BTCDOWNUSDT trade ideas

BTC Is Replaying a Bullish Fractal >>> Are You Watching?Hello guys!

I see a deja vu here! Let’s look at the historical daily chart (Jan–May 2025):

What happened?

Initial Drop (Yellow Oval): Bitcoin approached a key S&D zone but didn't touch it, triggering a short-lived bounce before dropping again.

Second Drop (Red Ovals): This time, price precisely touched the demand zone, triggering a clean bullish reversal.

What followed was a strong trend breakout, sustained higher lows, and an eventual surge past prior resistance levels.

Current 4H Chart Setup: A Mirror Image?

Yellow Highlight: Once again, we saw a bounce that didn't quite touch the key demand zone ($98K–$100K).

Red Zone Prediction: If this mirrors the historical move, the price is likely to return and touch this S&D area before launching a bullish leg.

Blue Path Projection: A sharp reversal is expected post-touch, aiming toward $111K–$113K as the next key resistance zone.

The descending trendline adds confluence

___________________

History Doesn’t Repeat, But It Often Rhymes

Based on this fractal analysis, Bitcoin is likely forming the same bullish base seen earlier in 2025. The setup hinges on one key event: a return to the $99K–$100K zone, where demand is likely to step in aggressively.

If the pattern repeats, the current market may offer one last high-reward long opportunity before a parabolic rally.

Bitcoin Offensive plan for S/R, risk-on scenario confirmed__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum : Strong across all timeframes, driven by the Risk On / Risk Off Indicator (“Strong Buy” bias from 1D to 1H).

Key Supports : 98–100k remains the crucial zone to defend. Interim supports at 103.6k and 106k.

Major Resistances : 107–110k critical cluster, intermediate resistance at 108.2k.

Volume : Normal to moderately increasing volumes on all timeframes, short-term spike at 15min (caution warranted).

Multi-TF behavior : No signs of euphoria or capitulation except for 15min (behavioral overheating & high volume detected).

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Structural bias : Strong bullish, confirmed by technical and sector data.

Opportunities : Pullback entries at 107–107.5k, trend-following plans on validated breakouts >108.2k/109.9k.

Risk zone : Major break under 106k then 103.6k = invalidation, watch for seller excess (ISPD)/extreme volume on 15min.

Macro catalyst : No major event expected; wait & see climate, caution around Middle East geopolitical headlines.

Action plan : Buy support, monitor breakout/volume, stop-loss below 106k then 99k.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D – 12H – 6H : Durable bullish structure, price capped below 107–110k, momentum confirmed by Risk On / Risk Off Indicator (“Strong Buy”), no volume climax, healthy volume. 98–100k supports remain crucial.

4H – 2H – 1H – 30min : Aligned uptrend, no sell signals. Pullbacks absorbed at 103.6–107.5k pivots. 108.2k–109.9k breakout is pivotal, volumes healthy outside 15min.

15min : Emerging behavioral excess (ISPD = Sell), very high volume → risk of short-term overheat, avoid chasing without validation.

Summary : Bullish multi-timeframe confluence, but caution on ultra-short-term excess and geopolitical news flow.

__________________________________________________________________________________

Synthesis & Strategic Plan

__________________________________________________________________________________

Directional bias : Structurally bullish on all higher TFs, supported by Risk On / Risk Off Indicator, MTFTI, no major alert signals.

Action scenarios :

Buy pullback at 107–107.5k, SL below 106k (Swings) or below 107k (Scalps).

Confirmed breakout (vol./no behavioral excess) above 108.2–109.9k, targets >110k.

Risk/invalidation : Any break under 106k then 103.6k then 99k = bullish bias neutralized.

Risk management : Take partial profits on 109–110k extensions; avoid persistence if ISPD turns red & volumes spike on lower TFs.

Fundamental & on-chain factors : No macro catalyst, healthy consolidation, $99k–$100k on-chain supports decisive, breakout requires new inflows.

Decision summary:

Bias = Bullish, buy supports and validate breakouts with volume, watch for 15min excess and Middle East headlines. Strict SL below 106k/103.6k, risk-off below 99k. Partial profit taking on 109–110k extension. No immediate macro catalyst.

