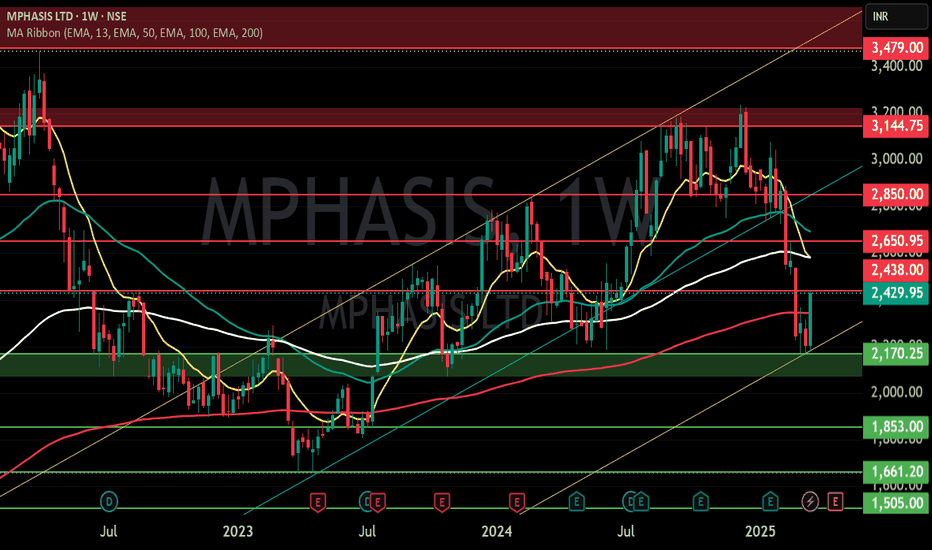

#MphasisDate: 29-07-2025

#Mphasis - Current Price: 2690

Pivot Point: 2698.00 Support: 2590.98 Resistance: 2805.96

#Mphasis Upside Targets:

Target 1: 2939.98

Target 2: 3074.00

Target 3: 3215.00

Target 4: 3356.00

#Mphasis Downside Targets:

Target 1: 2456.49

Target 2: 2322.00

Target 3: 2181.00

Target 4: 2040.00

#TradingView #Stocks #Equities #StockMarket #Investing #Trading #Nifty

#TechnicalAnalysis #StockCharts #Finance

MPHASIS trade ideas

#MPHASIS - 2309 OR 2746.60?Date: 27-05-2025

#MPHASIS Current Price: 2537.8

Mid-Point: 2527.80

,

#MPHASIS Upside Levels: 2671.01, 2746.60, 2828.65 and 2910.70

#MPHASIS Downside Levels: 2384.87, 2309.00, 2226.95 and 2144.90

Support: 2460.73

Resistance: 2595.41

#MPHASISChartAnalysis

#MPHASISChartPatterns

Mphasis: Bounce from Long-Term Support🚀 Mphasis: Bounce from Long-Term Support 🚀

📉 Current Market Price (CMP): ₹2790📈 Support Level: Long-term support bounce confirmed🔒 Stop Loss: ₹2170📈 Targets: ₹2518 | ₹2732

📊 Key Insights:

🔹 Sector Strength: Nifty IT index showed a strong recovery after an initial 2% gap down, reclaiming losses in the first hour – a sign of sector-wide resilience.

🔹 Technical Setup: Mphasis has bounced from long-term support and is forming an "N" pattern. Today's breakout further strengthens the bullish sentiment.

🔹 Swing Trading Opportunity: With quarterly results approaching in April, this could present an attractive swing trading opportunity in the IT space.

💡 Strategy & Risk Management:

🔒 Stop Loss: Maintain a strict stop loss at ₹2170 to protect against downside risk.📈 Staggered Entry: Given market volatility, consider building positions gradually as confirmation strengthens.

📈 Outlook: With the Nifty IT sector recovering and Mphasis confirming a technical breakout, there is potential for further upside. Careful position management can help navigate market fluctuations.

📍 Stay informed and stay disciplined!

📈 Disclaimer: As a non-SEBI registered analyst, I recommend conducting thorough research or seeking advice from financial professionals before making investment decisions.

#Mphasis #ITSector #SwingTrading #TechnicalAnalysis #StockMarket #InvestmentOpportunities #BreakoutStrategy

MPHASIS LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Head and shoulder pattern activatedMphasis, trading near 200 EMA

HNS pattern is activated

results on 23 jan'24.

the trend suggests weak results

the stock can correct from 15 to 20 % after results,

keep a watch on this counter for big upmoves

if stock closes above 2840, then the pattern may reverse and the downfall can be arrested.

MPHASIS Surges! TP 2 Hit, Targets in Sight!Technical Analysis:

Mphasis has been on a bullish move, as seen on the 15-minute timeframe. After a solid long entry at 3021.90, the price action has been steadily climbing, supported by the Risological Dotted Trendline, which signals continued upward momentum.

Key Levels:

Entry: 3021.90

Stop Loss (SL): 2993.70

Target 1 (TP1): 3056.75 ✅ (Hit!)

Target 2 (TP2): 3113.10 ✅ (Hit!)

Target 3 (TP3): 3169.50

Target 4 (TP4): 3204.35

Observations:

The price has already reached TP2, confirming the strong bullish momentum.

Momentum supported by the Risological Dotted Trendline shows the possibility of further targets being achieved.

With TP2 hit and momentum intact, Mphasis is showing strong signs of hitting higher targets. Keep an eye on the next resistance levels at TP3 and TP4 for continued gains!

MPHASIS LTD Long Trade Targets on RisologicalMPHASIS LTD Long Trade Targets on Risological

The long trade was from July 1, 2024

So far, 18.8% in 71 days

Which is close to 8% profit per month.

This is big profit for position traders and it looks like the rest of the upper targets are on their way.

The trailing stop loss and other upper targets are marked on the chart.

All the best and do follow me for more charts and updates.

Namaste!

MPHASIS - testing Weekly trendlineMphasis on the weekly timeframe is testing a trendline which if broken and hold can see 3300/3400

I am waiting for a close above 3160 on a daily closing basis to go long. Holding 3160 on DCB gives us the confirmation bias to go long towards 3300 and 3400 targets then All Time high test.

No longs for me below 3160.

#MPHASIS - SWING SETUP#MPHASIS

Looks very good for a sh ort term swing trade.

Strong Bullish engulfing. If it gets confirmed by another green candle closing above closing of 14th march, (and if crosses the zone marked around 2500 levels then can reach targets marked as red lines.

RSI also has come up from below 30 and is now around 40 levels.

RR not very good right now but if it retests the green support zone then looks more promising.

Standard disclaimer :

I am not a REGISTERED SEBI Analyst.

I am not responsible for anyone's losses or gains.