ITC 1D🔺 Triangle Pattern (likely Symmetrical/Ascending Triangle)

Current Price Zone: ₹416

Pattern Type: Likely Ascending Triangle (if higher lows are forming against a horizontal resistance)

Resistance Level: Around ₹416–420

Breakout Confirmation: Needs a strong bullish candle above resistance with significant volume.

📊 What to Watch:

Volume:

A genuine breakout should happen with above-average volume. Watch the 50-period or 20-period average volumes on daily or 1H chart.

Breakout Candle:

Should close above ₹420 ideally. A breakout without closing above resistance is risky.

Retest Possibility:

Sometimes, price may break out and retest the breakout level before continuing the uptrend. Don’t panic if it slightly dips and holds support near ₹416.

🎯 Target Levels After Breakout:

You can calculate the triangle breakout target like this:

Target = Height of triangle + Breakout point

Let’s assume the base of triangle is from ₹375 to ₹416 = ₹41 range

Breakout Target = ₹416 + ₹41 = ₹457

📌 Extended Target (Momentum-based): ₹475–₹500 zone

📌 If volumes + broader market support: ₹500+ is possible, especially in swing or positional setups.

📉 Invalidation (Risk Management):

If after breakout, price falls below ₹410–408 with volume, it could be a false breakout.

Keep a stop-loss below previous swing lows or support trendline.

🧠 Summary:

✅ Triangle breakout with volume = bullish confirmation

🎯 Targets: ₹457 → ₹475 → ₹500

❗ Risk zone: below ₹410

🔁 Retest is common before upmove continues

Disclaimer: The information provided is for educational and informational purposes only and should not be considered as financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Please consult with a certified financial advisor or conduct your own research before making any investment decisions. We are not responsible for any losses incurred as a result of using this information. Stock market investments are subject to market risks; read all related documents carefully.

ITC trade ideas

ITC🔷 ITC Trade Setup Summary

Key Element Details

Trade Type BUY (Long)

Entry Price ₹416

Stop Loss ₹380

Target Price ₹604

Risk ₹36

Reward ₹188

Risk-Reward 5.2 : 1

Last High ₹498

Last Low ₹392

✅ Trade is trend-aligned across all timeframes.

📌 Entry at ₹416 is at the top of a demand cluster (monthly to intraday) – ideal for breakout continuation.

🔷 Setup Logic

✅ All trends UP: From Yearly down to 60 min – strong alignment.

📈 Entry sits just above a dense demand cluster (₹380–₹416) – smart and safe.

🛡️ Stop Loss (₹380) is protected by all demand zones.

🎯 Target (₹604) is realistic long-term, breaking past the previous high of ₹498.

🔷 Strategy Recap

Action Price Reason

BUY ₹416 Breakout above demand zones (DMIP)

SL ₹380 Below demand cluster (safe risk)

Target ₹604 Swing target, above previous high

🔷 Verdict

✅ Good RR (5.2:1) — even a 30–40% move to target gives excellent profit.

✅ Ideal for swing or positional traders.

⚠️ Watch for price consolidation around ₹416–₹420 before breakout.

🔷 Multi-Timeframe Demand Zone Breakdown

Timeframe Zone Type Zone Range (₹) Avg Price Remarks

Yearly BUFL 340 – 307 324 Strong long-term demand base

Half-Yearly BUFL 340 – 307 324 Matches yearly zone

Quarterly BUFL 372 – 357 365 Consolidation before breakout

Monthly DMIP 416 – 380 398 Entry sits on top of this zone

Weekly DMIP + Swap 416 – 380 398 Strong structure at entry area

Daily DMIP 402 – 380 391 Repeated buying interest

Intraday DMIP 407 – 394 401 Confirming strong near-term demand

ITC Ltd – Breakout Watch!ITC has been consolidating between ₹424–₹438 for weeks. Today, it’s testing the upper range, signaling a possible breakout with a target near ₹450–₹452.