Bitcoin Update

Just to make it simple panda fam, Lets analyze it ! 💭

— Scenario #1 - PBr2 still possible we get rejected since we are on PBr2 keylevel resistance ranging 108099 - 107465, Same time we are under major trend resistance also. 📉

— Scenario #2 - PBr1 bounce support at 102188 - 101786 this will be valid if we get rejected at PBr2 and retest as normal correction movement. 🐂

— Scenario #3 - Breakout above major trend resistance, valid if we sit on trend major resistance as support . Short term possible target at 112004. 🚀

Always trade safe and stay updated to our updates panda fam ! Kupit kupit lang muna tayo sa altcoins. 🙌

BITCOINBITCOIN wait on the close of daily candle for clear directional bias ,break and close 108k will expose 111-115 and more higher zones .break below by rejection on daily candle will call for sell and target will be around 100-94k zone .

trading is 100% probability, some people are gifted while some are not.

Bitcoin short position After my win streak from previous trades on btcusd I happy to give me to the people who followed me

Here's another great trade for you

Short Bitcoin with a limit order at 108,500

Take profit at 101k , stop loss at 109,500

A 7.5 to 1 risk reward ratio 🔥😉

You can never find anybody trade Bitcoin like me

BTC Breakdown Stp Bearish triangle Sell below $60.5k target 58k$Chart Overview:

Asset: BTC/USDT (Bitcoin)

Chart Type: Candlestick

Timeframe: Likely intraday (short-term, possibly 15m or 1h)

Indicators/Tools Used:

Trendlines

Support/Resistance levels

Pattern formation (possible descending triangle)

---

Technical Analysis:

🔻 Bearish Bias (Sell Signal):

Pattern: A descending triangle pattern is visible—typically a bearish continuation pattern.

Lower Highs: Indicates selling pressure increasing over time.

Flat Support Zone: Around $60,500–$60,600. Price is testing this zone repeatedly.

Breakdown Likely: If price breaks and closes below this support, a sharp drop can be expected.

---

📉 Put Direction: Sell BTC

Entry (Sell): On break below $60,500

Target 1: $59,200 (near previous consolidation zone)

Target 2: $58,000 (measured move from triangle)

Stop Loss: $61,000 (above descending trendline)

---

✅ Summary:

BTC is under pressure below resistance and forming lower highs.

If it breaks $60,500 support, a downward continuation is expected.

Strategy: Sell on breakdown, target $58,000 short-term.

Bitcoin Pressing Up But This Compression Could Crack LowerBitcoin has been steadily climbing for months, respecting that long-term trendline since last year. Each dip into it brought a strong bounce, showing bulls are still in control of the bigger picture.

But right now price is pressing into a tight descending resistance line. We can see it making lower highs while struggling to break above that red trendline. At the same time, it’s sitting just above a key horizontal range, where buyers stepped in before.

This compression is risky . If BTC fails to push above the descending resistance and breaks back below the box, it could drop toward the next demand zone around the low 100K region .

As long as the major trendline from last year holds, the broader uptrend is intact . But losing this structure would open the door for a deeper correction.

This is the kind of spot where patience pays. Let the breakout or breakdown show its hand before jumping in heavy.

BTC TRrade Plan 08/06/2025Dear Traders,

📊 BTC/USDT 4H Analysis – June 8, 2025

Bitcoin is currently testing the upper boundary of a descending wedge pattern. We are monitoring two main bullish scenarios:

🔹 ALT 1: If the price breaks above the wedge resistance and holds, a continuation towards the $115,000–$120,000 zone is likely. This would confirm the breakout and a potential new bullish leg.

🔹 ALT 2: In case of a rejection from the current resistance, we expect a retracement toward the demand zone around $100,000–$101,600. If price action remains bullish in this zone, this could be a strong re-entry point for long positions.

🟥 Invalidation: A confirmed breakdown and consolidation below $100,000 would invalidate the bullish outlook and open the door to deeper corrections.

