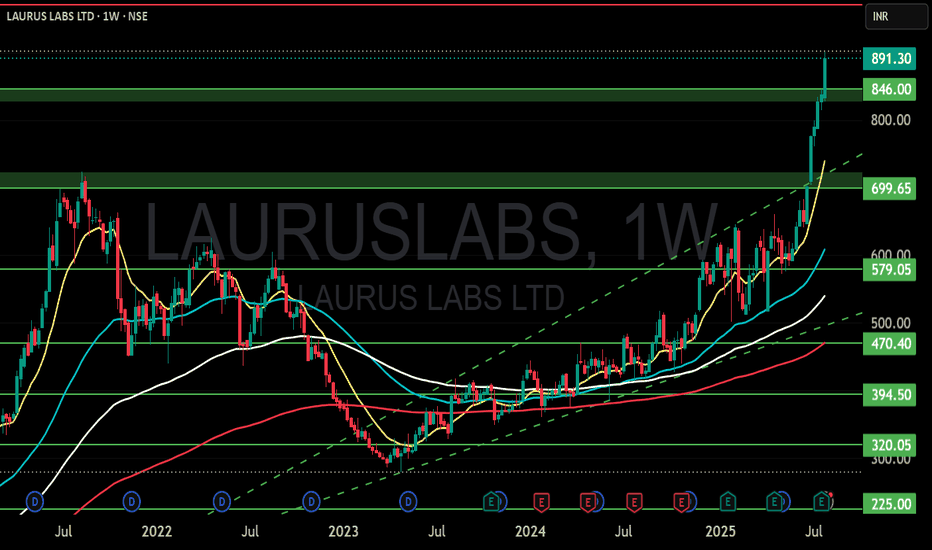

LAURUS LABS LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.45 INR

3.58 B INR

55.54 B INR

498.26 M

About LAURUS LABS LTD

Sector

Industry

CEO

Satyanarayana Chava

Website

Headquarters

Hyderabad

Founded

2005

ISIN

INE947Q01028

FIGI

BBG00FFGJFX4

Laurus Labs Ltd. develops and manufactures active pharmaceutical ingredients for therapeutic areas of anti-retrovirals and hepatitis C. The company was founded by Dr. Satyanarayana Chava on September 19, 2005 and is headquartered in Hyderabad, India.

Related stocks

Positional Setup for Laurus LabsCMP: ₹667.35

Breakout Level: ₹657–660 (now turned support)

Support Zones: ₹657, ₹618

Resistance Levels (next targets): ₹705–710, ₹735

Indicators:

Supertrend: ✅ Bullish

TEMA 5-9-20: ✅ Trending up

Volume/Price Action: Strong bullish candle post consolidation

📈 Technical View (Positional)

Lauru

Laurus Labs: Short-Term Momentum Setup! 🚀 Laurus Labs: Short-Term Momentum Setup! 🚀

📉 CMP: ₹624

🔒 Stop Loss: ₹604

🎯 Target: ₹660

🔍 Why Laurus Labs?

✅ Key Fibonacci Confluence: Price hovering around the crucial 62% retracement level.

✅ Derivatives Signal: Highest Call OI at ₹620—now acting as support.

✅ Momentum Watch: The stock is pos

Laurus Labs : In a buy trajectory,recovering quit well Laurus Labs : In a buy trajectory,recovering quit well after a consolidation from 660

It's in a Buy trajectory on a monthly time frame as well .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Laurus Labs Ltd.*Laurus Labs Ltd.*

P&F / RB on Yearly Basis

7% Upside required to complete the RB formation.

Should sustain, then only good to go!!!

Strong Vol. Accumulation / Continued Traction.

RSI: Needs to move in Bullish Zone

EMAs: Widening Gaps amongst 20 50 100 200 levels at Weekly / Monthly Basis.

*Trail

Laurus Lab CMP 583, 12.01.2025Laurus Labs at its resistance of 3 year back level, Good time to short for first target of 560 and second target of 520 which can be seen in next week.

If it breaks its resistance of 625 which is not easy, But if break good long position will initiate for target of 900 in 3-6 months

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of LAURUSLABS is 838.20 INR — it has decreased by −2.55% in the past 24 hours. Watch LAURUS LABS LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange LAURUS LABS LIMITED stocks are traded under the ticker LAURUSLABS.

LAURUSLABS stock has fallen by −8.18% compared to the previous week, the month change is a 7.31% rise, over the last year LAURUS LABS LIMITED has showed a 94.95% increase.

We've gathered analysts' opinions on LAURUS LABS LIMITED future price: according to them, LAURUSLABS price has a max estimate of 970.00 INR and a min estimate of 555.00 INR. Watch LAURUSLABS chart and read a more detailed LAURUS LABS LIMITED stock forecast: see what analysts think of LAURUS LABS LIMITED and suggest that you do with its stocks.

LAURUSLABS reached its all-time high on Jul 30, 2025 with the price of 922.55 INR, and its all-time low was 59.60 INR and was reached on Aug 7, 2019. View more price dynamics on LAURUSLABS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LAURUSLABS stock is 2.43% volatile and has beta coefficient of 1.12. Track LAURUS LABS LIMITED stock price on the chart and check out the list of the most volatile stocks — is LAURUS LABS LIMITED there?

Today LAURUS LABS LIMITED has the market capitalization of 462.82 B, it has increased by 3.62% over the last week.

Yes, you can track LAURUS LABS LIMITED financials in yearly and quarterly reports right on TradingView.

LAURUS LABS LIMITED is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

LAURUSLABS earnings for the last quarter are 3.00 INR per share, whereas the estimation was 2.12 INR resulting in a 41.78% surprise. The estimated earnings for the next quarter are 2.47 INR per share. See more details about LAURUS LABS LIMITED earnings.

LAURUS LABS LIMITED revenue for the last quarter amounts to 15.70 B INR, despite the estimated figure of 14.49 B INR. In the next quarter, revenue is expected to reach 15.50 B INR.

LAURUSLABS net income for the last quarter is 1.63 B INR, while the quarter before that showed 2.34 B INR of net income which accounts for −30.23% change. Track more LAURUS LABS LIMITED financial stats to get the full picture.

As of Aug 7, 2025, the company has 12.47 K employees. See our rating of the largest employees — is LAURUS LABS LIMITED on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LAURUS LABS LIMITED EBITDA is 12.66 B INR, and current EBITDA margin is 19.51%. See more stats in LAURUS LABS LIMITED financial statements.

Like other stocks, LAURUSLABS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LAURUS LABS LIMITED stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LAURUS LABS LIMITED technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LAURUS LABS LIMITED stock shows the buy signal. See more of LAURUS LABS LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.