🔹 Resistance: ₹438

🔹 Support: ₹424

🔹 Volume: 16.18M (rising)

A close above ₹439 with strong volume could confirm the breakout. Watch closely — this move could offer a quick swing opportunity! ⚡

Ye Chart Kuch Kehta Hai (ITC Ltd)ITC making consecutive 3 months higher high, early sign of cup formation and target is for cup breaking out point as golden ration of Fib. retracement. FMCG Sector turn-around and poised for growth. Multiple sign clearly indicates that ITC is picture perfect chart for growth.

Low cheat option, may turn around and ready for cup formation.

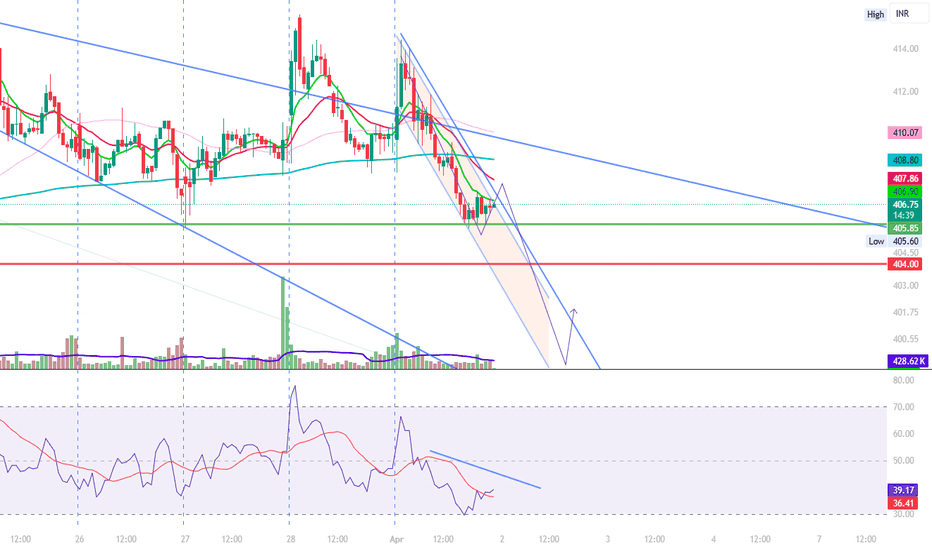

ITC Ltd view for Intraday 16th May #ITC ITC Ltd view for Intraday 16th May #ITC

Resistance 435 Watching above 436 for upside momentum.

Support area 425 Below 430 ignoring upside momentum for intraday

Watching below 424 for downside movement...

Above 430 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

ITC Ltd view for Intraday 15th May #ITC ITC Ltd view for Intraday 15th May #ITC

Resistance 435 Watching above 436 for upside momentum.

Support area 425 Below 430 ignoring upside momentum for intraday

Watching below 424 for downside movement...

Above 430 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

ITC Ltd view for Intraday 23rd April #ITC ITC Ltd view for Intraday 23rd April #ITC

Resistance 435 Watching above 436 for upside movement...

Support area 428-430 Below 430 ignoring upside momentum for intraday

Watching below 428 for downside movement...

Above 435 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

ITC Ltd view for Intraday 21ST April #ITCITC Ltd view for Intraday 21ST April #ITC

Resistance 429-430 Watching above 430 for upside movement...

Support area 420 Below 425 ignoring upside momentum for intraday

Watching below 419 for downside movement...

Above 425 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

#ITC Demand Zone An ITC Demand Zone refers to a specific price level or area on a chart where the buying interest in ITC Limited (a leading Indian conglomerate with businesses in FMCG, hotels, paperboards, packaging, agri-business, and IT) is significantly strong. This concept is used in technical analysis to identify key levels where the price of ITC's stock might find support and reverse upward. Demand zones are critical for traders looking to enter long positions at favorable prices.