WAAREERTL trade ideas

WAAREE RENEWABLE TECH LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

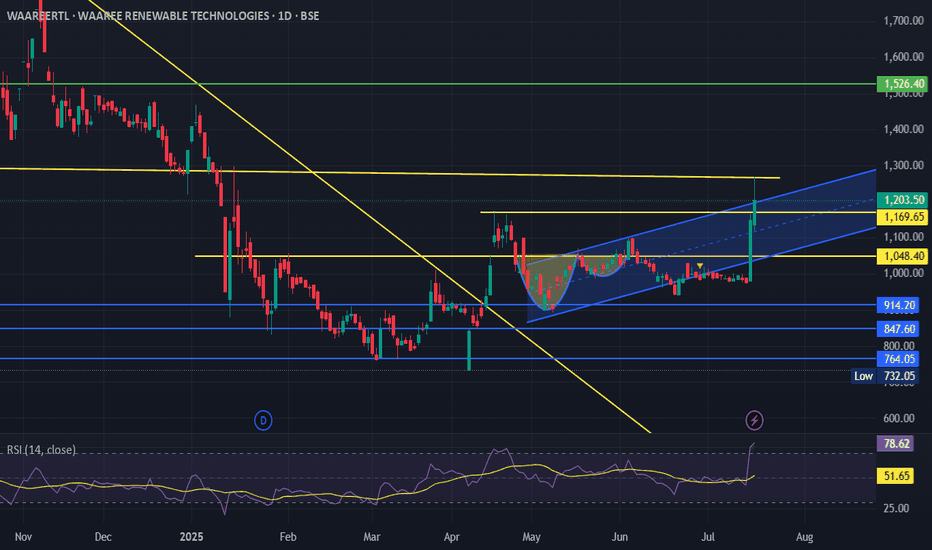

wareerti stock Cup and handle Wareerti formed a cup and handle pattern and also broke out; now it’s retesting. At this price, an entry can be made with a small stop loss — check it out and do your own analysis at your own risk. My analysis is mostly wrong anyway."

Entry kab avoid karein:

Agar retest zone par repeatedly price sustain nahi kar raha.

Retest par bhi selling pressure high ho raha hai (volume high).

Market sentiment overall bearish ho.

cup and handle breakout retest entry

Retest price: Retest ideally breakout level ke aas-paas ya thoda upar hota hai. Agar retest bahut deep chala gaya (cup ki midpoint ya handle ke bottom tak), toh setup weak ho jata hai.

Volume confirmation: Breakout par volume high hona chahiye, aur retest par volume kam hona chahiye.

Price action: Retest par bullish candle, hammer, bullish engulfing ya koi bhi strong reversal candle milti hai toh aur confirmation milta hai.

Stop-loss: Retest low ke thoda niche ya handle ke low ke niche (as per risk appetite).

WAAREE Short Trade Targets in Play, Massive Drop to 1571!WAAREE (15m time frame), Short Trade

Entry: ₹1,763.00

Current Price: ₹1,571.00

All Targets Done!

Key Levels:

Entry: ₹1,763.00 – After confirming a strong bearish signal, short entry was executed.

Stop-Loss (SL): ₹1,767.60 – Placed above key resistance to protect against potential reversals.

Take Profit 1 (TP1): ₹1,757.30 – First target triggered, confirming downward movement.

Take Profit 2 (TP2): ₹1,748.10 – Critical support level broken.

Take Profit 3 (TP3): ₹1,738.90 – More aggressive downside level confirmed

Take Profit 4 (TP4): ₹1,733.25 – Final target hit for deep correction in this trend.

Trend Analysis:

WAAREE’s price continues to plunge after a decisive break below multiple support levels, confirming strong selling pressure. With the current price at ₹1,571, this trade has captured a significant move, with further downside potential still in play.

Neutral Outlook on Waaree Renewable Technologies – Key Levels toNeutral Outlook on Waaree Renewable Technologies – Key Levels to Watch

Waaree Renewable Technologies is currently forming a symmetrical triangle pattern after a significant downtrend, signaling potential consolidation. A key technical indicator, the bullish RSI divergence , suggests weakening downside momentum. The stock is also stabilizing near the 200-day moving average , a critical support level.

Upside Potential:

A confirmed breakout above ₹1,648.05 , accompanied by strong volume, could push the stock towards the next resistance at ₹2,120.85, offering a potential upside of approximately 26%.

Downside Risk:

On the other hand, failure to hold the 200-day MA could lead to a breakdown below ₹1,248.00 , potentially driving the stock down to the next support at ₹793.40 , implying a 36% downside.

Given the technical setup, the stock remains in a neutral zone , and traders should watch for a breakout from the triangle for directional clarity.