⚠️ Wait for confirmation and observe price action in key zones before entering any trades.

if you enjoyed this forecast, please show your support with a like and comment. Your feedback is what drives me to keep creating valuable content."

Regards,

Alireza!

Bitcoin - Weekend OutlookCRYPTOCAP:BTC | 6h

Bitcoin is compressing below its all-time high, with 108k as the local resistance that must be reclaimed for a bullish continuation to retest the highs.

I expect the price to clear some poor highs around 108.8k–109.6k before taking out the bad lows around 106.3k-105.4k

As long as we hold above 104k , I believe we’re in a strong position and expect we will retest the highs.

However, losing the 103k support level would be concerning.

BITCOIN → Pause for consolidation before growth. 115K?BINANCE:BTCUSDT focus on the structure on D1. The market is forming local resistance and consolidation after growth. The fundamental background is positive. BTC is following the SP500

The market is recovering in line with the stock market (SP500, NQ) after the de-escalation of the situation in the Middle East. The fall in the DXY is also providing support.

Technically, the focus is on the consolidation phase after the distribution triggered by a false breakout of 100K. The price stopped before the resistance at 108100 and rolled back to 106500, confirming the boundaries of the local trading range, the essence of which is a pause for a breather before a possible continuation of growth. The structure on D1 is compression towards resistance. The trigger is 108100, and a breakout of this level could trigger distribution towards 110500 and ATH.

Despite the fact that the market is under a cascade of resistance (resistance: 108100, 110400, 11900 (ATH)), an important nuance is that after strong growth, the price moved into accumulation in the 100K-110K range on D1-W1, and there are no reasons for a decline yet.

Resistance levels: 108100, 108900, 110400

Support levels: 106500, 104650

If the market structure within 106500 - 108100 remains unchanged and BTC continues to storm the consolidation resistance in the “compression to level” format and stick to the level, the chances of a breakout will increase. I do not rule out the possibility of a pullback to 106500, 105650 before a possible rise to ATH.

Best regards, R. Linda!

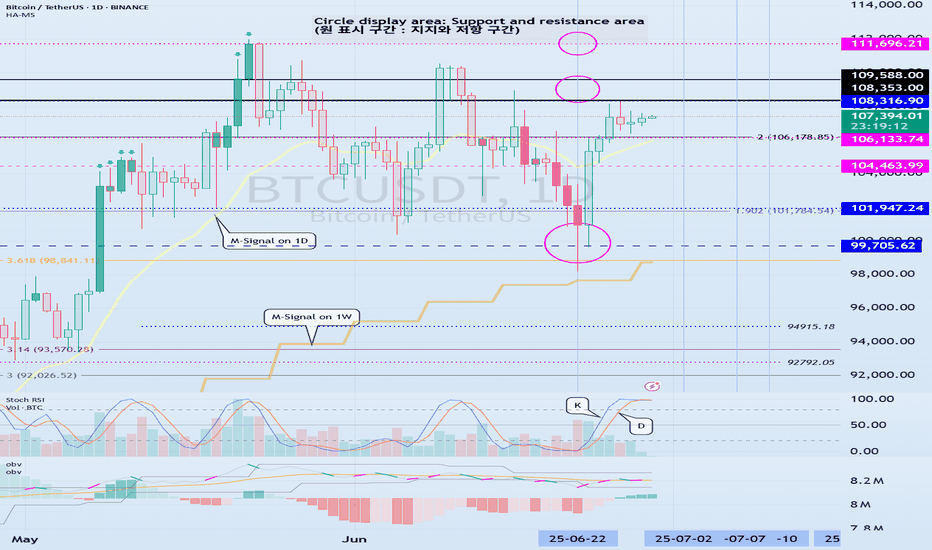

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

BTC LONG TRADE BTC LONG TRADE

ENTRY : 106398.1

PROFIT : 107512.7

STOP : 106028.8

ALL trading ideas have entry point + stop loss + take profit + Risk level.

hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

Disclaimer

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

In our previous outlook, we anticipated a pullback to the channel bottom followed by a bullish move, and so far, price has followed that scenario perfectly.

