ONGC trade ideas

ONGC Swing Outlook Swing Trade Outlook – ONGC (Updated View)

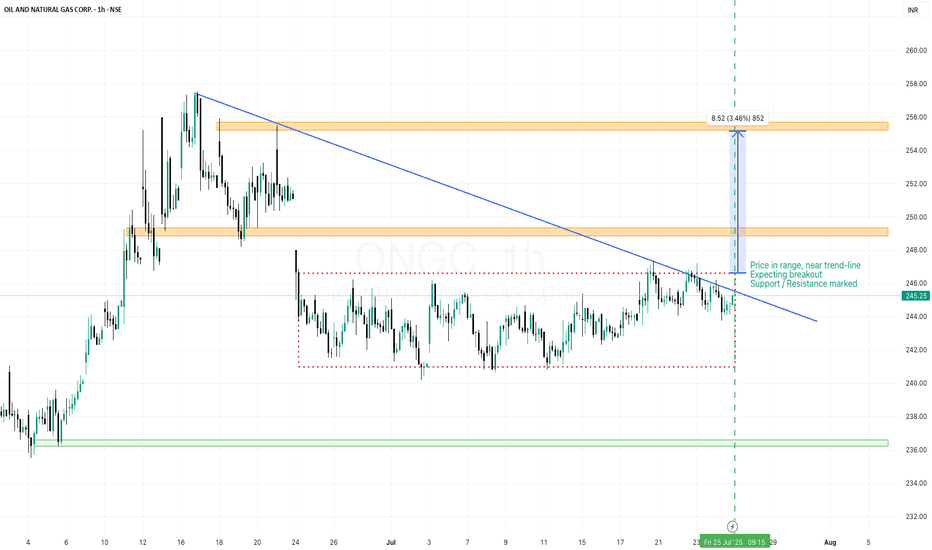

📌 Key Levels and Observations

🔲 Major Resistance Zone:

The green zone (~₹252–₹258) has been a critical resistance area since October 2023.

Price has tested this zone multiple times but failed to close above it decisively—forming a long-term horizontal resistance.

🟢 Support Levels:

Near-term: ₹246 (support from PEMA cloud and prior reaction zone)

Stronger support: ₹240–₹232 zone (previous higher lows and EMA base)

🕯️ Candle Behavior:

The latest candles show rejection near resistance with a long upper wick, indicating supply pressure at highs.

Volumes are not spiking on this attempt—no strong breakout confirmation yet.

🎯 Trading Conclusion

Trader Type Action

Crude Oil Swing Trader Look for breakout above $78; trade long with tight SL

ONGC Investor Wait for ₹258 breakout; use dips toward ₹245 for positioning

ONGCONGC

MTF MTF-Zone TREND MTF Analysis Logic Proximal

HTF Yearly UP ONGCYearly Demand RR 111

HTF Half-Yearly UP ONGC6 Month Demand BUFL 106

HTF Qtrly UP ONGCQtrly Demand BUFL BUFL 212

HTF Average UP 143

MTF Monthly UP ONGCMonthly Demand BUFL 212

MTF Weekly UP ONGCWeekly Demand DMIP 225

MTF Daily UP ONGCDaily Demand DMIP BUFL 235

MTF Average UP 224

ITF 240M UP ONGC240Mn Demand BUFL 235

ITF 180M UP ONGC180 Mn Demand BUFL 218

ITF 60M UP ONGC60 Mn Demand BUFL 213

ITF Average UP 222

Trade Points 196

Trade Plan BUY ONGC ENTRY-1

Entry-1 224

Entry-2 213

SL 200

RISK 24

REWARD 105

Target as per Entry 329

RR 4.4

Last High 305

Last Low 200

ONGC LongTrade Plan:

Entry:

Breakout Confirmation: Enter above 265 for confirmation of sustained buying pressure.

Use smaller timeframes (e.g., 15 min or 1 hour) to confirm strong green candles with volume.

Stop Loss (SL):

Place your stop loss just below the support level at 260 to minimize risk in case of a fake breakout.

Targets:

Target 1: Aim for a 12% gain. Calculate the price level from the breakout point.

Target 2: If momentum sustains, hold for a 27% gain.

Position Sizing:

Risk no more than 1-2% of your capital on this trade.

Exit Strategy:

If the breakout fails (price closes below 264), exit immediately.

Trail your stop loss as the price approaches the targets to lock in profits.

Decoding Reversals: Technical Analysis of ONGC: Educational postEDUCATIONAL POST

Technical Analysis of ONGC Stock

This post is for educational purposes only and should not be considered as investment advice.

In this post, we'll analyze the ONGC stock chart using technical indicators.

Key Points:

1. Bullish Divergence: Price and MACD are diverging, indicating a potential reversal.

2. Bullish Divergence: Price and RSI are also diverging, supporting the reversal idea.

3. Resistance Breakout: The stock has broken through a key resistance level with strong volume.

4. MACD Turns Positive: MACD has turned positive after the breakout, confirming the reversal.

5. Elliott Wave Counts: Wave counts suggest a potential reversal.

What to Expect:

Based on these indicators, we can see a potential reversal in ONGC's stock price. It may retrace to Fibonacci levels (50-61.8%) before continuing upward.

Conclusion:

This post is meant to illustrate how technical indicators can be used to analyze a stock chart. Please do your own research and consult with a financial advisor before making any investment decisions.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

wait and buy @ zone - swing / intradayENTRY

- lines marked below is potential reversal zone ( PRZ)

- entry is strictly inside the zone

- look for buying confirmation in smaller time frame ( 15 minutes preferred )

EXIT

1. target

- mark fib retracement from C to latest swing low

- TGT 1 - 0.236 fib level ( intraday target )

- TGT 2 - 0.382 fib level

- TGT 3 - 0.5 fib level ( preferred target )

2. SL

- candle close below (PRZ)

- if u didn't get confirmation inside the zone , ignore this pick

- if candle close is below zone , this pattern becomes invalid . IGNORE THIS PICK

- RE-ENTRY can be done , if u again get buying confirmation inside the zone