INFOSYSINFOSYS

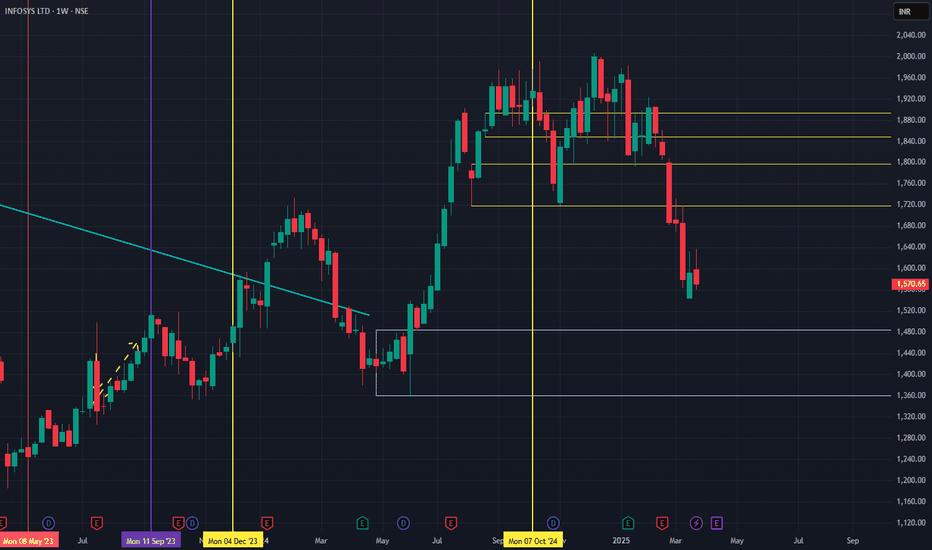

MTF Analysis

INFOSYSYearly Demand 1,260

INFOSYS 6 Month Demand 1,730

INFOSYSQtrly Demand BUFL 1,730

INFOSYSMonthly Demand 1,481

INFOSYSWeekly Demand 1,481

INFOSYSDaily Demand DMIP 1,415

ENTRY -1 Long 1,481.0

SL 1,400.0

RISK 81.0

Target as per Entry 2,502.0

RR 12.6

Last High 1,951.0

Last Low 1,400.0

INFY trade ideas

Infy Analysis Past and short termInfy has been a good stock for beginners or well-versed investors. They have consistently grown their earnings and have rarely caused turmoil. With Tariff concerns of US and FII selling, I think the max drop that would happen is around 1420 by the end of March. I would be setting up GTTs around 1500 and 1420. Let's see what news we get from Mr. Trump by April 2nd.

Review and plan for 13th March 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

INFY | SHORT | STBTINFOSYS and IT scrips are what is dragging Nifty down.

A short trade is setting up on INFY.

The Monthly Pivot and Weekly Pivot has been rejected and price is unable to sustain.

I anticipate a correction towards the 200 DEMA.

The Daily RSI is also weak which confirms the sentiment.

Target - 1802

SL - 1890

Infosys going for Gap fill to the upside Infosys on the Daily timeframe looks like it wants to fill the gap to the upside. Post ER, INFY gapped down and it is reversing now.

With a stop loss of < 1850 on the daily closing basis, expecting targets of 1900. 1950 and 2000

Scaling out as we achieve targets is the best way to secure profits

Technical Analysis Overview of InfosysMonthly Timeframe:

Infosys is forming a potential Double Top pattern near its resistance zone. However, confirmation of this bearish structure is pending as the price has not yet broken below critical support levels. The stock appears to be moving sideways near resistance, suggesting the possibility of a breakout. However, MACD is showing bearish divergences, which could indicate weakening bullish momentum, hinting at a potential reversal.

Weekly Timeframe:

In the weekly chart, Infosys experienced a fake breakout, confirmed by the bearish candle formed during the week of 13th January 2025. This high-volume bearish candle reinforces the idea of a trend reversal as it establishes a lower high, in line with Dow Theory's bearish trend structure. The price action is strongly negative, supported by increased selling pressure.

Daily Timeframe:

On 17th January 2025, Infosys gapped down following the announcement of positive results, signaling a classic "bad price action after good news" scenario—often considered a highly bearish signal. The gap-down candle suggests strong bearish sentiment, despite the favorable earnings report. Traders may use the high of the result day candle as a stop loss on a closing basis to manage risk.

INFY S/R for 20/1/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Infosys is Getting Benefit Or USD RiseNow Looks like every chart has Head & Shoulders Pattern.

A Upside can be seen of around 250 points.

This post is just my perception and for study purpose only.

I am not a SEBI registered analyst. As stock market has risk of loosing money.

Please invest your hard earned money carefully.

I will not be responsible for any loss in the stock market.

INFY S/R for 13/1/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

INFY S/R for 6/1/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

INFY :Programming for Rise Up🚀 Infosys Ltd.? 📈

Technical Analysis

Wave Count : The chart identifies five waves labeled 1 through 5 . Current price action suggests the completion of Wave 4 and the beginning of Wave 5 .

Wave 1 : Starts from the bottom left and peaks around November 11.

Wave 2 : Corrective wave ending around November 18.

Wave 3 : Strong upward wave peaking around December 16.

Wave 4 : Corrective wave in progress, retracement zone: ₹1899-₹1940 .

Wave 5 : Projected upward move towards the target zone: ₹2018-₹2032 .

Corrective Waves : The intermediary correction ( Wave C ) is expected to complete within the highlighted yellow zone .

Target Zone : The target zone for Wave 5 is ₹2018-₹2032 .

Stop Loss : Place at ₹1890 based on Wave 4's failure.

Volume : Volume at 2.3M (bottom right of the chart).

Trading Plan

Entry Point : Enter long as Wave 4 completes and Wave 5 begins, ideally near the Wave C completion zone .

Target : Aim for ₹2018-₹2032 .

Stop Loss : Place a stop loss at ₹1890 to manage risk.

Disclaimer

This analysis is for informational purposes only and should not be considered financial advice. Trading stocks, options, and other financial instruments involves risk and may not be suitable for all investors. Always conduct your research and consult with a licensed financial advisor before making investment decisions.

#Infosys #TechnicalAnalysis #TradingPlan #StockMarket #Investment #ElliottWave