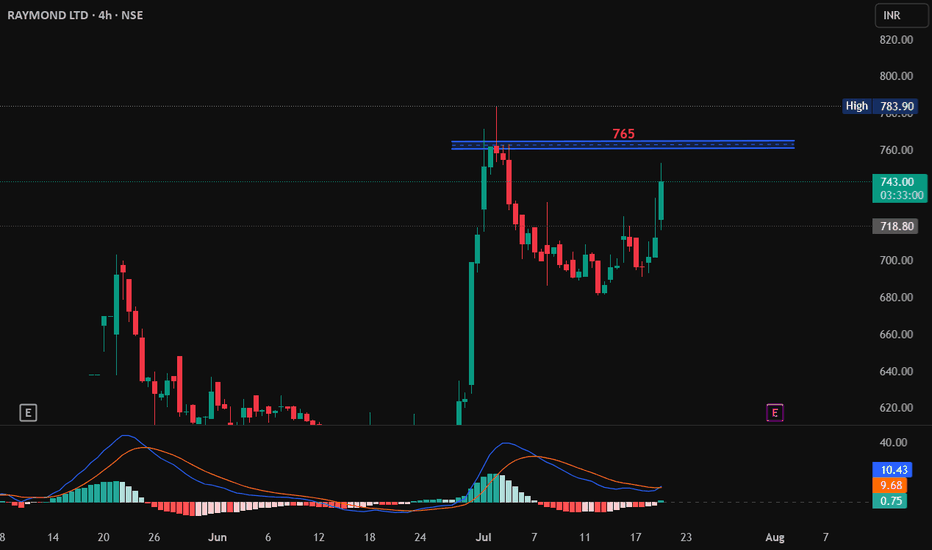

Raymond, 4Hr, Long, ResistanceRaymond is showing a resistance in 4 hour Time Frame. If it closes above 765 then it may go up from here, if it closes above it with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami.

E

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1,146.70 INR

76.31 B INR

19.23 B INR

33.28 M

About RAYMOND LTD

Sector

Industry

CEO

Gautam Hari Singhania

Website

Headquarters

Mumbai

Founded

1925

ISIN

INE301A01014

FIGI

BBG000CYLVV5

Raymond Ltd. is a textile and branded clothing company, which engages in the provision of end-to-end solutions for fabrics and garmenting. It operates through the following segments: Textile, Shirting, Apparel, Garmenting, Tools and Hardware, Auto Components, Real Estate Development, and Others. The Textiles segment produces fabric, rugs, blankets, shawls, and furnishing fabric. The Shirting segment provides denim fabric and cotton yarn. The Apparel segment includes branded readymade garments. The Others segment includes non-scheduled airline operations and real estate development. The company was founded on September 10, 1925 and is headquartered in Mumbai, India.

Related stocks

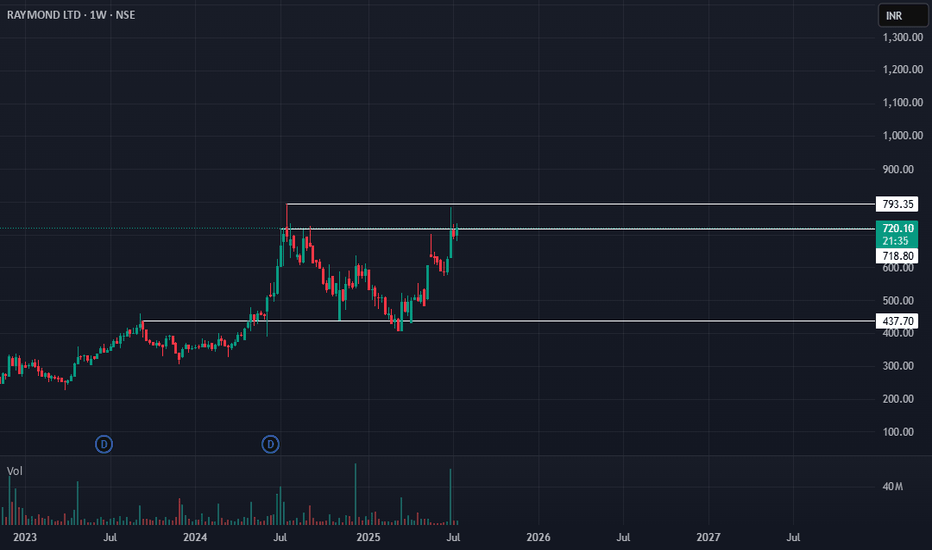

Raymond: Poised for All-Time High Breakout?🚀 Raymond: Poised for All-Time High Breakout? 🚀

