain, we’ll need strong fundamental support — like earnings, news, or sector momentum.

🔍 If fundamentals align, this could become a long-term multibagger setup.

✅ Strategy:

Wait for ₹6.38 zone

Accumulate small quantities

Hold for long-term with regular news tracking

💬 What do you think?

Would you wait for breakout or buy inside the range?

#TechnicalAnalysis #SwingTrade #LongTermView #SupportZone #BreakoutSetup #StockMarketIndia

IDEA LONG TRADE SETUP📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

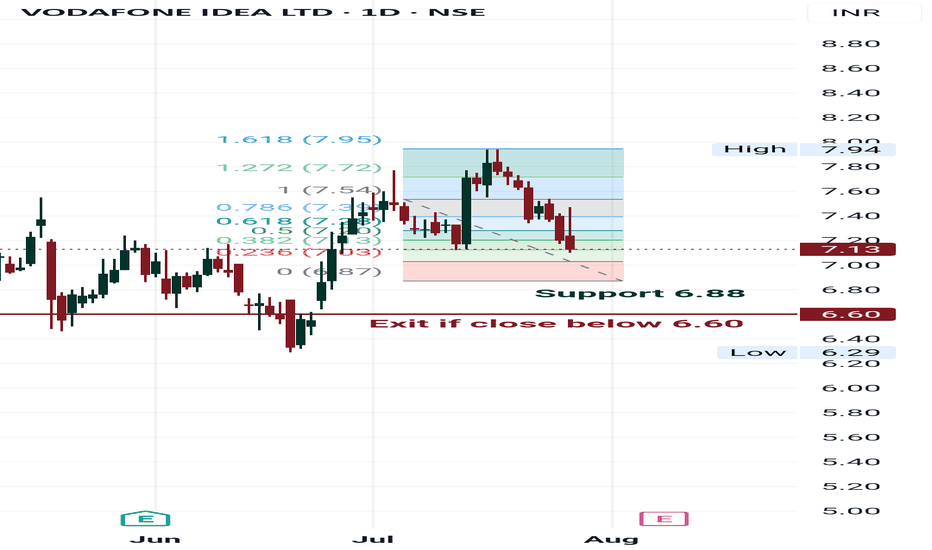

IDEA VODAFONE - Second Entry Initiated."Everything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

For any query kindly dm.

Thank you and invest wisely. "

VodaFone Idea - Bottom made and ready for potential of 20 On a Monthly time Frame Vodafine Idea has touched bottom channel & along with that it has formed Bullish Shark pattern as well.

It will have next resistance at 13 (0.5 Fib). Monthly candle close above 13 will take it to 20.

Vodafone Idea is buy for 1 to 1.5 year time period for following targets.

13 - 20 - 23 - 26

AN IDEA CAN MAKE YOU BIG MONEY - VODAFONE IDEA LTDEverything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

For any query kindly dm.

Thank you and invest wisely.

Idea : Getting ready to breakout?It seems big money is entering Idea. Look at the last few candles volume.

Volume keeps increasing with price. Good sign but, this has stock has been ultimate trap for retailers for a long time, so proceed with caution.

Exit as soon as small targets achieved. You can always enter again at higher price. If this breaks out it might break out really big.

SL - 12

Target 1 - 20

Target 2 - 28

Still, this has been tricky stock. So I will proceed with caution.

Idea vodafone looks good for an upmoveLooks like corrected a bit!

Loss making co! But technically looks ok!

Target 8.50

stop 7.5

risk 0.25 reward 0.75 rs

short term 15 days period only!

Recent news that cabinet aproved bank guarantee waiver..

Fundamnetals bot supportive!

Only technical call!

Not a buy or sell reco!

Only for study purpsoe!

IDEA D-W-M-Q StatusIdea have shown a good fall from Rs 19 CMP 7.9 . in four window you can see we have good levels for entry with limited SL . If you have planned for entry in this stock then this is good time . check out all four windows for longer view on this stock .

we have share Daily , Weekly , Monthly and Quarterly view with RSI, Zones, EMA and SMA, Volume candles.