BTCGBP trade ideas

BTC ready to break descending channel up or down?Since the ATH on 21 February BTC dropped to a low of £31,112 on 28 February. After another rise (green dotted line) it reached £37,812, testing the downward trend's 0.618 Fibonacci level before forming a downward channel and testing the rises' own 0.618 level.

Will it now break the rises' 0.618 level and continue the downward trend (red arrows) or will the rise only be a retracement of the ATH's upward trend (green arrow)?

There are plenty of opportunities to scalp around the fib levels or short and long depending on how you see the outlook over the next few weeks.

Let me know what you think below.

Thanks and good luck!

Bitcoin needs to hold the 21 MA on the dailyHere you can see the last time the price action plummeted to the 21MA on the daily chart. That was the start of a descending triangle pattern. I am watching for the price to hold above the 21 MA, if not then some further downside is on the cards. Structure needs to hold the recent lows of £34-35k or we could see a drop to major support / previous resistance / price floor (according to WIlly Woo on-chain analysis) at around £30k.

This weekend or tonight we have 2 options for Bitcoin' move.Based on my prediction of a few hours ago.

Tracing Bitcoins 11th Jan flashcrash to now, extended onwards...Bitcoins flashcrash on January 11th 2021 was a 31% drop, the current one is the same length, if it holds at the current support level and maintains the 4 hour EMA then retracing the same path, extended into the future puts it at the current price in the next couple of weeks, before a push towards the £50,000 mark at the start of April just before the new tax season. Setting new ATH's from the end of March.

With $2Billion BTC having been transferred over to Gemini, a more institutional orientated platform. This could be the start of the whales and institutions trying to monopolise (and stabilise) bitcoin, whilst hiking the prices for the BTC left in other platforms for retail traders. With ETH launching 2.0, cross chain projects springing up, and Celo looking to bring crypto to a more public consumer & mobile payments market, will Alt coins finally start to move away from reacting to every twitch BTC has after this?

changed to standard shift pitchfork holds price betterTrade setup on BTC ( Bitcoin ) this is going to be your last big buy op before wave 4 of 3 is completed and we start on wave 5 of 3 targeting between 36k to 74k GBP (I know that’s a huge range but that’s what the trend based fibs line up to), each one of the 4 price points highlighted can be the end of the down Trent (wave 4 of 3) unless it turns into a double correction, i would prefer for the price to come all the way down to the lower warning line of the modified shift pitchfork (the white dotted line (minimum the solid white lower line), this is not guaranteed markets can do whatever they like, and you trade what you can afford to lose so don’t bet the farm (even thou I will be!) but I do expect this trade setup to play out, expect the news to really bearish BTC is dead governments are banning it that sort of shit, they might even stop you opening and transferring funds into your trading account to buy this dip (and yes they can do this and they have with wall street bets so much for the free market!) this is why you need to have funds in this now ready to buy in, I will be watching these price points to see which level will be best to buy in for long term, but this is a major opportunity! You snooze you will Louze!!!!

BTC completion of wave 4 of 3trade idea

Trade setup on BTC (Bitcoin) this is going to be your last big buy op before wave 4 of 3 is completed and we start on wave 5 of 3 targeting between 36k to 74k GBP (I know that’s a huge range but that’s what the trend based fibs line up to), each one of the 4 price points highlighted can be the end of the down Trent (wave 4 of 3) i would prefer for the price to come all the way down to the lower warning line of the modified shift pitchfork (the white dotted line (minimum the solid white lower line), this is not guaranteed markets can do whatever they like, and you trade what you can afford to lose so don’t bet the farm (even thou I will be!) but I do expect this trade setup to play out, expect the news to really bearish BTC is dead governments are banning it that sort of shit, they might even stop you opening and transferring funds into your trading account to buy this dip (and yes they can do this and they have with wall street bets so much for the free market!) this is why you need to have funds in this now ready to buy in, I will be watching these price points to see which level will be best to buy in for long term, but this is a major opportunity! You snooze you will Louze!!!!

This weekend or tonight we have 2 option for Bitcoin' moveEither up or down, but do not expect a big change soon.

The bottom of bitcoins bearish move?As we can see, the price has reached the bottom of a tested and tried support zone, we are seeing a loss in momentum of the downtrend move and on market cipher on the 4HR there is a buy signal formed.

On the other hand if we see a break of this support zone it will do one of 2 things, Wik out and therefore reject the support zone or it will close below this level and therefore it will continue the downtrend.

Let me know what you guys think!.

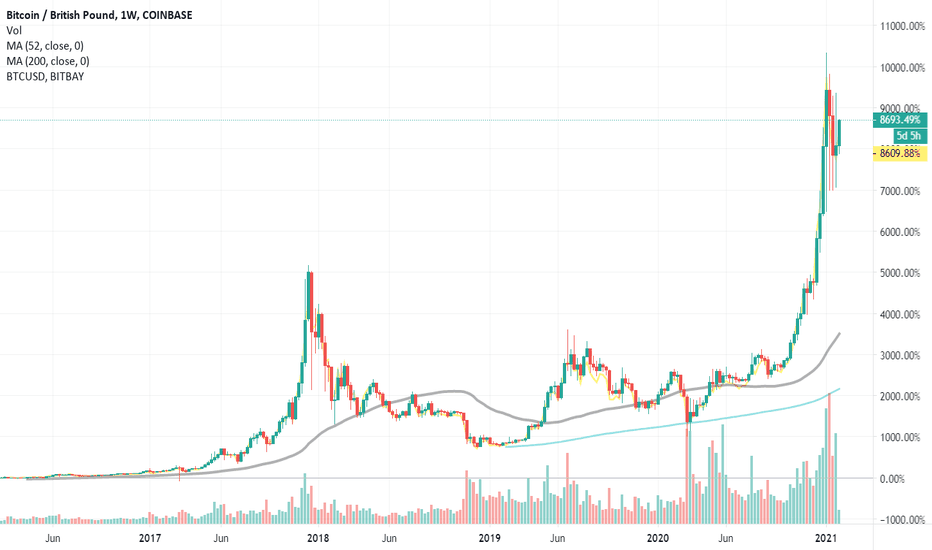

Bitcoin 3 optionOption 1) Long Bull trend. 1D Chart.

Market currently appears to show a bear trend in Elliot wave 4 of 5.

We are looking to enter on a confirmation bar moving higher from a wave 5 bottom.

This may or may not be lower than the previous wave 3 low, signalling either exhaustion or a shift in momentum to the up side. Either way, we would expect movement toward the short term average, green dash line.

Should an ABC Elliot wave begin to form, exercise caution and consider locking profit as this may signal the start of a Long Bear trend.

Option 2) Long Bear trend, back to long term average, green dotted line.

We see a channel forming (red dotted lines).

An example of what this scenario may look like can be seen between Nov-2017 and Mar-2018.

The opportunity here is, using lower chart timeframe, buy/sell lower/upper red channel on approach to the green dotted line provided the trend holds.

This option assumes more risk than option 1 as we are working against the trend by buying pullbacks in a downward market.

For this option to be nullified, the channel structure would be breached with price finding new support/resistance outside of this channel.

Option 3) Alternatively, this could be an ABC Elliot wave, with wave 4 actually being wave 1 of a bull 5 wave. If so, we would expect this to break the red channel, see signs of wave 2 pullback and would look to enter on a confirmation bar moving higher to form wave 3.