ONGC - 227 by Sep 2021 ?This should chug along nice and slowly however eyes on price action and life ! It has to come back to normal at some point and demand should pick up.

101 is where the confluence of the 3 moving averages may happen.

Most likely book profit from 115 and see what's up then.

Currently just retesting resistance turned support .

I'd keep a loose stop loss and let this play out .

Looking for a rejection from the 200 day on the weekly where i intend to load up for the break of the MONTHLY downtrend line and the ride to 227.

ONGC trade ideas

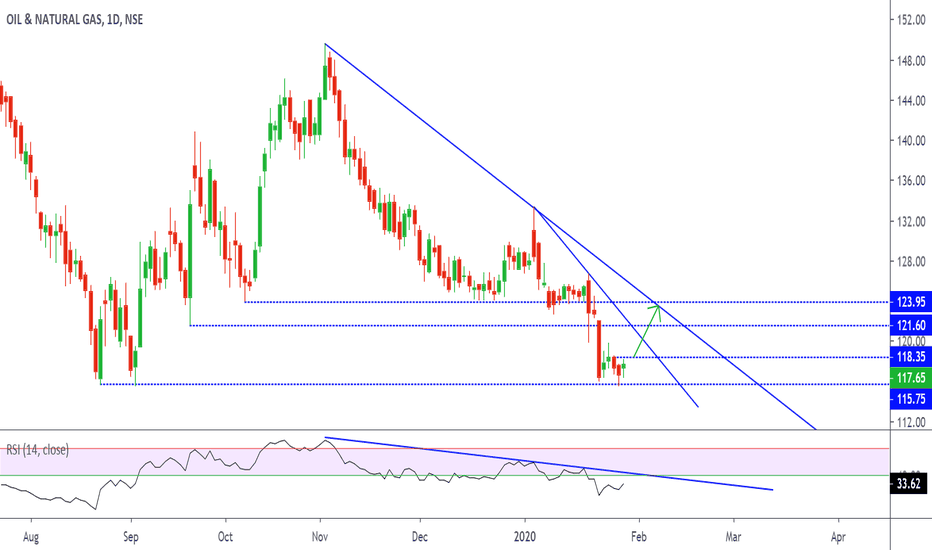

ONGC long termONGC has broken down below the long term wedge pattern. It should continue its downward movement below the wedge. In addition it also has a Head and Shoulders pattern which has already broken down. The volume has been climactic as well.

Bets off if it goes back inside the wedge and does a breakout above. It will turn very bullish in that case, but until that happens, I would stay away from the long side.

Disclaimer: Not a recommendation to buy or sell.

Long ONGC in Cash Segment Bought 1 lot of #ONGC in Cash segment @ 68.85

1) shorted 75 CE of April Month @ 1.2

2) Shorted 80 CE of April Month @ .65

During Expiry :-

if Stocks will stay between 75 to 80 in this month then we will be in profit.

if it will close below 68 all the Options will be OTM.

if goes above 80 then all the Options will be ITM but we will be in Profit in Cash and we also can consider Upside BEP as 88.

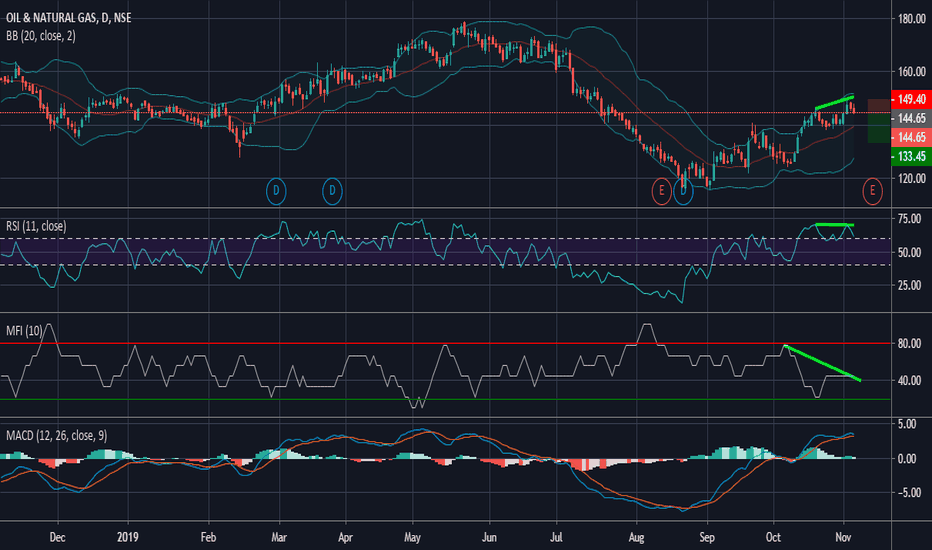

ONGC (A Falling Knife to a Rising Knight ?)Looking at the Chart ONGC looks ready for a move within a day or two. ONGC has taken quiet a hit and bounce due to the ongoing news surrounding the crude oil. With all the news surrounding the production booms / cuts which has impacted the Crude prices on a high magnitude has kept the volatility around the crude at a high level. Keeping the effect of this scenario in mind ONGC is currently taking at a Monthly resistance level (Blue Line), which was broken around the 10 of March and has been there twice only to be rejected. The yellow boxes on the 2 corners of the chart represent a similar pattern, just inverted on the right side. The first formation was the start of a high bearish sentiment, however the current one is possibly signalling off a bullish sentiment.The yellow arrow represents a sharp fall and the purple area focuses on an eventual rise to almost the same level as the fall, being supported by the change in trend angle which has increased from 12 Degrees to 40 Degrees as represented by the Dotted blue lines. The Green lines represent an area of Support and a Trend which has been respected strongly. The Yellow channel is The Demand zone, which has stood strong now for over a month.The yellow box formations were formed almost around that area indicating a change in sentiment.The other 2 Pink lines are an area of Support and Resistance. The MACD also stands at a crucial level which has currently seen a breakout below the yellow line, however it remains to be seen whether the price will respect the movement or is it deemed to reverse and have a breakout to the long side.

Any breakout towards the upside might see the price go atleast till the top pink line and depending upon the momentum and volume might fill in the gap which stands at around 88 levels. Any breakout below the trendline might see the price ranging between the Pink and the yellow area which if broken might give some good momentum and a strong bearish move.

ONGC - Uptrend Start - Target 1 - 115$Swing Trade Opportunity here in an old INDIAN OIL Stock. On request charting for a friend.

I am a budding FOREX/ CRYPTO trader, with much of my experience coming from trading CRYPTO markets since 2016.

If you enjoy the idea and make gains, please leave a LIKE and hit Follow for more such posts.

Cheers