How many bag holders will BTC leave behind?We've had our fun and some fake pumping from the short squeeze. No comes the real stuff! What are the fundamentals and what problem is BTC trying to solve? Ok, crickets. It's a speculative asset, that's it. If history repeats itself, which it typically does, we will see a major pull back and anyone who's bought at the top will have a negative performing portfolio. It's too expensive and you still can't buy a banana with BTC and there are plenty of middlemen involved, which goes 100% against it's original purpose (after the financial crisis).

If you're up, this would be a good time to sell IMHO and buy at the next support level, which is way below 100k.

BTCDOWNUSDT trade ideas

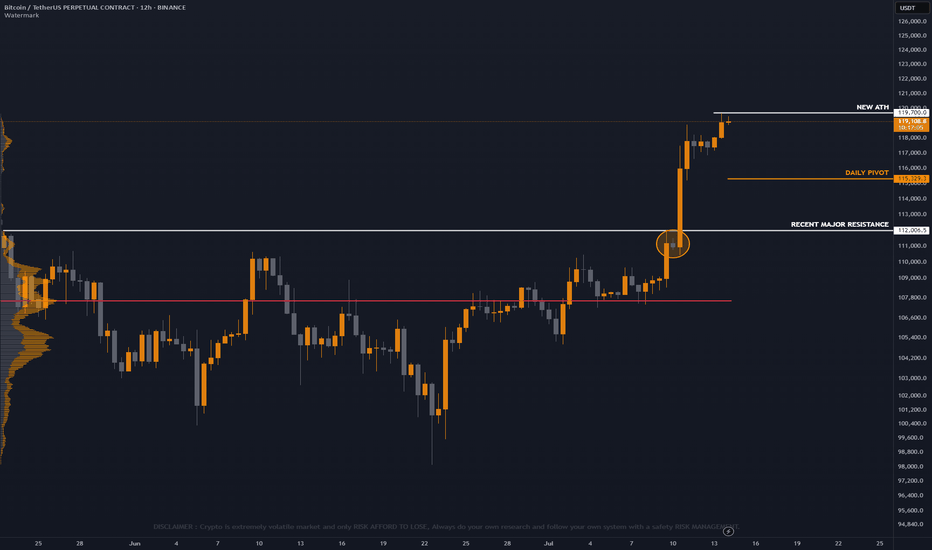

14/07/25 Weekly OutlookLast weeks high: $119,494.32

Last weeks low: $107,467.52

Midpoint: $113,480.92

NEW BTC ATH!

This is what we've all been waiting for, BTC breaks through resistance at $110,000-112,000 to set a the highest weekly close ever ($119,086). Thanks to a further $2.27B net inflows via BTC ETFs, the passing of the "big beautiful bill" flipping from a more deficit reduction stance by the US to an environment perfectly suited to risk on assets. Things are looking good for Bitcoin.

This week already in the Asia session BTC has broken above the weekly high to hit $123,100. Despite this incredible rally BTC.D has been falling since Thursday of last week. To me this signals altcoins have started to play catch up and we've seen that with ETH breaking $3000 (+14% relative to BTC).

I would like to see BTC consolidating here above the weekly high while altcoin majors break their choppy rangebound environments and shift to a trending environment just as BTC had last week.

There are also major data releases this week:

Tuesday CPI

Wednesday PPI

Thursday Euro CPI

Thursday US Initial Jobless Claims

I do not expect these data releases to have a major effect on the markets in their current state due to the risk appetite we've seen in both crypto and equities, such shallow pullbacks prove the demand is there to absorb and sell-side pressure for now.

Now is an excellent time to back strong projects with great fundamentals that are breaking out from downtrends/ranges in both their USD & BTC pairs, as BTC.D drops alts can print some great returns. Beta plays of ETH & SOL can offer higher returns than the majors themselves in these market conditions too.

Good luck this week everybody!

Want to Know What Happens in Crypto? Check Silver InsteadThe Gold/Silver ratio is one of the key indicators that highlights major turning points in modern economic history. Similarly, the ETH/BTC ratio is widely followed as a gauge of strength in the crypto market and the beginning of altcoin seasons. Interestingly, these two ratios also appear to correlate well with each other.

As adoption of both Ethereum and Bitcoin has grown, the Gold/Silver and BTC/ETH ratios have started to move more closely together. They often follow similar patterns, with tops and bottoms forming one after the other. For clarity, this analysis uses the BTC/ETH ratio rather than ETH/BTC.

Historically, BTC/ETH tends to lead during market tops, followed by a similar move in the Gold/Silver ratio. This pattern has been observed repeatedly since 2020. When it comes to bottoms, the timing between the two ratios is usually tighter, as seen during the 2020, 2021, and 2024 lows.

The latest signal came from a top in the BTC/ETH ratio, and the Gold/Silver ratio now appears to be following that move. Given the cyclical nature of crypto markets, both ETH and silver could be at the early stages of new upward trends. For a potential trend reversal, it may be wise to keep a closer eye on silver in the coming weeks.

BTC Hits Channel Ceiling – Smart Money Taking ProfitsBINANCE:BTCUSDT.P

🚨 BTC has cleanly broken above $120K, tagging $123,300 today (ATH) — pushing the top boundary of a well-respected rising channel that’s been in play since April.

🔍 Analysis:

Structure & Trend:

Price broke out of a Descending Triangle back in March — that move initiated a trend, not just a spike. Since then, BTC has followed an ascending channel, showing institutional-style demand: controlled, aggressive, and layered.

