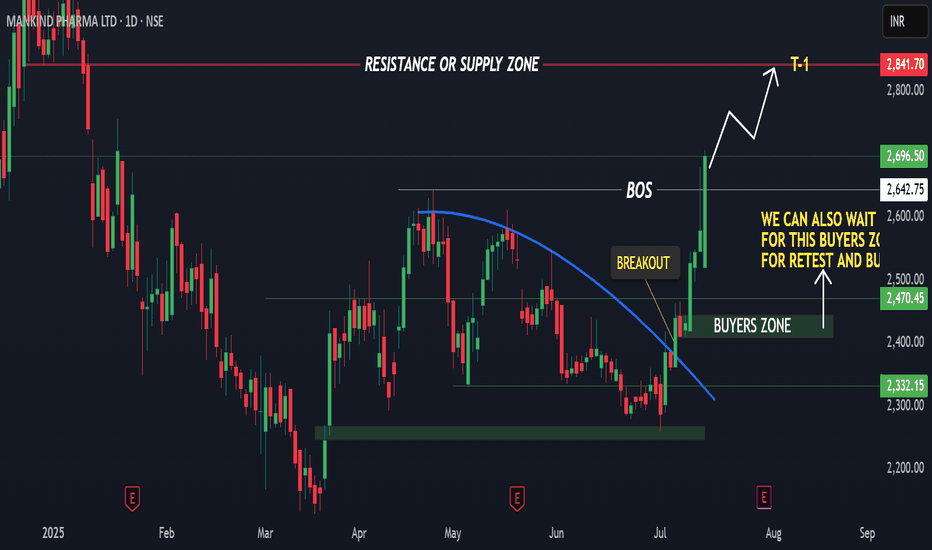

MANKIND PHARMA - For swing Trade1. In monthly time frame price is looking very bullish.

2. In weekly time frame price has given a breakout of double bottom pattern which is also showing bullish sign. And also from last 4 weeks price is making a good bullish move upside.

3. In daily time frame price has given a curve

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

46.60 INR

19.91 B INR

122.07 B INR

104.47 M

About MANKIND PHARMA LTD

Sector

Industry

CEO

Sheetal Arora

Website

Headquarters

New Delhi

Founded

1986

ISIN

INE634S01028

FIGI

BBG01G9WXG92

Mankind Pharma Ltd. engages in the development, manufacture, and marketing of pharmaceutical formulations across acute and chronic therapeutic areas. It offers products under the brands of Nurokind, Telmikind, Manforce, Unwanted, Gudcef, Moxikind, Amlokind, Glimestar, Asthakind, Codistar, Candiforce, Mahacef, Prega News, Dydroboon, Cefakind, Monticope, and Caldikind. The company was founded by Ramesh Chand Juneja in 1986 and is headquartered in New Delhi, India.

Related stocks

Mankind Pharma Ltd view for Intraday 22nd May #MANKIND Mankind Pharma Ltd view for Intraday 22nd May #MANKIND

Resistance 2550 Watching above 2555 for upside momentum.

Support area 2500 Below 2520 ignoring upside momentum for intraday

Watching below 2498 for downside movement...

Above 2520 ignoring downside move for intraday

Charts for Educational pu

MANKIND PHARMA LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

MANKIND PHARMA- MULTIPLE SUPPORTS & RESISTANCESI have drawn support and resistance lines. it may be following the trend lines. May not be as well... need more time to see if the trend lines are being supported by the stock. As of now, volumes are missing and stock has held its price. Earnings on 28th August. Stock likely to remain range bound. M

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

799MPL26A

MPL-7.99%-16-10-26-PVTYield to maturity

—

Maturity date

Oct 16, 2026

799MPL26

MPL-7.99%-16-4-26-PVTYield to maturity

—

Maturity date

Apr 16, 2026

797MPL27

MPL-7.97%-16-11-27-PVTYield to maturity

—

Maturity date

Nov 16, 2027

See all MANKIND bonds

Frequently Asked Questions

The current price of MANKIND is 2,562.30 INR — it has increased by 1.27% in the past 24 hours. Watch MANKIND PHARMA LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange MANKIND PHARMA LIMITED stocks are traded under the ticker MANKIND.

MANKIND stock has risen by 0.89% compared to the previous week, the month change is a 13.55% rise, over the last year MANKIND PHARMA LIMITED has showed a 25.30% increase.

We've gathered analysts' opinions on MANKIND PHARMA LIMITED future price: according to them, MANKIND price has a max estimate of 3,150.00 INR and a min estimate of 2,150.00 INR. Watch MANKIND chart and read a more detailed MANKIND PHARMA LIMITED stock forecast: see what analysts think of MANKIND PHARMA LIMITED and suggest that you do with its stocks.

MANKIND reached its all-time high on Dec 23, 2024 with the price of 3,050.00 INR, and its all-time low was 1,240.75 INR and was reached on May 22, 2023. View more price dynamics on MANKIND chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MANKIND stock is 3.67% volatile and has beta coefficient of 0.72. Track MANKIND PHARMA LIMITED stock price on the chart and check out the list of the most volatile stocks — is MANKIND PHARMA LIMITED there?

Today MANKIND PHARMA LIMITED has the market capitalization of 1.06 T, it has increased by 3.15% over the last week.

Yes, you can track MANKIND PHARMA LIMITED financials in yearly and quarterly reports right on TradingView.

MANKIND PHARMA LIMITED is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

MANKIND net income for the last quarter is 4.38 B INR, while the quarter before that showed 4.21 B INR of net income which accounts for 4.17% change. Track more MANKIND PHARMA LIMITED financial stats to get the full picture.

MANKIND PHARMA LIMITED dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 1, 2025, the company has 21.32 K employees. See our rating of the largest employees — is MANKIND PHARMA LIMITED on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MANKIND PHARMA LIMITED EBITDA is 32.10 B INR, and current EBITDA margin is 25.41%. See more stats in MANKIND PHARMA LIMITED financial statements.

Like other stocks, MANKIND shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MANKIND PHARMA LIMITED stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MANKIND PHARMA LIMITED technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MANKIND PHARMA LIMITED stock shows the buy signal. See more of MANKIND PHARMA LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.