BTC Dominance (BTC.D)BTC Dominance (BTC.D) Analysis - Historical Resistance at 64%; Is the Market Ready for a Big Shift?🔥

Hey there, awesome traders! 👋

I’m here with a mind-blowing analysis of the Bitcoin Dominance (BTC.D) chart that could be a game-changer in this critical market moment. BTC Dominance is currently sitting at 64.01%, right at a super pivotal point. Let’s break down the chart together and see what’s coming next! 🚀

📊 Technical Analysis:

1. Current Situation and Ascending Triangle Pattern:

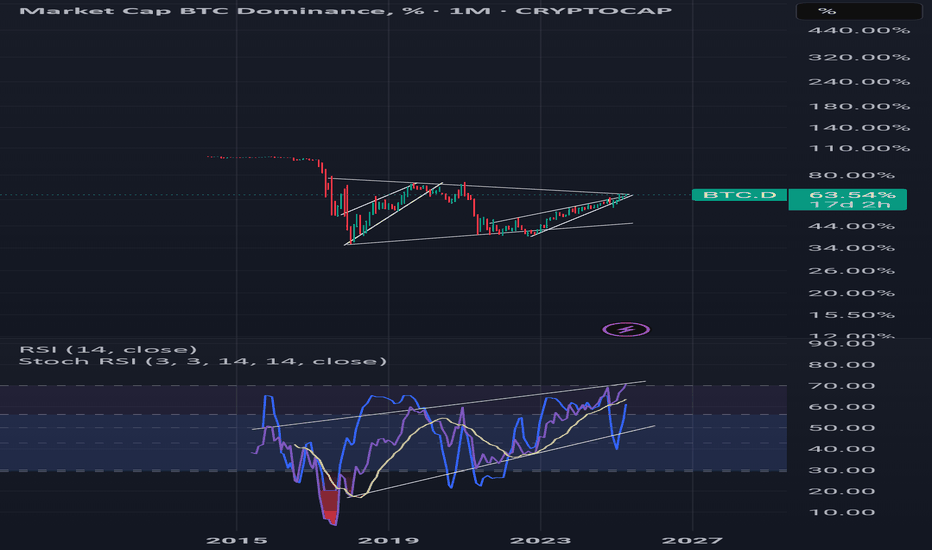

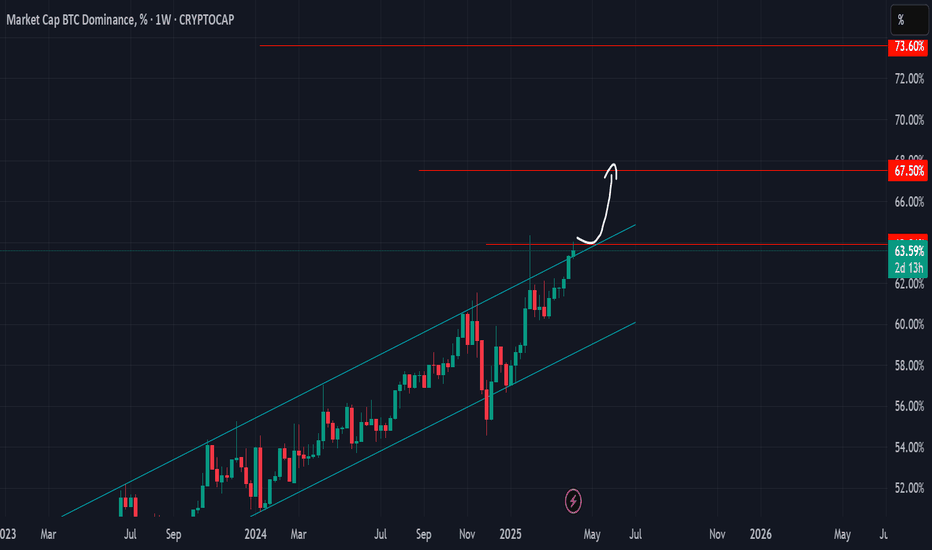

BTC Dominance has hit 64.01% and is forming an ascending triangle pattern (white lines on the chart). This pattern is typically bullish and signals strong buying pressure in the market. Right now, the price is testing the historical resistance at 64%, a level that has rejected price multiple times in the past (like in 2017 and 2021). If this resistance breaks, it could be a massive bullish signal for Bitcoin’s dominance and the start of a new uptrend. But if it gets rejected, we might see a significant drop!