Current Price Action:

We’re at the upper edge of the rising channel, where many traders either:

- Exit early out of fear of reversal,

or

- Chase breakout longs, often just before a shakeout.

Smart trading now = discipline, not FOMO

If BTC fails to hold above $120K, expect a cool-off to the channel midline around ($111K–$112K) or even lower.

🧠 What to Do as a Trader:

Already in from Lower?

This is your TP zone or trailing stop region. Don't get greedy.

Protect capital. Re-enter on retest or new setup.

Looking to Enter Now?

Not ideal. Let the chart either break and retest cleanly OR

pull back to mid-channel ($112K area) for a high-R:R setup.

📌 Summary

BTC is bullish — no denial. But this is the zone where pros reduce risk and wait for confirmation, while most retail enters blindly.

Don’t be the liquidity.

✅ Follow for more real-time updates

🔁 Share it with your fellow traders

🚀 And hit that Boost button to support the work!

Let’s trade smart, not emotionally. 💯

#CMPInsights

BITCOIN BREAKS YEARS LONG ASCENDING TRENDLINE RESISTANCEThe recent surge in the price of Bitcoin has led to the break of years long ascending trendline resistance as can be seen on Weekly BTC chart.

The price of BTC can soar higher above this resistance level and can take support from this level to mark a successful breakout.

Breakouts like this does create FOMO among traders but trading such breakouts must be done with caution as the price can still fall under the resistance level.

Best of Luck!!

btc buy longterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Bitcoin's Macro View: The Next Major Resistance ZoneAnalysis of the Daily Chart

This is the daily (1D) chart for Bitcoin (BTC/USDT), which shows the "big picture" trend over many months.

1. The Significance of the Breakout

You are correct to highlight the breakout. After consolidating for months and forming a solid base since April 2025, Bitcoin has now decisively broken out to new highs for the year. This is a very strong bullish signal on a macro scale, indicating that the long-term uptrend is accelerating.

2. The Immediate Resistance: The Green Zone ($128,000 - $132,000)

After such a powerful move, the next major obstacle is the area marked by the green box on your chart.

What is this zone? This area, approximately between $128,000 and $132,000, represents a major historical resistance or supply zone.

Why is it important? This is likely a price level where significant selling occurred in the past. As the price returns to this zone:

Traders who bought at the previous top may look to sell to get their money back ("break-even selling").

Bulls who have been riding the trend up from the lows may see this as a logical area to take profits.

New sellers may view it as an opportune level to open short positions.

What to Expect

When the price enters this key zone, we can expect a significant reaction. It is the next major battleground between buyers and sellers. Watch for:

A slowdown in the upward momentum.

A period of consolidation or sideways price action.

A potential rejection or a significant pullback from this area.

A clean and powerful break above this $128k - $132k zone would be an exceptionally bullish event, signaling a high probability of continuation towards new all-time highs.

Bitcoin Update H12 Timeframe

New All time high unlocked again this time at 119700 area ! 🚀

Take note panda fam there's a unfilled gap below on bitcoin price still consider correction below is still possible, Above ATH price is discovery price panda fam.

But as of now since BTC is on fire and hype, Buyers volume are still strong this time, Trade safe always panda fam will focus on altcoins scalp trade. 🔥

Bitcoin - BTC | Weekly Market Recap & Outlook 13.07.2025What Happened Last Week?

Bitcoin broke out of the recent downtrend structure and established a bullish leg with clear momentum.

The breakout was supported by volume and price structure, suggesting a trend reversal rather than a temporary deviation.

Weekly Bias and Strategy

The current outlook is bullish.

A retracement or sideways consolidation between the $120,000 and $114,000 zone is possible.

This zone may act as accumulation before further upside.

Key Points of Interest (POIs):

12H Swing Liquidity (turquoise line)

Daily FVG (blue line)

These levels will be monitored for long setups with confirmation on lower timeframes.

Macro Consideration – Fed Chairman Jerome Powell

Recent market speculation has increased regarding Jerome Powell potentially stepping down as Chair of the Federal Reserve.

If such a resignation is confirmed, it may act as a significant bullish catalyst for Bitcoin and other risk assets, possibly accelerating upside without allowing for any meaningful pullback.

Summary

• Bullish breakout confirmed

• Long bias maintained unless major invalidation occurs

• Watching retracement levels for entries

• Macro catalyst (Powell resignation) may trigger strong continuation without retrace

BTC/USD Thief Breakout at $107K – Eyeing $115K!🚨 Thief Entry Setup: BTC/USD Breakout Play 🚨

Overview:

Jump in after the $107 000 breakout—aiming for $115 000 with a tight “Thief SL” at $102 500. Adjust the stop‑loss to match your personal risk tolerance.

🧠 Setup Summary

Pair: BTC/USD

Entry trigger: Breakout above $107 000

Stop‑Loss: “Thief SL” at $102 500 (use your own risk‑based SL)

Target: $115 000

🎯 Why This Setup?

Clear breakout level at $107 000 = fresh momentum

Tight SL cushion (≈‑4.3%) = defined risk

Target ≈ +7.5% potential = strong reward-to-risk (~1.75:1)

📏 Risk Management Tips:

Only risk a small % of your capital—never exceed your comfort zone.

Move your SL to breakeven once mid‑target is hit to lock in profits.

Trailing your stop‑loss could secure bigger gains if BTC surges toward $115 000.