💰 CMP: ₹722

🔒 Stop Loss: ₹578

🎯 Targets: ₹780 | ₹828 | ₹880

🔍 Rationale:

Raymond is showing strong signs of an all-time high breakout with its highest weekly close, a successful breakout, small pullback, and resumption of upward momentum. Range break

Raymond 1 d chart signalling price action Raymond is looking in the uptrend after making a low near 1326. It is reversing from there on daily chart .

Ascending triangle pattern is forming and is about to complete the same .

Volume is Supporting in this uptrend .

RSI momentum is showing intact with higher high with Price in conjunction. Both

Raymond Rockets Past ₹1811! Bullish Targets Await!Raymond on the 4-hour timeframe has initiated a long trade setup, with TP1 already achieved at ₹1811.60. This trade was identified using the Risological Swing Trading Indicator , which confirms the potential for further bullish movement as long as the trend holds steady.

Key Levels:

TP1: ₹1811.

RAYMOND LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/share) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

Raymond - Risky Whisky🎯The stock is in red as the Raymond Boss is getting divorced. Details here -

x.com

🎯 The price is down about 20% since the news came out, the company is still the same.

🎯Price stands at 1500 i.e. the first psy. Support level

🎯The delivery data shows an accumulation

🎯We may see a quick bounce fro

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RAYMOND is 657.00 INR — it has decreased by −1.79% in the past 24 hours. Watch RAYMOND LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange RAYMOND LTD. stocks are traded under the ticker RAYMOND.

RAYMOND stock has fallen by −8.69% compared to the previous week, the month change is a −14.21% fall, over the last year RAYMOND LTD. has showed a −7.65% decrease.

We've gathered analysts' opinions on RAYMOND LTD. future price: according to them, RAYMOND price has a max estimate of 903.00 INR and a min estimate of 903.00 INR. Watch RAYMOND chart and read a more detailed RAYMOND LTD. stock forecast: see what analysts think of RAYMOND LTD. and suggest that you do with its stocks.

RAYMOND reached its all-time high on Jul 18, 2024 with the price of 847.55 INR, and its all-time low was 9.60 INR and was reached on Oct 8, 1998. View more price dynamics on RAYMOND chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RAYMOND stock is 2.96% volatile and has beta coefficient of 1.90. Track RAYMOND LTD. stock price on the chart and check out the list of the most volatile stocks — is RAYMOND LTD. there?

Today RAYMOND LTD. has the market capitalization of 43.74 B, it has increased by 2.10% over the last week.

Yes, you can track RAYMOND LTD. financials in yearly and quarterly reports right on TradingView.

RAYMOND LTD. is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

RAYMOND net income for the last quarter is 1.33 B INR, while the quarter before that showed 721.30 M INR of net income which accounts for 84.06% change. Track more RAYMOND LTD. financial stats to get the full picture.

Yes, RAYMOND dividends are paid annually. The last dividend per share was 10.00 INR. As of today, Dividend Yield (TTM)% is 1.52%. Tracking RAYMOND LTD. dividends might help you take more informed decisions.

As of Aug 3, 2025, the company has 375 employees. See our rating of the largest employees — is RAYMOND LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. RAYMOND LTD. EBITDA is 4.10 B INR, and current EBITDA margin is 8.52%. See more stats in RAYMOND LTD. financial statements.

Like other stocks, RAYMOND shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade RAYMOND LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So RAYMOND LTD. technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating RAYMOND LTD. stock shows the buy signal. See more of RAYMOND LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.