2. Resistance Levels:

64% (Current Resistance): This is a strong historical resistance where the price is currently struggling. It’s been rejected at this level several times in the past, leading to pullbacks. A confirmed breakout above this level could be a powerful bullish signal.70.50%: If 64% breaks, the next resistance is at 70.50%. This level acted as resistance back in early 2021.78%: The next resistance is at 78%, a level that has been a solid barrier during historical peaks (like late 2017).86%: A longer-term resistance sits at 86%, which played a role in early 2017. It’s unlikely we’ll hit this in the short term, but it could be a target in a strong bullish trend.

3. Support Levels:

58.50%: If the price gets rejected at 64% and drops, the first support is at 58.50%. This level has acted as good support in the past (e.g., mid-2023).

54.50%: The next support is at 54.50%. This area has also held price during previous downtrends.

50.50%: A stronger support lies at

50.50%, which could be a good reversal point if the price reaches it.46.50%: A long-term support is at

46.50%, where the price bounced back in late 2022.

4. Signals and Market Behavior:

The chart shows an active "SELL" signal, indicating potential selling pressure at this 64% level. However, if trading volume picks up and the price manages to stabilize above 64%, this signal could be invalidated, turning into a strong buy signal for Bitcoin. On the other hand, if it gets rejected, we might see a drop toward the supports at 58.50% or even 54.50%.

📈 Overall Analysis and Prediction:

BTC Dominance at 64% is at a critical juncture. This level reflects Bitcoin’s control over the market, and a breakout here would signal that investors are favoring Bitcoin as a safer asset in the current market environment. This could put significant pressure on altcoins, as capital flows from them into Bitcoin, potentially leading to a downtrend for altcoins. However, if this resistance is rejected and dominance drops, it could spark a golden opportunity for an altseason, with altcoins seeing a solid rally as funds shift away from Bitcoin.Possible Scenarios:

Bullish Scenario: If the price stabilizes above 64% (e.g., a few weekly candles close above this level), it could head toward 70.50% and then 78%. In this case, Bitcoin would gain more strength, and altcoins might face selling pressure.

Bearish Scenario: If the price gets rejected and falls below 64%, we could see a drop to 58.50% or even 54.50%. In this scenario, altcoins could see a strong growth opportunity as capital flows from Bitcoin into them.

💡 Suggested Strategy:

For Bitcoin Traders: Wait to see if the price stabilizes above 64%. If it does, this could be a strong buy signal for Bitcoin. But if it gets rejected, be cautious of a drop and consider buying at lower support levels like 58.50%.

For Altcoin Traders: If you’re focused on altcoins, play it safe for now. A breakout above 64% could hurt altcoins, but a rejection might create an excellent opportunity for altcoin growth.

Trading Volume: Keep an eye on trading volume. A breakout without high volume might be a fakeout.

🔥 Final Thoughts:

This chart shows the market is at a crucial, game-changing moment. A breakout or rejection at 64% could shift the entire crypto market’s direction. What do you think? What’s your take on this analysis? Drop your thoughts in the comments—I’d love to hear from you! 🙌

Don’t forget to like and follow—let’s rock the market together! 💪

#BTC #Dominance #Crypto #TechnicalAnalysis #TradingView

Quick Recap:

Resistances: 64%, 70.50%, 78%, 86%

Supports: 58.50%, 54.50%, 50.50%, 46.50%

BTC.D trade ideas

Altcoin Season in May/June 2025First proper Altcoin Season -> 1 Year, -62% for BTC Dominance (Alts Crush BTC)

Second proper Altcoin Season -> 6 months, -44% for BTC Dominance (Alts Crush BTC again)