Bitcoin is now approaching the channel top and a major resistance zone. At this point, we are watching two potential scenarios:

Scenario 1 – Pullback Before Continuation:

If price rejects the resistance, a correction toward the midline of the channel (which aligns with a key support level) may occur. This could offer a strong entry point for the next bullish wave.

Scenario 2 – Breakout and Retest:

If Bitcoin breaks above the channel and resistance zone, we can look for buy opportunities on the pullback to the broken level, with potential targets at higher levels.

Price action in this area is crucial. Both a midline pullback and a resistance breakout could provide valuable trading setups.

Is Bitcoin gearing up for a breakout, or is another correction coming first? Share your view below! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

BTC's Mid 2025 OutlookBitcoin is currently trading around $107,000 on the 4-hour 4H timeframe, navigating a consolidation phase following a sharp rally that culminated in a new all-time high of $111,900 in May 2025. Despite recent price corrections, BTC remains up 3% on the week, reflecting underlying bullish momentum. This sustained strength hints at continued confidence in the market, particularly among larger players.

A notable development supporting this view is the increase in the number of Bitcoin wallets holding at least 10 BTC, which has surged to a three-month high of 152,280. This metric is widely regarded as a proxy for whale activity and may indicate renewed institutional interest, especially amid accelerating inflows into spot Bitcoin ETFs.

On the 4H chart, Bitcoin appears to be consolidating within a tight range, hovering just beneath a key supply zone at $107,000, which could act as short-term resistance.

Several potential outcomes are currently in play:

Bullish scenario:

A breakout above the $107,000–$108,000 range could clear the path toward the critical resistance at $115,000. A successful move above this threshold would likely signal resumption of the broader uptrend, with some technical analysts eyeing a potential cup and handle formation that could project long-term targets up to \$180,000

Bearish scenario:

If BTC fails to hold above the current level, it may correct toward the first major support at $102,800, with further downside risk to $98,500. In a more pessimistic setup, price could extend losses toward $96,000, especially if macroeconomic or geopolitical pressures intensify

Key levels to watch:

Resistance: $107,000 - $115,000

Support: $102,800 - $98,500 - $96,000

Market Sentiment and External Drivers:

Bitcoin's price is being shaped not only by technical dynamics but also by powerful external forces

Spot Bitcoin ETFs:

The US regulatory greenlight for spot ETFs has dramatically altered market dynamics. With projections of $190 billion in assets under management AUM for these products by the end of 2025, institutional access to BTC has become more streamlined, providing strong tailwinds for long-term accumulation

Geopolitical risk and macro conditions:

Global uncertainty, particularly due to escalating tensions in the Middle East and potential US military involvement, has introduced volatility. At the same time, rising inflation and economic instability in developed markets is a double-edged sword, either undermining risk assets or conversely boosting Bitcoin’s narrative as digital gold and a hedge against fiat devaluation

Forward-Looking Outlook:

Bitcoin is at a critical juncture. The ability to sustain above $107,000 and reclaim the $115,000 resistance will be pivotal. A confirmed breakout could open the door to price discovery and possibly a surge toward $130,000 to $150,000, with $180,000 as an extended target in more bullish scenarios

However, a failure to hold key support levels could shift momentum toward the bears, prompting a deeper correction toward the $96,000 zone. Traders should monitor:

- Price reaction around $107,000 and $115,000

- ETF inflow data and AUM growth

- Macro news especially inflation reports and central bank commentary

- Developments in global conflict zones impacting risk appetite

Conclusion:

Bitcoin’s medium-term direction hinges on a delicate interplay of technical consolidation institutional flow and macro geopolitical signals. While the bullish structure remains intact for now a decisive move in either direction above $115,000 or below $98,000 could set the tone for the next major trend.

Bitcoin 100K$ is strong soon range will end and bulls will winSoon we are looking for a heavy rise here like the green arrows on chart and new ATH which would be nonstop and first target for that is around 120K$.

Also we should consider that we have range zone around 100K$ support to 110K$ resistance zone and we need breakout first and then next possible move is obvious.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