WOCKPHARMA trade ideas

neutral at this momentRSI is downwards on a weekly chart. There is a huge resistance in the 550-560 range. The price might keep falling fall or remain flat for next couple of weeks. Be careful before trading.

As Ichimoku Cloud is in green, it will go up but before this, the price will be tested hard.

WOCKPHARMA - Volume BreakoutWOCKPHARMA broke 9 month level today with heavy volume. This is a strong move by stock. Do checkout for a retracement / sideways move and resumption of up move after that.

These idea's are not my recommendations. Do perform your own analysis before making any trade based on this idea.

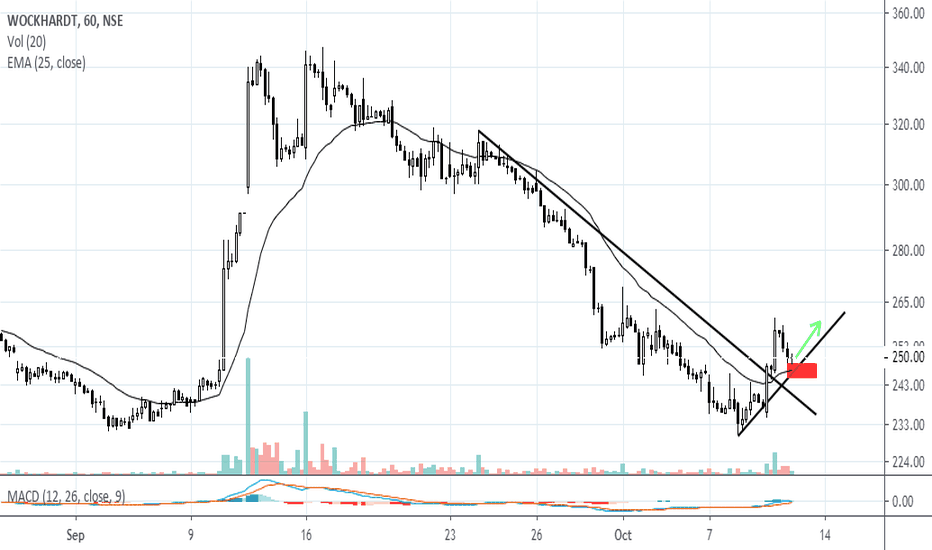

WOCKHARDT MEDIUM TERM BUY OPPORTUNITYWOCKHARDT STOCK IS FORMING POTENTIAL HEAD AND SHOULDERS PATTERN ON H-1 CHART. HEAD AND SHOULDERS FORMATION IS A REVERSAL SIGNAL. STOCK HAS FORMED THAT REVERSAL SIGNAL RIGHT AT THE BOTTOM AROUND MULTI YEAR LOW PRICE.

BUY ENTRY: INR 175-165

STOP LOSS: INR 146

TARGET-1: INR 210

TARGET-2: INR 227

HOLDING PERIOD: AROUND 4-6 WEEKS.

207.PA tredline breakoutMany times Market does not provides good and ideal entry points. Hence needs PITS for your entries and exists (Profit taking point 1 (PT1 or PT2) or Stop loss points (SL)).

Disclaimer: Set-up shown here is only for Educational purpose only; This is not a sell or buy recommendation. We are not responsible for any loss or gain; Consult your financial advisor before your execution of any recommended trade.

Set-up presented here is for observational purpose only and most of the set-up designed by WavoZen is based on passive analysis (PA) or static analysis for intraday purpose only to get the basic structure for intra-day short term or ultra-short term purpose only. Most of the set-up is valid for a day or otherwise mentioned. Hence requires your fine tuned personalized intraday techniques and strategies (PITS) based on real-time Active Analysis (AA) to get benefit from these structures or to have minimum loss, if wrong through your PIT Strategies (your trade plan). Overnight events, news, major economic data release etc may impact the deviation from the assumed scenarios.