Third proper Altcoin Season (upcoming) -> 2-3 months, -20-25% for BTC Dominance (Alts will outperform BTC)

Diminishing returns for Altcoins, because there is not much utility for Altcoins as of now

ETH -> underwhelming performance in the last 2 years, thus gthe eneral altcoin market suffers

Mantra, memecoins, Luna, FTT , and many other scams affect the market, More people just buy BTC and forget and don't touch alts

Maybe?7 Consecutive weekly Green candles, 5 consecutive monthly green candles

Retesting Ascending Wedge/ Convergence of trendline from previous highs.

Uncertainty in the markets with tariffs, Alts getting crushed. Reprieve rally incoming?

Then again could be making all these trend lines up.. Time will tell

They say things never go up in a straight line….64% been the target back up

I would hope nothing higher than that would truly hurt the alts.

In my opinion I really think we have bottom unless this trade war starts to change the direction of the market again.

A break down from such a massive run should be biblical !

Higher Highs for BTC.D???COINBASE:BTCUSD

BTC.D currently printing an inverted creek inside another bowl and catching resistance at the supply trend line. And often creeks need to be jumped, so this jump could be cause building for higher highs here soon.

It's unlikely that we exceed the 1:2.414, but the strength of BTC has been blowing hats off so it would be no surprise there.

If this TA does play out, it suggests continued weakness in most altcoins compared to BTC for this next potential rally up. But I do believe when it tops, the drop could be quite impulsive as we witnessed in November 2024.

Good Luck!

- Not Financial Advice-

Trump's Crypto Policies Drive Bitcoin Dominance to New HighsSince President Trump's inauguration, Bitcoin dominance (BTC.D) has steadily climbed from around 55% to over 63%, reflecting a significant shift in market dynamics. This rise is largely attributed to the U.S. government's strategic accumulation of Bitcoin, including the establishment of a Strategic Bitcoin Reserve funded by seized assets. Such initiatives have redirected capital from altcoins to Bitcoin, reinforcing its dominance in the cryptocurrency market.

BTC Dominance (BTC.D) is hovering at a critical resistance zone between 63% and 64%. A breakout above 65% could signal increased capital flow into Bitcoin, potentially pushing its price down to $75K or even $55K, while altcoins may underperform. Conversely, a rejection at this level might indicate the onset of an altcoin season. Currently, Bitcoin is trading around $85K, awaiting a catalyst to determine its next significant move.

Bitcoin Dominance Ascending Channel and Altseason (1W Log)CRYPTOCAP:BTC.D has been in a clean uptrend inside an ascending channel for over 2 years.

• The midline has consistently acted as a magnet, but BTC.D has recently detached from it and might be headed for another retest of the upper boundary.

• Unless major macro catalysts intervene, I expect no notable changes until the 72-73% key area, the same zone that triggered 2021's altseason.

Regarding altseason, this cycle isn't like previous ones. With millions of tokens today, dilution is real, and a full-blown altseason where everything pumps seems unlikely.

Instead, I expect selective rotation into quality projects, and that might actually make it easier to find real outperformance.

Bitcoin Dominance Is Printing The Last Shakeout Hello, Skyrexians!

Recently we pointed out that CRYPTOCAP:BTC.D is in the last bullish wave which has a target approximately at 66% and the bear market on altcoins is almost over. Today we will look in details on this wave inside and try to predict the most precise scenario.

Let's take a look at 12h time frame. Here we can see the wave 1 and 2 and now price is in wave 3. Fibonacci extension levels 1 and 1.61 is the target for wave 3. Looking at the current wave we can say that it's not over, so it will likely to see 64.7% in this wave before the correction. Correction is going to be subwave 4 which will likely be finished at 63% then we have the last wave which can be equal to wave 1. In this case predicted earlier 66% will be reached at the end of April.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

$BTC.D to 66%, $TOTAL2 / BTC down to 0.43The final year of bitcoin halving year is usually a bullish year for the Altcoins. CRYPTOCAP:TOTAL2 is the measure of the Total Market Crypto Market CAP without $BTC. Today we are looking into a ratio chart of TOTAL2 vs BTC Market cap. The supposed strength in Altcoin is missing as is evident from the CRYPTOCAP:BTC.D chart and the ration chart between TOTAL2 vs BTC.

If we plot the Fib Retracement levels on the CRYPTOCAP:BTC.D from the last cycle lows to the highs, we see that in the current halving cycle the CRYPTOCAP:BTC.D is progressing towards 0.786 Fib retracement levels which is currently indicating a CRYPTOCAP:BTC.D of 66.2 %. The ratio of Toatal2 vs BTC Market cap fits surprisingly within the Fib levels and makes new lows every week in this weekly chart. The levels to watch on the ratio chart will be 0.43

What does this trend tell us. It might be possible that the Altcoins USD pairs are bullish, but the Altcoins are making new lows vs BTC. So, it's a better strategy to go long $BTC. The risk reward is very much in favour of CRYPTOCAP:BTC rather than Altcoins.

Verdict: Long CRYPTOCAP:BTC , CRYPTOCAP:BTC.D to 66%.

BTC.D - Still in the ascending channelCRYPTOCAP:BTC.D remains firmly within its long-standing ascending channel. The recent “fake breakout” below the channel has been invalidated as dominance swiftly returned to the channel, showing a strong reaction and confirming the channel’s validity.

This suggests:

✅ Bullish Implication for BTC: Bitcoin is likely to continue gaining dominance in bullish moves, outpacing altcoins in performance.

✅ Bearish Impact on Altcoins: In downturns, altcoins are expected to experience sharper declines compared to Bitcoin.

Traders should monitor this channel as a key indicator for market behavior, especially for Bitcoin and altcoin strategies.

Bitcoin Dominance Update (1D)Bitcoin dominance is currently showing signs of weakness and appears to be losing momentum for another upward move.

If we see a breakdown below the 62% level, a sharp decline toward 57% is likely.

During this phase, it may feel like an altcoin season is approaching, but in reality, most altcoins will likely just be retracing previous losses rather than entering true price discovery.

Still, for those who buy the dips, it can present a profitable rally opportunity—especially in short to mid-term cycles.

— Thanks for reading.

Bitcoin Dominance, We Are Waiting For You!Hello, Skyrexians!

We are changing color according to the new upcoming market cycle phase, hope our forecast will be realized and it's time to be bullish. CRYPTOCAP:BTC.D is about to flash the reversal signal, while altcoins dominance and USDT dominance are already did it, but we don't also forget about disaster targets.

Let's take a look at the daily chart. Earlier we told that this is final wave 5 and now we are trying to catch its top. We mentioned that dominance will enter into 63-66% target area and it did it. Now we have to be focused on the reversal signals. For example Bullish/Bearish Reversal Bar Indicator has already printed the red dot at the top. Moreover Awesome Oscillator started reversing. You can say that this is the top, be our intuition tell us that some small move to the upside will be continued to 65%. Also we need to mention about nightmare wave 5 extended target at 70%, but this scenario is unlikely because it will break the divergence on the daily chart.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

near to dump btc.dConsidering the growth of Bitcoin dominance since 2022 and Bitcoin's tendency to flow liquidity between other altcoins, it seems that, contrary to expectations, Bitcoin's power relative to the entire market will only reach such high levels of 66% under the influence of political and economic events, and the tendency to fall is quite evident.altcoin season is coming

Big Fish said to the swarm of tiny little fish: ......"You little filthy retail, take my ETH now. Since it is unlocked and in a profit. and choke on it ! "

You can already see how they 'talk' via all the twitter and YouTube influencer b.s. feed.

BTC Dominance without stable coins tells the real story.

BTD Dominance is in uptrend.

It did not finish yet.

This is the 'buy local top on ETH' moment for retail.

and they will shove it up your throat if you let them.

ETH is between 100-144% in profit since major bottom.

***there will be upticks on ETH usd valuation to keep 'little fish' excited and interested.